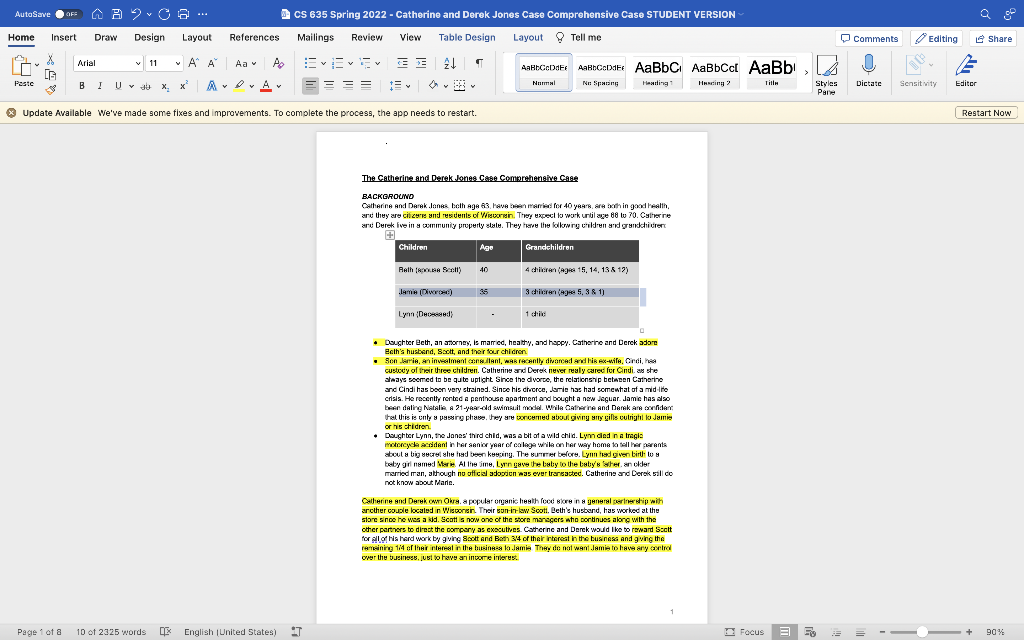

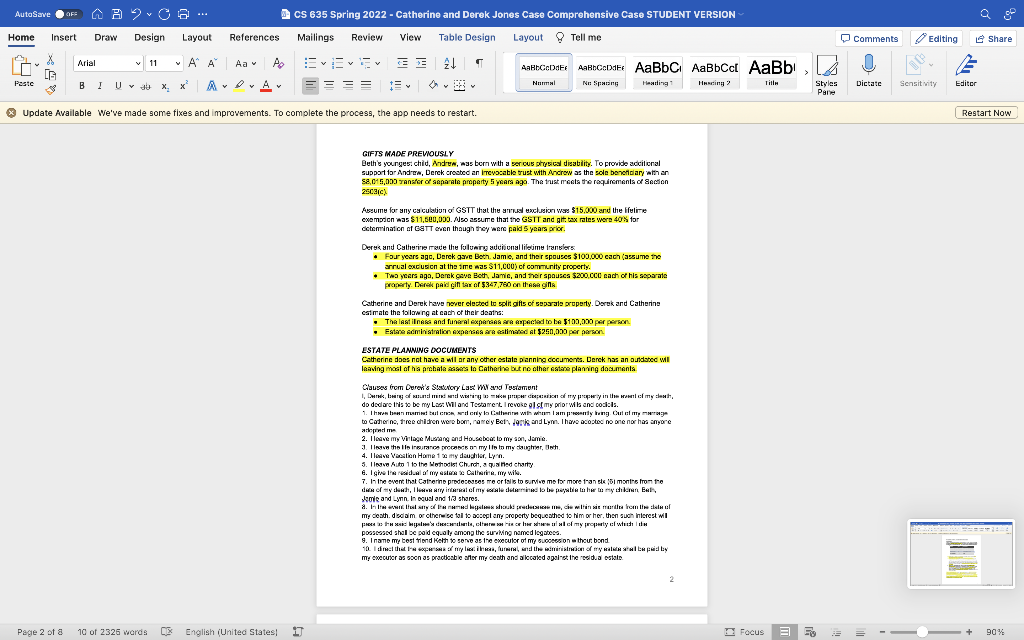

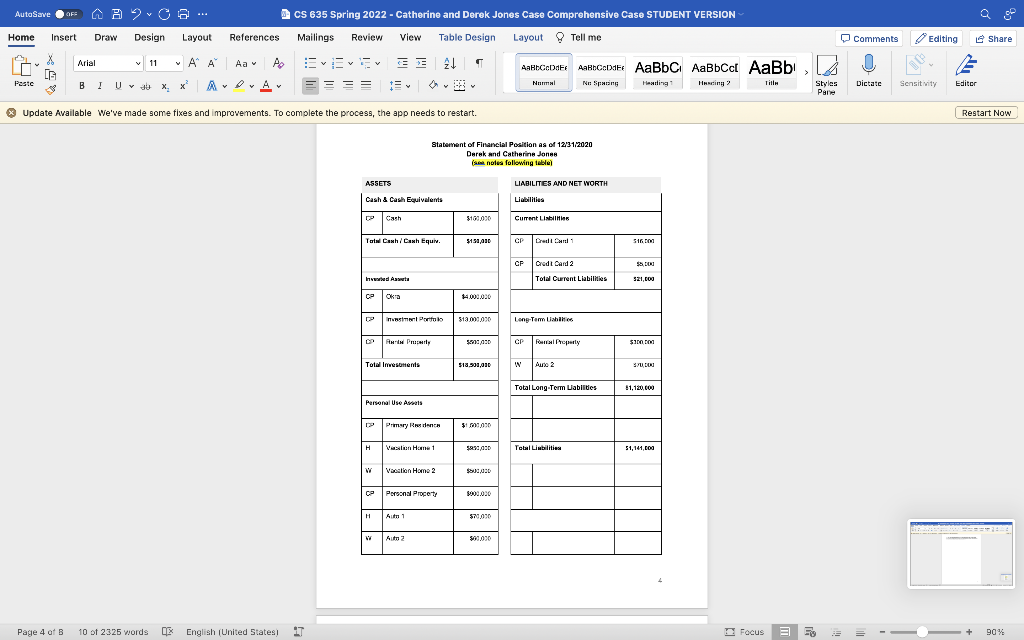

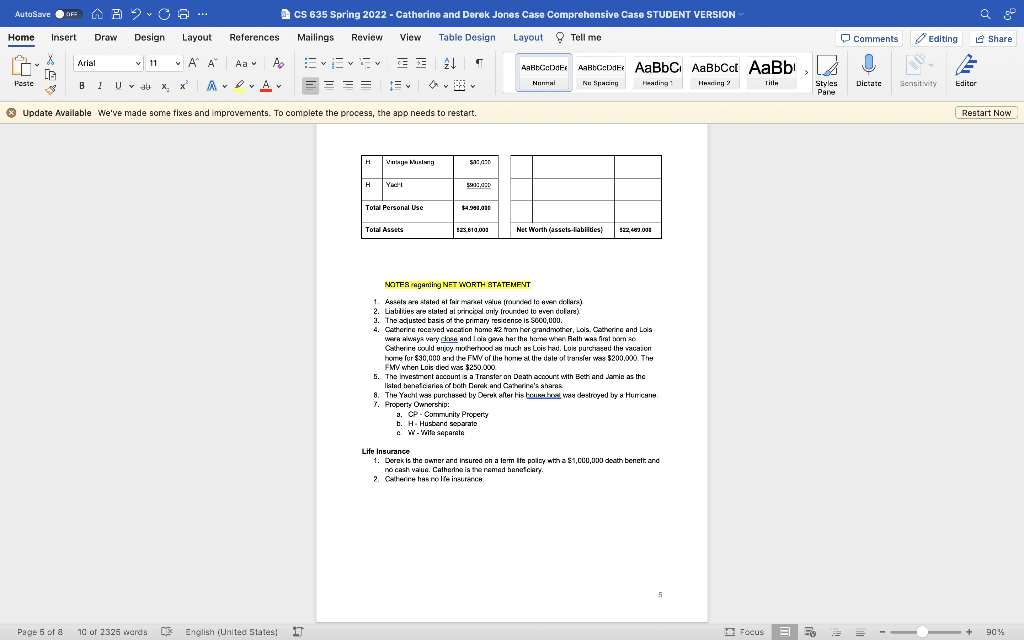

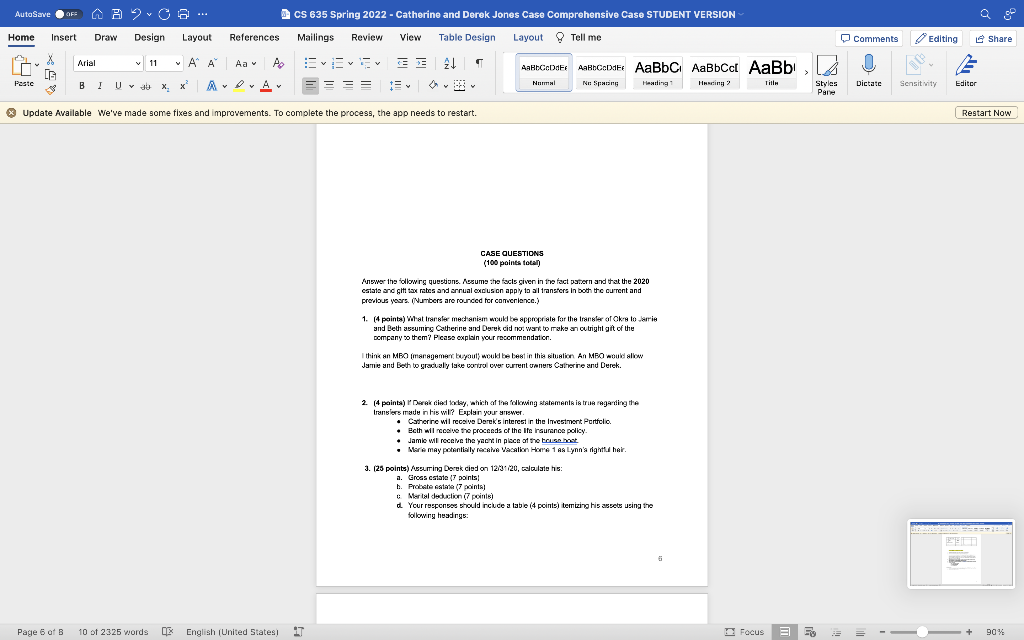

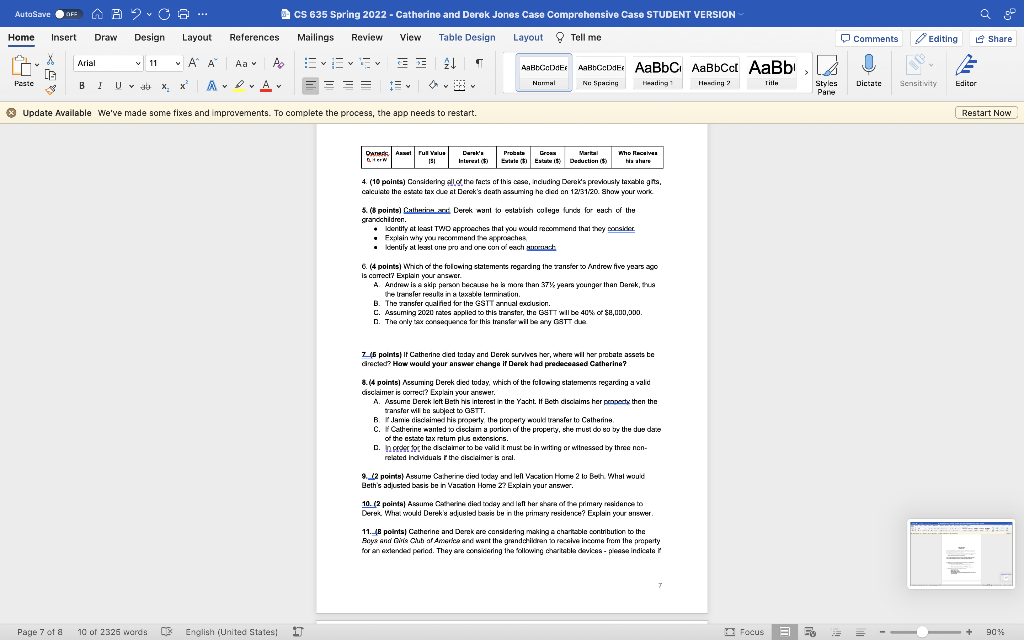

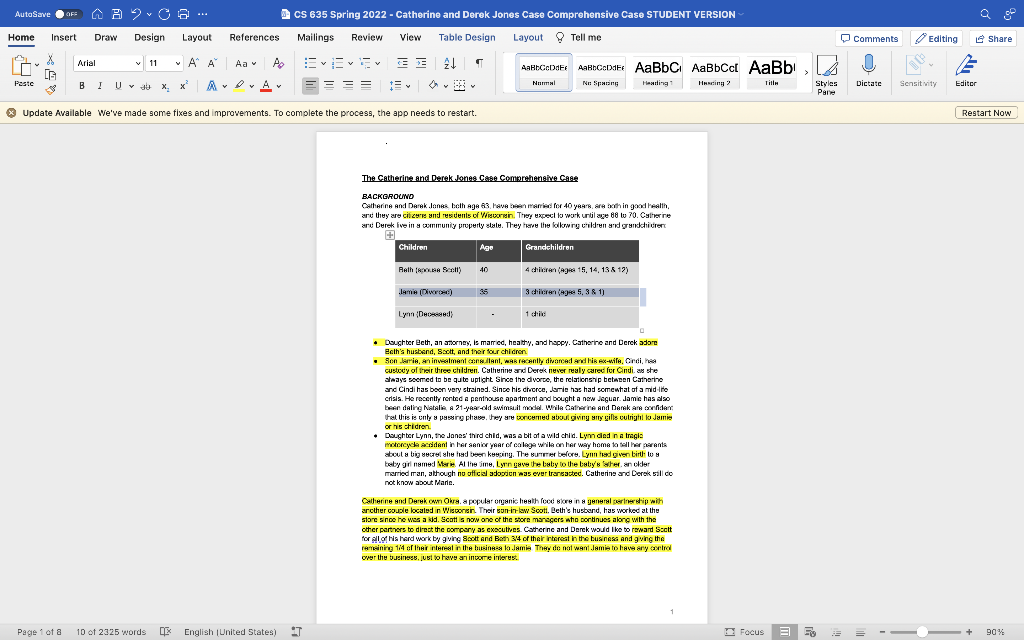

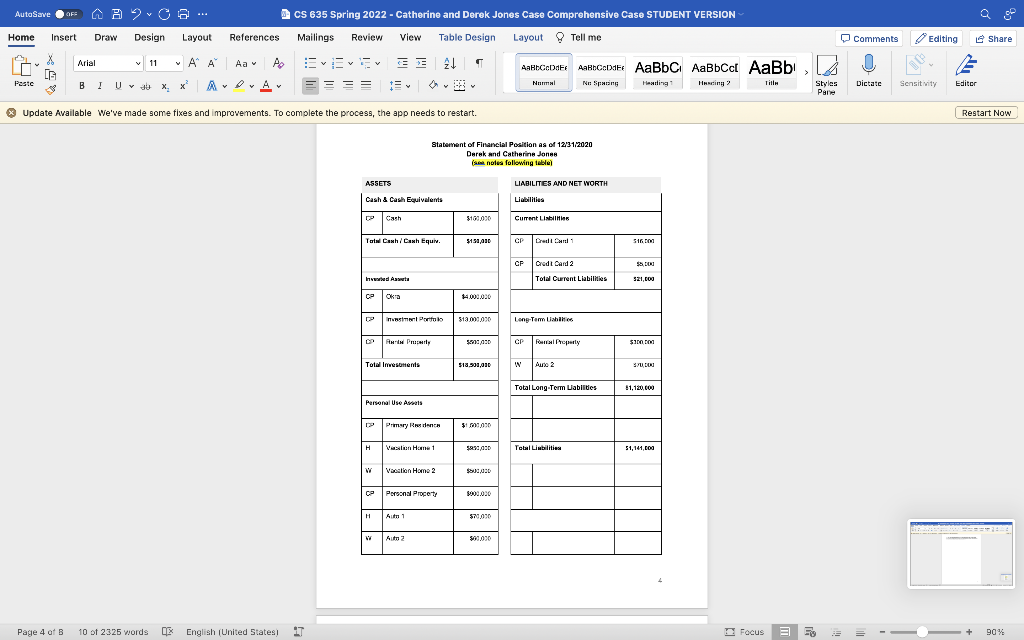

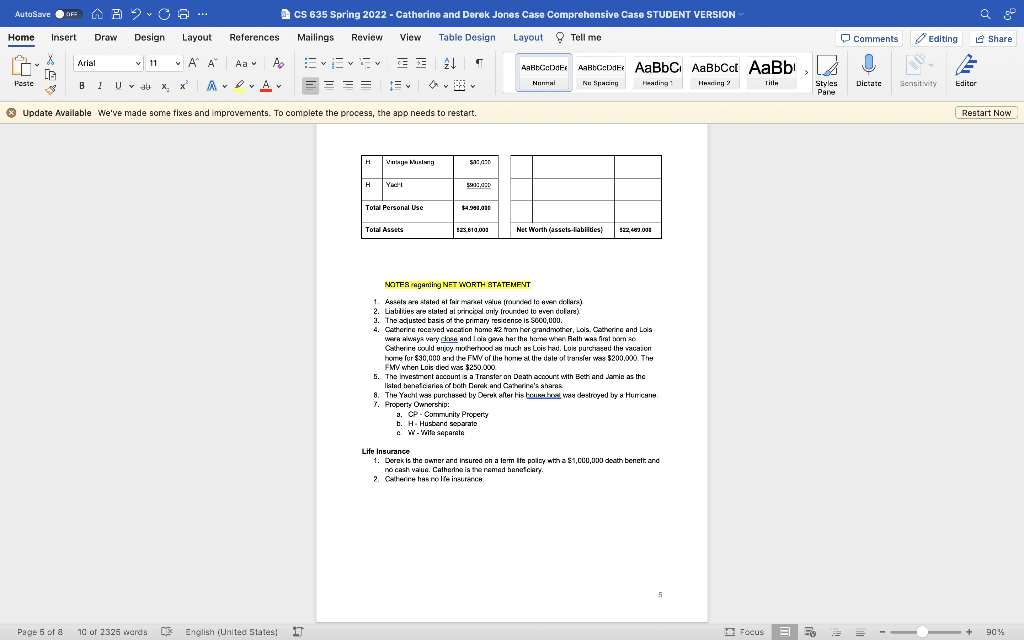

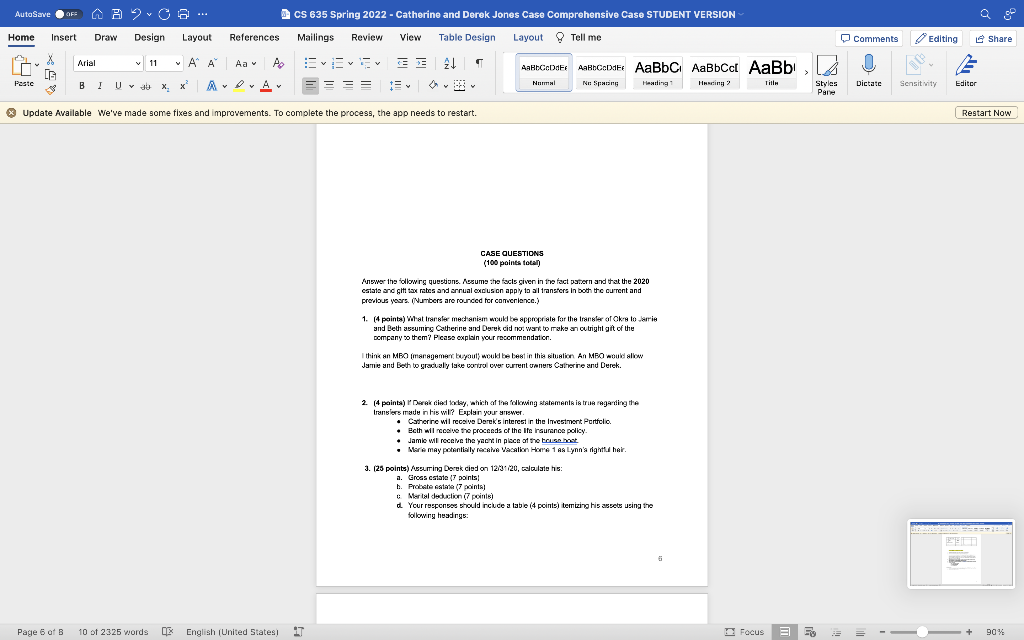

The Catherint and Derek Jones Case Comerehensive Case BACKGROUM - Coughber Beth, an atorney; is marred, healty, and happy. Catherine and Derek adoot Eoth's husbend, scett, and ther sour chiden. - Sen Jertie, an inveetmant dens. llant, war recantly dhamead ard kis ex-wife, Creid, hea custody of thair three children. Catherine and Derek nuver realy cared for Cindi. as ste stang seered to be qute upticht Sinoe the dworbe, the reiationship betanen Catherine and Cindi has been very strainat. Sinse his cherce, dsrie has had sementat of a mid tio crisia. He rocentty rerted a penthouse apatment and bought a new Jaguar. Jamis has also bean datiog Matalis a 21 yaer-edd swimeit model. Wila Catherine and Danak ars covidar: or tis stidren. - Dsughter Lynn, the Janes' third chid, was a bit of a wid chid. Lym ded n a tragia motroyda scridant in tar sanior yane of calaga whila on har way hama ta tell her perants atoul y big secrel alie trad ben ketsing. The sumper teiort. Limn trad given birth w y taty giri named Marie. Al the jme, Lyrn gave the baty to the baty's adter. an cider marriod man, although no vffeial adopien was ever trancacted. Cathering and Derek sill co not know about Maric. Cellerine and Derik onni Okrs. a pepulat ongnic hesth focd sicre in a guneral asrlnerctip with arcther couple becaled in Wisconsin. Their bon-i7-law Scott. Qethis husbend, has worked at the stare sinoe he wse a kid. Scatt is now one of the store mansgers who dorthues along with the oher partens bo diest the compory as exosuthes. Cstherine and Derek would lke to reward Ssett for of his hwrd work by g ging soset and Bath 344 of their rerest in the businesa and ging the orer the business, just bo hawy an intorte imerts. GIFTS MADE PREWOUSLY Gethis younges: chidd, hndrew, was bern w th a ser cus ohysical diasbility. To proride adcitional suppot1orAndrw, Derek cresbed an iTcuocable trust with Anciew as the sole benefidary ath an S8,01 5, DJJ ranefor of asparats pmparty 5 yeara ago. Tha tuak mesta the roquincmenta of Bncton 2scaici Assume for any cs culetion of GSTT that the armesl uxctsicn wes $15,000 and the ffulime cetsmination of GatT eonn thaugh they wane paid 5 yaara prior. Dery$100,000 each (agsume the arrual execusen at the ime was (11,COO) of commurity property. - Tina years ago, Derek gave Beth, Jamic, and their spausca $200, cco each of his separate pragerty. Derelk paid gifl tax of $347,760 an these gink Catherne and Derek have never elected to splin gifts of separaie oroperty. Derek and Catherine catmate the tolawng at each of thel death: - Tha last iInesci and funcral exparcana ara cipocted to ba $103,000 per permon. - Estane atiministration axparses ara datimated at $250,020 per parson. ESTATE PLANWWG DOCUAENTS Catherine does not have a wil ar any other estale pianning cocumerts. Derek has an audsbed wil laswing mait of ha pmhata sases to Catharise but no othar natane planing dacumenta Ciaves from Dener's Statutory Last Wr sund Tegiament do dodore this to be my Las: wil and Tecomett I revose glgf my priarwis and coaiz1s. to Caterns, tree dhidren wee bom, ramey Eeth, dqgke and Lym, I haus acostos no one nor har anyore atheprat m= J. Ileave the lle ineurares procesce on mylte to my taugher, Jeth. 4. Ilanve Vastien Hame 1 xe my daughior, Li'n. 5. Ilesve huto 1 to the Wetrotist Ch.nch, a qua ned charty s.ove and - snn. In equel and 1 i. shares. mi cesth. ded om or cthene se toll to acsepl eng property bequeathed to him or her, then sudh inierest wil poasessed shal be poid cq-alf amsep the suribing named legabes. 9. I Iame my test tiend keth to serve ss the execuior of my suocess on e theu. bond mf ewecuier as cocn se proctiesble siter mf cesth and alecaied agsieet the reeid. a cesisle. the ch lereris shsre, regsrdees of whsther ny beo.es suratses me. Statement of Financisi preition a m 12919 mon no.al a.d ? NOTES rggAming NET WORTH BTATEMENT 1. Asaata arh atatad at fair marat velue frorabed to huen iblars) 3. The sciusted tasis of the prmary res dende is scou,000. 4. Catherine receved weat on hame th from her gandmother, Lols. Catherine and Lois were alvayz vary dkaA and lcia geon haf the hame when Reth war fifat acen as Catherire could urioy motherhod as much ys Lois tad. Loia purdessed the valaien hare fer \$30,000 s.d the FAld of tie ikate al die dile al frutisier wass 5200.000 . The FMFV uten Lois died was $250,000. 5. The Irwesement abcount is a Trarster an Death scoourt with Beth and Jartie as the liathd hanof ciariae of both Darek and Catherine's ahara. 8. The Yacal wes purchssed by Derek after lis teaike tocel way destrofud ing a Hurr certe. 7. Property Omership: s. CP-Commurity Property b. H - Huberd seporate c. W' - Wia sipanta Life Insurance 1. Derek is the awner and hesured on a tem lfe poler wth a $1, Ccu,0D0 desth benett: and no cash vaus. Calhanine ia the ramed hangfiary. 2. Cafierire has ro libe inturarce. (100 paints totel) Answer the tollowrg questions. Aegume the facts given in the foct pstern and that the 2020 estate and gitt tax mbes and srrual excius on apply to al toneters in both the curtent and predous yosrs. (N Wumbers are rounced ter camverience.) 1. (4 pointa) Wiat transler mectianiam wcukd to sppopriate for the transler af okre to Jarrie and Deth assumirg Catherine and Derek cid not wart to rake an cutright gitt of the bompany totem? Piease explsin your rocommendation. It thin an MBO (maragemer targauly woukd be best in thia situation An MEO wouk albw Jamie and Eeth to growialy lase corisal over current oneners Csinerine and Derek. 2. (4 paints) Ir Derak tied tadyy, which of the folkwing shatements is trua mageting the Iransiers madu in tis wil? Eaplain your smewer. - Catherine wil receiwe Derek's interest in the Imoestment Partuclio. - Ecth wil moeve the procecds of the Ifs reaursnoe polly. - Jamie wil receloe the yache in plsce of the tcian most - Mare may poobntiely recabo Jacalion Hare 1 as L.jnn'a nightlul hair. 3. (25 points) Assuring Deruk cist on 12 Jl i20, calaulaie hs: a. Groes catate {7 points| b. Probete estata (7 coints) t. Mar lal deduction (7 points) d. Ycur raspenese should relude a labie (4 pcints) temizing his assets using the follownghesdnue: (100 paints totel) Answer the tollowrg questions. Aegume the facts given in the foct pstern and that the 2020 estate and gitt tax mbes and srrual excius on apply to al toneters in both the curtent and predous yosrs. (N Wumbers are rounced ter camverience.) 1. (4 pointa) Wiat transler mectianiam wcukd to sppopriate for the transler af okre to Jarrie and Deth assumirg Catherine and Derek cid not wart to rake an cutright gitt of the bompany totem? Piease explsin your rocommendation. It thin an MBO (maragemer targauly woukd be best in thia situation An MEO wouk albw Jamie and Eeth to growialy lase corisal over current oneners Csinerine and Derek. 2. (4 paints) Ir Derak tied tadyy, which of the folkwing shatements is trua mageting the Iransiers madu in tis wil? Eaplain your smewer. - Catherine wil receiwe Derek's interest in the Imoestment Partuclio. - Ecth wil moeve the procecds of the Ifs reaursnoe polly. - Jamie wil receloe the yache in plsce of the tcian most - Mare may poobntiely recabo Jacalion Hare 1 as L.jnn'a nightlul hair. 3. (25 points) Assuring Deruk cist on 12 Jl i20, calaulaie hs: a. Groes catate {7 points| b. Probete estata (7 coints) t. Mar lal deduction (7 points) d. Ycur raspenese should relude a labie (4 pcints) temizing his assets using the follownghesdnue: calcukts the astabs tax due at Derck's death assuming ha ded an 12/31 izo shaw ycur work. S. (s points) Catheriz4 and Derek wunl to estsbish colugy funde for esth of the cogranchidren. - bortify at laset TWO approsches that you would moommend that they moakre - Fxalaio thing you recammend the epprcesthak 6. (4 points) Which of the folcwing statements regarding the raneter o fudrew five yeat apo is carochl Expisin your anawer. The vermeter resuly in a laxyide lonniradien. B. The ransfer qualing for the gim arrual suduscn. C. Assuming 2020 rabes appliad to tis trarefer, the Gsi w wi be 40 of of $R,dDD,000. 7 (. points) If Catherine ded taday and Derek surutecs her, where wil her probate assets te cinctod? Horw would your answer change if Derak had predecoased Catharine? 6. (4 points) Assuming Derek ded todsy, which of the folvaing slsigmens regarcing a vald ciselaimer is correct? Explain your answer. A. Assume Derek ieft Beth ivs interest in the rost. If Beth cleclsims her ponaecte then the tracafie wil ha a.bjact to GSTT. C. If Catherine asnled to cisctam a partion of the propery, she musi do so ty the due dse of the estabe tax retum plus extersiors. D. Vicrogr for the dadaimer bo be valid it must be in writing or witnasand by thme nenrektod lndividuate r the disc aimer ts arsl. 9. (2 points) ssume Caherine tied lockay ard lefl Wacalion Hore 2 iv Eeth Whsl wuu d Beth's adusied besis be in Vacaton Home 2 ? Explain yuur answer. 11. IB polints) Cetherine and Derak are cansidering making a chatable contritution to the ENCH of these dewibes). - A Charitable Fomainder Arrulty Truz. - A Chantahie Fismainder Unituat Truat. - A packe Inoama Fund - A Clarilabie Lega Trial. 12 i2 points) which of the following types of clsuses appear in Derek 5 wII A. apocin: Baquesta. A. Surviourahip Cloute B. No-cxntest ctases. C. Simulaneous death dause. 13. (2 points) Asauma Dersk cled in 2020. What filng shatua can Catharle Las an her 2020 inceme tax ralum? 14 I2 points) Aasume Derek diod in 20a0. Whioh fi ing stolua can Cather ne uae cn her 2021 16. 12 points) Mssume Derek dies today and Kelt is acpo nisd exeoutor. Kelth is considering ekesne the sliernate waluaten date. Which of the folk wing statementa does not comesthr refect the nules sppicabie io the sternste walualien cale? xppieat Ia anly s purtien :a lhe prop:urty. E. Asects daposed of w thin six months of the dcosdents dath mus: be valued en the daxe of dhapeatior. 5. The evecten can se msde vien though sh estaie tax rebum dees not have is be tled. D. The edection mist decrease the velue of the gross csste and dcorves the csabe 12x liwhisy 16. p6 points) Aasume Derek tronsfers ownershp ot the lic haserano poiky on his Ife 0 an Derek dies the years ister. tresied from an estaxe taw stantpoint Ee spe:Ho li explan ng why the proeseds wil wil net be inchaled in hice leckelu wsich. 17 [10 points) Idently the fve moat impertant ssatoe pla ning hasues that Cat onine and Derek The Catherint and Derek Jones Case Comerehensive Case BACKGROUM - Coughber Beth, an atorney; is marred, healty, and happy. Catherine and Derek adoot Eoth's husbend, scett, and ther sour chiden. - Sen Jertie, an inveetmant dens. llant, war recantly dhamead ard kis ex-wife, Creid, hea custody of thair three children. Catherine and Derek nuver realy cared for Cindi. as ste stang seered to be qute upticht Sinoe the dworbe, the reiationship betanen Catherine and Cindi has been very strainat. Sinse his cherce, dsrie has had sementat of a mid tio crisia. He rocentty rerted a penthouse apatment and bought a new Jaguar. Jamis has also bean datiog Matalis a 21 yaer-edd swimeit model. Wila Catherine and Danak ars covidar: or tis stidren. - Dsughter Lynn, the Janes' third chid, was a bit of a wid chid. Lym ded n a tragia motroyda scridant in tar sanior yane of calaga whila on har way hama ta tell her perants atoul y big secrel alie trad ben ketsing. The sumper teiort. Limn trad given birth w y taty giri named Marie. Al the jme, Lyrn gave the baty to the baty's adter. an cider marriod man, although no vffeial adopien was ever trancacted. Cathering and Derek sill co not know about Maric. Cellerine and Derik onni Okrs. a pepulat ongnic hesth focd sicre in a guneral asrlnerctip with arcther couple becaled in Wisconsin. Their bon-i7-law Scott. Qethis husbend, has worked at the stare sinoe he wse a kid. Scatt is now one of the store mansgers who dorthues along with the oher partens bo diest the compory as exosuthes. Cstherine and Derek would lke to reward Ssett for of his hwrd work by g ging soset and Bath 344 of their rerest in the businesa and ging the orer the business, just bo hawy an intorte imerts. GIFTS MADE PREWOUSLY Gethis younges: chidd, hndrew, was bern w th a ser cus ohysical diasbility. To proride adcitional suppot1orAndrw, Derek cresbed an iTcuocable trust with Anciew as the sole benefidary ath an S8,01 5, DJJ ranefor of asparats pmparty 5 yeara ago. Tha tuak mesta the roquincmenta of Bncton 2scaici Assume for any cs culetion of GSTT that the armesl uxctsicn wes $15,000 and the ffulime cetsmination of GatT eonn thaugh they wane paid 5 yaara prior. Dery$100,000 each (agsume the arrual execusen at the ime was (11,COO) of commurity property. - Tina years ago, Derek gave Beth, Jamic, and their spausca $200, cco each of his separate pragerty. Derelk paid gifl tax of $347,760 an these gink Catherne and Derek have never elected to splin gifts of separaie oroperty. Derek and Catherine catmate the tolawng at each of thel death: - Tha last iInesci and funcral exparcana ara cipocted to ba $103,000 per permon. - Estane atiministration axparses ara datimated at $250,020 per parson. ESTATE PLANWWG DOCUAENTS Catherine does not have a wil ar any other estale pianning cocumerts. Derek has an audsbed wil laswing mait of ha pmhata sases to Catharise but no othar natane planing dacumenta Ciaves from Dener's Statutory Last Wr sund Tegiament do dodore this to be my Las: wil and Tecomett I revose glgf my priarwis and coaiz1s. to Caterns, tree dhidren wee bom, ramey Eeth, dqgke and Lym, I haus acostos no one nor har anyore atheprat m= J. Ileave the lle ineurares procesce on mylte to my taugher, Jeth. 4. Ilanve Vastien Hame 1 xe my daughior, Li'n. 5. Ilesve huto 1 to the Wetrotist Ch.nch, a qua ned charty s.ove and - snn. In equel and 1 i. shares. mi cesth. ded om or cthene se toll to acsepl eng property bequeathed to him or her, then sudh inierest wil poasessed shal be poid cq-alf amsep the suribing named legabes. 9. I Iame my test tiend keth to serve ss the execuior of my suocess on e theu. bond mf ewecuier as cocn se proctiesble siter mf cesth and alecaied agsieet the reeid. a cesisle. the ch lereris shsre, regsrdees of whsther ny beo.es suratses me. Statement of Financisi preition a m 12919 mon no.al a.d ? NOTES rggAming NET WORTH BTATEMENT 1. Asaata arh atatad at fair marat velue frorabed to huen iblars) 3. The sciusted tasis of the prmary res dende is scou,000. 4. Catherine receved weat on hame th from her gandmother, Lols. Catherine and Lois were alvayz vary dkaA and lcia geon haf the hame when Reth war fifat acen as Catherire could urioy motherhod as much ys Lois tad. Loia purdessed the valaien hare fer \$30,000 s.d the FAld of tie ikate al die dile al frutisier wass 5200.000 . The FMFV uten Lois died was $250,000. 5. The Irwesement abcount is a Trarster an Death scoourt with Beth and Jartie as the liathd hanof ciariae of both Darek and Catherine's ahara. 8. The Yacal wes purchssed by Derek after lis teaike tocel way destrofud ing a Hurr certe. 7. Property Omership: s. CP-Commurity Property b. H - Huberd seporate c. W' - Wia sipanta Life Insurance 1. Derek is the awner and hesured on a tem lfe poler wth a $1, Ccu,0D0 desth benett: and no cash vaus. Calhanine ia the ramed hangfiary. 2. Cafierire has ro libe inturarce. (100 paints totel) Answer the tollowrg questions. Aegume the facts given in the foct pstern and that the 2020 estate and gitt tax mbes and srrual excius on apply to al toneters in both the curtent and predous yosrs. (N Wumbers are rounced ter camverience.) 1. (4 pointa) Wiat transler mectianiam wcukd to sppopriate for the transler af okre to Jarrie and Deth assumirg Catherine and Derek cid not wart to rake an cutright gitt of the bompany totem? Piease explsin your rocommendation. It thin an MBO (maragemer targauly woukd be best in thia situation An MEO wouk albw Jamie and Eeth to growialy lase corisal over current oneners Csinerine and Derek. 2. (4 paints) Ir Derak tied tadyy, which of the folkwing shatements is trua mageting the Iransiers madu in tis wil? Eaplain your smewer. - Catherine wil receiwe Derek's interest in the Imoestment Partuclio. - Ecth wil moeve the procecds of the Ifs reaursnoe polly. - Jamie wil receloe the yache in plsce of the tcian most - Mare may poobntiely recabo Jacalion Hare 1 as L.jnn'a nightlul hair. 3. (25 points) Assuring Deruk cist on 12 Jl i20, calaulaie hs: a. Groes catate {7 points| b. Probete estata (7 coints) t. Mar lal deduction (7 points) d. Ycur raspenese should relude a labie (4 pcints) temizing his assets using the follownghesdnue: (100 paints totel) Answer the tollowrg questions. Aegume the facts given in the foct pstern and that the 2020 estate and gitt tax mbes and srrual excius on apply to al toneters in both the curtent and predous yosrs. (N Wumbers are rounced ter camverience.) 1. (4 pointa) Wiat transler mectianiam wcukd to sppopriate for the transler af okre to Jarrie and Deth assumirg Catherine and Derek cid not wart to rake an cutright gitt of the bompany totem? Piease explsin your rocommendation. It thin an MBO (maragemer targauly woukd be best in thia situation An MEO wouk albw Jamie and Eeth to growialy lase corisal over current oneners Csinerine and Derek. 2. (4 paints) Ir Derak tied tadyy, which of the folkwing shatements is trua mageting the Iransiers madu in tis wil? Eaplain your smewer. - Catherine wil receiwe Derek's interest in the Imoestment Partuclio. - Ecth wil moeve the procecds of the Ifs reaursnoe polly. - Jamie wil receloe the yache in plsce of the tcian most - Mare may poobntiely recabo Jacalion Hare 1 as L.jnn'a nightlul hair. 3. (25 points) Assuring Deruk cist on 12 Jl i20, calaulaie hs: a. Groes catate {7 points| b. Probete estata (7 coints) t. Mar lal deduction (7 points) d. Ycur raspenese should relude a labie (4 pcints) temizing his assets using the follownghesdnue: calcukts the astabs tax due at Derck's death assuming ha ded an 12/31 izo shaw ycur work. S. (s points) Catheriz4 and Derek wunl to estsbish colugy funde for esth of the cogranchidren. - bortify at laset TWO approsches that you would moommend that they moakre - Fxalaio thing you recammend the epprcesthak 6. (4 points) Which of the folcwing statements regarding the raneter o fudrew five yeat apo is carochl Expisin your anawer. The vermeter resuly in a laxyide lonniradien. B. The ransfer qualing for the gim arrual suduscn. C. Assuming 2020 rabes appliad to tis trarefer, the Gsi w wi be 40 of of $R,dDD,000. 7 (. points) If Catherine ded taday and Derek surutecs her, where wil her probate assets te cinctod? Horw would your answer change if Derak had predecoased Catharine? 6. (4 points) Assuming Derek ded todsy, which of the folvaing slsigmens regarcing a vald ciselaimer is correct? Explain your answer. A. Assume Derek ieft Beth ivs interest in the rost. If Beth cleclsims her ponaecte then the tracafie wil ha a.bjact to GSTT. C. If Catherine asnled to cisctam a partion of the propery, she musi do so ty the due dse of the estabe tax retum plus extersiors. D. Vicrogr for the dadaimer bo be valid it must be in writing or witnasand by thme nenrektod lndividuate r the disc aimer ts arsl. 9. (2 points) ssume Caherine tied lockay ard lefl Wacalion Hore 2 iv Eeth Whsl wuu d Beth's adusied besis be in Vacaton Home 2 ? Explain yuur answer. 11. IB polints) Cetherine and Derak are cansidering making a chatable contritution to the ENCH of these dewibes). - A Charitable Fomainder Arrulty Truz. - A Chantahie Fismainder Unituat Truat. - A packe Inoama Fund - A Clarilabie Lega Trial. 12 i2 points) which of the following types of clsuses appear in Derek 5 wII A. apocin: Baquesta. A. Surviourahip Cloute B. No-cxntest ctases. C. Simulaneous death dause. 13. (2 points) Asauma Dersk cled in 2020. What filng shatua can Catharle Las an her 2020 inceme tax ralum? 14 I2 points) Aasume Derek diod in 20a0. Whioh fi ing stolua can Cather ne uae cn her 2021 16. 12 points) Mssume Derek dies today and Kelt is acpo nisd exeoutor. Kelth is considering ekesne the sliernate waluaten date. Which of the folk wing statementa does not comesthr refect the nules sppicabie io the sternste walualien cale? xppieat Ia anly s purtien :a lhe prop:urty. E. Asects daposed of w thin six months of the dcosdents dath mus: be valued en the daxe of dhapeatior. 5. The evecten can se msde vien though sh estaie tax rebum dees not have is be tled. D. The edection mist decrease the velue of the gross csste and dcorves the csabe 12x liwhisy 16. p6 points) Aasume Derek tronsfers ownershp ot the lic haserano poiky on his Ife 0 an Derek dies the years ister. tresied from an estaxe taw stantpoint Ee spe:Ho li explan ng why the proeseds wil wil net be inchaled in hice leckelu wsich. 17 [10 points) Idently the fve moat impertant ssatoe pla ning hasues that Cat onine and Derek