Answered step by step

Verified Expert Solution

Question

1 Approved Answer

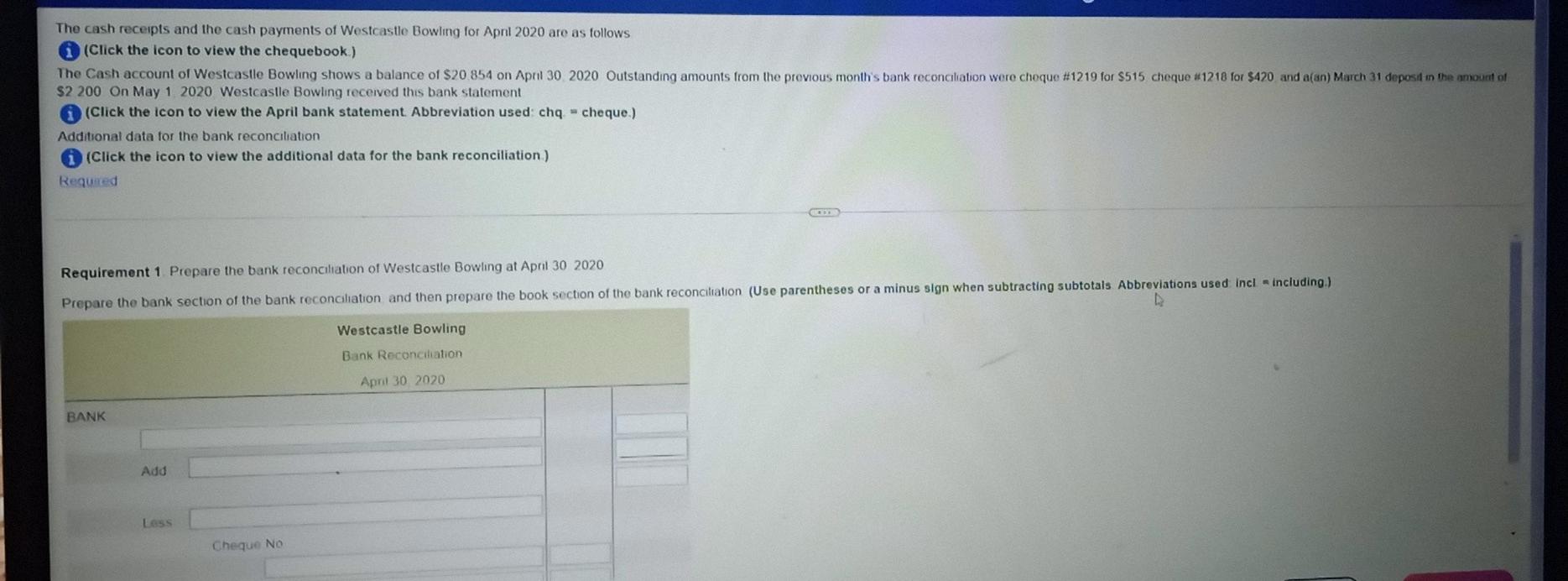

The cash receipts and the cash payments of Westcastle Bowling for April 2020 are as follows (Click the icon to view the chequebook) The Cash

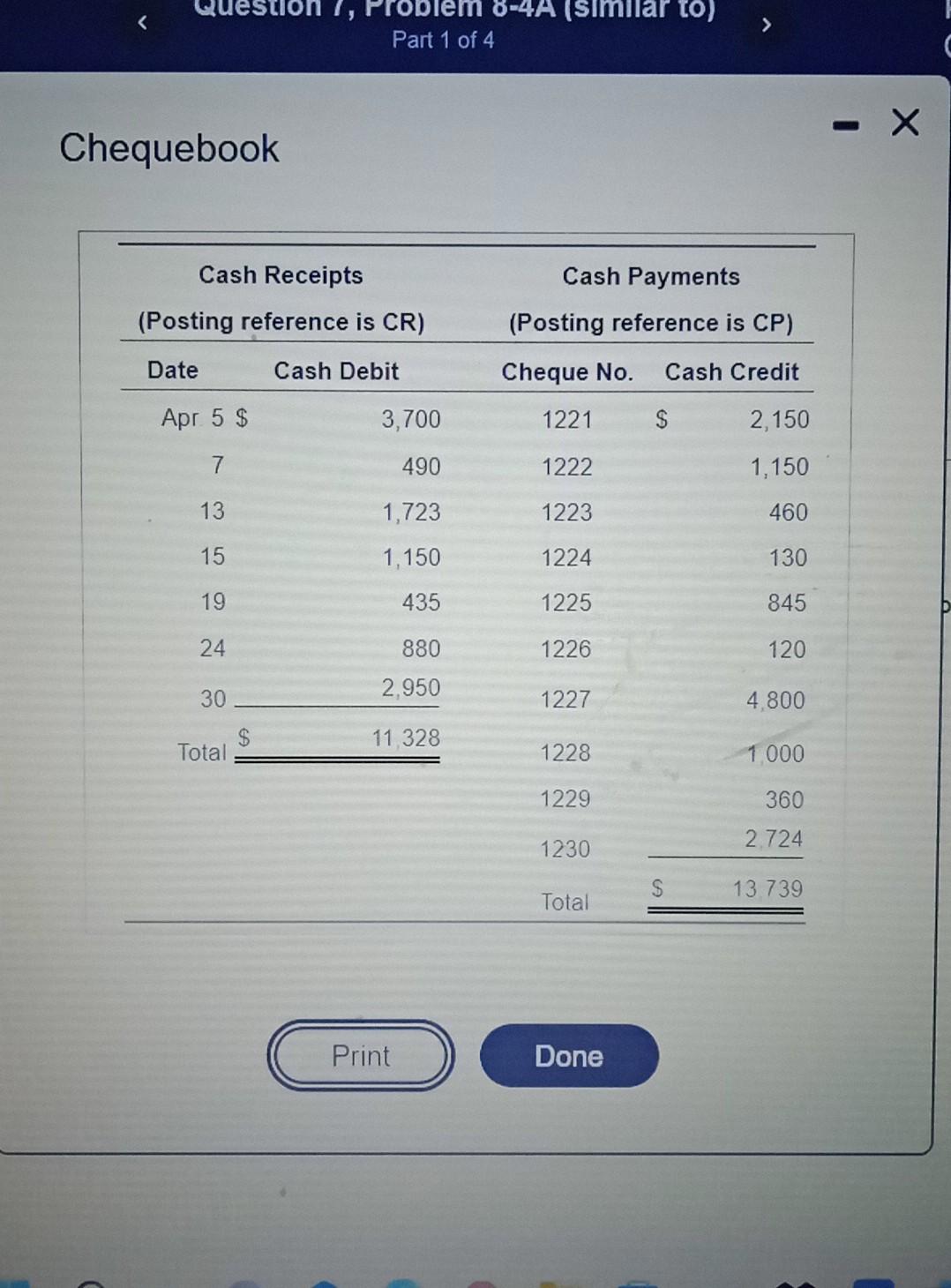

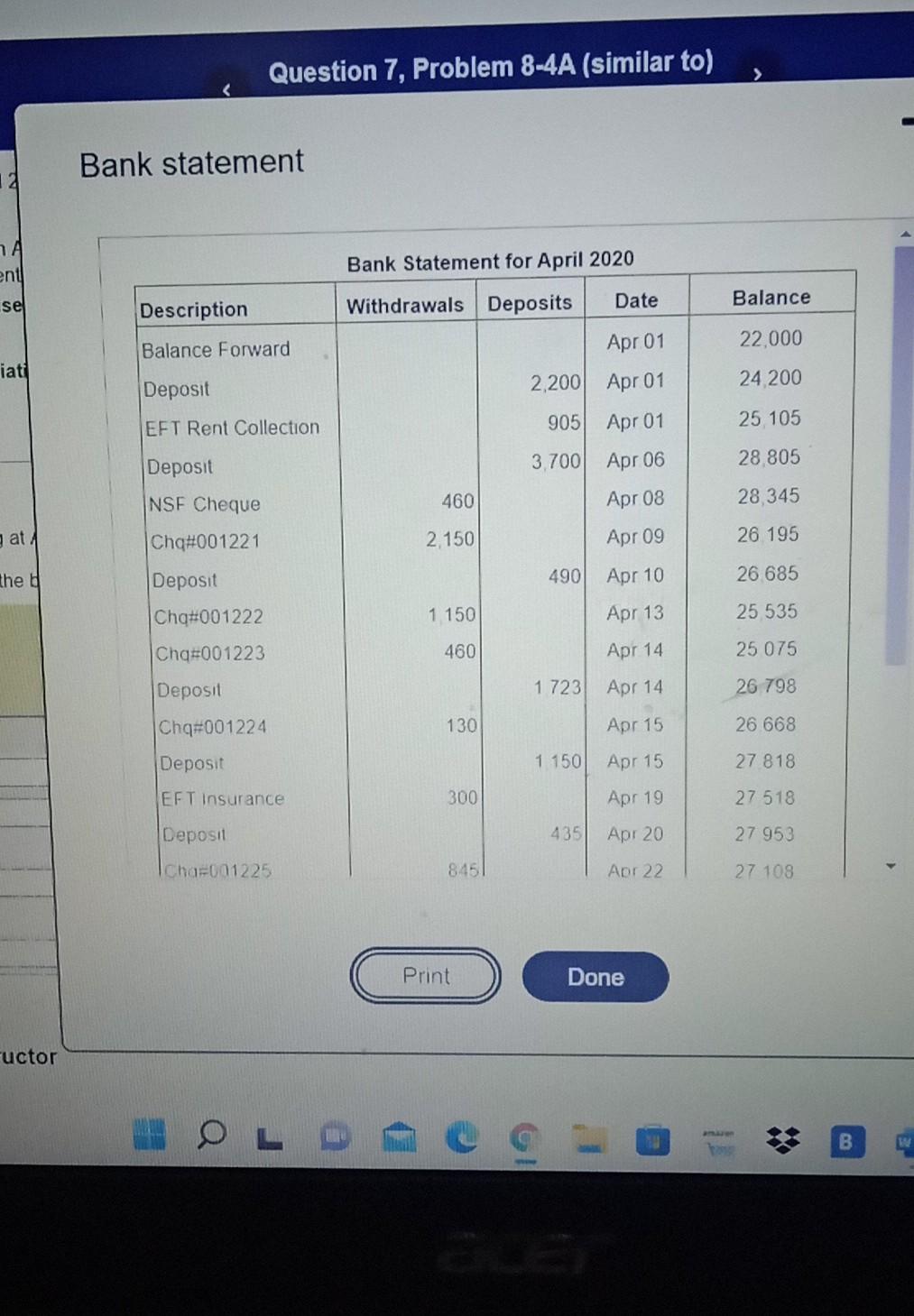

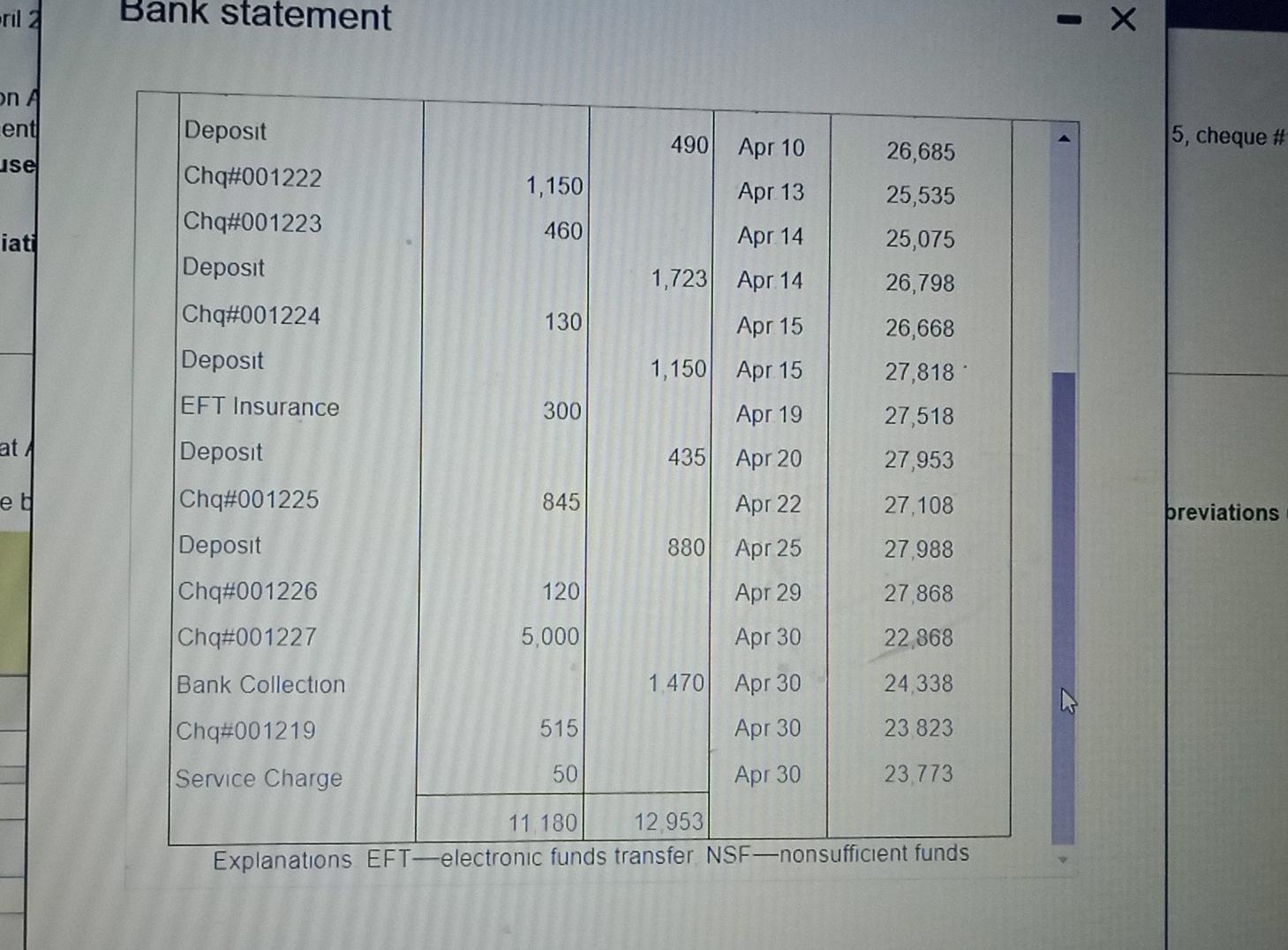

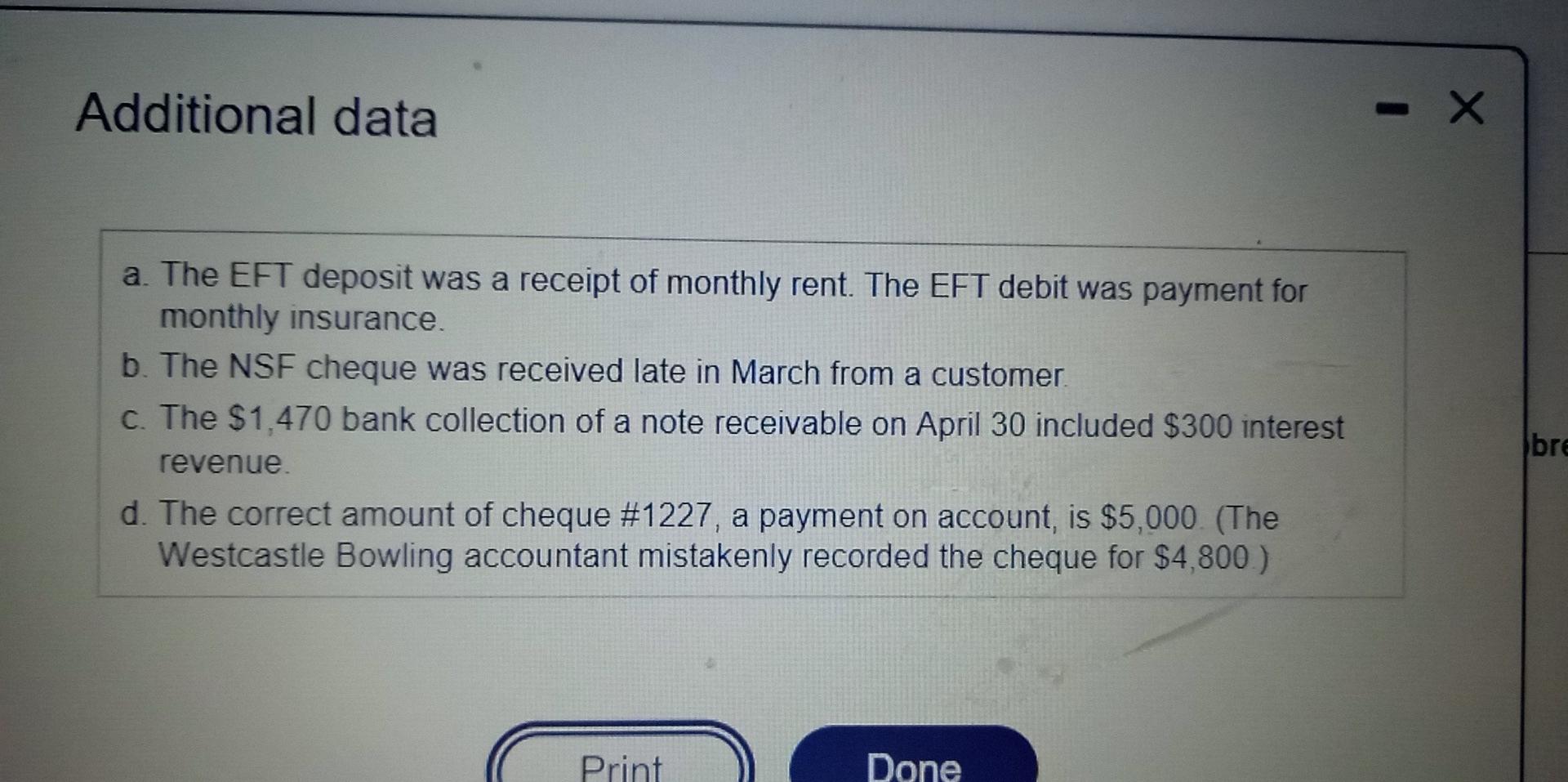

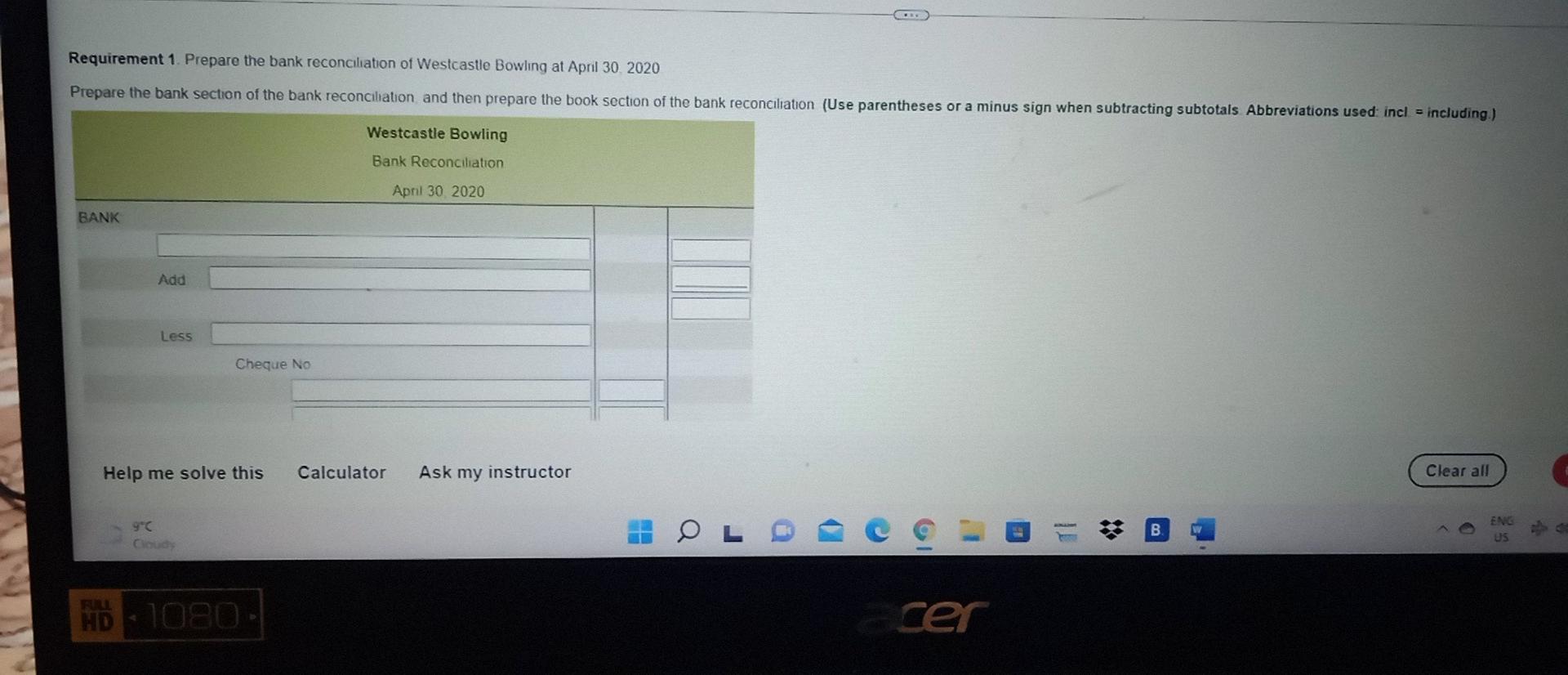

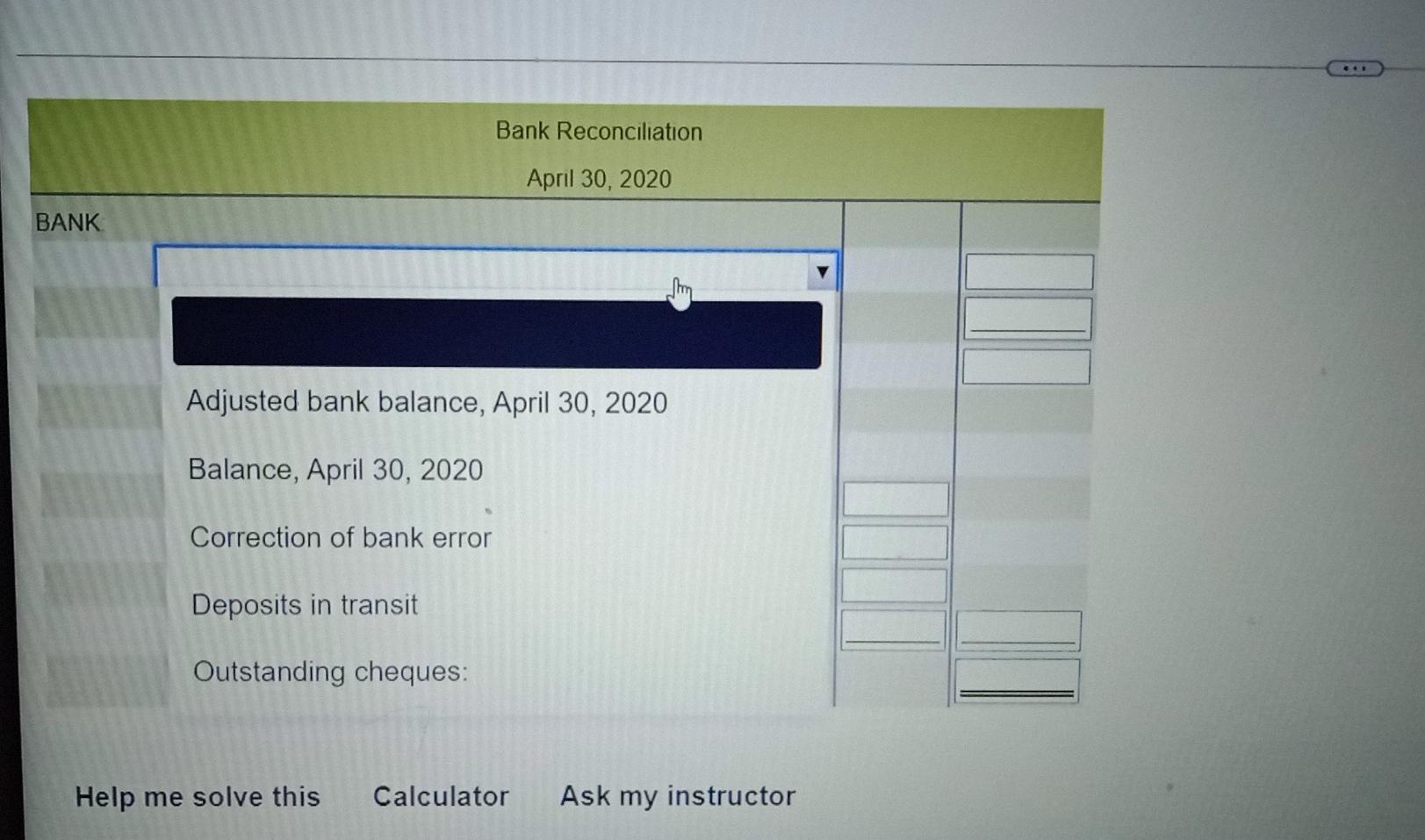

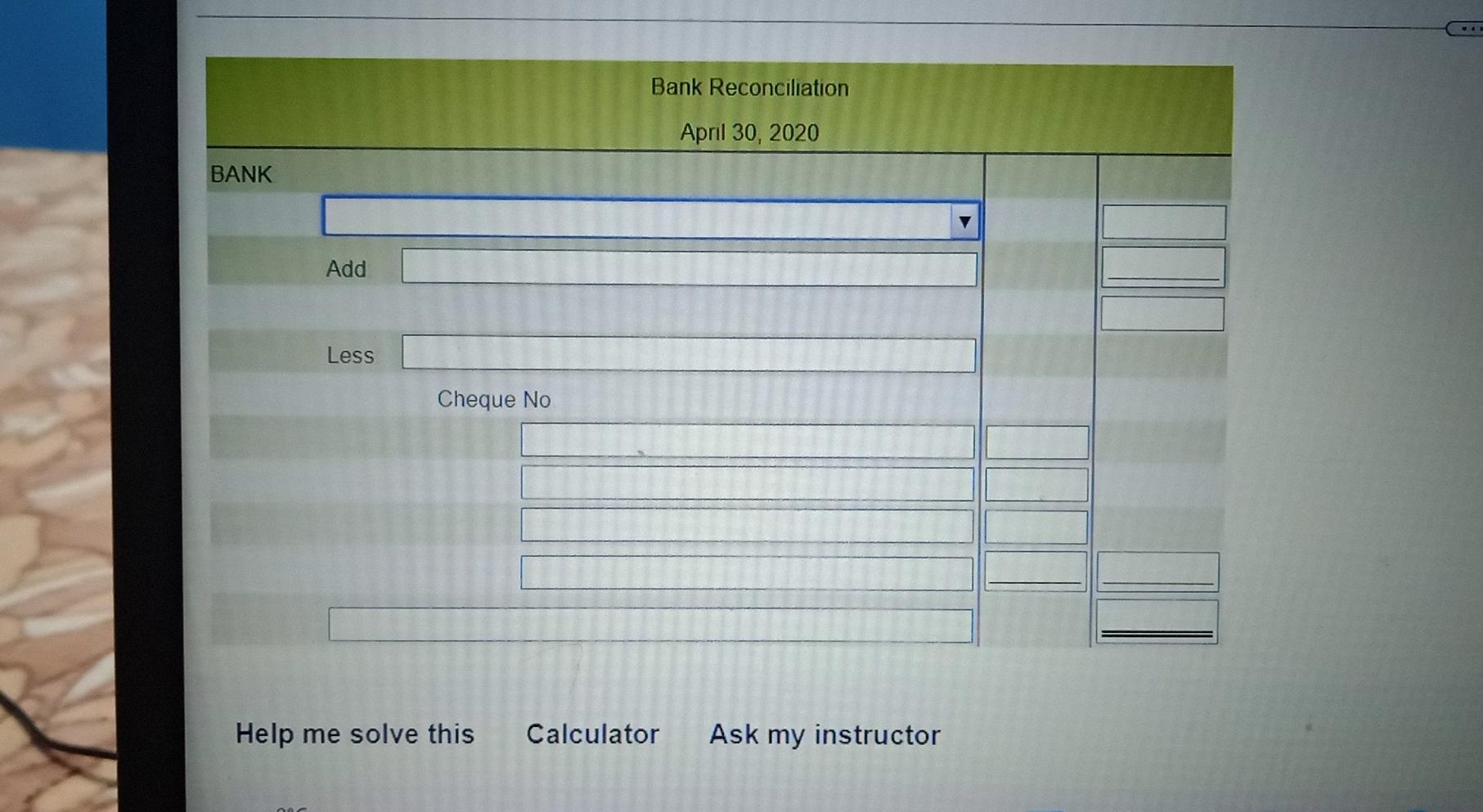

The cash receipts and the cash payments of Westcastle Bowling for April 2020 are as follows (Click the icon to view the chequebook) The Cash account of Westcastle Bowling shows a balance of $20 854 on April 30 2020 Outstanding amounts from the previous month's bank reconciliation were choque #1219 for $515 cheque #1218 for $420 and a(an) March 31 deposit m the amount of $2 200 On May 1 2020 Westcastle Bowling received this bank statement (Click the icon to view the April bank statement Abbreviation used chq - cheque.) Additional data for the bank reconciliation (Click the icon to view the additional data for the bank reconciliation ) Regunted Requirement 1 Prepare the bank reconciliation of Westcastle Bowling at April 30 2020 Prepare the bank section of the bank reconciliation and then prepare the book section of the bank reconciliation (Use parentheses or a minus sign when subtracting subtotals Abbreviations used incl - including) Westcastle Bowling Bank Reconciliation April 30 2020 BANK Add Los Cheque NO on 1, lem 8-4A (similar to) Part 1 of 4 Chequebook Cash Receipts Cash Payments (Posting reference is CR) (Posting reference is CP) Date Cash Debit Cheque No. Cash Credit Apr 5 $ 3,700 1221 $ 2,150 7 490 1222 1,150 13 1,723 1223 460 15 1,150 1224 130 19 435 1225 845 24 880 1226 120 30 2,950 1227 4.800 GA 11 328 Total 1228 1.000 1229 360 2.724 1230 ( 13 739 Total Print Done Question 7, Problem 8-4A (similar to) > Bank statement ent Bank Statement for April 2020 se Description Balance Withdrawals Deposits Date Apr 01 22.000 Balance Forward iati Deposit 24 200 2,200 Apr 01 905 EFT Rent Collection 25 105 Apr 01 3.700 Apr 06 Apr 08 Deposit 28 805 NSF Cheque 460 28 345 3 at 1 Chg#001221 2.150 Apr 09 26 195 the 490 Apr 10 26 685 Deposit Cha#001222 1 150 Apr 13 25 535 Cha=001223 460 Apr 14 25 075 1 723 Apr 14 26 798 Deposit Ch#001224 130 26 668 Apr 15 Apr 15 Deposit 1 150 27 818 EFT Insurance 300 Apr 19 27 518 Deposit 435 Apr 20 27 953 Cha=001225 8.451 Apr 22 27 108 Print Done uctor Q LO B Bank statement - ONA ent 490 Apr 10 5, cheque # 26,685 se Deposit Chq#001222 Chq#001223 Deposit 1,150 Apr 13 25,535 460 iati Apr 14 25,075 26,798 1,723 Apr 14 Chq#001224 130 Deposit Apr 15 1,150 Apr 15 Apr 19 26,668 27,818 EFT Insurance 300 27,518 at Deposit 435 Apr 20 27,953 el Chq#001225 845 Apr 22 breviations 27,108 27,988 880 Apr 25 Deposit Chq#001226 Chq#001227 120 Apr 29 27 868 5,000 Apr 30 22,868 Bank Collection 1.470 Apr 30 24 338 Chq#001219 515 Apr 30 23 823 Service Charge 50 Apr 30 23773 11.180 12.953 Explanations EFT-electronic funds transfer NSF-nonsufficient funds Additional data - X a. The EFT deposit was a receipt of monthly rent. The EFT debit was payment for monthly insurance. b. The NSF cheque was received late in March from a customer. C. The $1,470 bank collection of a note receivable on April 30 included $300 interest revenue. d. The correct amount of cheque #1227, a payment on account, is $5,000. (The Westcastle Bowling accountant mistakenly recorded the cheque for $4,800) bre Print Done Requirement 1. Prepare the bank reconciliation of Westcastle Bowling at April 30 2020 Prepare the bank section of the bank reconciliation and then prepare the book section of the bank reconciliation (Use parentheses or a minus sign when subtracting subtotals Abbreviations used: incl = including) Westcastle Bowling Bank Reconciliation April 30 2020 BANK Add Less Cheque NO Help me solve this Calculator Ask my instructor Clear all 90 OL 11 B w ENG US FULL HD 1080. cer Bank Reconciliation April 30, 2020 BANK Adjusted bank balance, April 30, 2020 Balance, April 30, 2020 Correction of bank error Deposits in transit Outstanding cheques: Help me solve this Calculator Ask my instructor Bank Reconciliation April 30, 2020 BANK Add Less Cheque No Help me solve this Calculator Ask my instructor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started