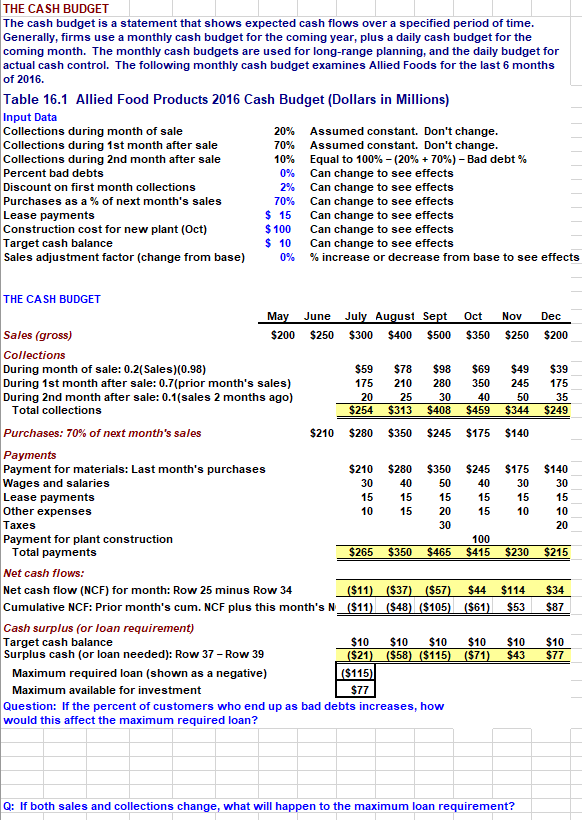

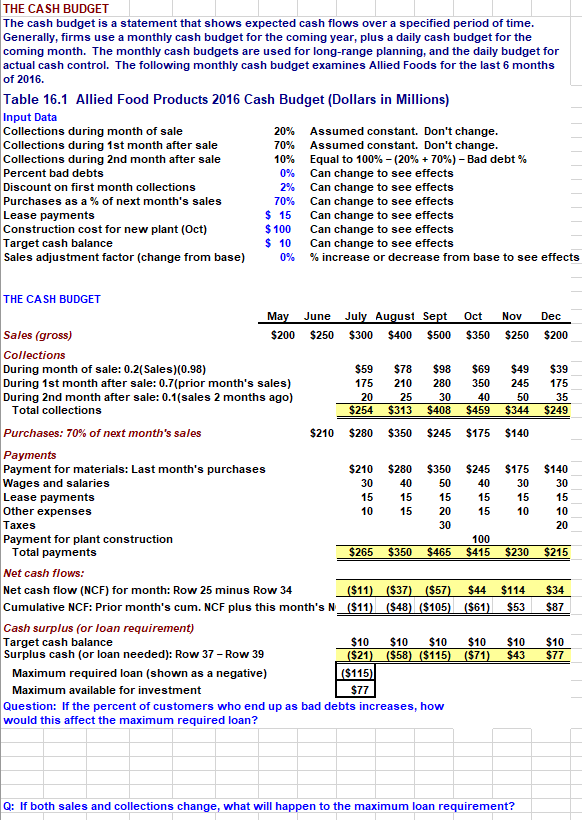

THE CASH BUDGET The cash budget is a statement that shows expected cash flows over a specified period of time Generally, firms use a monthly cash budget for the coming year, plus a daily cash budget for the coming month. The monthly cash budgets are used for long-range planning, and the daily budget for actual cash control. The following monthly cash budget examines Allied Foods for the last 6 months of 2016 Table 16.1 Allied Food Products 2016 Cash Budget (Dollars in Millions) Input Data Collections during month of sale Collections during 1st month after sale Collections during 2nd month after sale Percent bad debts Discount on first month collections Purchases as a % of next month's sales Lease payments Construction cost for new plant (Oct) Target cash balance Sales adjustment factor (change from base) 20% 70% 10% 0% 2% 70% $ 15 $100 $ 10 0% Assumed constant. Don't change Assumed constant. Don't change Equal to 100%-20% + 70%)-Bad debt % can change to see effects Can change to see effects Can change to see effects Can change to see effects Can change to see effects Can change to see effects % increase or decrease from base to see effects THE CASH BUDGET Ma June July August Se Oct Nov Dec Sales (gross) Collections During month of sale: 0.2(Sales)(0.98) During 1st month after sale: 0.7(prior month's sales) During 2nd month after sale: 0.1(sales 2 months ago) $200 $250 $300 $400 $500 $350 $250 $200 $59 S78 $98 $69 $49 $39 175 210 280 350 245 175 35 $254 $313 $408 $459 $344 $249 20 25 30 40 50 Total collections Purchases: 70% of next month's sales $210 $280 $350 $245 $175 $140 Payments Payment for materials: Last month's purchases Wages and salaries Lease payments Other expenses Taxes Payment for plant construction $210 $280 $350 $245 $175 $140 40 5 0 20 15 15 30 15 15 30 15 10 15 15 15 $265 $350 $465 $415 $230 $215 Total payments Net cash flows: Net cash flow (NCF) for month: Row 25 minus Row 34 Cumulative NCF: Prior month's cum. NCF plus this month's N_($11) ($48) S105) $11) ($37) ($57) $44 $114 $34 (S61) $53$87 Cash surplus (or loan requirement) Target cash balance Surplus cash (or loan needed): Row 37 - Row 39 $10 $10 $10 $10 $10 $10 $21) ($58) ($115) ($71) $43 $77 Maximum required loan (shown as a negative) Maximum available for investment $115 S77 Question: If the percent of customers who end up as bad debts increases, how would this affect the maximum required loan? Q: If both sales and collections change, what will happen to the maximum loan requirement