Question

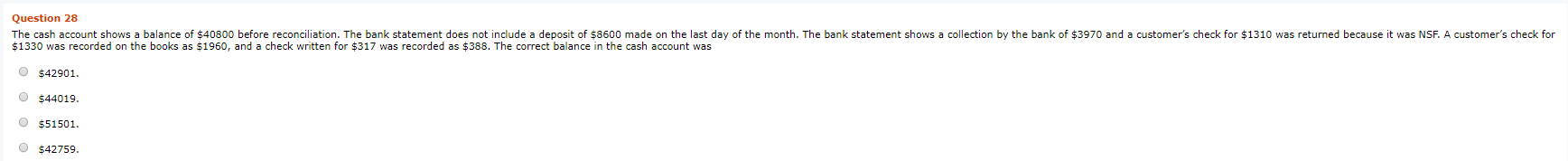

The cash account shows a balance of $40800 before reconciliation. The bank statement does not include a deposit of $8600 made on the last day

The cash account shows a balance of $40800 before reconciliation. The bank statement does not include a deposit of $8600 made on the last day of the month. The bank statement shows a collection by the bank of $3970 and a customers check for $1310 was returned because it was NSF. A customers check for $1330 was recorded on the books as $1960, and a check written for $317 was recorded as $388. The correct balance in the cash account was $42901. $44019. $51501. $42759.

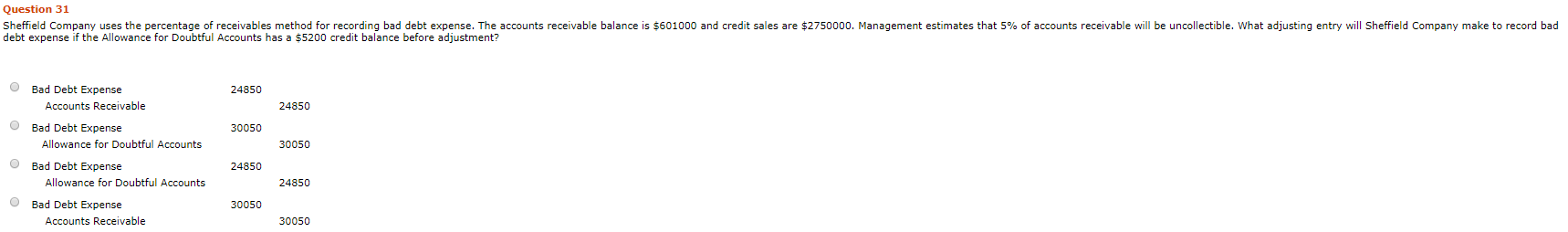

Sheffield Company uses the percentage of receivables method for recording bad debt expense. The accounts receivable balance is $601000 and credit sales are $2750000. Management estimates that 5% of accounts receivable will be uncollectible. What adjusting entry will Sheffield Company make to record bad debt expense if the Allowance for Doubtful Accounts has a $5200 credit balance before adjustment?

|

|

|

|

|

|

|

|

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started