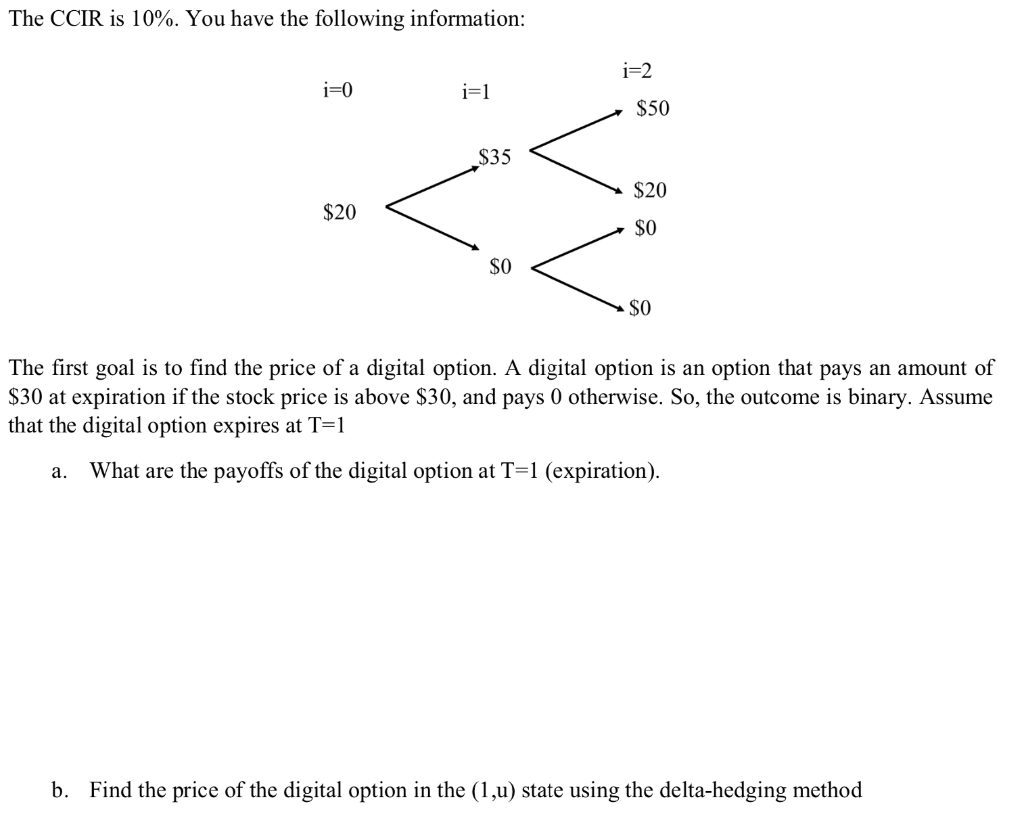

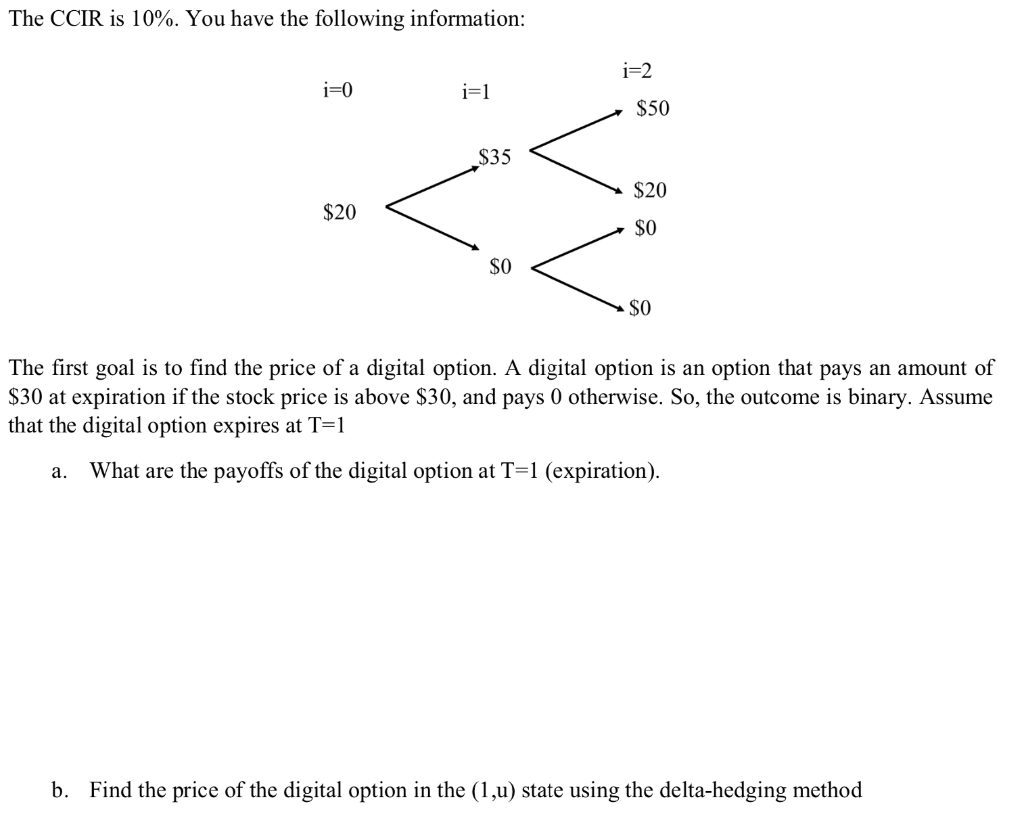

The CCIR is 10%. You have the following information: i=2 i=0 i=1 $50 $35 $20 $20 $0 SO SO The first goal is to find the price of a digital option. A digital option is an option that pays an amount of $30 at expiration if the stock price is above $30, and pays 0 otherwise. So, the outcome is binary. Assume that the digital option expires at T=1 What are the payoffs of the digital option at T=1 (expiration). a. b. Find the price of the digital option in the (1,u) state using the delta-hedging method c. Find the price of the digital option at T=0 using the replication method. d. Compute the risk-neutral probabilities at each node (98, 91,u, 91,d) e. Under the risk-neutral probabilities, if one buys the digital option in the node (1,u), compute the expected return from buying the digital option from i=1 to i=2. f. What is the probability that the digital option payoff is zero at T=1? Now suppose that at t=0 we have the opportunity to buy a choosers option. At t=0.5 we have to declare whether the choosers option to be a European put option with strike price K=20 or a European Digital option such as the one specified above. g. Compute the price of the choosers option today. The CCIR is 10%. You have the following information: i=2 i=0 i=1 $50 $35 $20 $20 $0 SO SO The first goal is to find the price of a digital option. A digital option is an option that pays an amount of $30 at expiration if the stock price is above $30, and pays 0 otherwise. So, the outcome is binary. Assume that the digital option expires at T=1 What are the payoffs of the digital option at T=1 (expiration). a. b. Find the price of the digital option in the (1,u) state using the delta-hedging method c. Find the price of the digital option at T=0 using the replication method. d. Compute the risk-neutral probabilities at each node (98, 91,u, 91,d) e. Under the risk-neutral probabilities, if one buys the digital option in the node (1,u), compute the expected return from buying the digital option from i=1 to i=2. f. What is the probability that the digital option payoff is zero at T=1? Now suppose that at t=0 we have the opportunity to buy a choosers option. At t=0.5 we have to declare whether the choosers option to be a European put option with strike price K=20 or a European Digital option such as the one specified above. g. Compute the price of the choosers option today