Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The discounted dividend model suggests a relationship between the price per share, the dividend yield, and the dividend growth. What dividend payment per share should

The discounted dividend model suggests a relationship between the price per share, the dividend yield, and the dividend growth. What dividend payment per share should the investors expect if this model is correct next year?

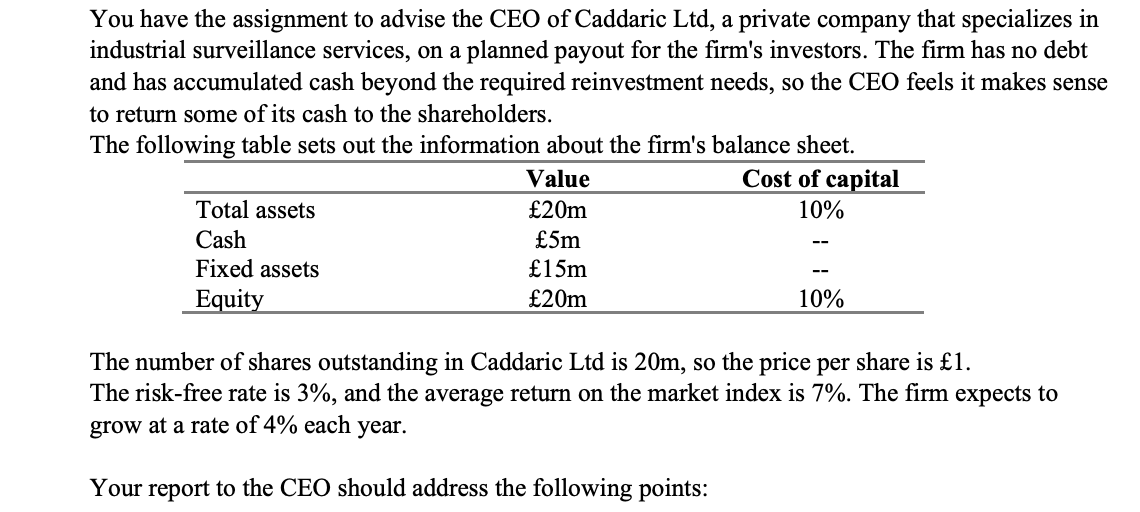

You have the assignment to advise the CEO of Caddaric Ltd, a private company that specializes in industrial surveillance services, on a planned payout for the firm's investors. The firm has no debt and has accumulated cash beyond the required reinvestment needs, so the CEO feels it makes sense to return some of its cash to the shareholders. The following table sets out the information about the firm's balance sheet. Value Cost of capital Total assets 20m 10% Cash 5m Fixed assets 15m Equity 20m 10% The number of shares outstanding in Caddaric Ltd is 20m, so the price per share is 1. The risk-free rate is 3%, and the average return on the market index is 7%. The firm expects to grow at a rate of 4% each year. Your report to the CEO should address the following pointsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started