Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Case Study Please 10. Suppose a company currently pays $1 in dividends, and dividends are expected to grow at a rate of 5% pery

The Case Study Please

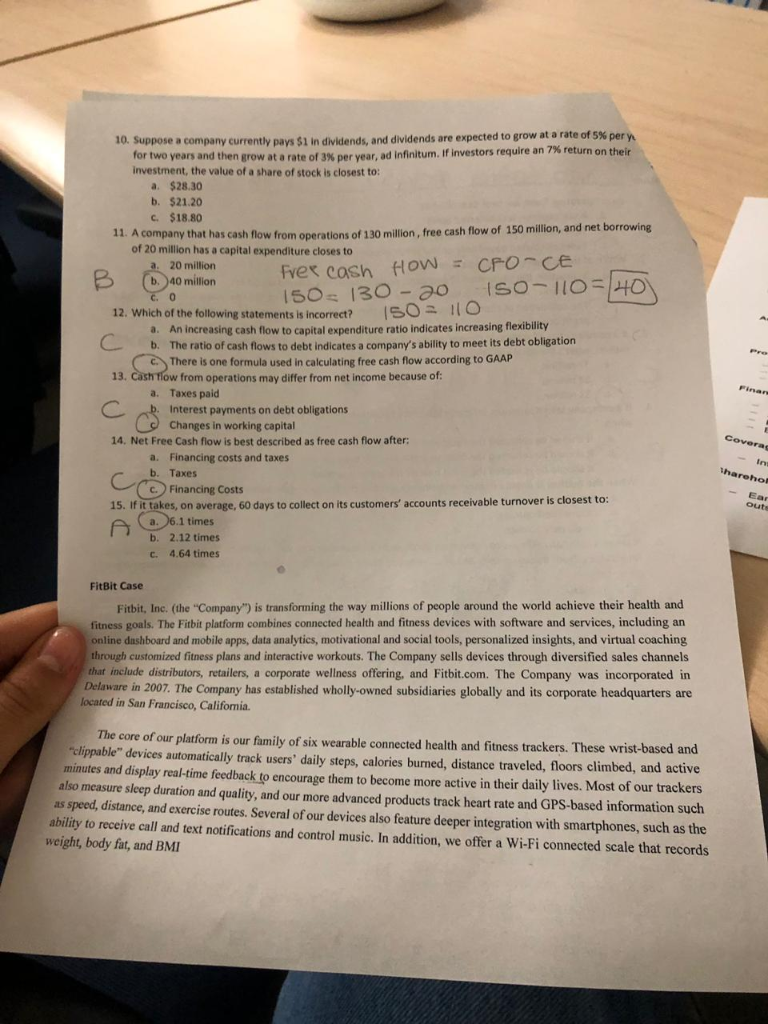

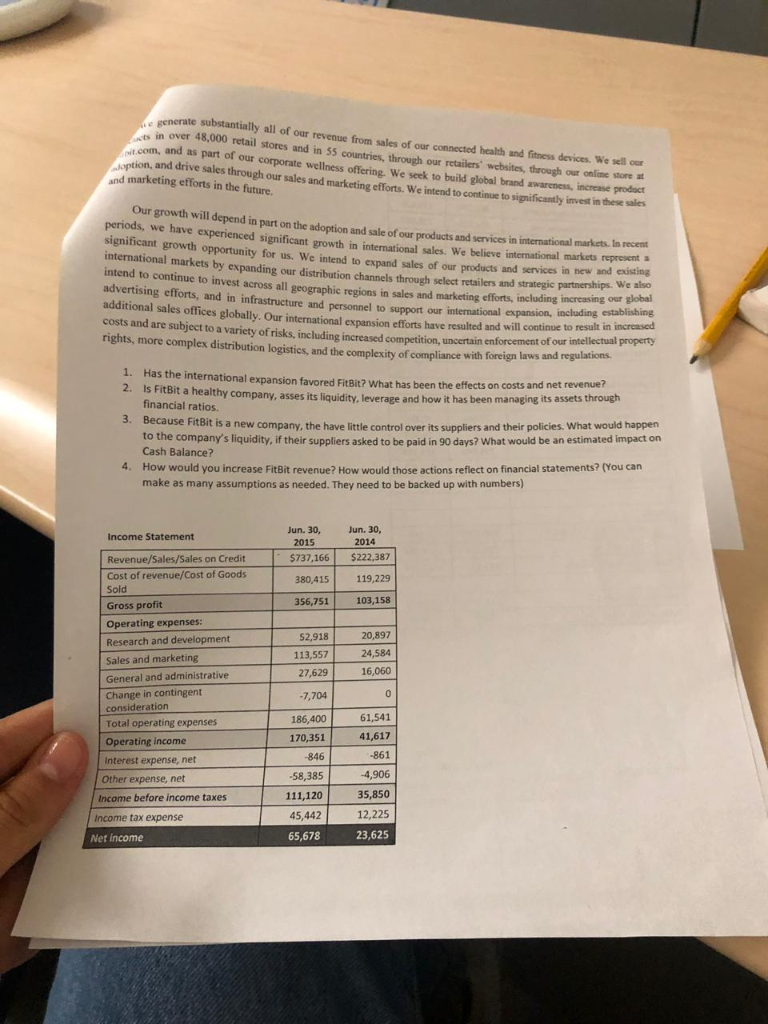

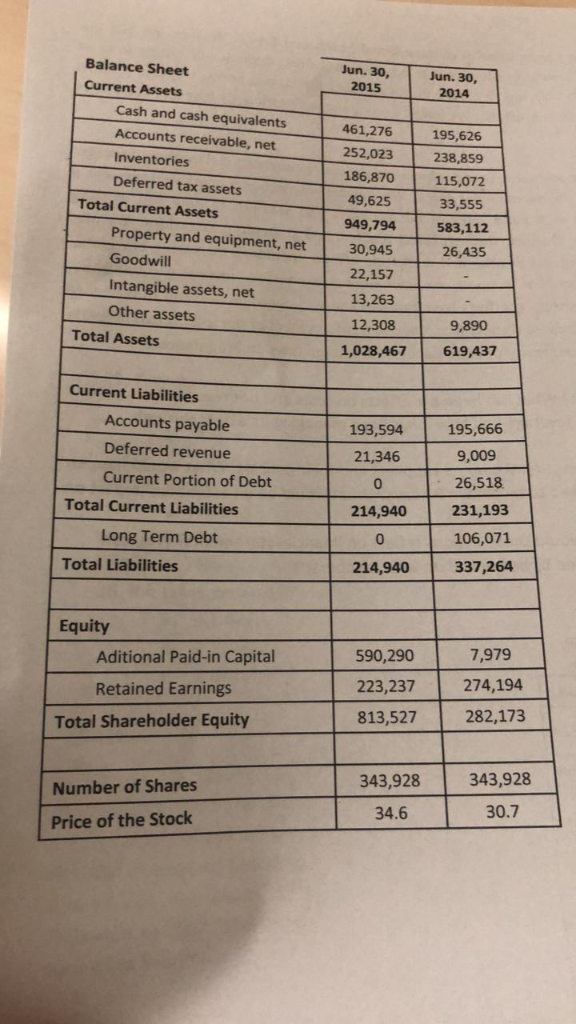

10. Suppose a company currently pays $1 in dividends, and dividends are expected to grow at a rate of 5% pery for two years and then grow at a rate of 3% per year, ad infinitum. If investors require an 7% return on their investment, the value of a share of stock is closest to a $28.30 b. $21.20 C. $18.80 1. A company that has cash flow from operations of 130 million, free cash flow of 150 million, and net borrowing of 20 million has a capital expenditure closes to a. 20 million Free cash HOW : CFO-CE (b. 40 million co 12. Which of the following statements is incorrect? ISO- a. An increasing cash flow to capital expenditure ratio indicates increasing flexibility C b. The ratio of cash flows to debt indicates a company's ability to meet its debt obligation c. There is one formula used in calculating free cash flow according to GAAP 13. Cash flow from operations may differ from net income because of: a. Taxes paid b. Interest payments on debt obligations C Changes in working capital 14. Net Free Cash flow is best described as free cash flow after: a. Financing costs and taxes b. Taxes 150- 130 - 20 150-110 = 40 Coverag harehol c . Financing Costs Ear Out 15. if it takes, on average, 60 days to collect on its customers' accounts receivable turnover is closest to: A a. 6.1 times b. 2.12 times c. 4.64 times FitBit Case Fitbit, Inc. (the "Company) is transforming the way millions of people around the world achieve their health and fitness goals. The Fitbit platform combines connected health and fitness devices with software and services, including an online dashboard and mobile apps, data analytics, motivational and social tools, personalized insights, and virtual coaching through customized fitness plans and interactive workouts. The Company sells devices through diversified sales channels that include distributors, retailers, a corporate wellness offering, and Fitbit.com. The Company was incorporated in Delaware in 2007. The Company has established wholly-owned subsidiaries globally and its corporate headquarters are located in San Francisco, California. The core of our platform is our family of six wearable connected health and fitness trackers. These wrist-based and lippuble" devices automatically track users' daily steps, calories burned, distance traveled, floors climbed, and active minutes and display real-time feedback to encourage them to become more active in their daily lives. Most of our trackers also measure sleep duration and quality, and our more advanced products track heart rate and GPS-based information such as speed, distance, and exercise routes. Several of our devices also feature deeper integration with smartphones, such as the ability to receive call and text notifications and control music. In addition, we offer a Wi-Fi connected scale that records weight, body fat, and BMI enerate substantially all of our revenue from sales of our connected health and fitness devices. We sell out in over 1,000 retail stores and in 55 countries, through our retailers' websites, through our online More com, and as part of our corporate wellness offering. We seek to build global brand awareness, increase produce option, and and marketing efforts in the future, sales through our sales and marketing efforts. We intend to continue to significantly invest in the Our growth will depend in part on the depend in part on the adoption and sale of our products and services in international markets. In recent periods, we have experienced significant growth in international sales. We believe international markets represent significant growth opportunity for us. We growth opportunity for us. We intend to expand sales of our products and services in new international markets by expanding our distribution channels through se intend to continue to invest across all necgraphic regions in sales and expanding our distribution channels through select retailers and strategic partnership advertising efforts, and in infrastructure and personnel to support our mvest across all geographic regions in sales and marketing efforts, including increasing our additional sales offices globally. Our international expansion efforts has costs and are subject to a variety of risks, including increased competitie globally. Our international expansion efforts have resulted and will continue to result in increased d variety of risks, including increased competition uncertain enforcement of our intellectum rights, more complex distribution logisties and the complexity of compliance with foreign laws and regulations ational expansion, including establishing 1. Has the international expansion favored FitBit? What has been the effects on costs and net revenue 2. Is FitBit a healthy company asses its liquidity leverage and how it has been managing its assets throus financial ratios. 3. Because FitBit is a new company, the have little control over its suppliers and their policies. What would happen to the company's liquidity, if their suppliers asked to be paid in 90 days? What would be an estimated impact on Cash Balance? 4. How would you increase FitBit revenue? How would those actions reflect on financial statements? You can make as many assumptions as needed. They need to be backed up with numbers) Income Statement Jun. 30, 2015 $737,166 Jun. 30, 2014 $222,387 | Revenue/Sales/Sales on Credit Cost of revenue/Cost of Goods Sold 380,415 356,751 119,229 103,158 52,918 113,557 27,629 20,897 24,584 16,060 -7,704 Gross profit Operating expenses: Research and development Sales and marketing General and administrative Change in contingent consideration Total operating expenses Operating income Interest expense, net Other expense, net Income before income taxes Income tax expense Net income 186,400 170,351 -846 -58,385 111,120 45,442 65,678 61,541 41,617 -861 4,906 35,850 12,225 23,625 Jun. 30, 2015 Jun. 30, 2014 Balance Sheet Current Assets Cash and cash equivalents Accounts receivable, net Inventories Deferred tax assets Total Current Assets Property and equipment, net Goodwill Intangible assets, net Other assets Total Assets 461,276 252,023 186,870 1 49,625 949,794 30,945 22,157 13,263 12,308 1,028,467 195,626 238,859 115,072 33,555 583,112 26,435 9,890 619,437 Current Liabilities Accounts payable Deferred revenue Current Portion of Debt Total Current Liabilities Long Term Debt Total Liabilities 193,594 21,346 0 214,940 195,666 9,009 26,518 2 31,193 106,071 337,264 214,940 Equity Aditional Paid-in Capital Retained Earnings Total Shareholder Equity 590,290 223,237 813,527 7,979 274,194 282,173 Number of Shares Price of the Stock 343,928 34.6 343,928 30.7 . 10. Suppose a company currently pays $1 in dividends, and dividends are expected to grow at a rate of 5% pery for two years and then grow at a rate of 3% per year, ad infinitum. If investors require an 7% return on their investment, the value of a share of stock is closest to a $28.30 b. $21.20 C. $18.80 1. A company that has cash flow from operations of 130 million, free cash flow of 150 million, and net borrowing of 20 million has a capital expenditure closes to a. 20 million Free cash HOW : CFO-CE (b. 40 million co 12. Which of the following statements is incorrect? ISO- a. An increasing cash flow to capital expenditure ratio indicates increasing flexibility C b. The ratio of cash flows to debt indicates a company's ability to meet its debt obligation c. There is one formula used in calculating free cash flow according to GAAP 13. Cash flow from operations may differ from net income because of: a. Taxes paid b. Interest payments on debt obligations C Changes in working capital 14. Net Free Cash flow is best described as free cash flow after: a. Financing costs and taxes b. Taxes 150- 130 - 20 150-110 = 40 Coverag harehol c . Financing Costs Ear Out 15. if it takes, on average, 60 days to collect on its customers' accounts receivable turnover is closest to: A a. 6.1 times b. 2.12 times c. 4.64 times FitBit Case Fitbit, Inc. (the "Company) is transforming the way millions of people around the world achieve their health and fitness goals. The Fitbit platform combines connected health and fitness devices with software and services, including an online dashboard and mobile apps, data analytics, motivational and social tools, personalized insights, and virtual coaching through customized fitness plans and interactive workouts. The Company sells devices through diversified sales channels that include distributors, retailers, a corporate wellness offering, and Fitbit.com. The Company was incorporated in Delaware in 2007. The Company has established wholly-owned subsidiaries globally and its corporate headquarters are located in San Francisco, California. The core of our platform is our family of six wearable connected health and fitness trackers. These wrist-based and lippuble" devices automatically track users' daily steps, calories burned, distance traveled, floors climbed, and active minutes and display real-time feedback to encourage them to become more active in their daily lives. Most of our trackers also measure sleep duration and quality, and our more advanced products track heart rate and GPS-based information such as speed, distance, and exercise routes. Several of our devices also feature deeper integration with smartphones, such as the ability to receive call and text notifications and control music. In addition, we offer a Wi-Fi connected scale that records weight, body fat, and BMI enerate substantially all of our revenue from sales of our connected health and fitness devices. We sell out in over 1,000 retail stores and in 55 countries, through our retailers' websites, through our online More com, and as part of our corporate wellness offering. We seek to build global brand awareness, increase produce option, and and marketing efforts in the future, sales through our sales and marketing efforts. We intend to continue to significantly invest in the Our growth will depend in part on the depend in part on the adoption and sale of our products and services in international markets. In recent periods, we have experienced significant growth in international sales. We believe international markets represent significant growth opportunity for us. We growth opportunity for us. We intend to expand sales of our products and services in new international markets by expanding our distribution channels through se intend to continue to invest across all necgraphic regions in sales and expanding our distribution channels through select retailers and strategic partnership advertising efforts, and in infrastructure and personnel to support our mvest across all geographic regions in sales and marketing efforts, including increasing our additional sales offices globally. Our international expansion efforts has costs and are subject to a variety of risks, including increased competitie globally. Our international expansion efforts have resulted and will continue to result in increased d variety of risks, including increased competition uncertain enforcement of our intellectum rights, more complex distribution logisties and the complexity of compliance with foreign laws and regulations ational expansion, including establishing 1. Has the international expansion favored FitBit? What has been the effects on costs and net revenue 2. Is FitBit a healthy company asses its liquidity leverage and how it has been managing its assets throus financial ratios. 3. Because FitBit is a new company, the have little control over its suppliers and their policies. What would happen to the company's liquidity, if their suppliers asked to be paid in 90 days? What would be an estimated impact on Cash Balance? 4. How would you increase FitBit revenue? How would those actions reflect on financial statements? You can make as many assumptions as needed. They need to be backed up with numbers) Income Statement Jun. 30, 2015 $737,166 Jun. 30, 2014 $222,387 | Revenue/Sales/Sales on Credit Cost of revenue/Cost of Goods Sold 380,415 356,751 119,229 103,158 52,918 113,557 27,629 20,897 24,584 16,060 -7,704 Gross profit Operating expenses: Research and development Sales and marketing General and administrative Change in contingent consideration Total operating expenses Operating income Interest expense, net Other expense, net Income before income taxes Income tax expense Net income 186,400 170,351 -846 -58,385 111,120 45,442 65,678 61,541 41,617 -861 4,906 35,850 12,225 23,625 Jun. 30, 2015 Jun. 30, 2014 Balance Sheet Current Assets Cash and cash equivalents Accounts receivable, net Inventories Deferred tax assets Total Current Assets Property and equipment, net Goodwill Intangible assets, net Other assets Total Assets 461,276 252,023 186,870 1 49,625 949,794 30,945 22,157 13,263 12,308 1,028,467 195,626 238,859 115,072 33,555 583,112 26,435 9,890 619,437 Current Liabilities Accounts payable Deferred revenue Current Portion of Debt Total Current Liabilities Long Term Debt Total Liabilities 193,594 21,346 0 214,940 195,666 9,009 26,518 2 31,193 106,071 337,264 214,940 Equity Aditional Paid-in Capital Retained Earnings Total Shareholder Equity 590,290 223,237 813,527 7,979 274,194 282,173 Number of Shares Price of the Stock 343,928 34.6 343,928 30.7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started