Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the case study is already available in this site. Ceres gardening business case Find - mac Replace Select Title Subtitle Subtle Em... Emphasis Intense E...

the case study is already available in this site. Ceres gardening business case

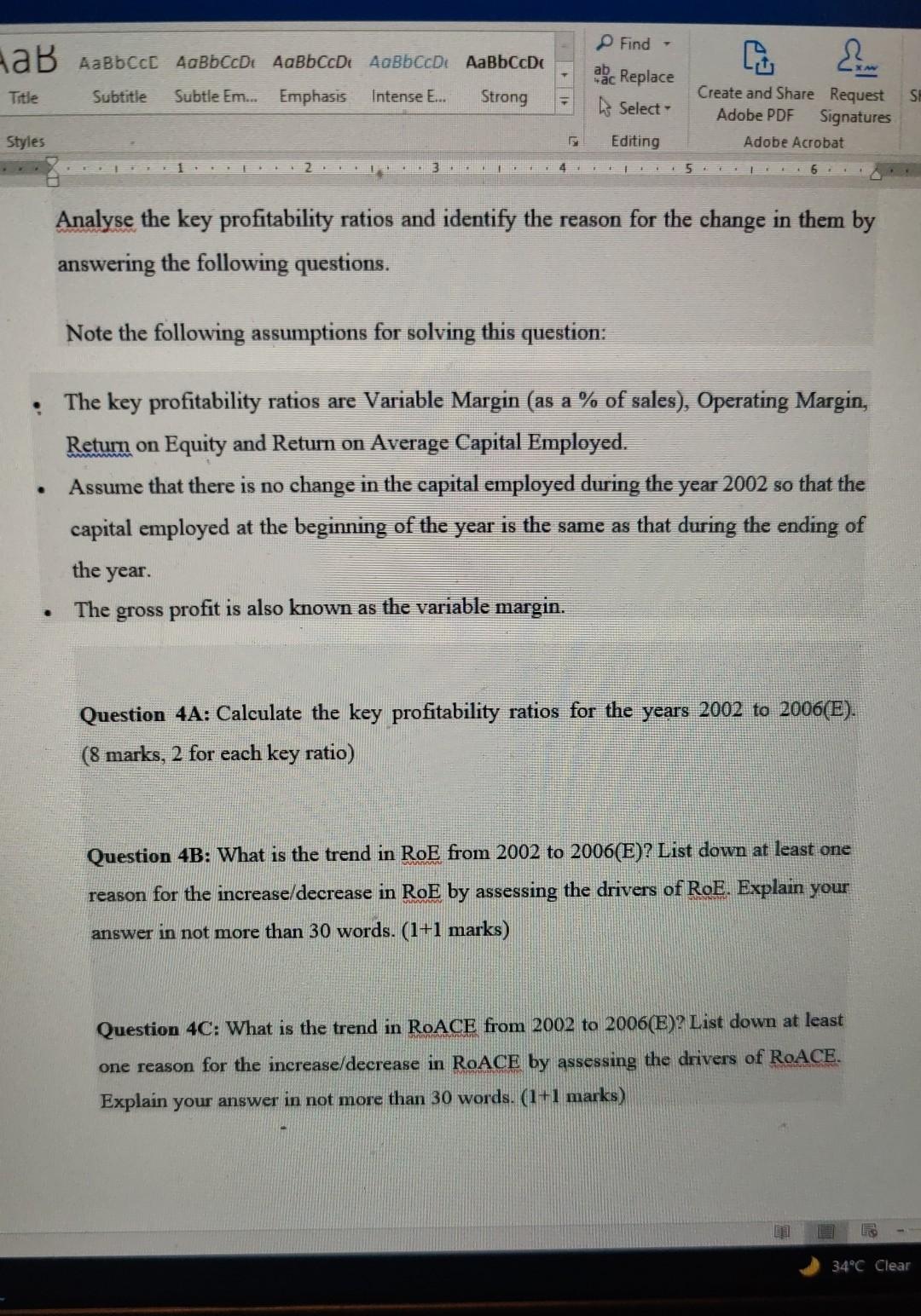

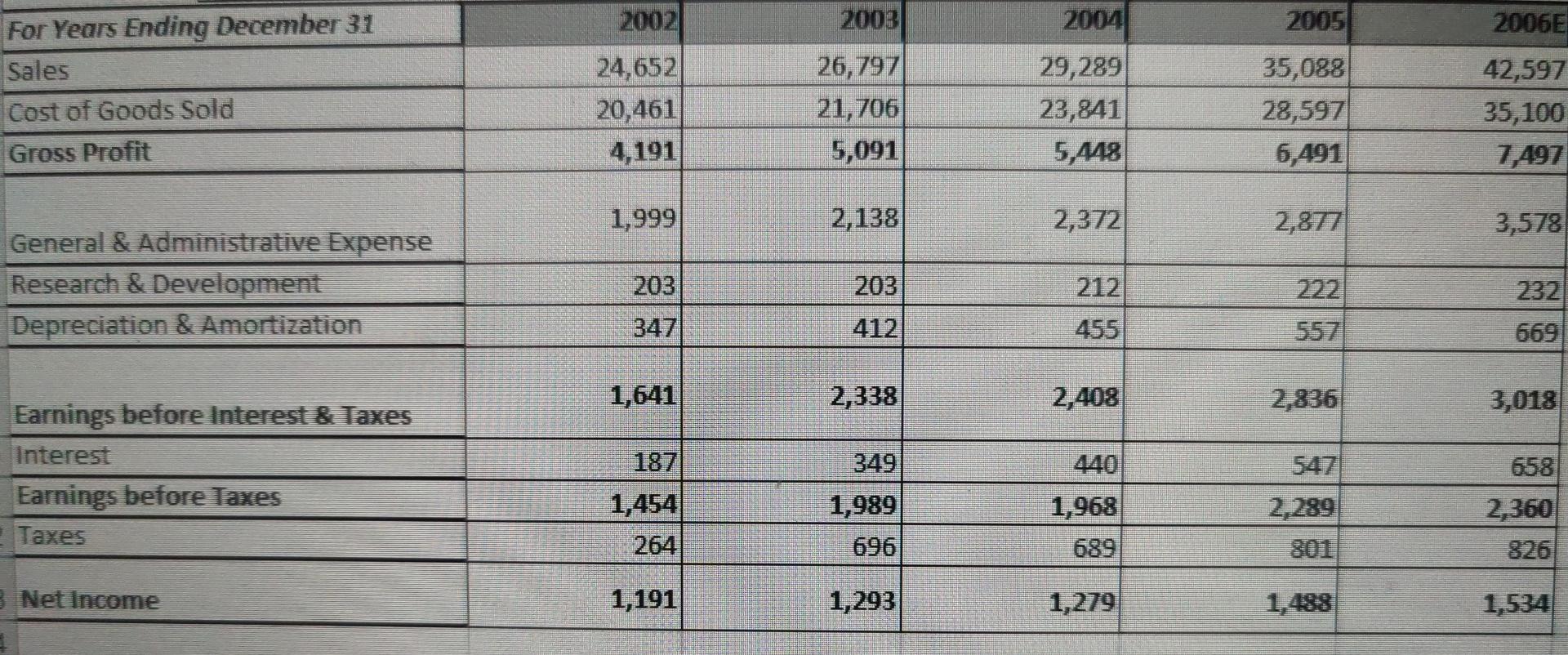

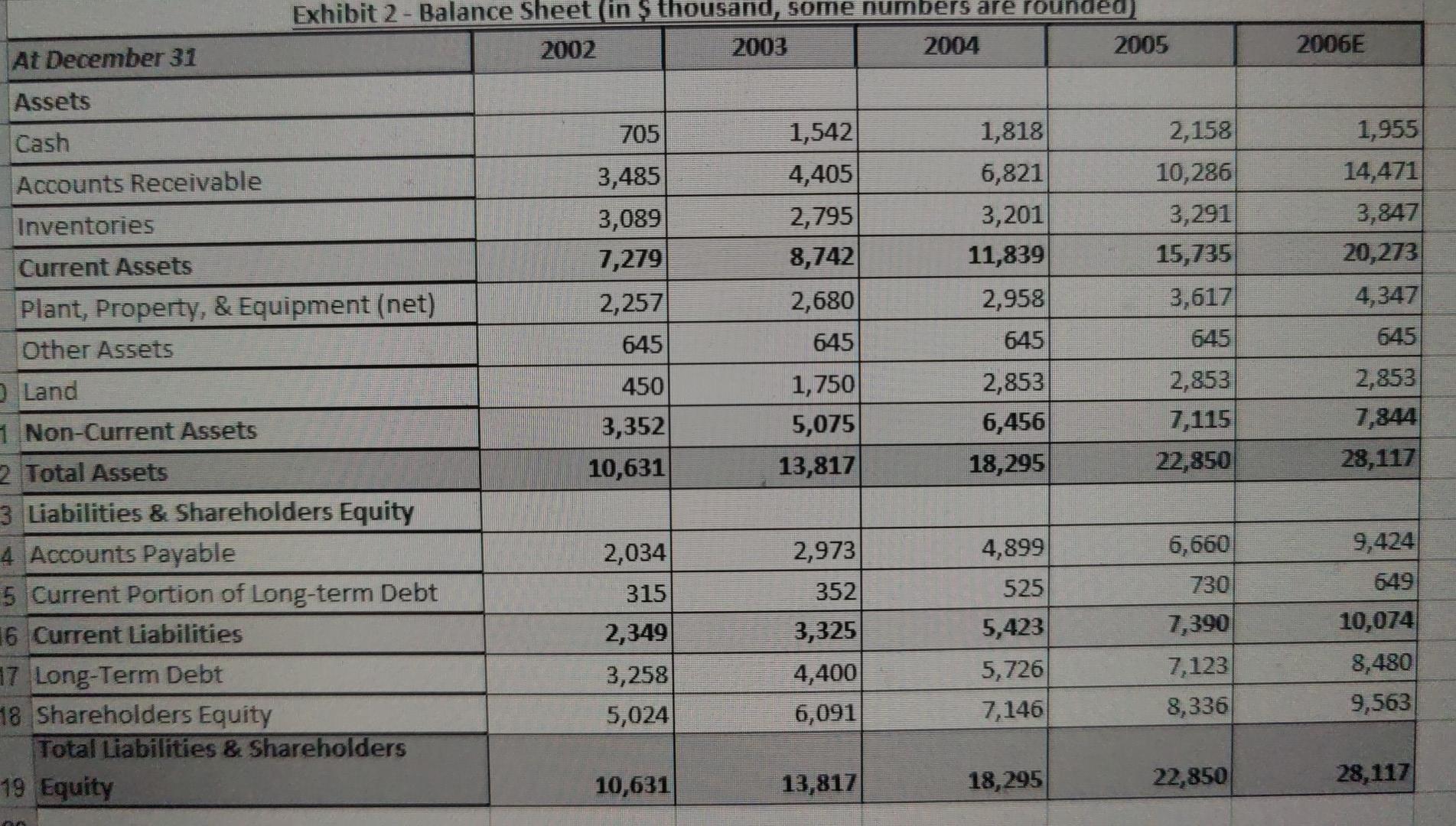

Find - mac Replace Select Title Subtitle Subtle Em... Emphasis Intense E... Strong SE Create and Share Request Adobe PDF Signatures Adobe Acrobat Styles Editing 3 4 Analyse the key profitability ratios and identify the reason for the change in them by answering the following questions. Note the following assumptions for solving this question: The key profitability ratios are Variable Margin (as a % of sales), Operating Margin, Return on Equity and Return on Average Capital Employed. Assume that there is no change in the capital employed during the year 2002 so that the capital employed at the beginning of the year is the same as that during the ending of the year. . The gross profit is also known as the variable margin. Question 4A: Calculate the key profitability ratios for the years 2002 to 2006(E). (8 marks, 2 for each key ratio) Question 4B: What is the trend in RoE from 2002 to 2006(E)? List down at least one reason for the increase/decrease in RoE by assessing the drivers of RoE. Explain your answer in not more than 30 words. (1+1 marks) Question 4C: What is the trend in ROACE from 2002 to 2006(E)? List down at least one reason for the increase/decrease in RoACE by assessing the drivers of RoACE. Explain your answer in not more than 30 words. (1+1 marks) 34C Clear 2002 2003 2004 2005 2006E For Years Ending December 31 Sales Cost of Goods Sold Gross Profit 24,652 20,461 4,191 26,797 21,706 5,091 29,289 23,841 5,448 35,088 28,597 6,491 42,597 35,100 7,497 1,999 2,138 2,372 2,877 3,578 General & Administrative Expense Research & Development Depreciation & Amortization 203 203 212 232 347 412 455 669 1,641 2,338 2,408 2,836 3,018 187 349 Earnings before Interest & Taxes Interest Earnings before Taxes Taxes 440 658 1,454 1,968 2,289 2,360 1,989 696 264 689 801 3 Net Income 1,191 1,293 1,279 1,534 Exhibit 2 - Balance Sheet in thousand, some numbers are 2002 2003 2004 ounded) 2005 2006E At December 31 Assets Cash 705 Accounts Receivable 1,542 4,405 2,795 8,742 3,485 3,089 7,279 2,257 1,818 6,821 3,201 11,839 2,958 645 2,158 10,286 3,291 15,735 Inventories 1,955 14,471 3,847 20,273 4,347 Current Assets 2,680 3,617 645 Plant, Property, & Equipment (net) Other Assets Land 645 645 645 450 1,750 5,075 3,352 10,631 2,853 6,456 18,295 2,853 7,115 22,850 2,853 7,844 28,117 13,817 2,034 2,973 4,899 9,424 315 352 525 649 1 Non-Current Assets 2 Total Assets 3 Liabilities & Shareholders Equity 4 Accounts Payable 5 Current Portion of Long-term Debt 16 Current Liabilities 17 Long-Term Debt 48 Shareholders Equity Total Liabilities & Shareholders 19 Equity 6,660 730 7,390 2,349 3,258 5,024 3,325 4,400 6,091 5,423 5,726 7,146 7,123 8,336 10,074 8,480 9,563 10,631 13,817 18,295 22,850 28,117

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started