Question

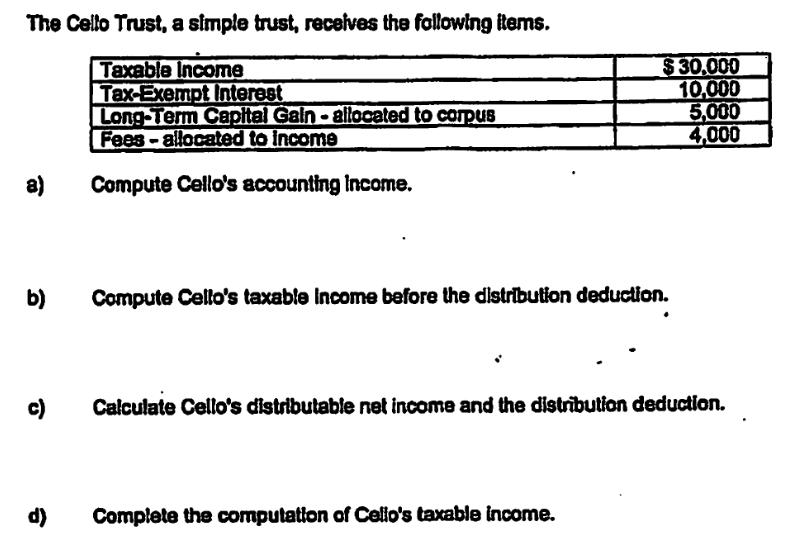

The Cello Trust, a simple trust, receives the following items. Taxable Income Tax-Exempt Interest Long-Term Capital Gain- allocated to corpus Fees-allocated to income Compute

The Cello Trust, a simple trust, receives the following items. Taxable Income Tax-Exempt Interest Long-Term Capital Gain- allocated to corpus Fees-allocated to income Compute Cello's accounting Income. a) b) c) d) $30,000 10,000 5,000 4,000 Compute Cello's taxable income before the distribution deduction. Calculate Cello's distributable net income and the distribution deduction. Complete the computation of Cello's taxable income.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Accounting Income Accounting income considers all income and expenses of the trust regardless of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2014 Comprehensive

Authors: Timothy J. Rupert, Thomas R. Pope, Kenneth E. Anderson

27th Edition

978-0133452006, 013345200X, 978-0133450118, 133450112, 978-0133438598

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App