Answered step by step

Verified Expert Solution

Question

1 Approved Answer

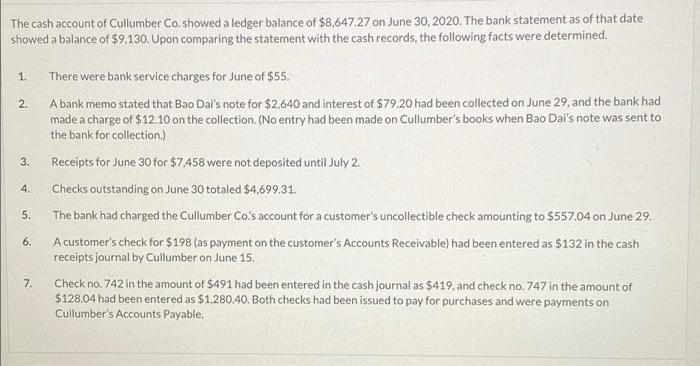

The cash account of Cullumber Co. showed a ledger balance of $8,647.27 on June 30, 2020. The bank statement as of that date showed

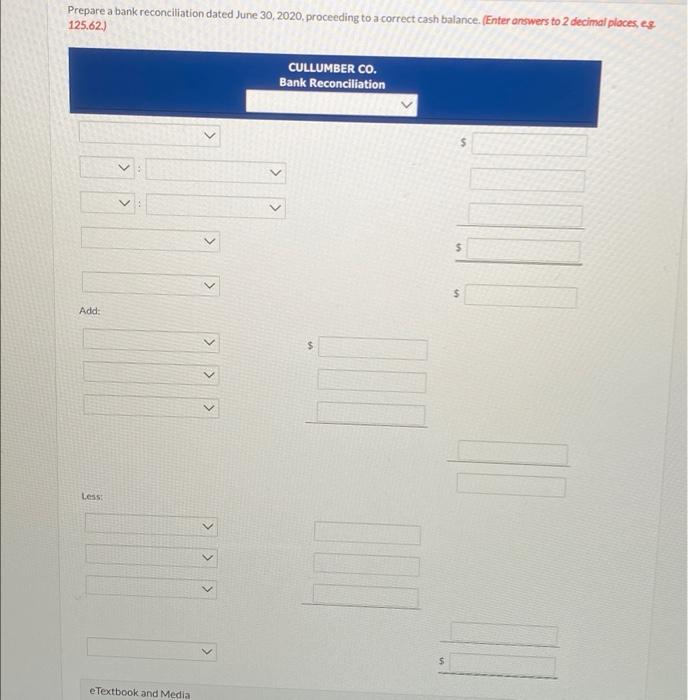

The cash account of Cullumber Co. showed a ledger balance of $8,647.27 on June 30, 2020. The bank statement as of that date showed a balance of $9.130. Upon comparing the statement with the cash records, the following facts were determined. There were bank service charges for June of $55. 1. A bank memo stated that Bao Dai's note for $2,640 and interest of $79.20 had been collected on June 29, and the bank had made a charge of $12.10 on the collection. (No entry had been made on Cullumber's books when Bao Dai's note was sent to the bank for collection.) 2. 3. Receipts for June 30 for $7,458 were not deposited until July 2. Checks outstanding on June 30 totaled $4,699.31. 5. The bank had charged the Cullumber Co's account for a customer's uncollectible check amounting to $557.04 on June 29. 6. A customer's check for $198 (as payment on the customer's Accounts Receivable) had been entered as $132 in the cash receipts journal by Cullumber on June 15. Check no. 742 in the amount of $491 had been entered in the cash journal as $419, and check no. 747 in the amount of $128.04 had been entered as $1,280.40. Both checks had been issued to pay for purchases and were payments on 7. Cullumber's Accounts Payable. 4. Prepare a bank reconciliation dated June 30, 2020, proceeding to a correct cash balance. (Enter answers to 2 decimal places, eg 125.62.) CULLUMBER CO. Bank Reconciliation 24 Add: Less: eTextbook and Media > > The cash account of Cullumber Co. showed a ledger balance of $8,647.27 on June 30, 2020. The bank statement as of that date showed a balance of $9.130. Upon comparing the statement with the cash records, the following facts were determined. There were bank service charges for June of $55. 1. A bank memo stated that Bao Dai's note for $2,640 and interest of $79.20 had been collected on June 29, and the bank had made a charge of $12.10 on the collection. (No entry had been made on Cullumber's books when Bao Dai's note was sent to the bank for collection.) 2. 3. Receipts for June 30 for $7,458 were not deposited until July 2. Checks outstanding on June 30 totaled $4,699.31. 5. The bank had charged the Cullumber Co's account for a customer's uncollectible check amounting to $557.04 on June 29. 6. A customer's check for $198 (as payment on the customer's Accounts Receivable) had been entered as $132 in the cash receipts journal by Cullumber on June 15. Check no. 742 in the amount of $491 had been entered in the cash journal as $419, and check no. 747 in the amount of $128.04 had been entered as $1,280.40. Both checks had been issued to pay for purchases and were payments on 7. Cullumber's Accounts Payable. 4. Prepare a bank reconciliation dated June 30, 2020, proceeding to a correct cash balance. (Enter answers to 2 decimal places, eg 125.62.) CULLUMBER CO. Bank Reconciliation 24 Add: Less: eTextbook and Media > >

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer CLLUMBER Co Bank Reconciliation Statement June 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started