Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CEO of Everest Ltd. stated the following in the company's 2021 annual report: Everest continues to make good use of shareholders' funds through

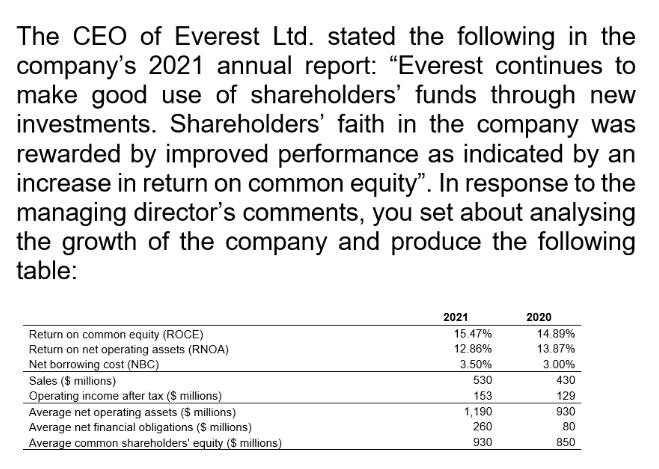

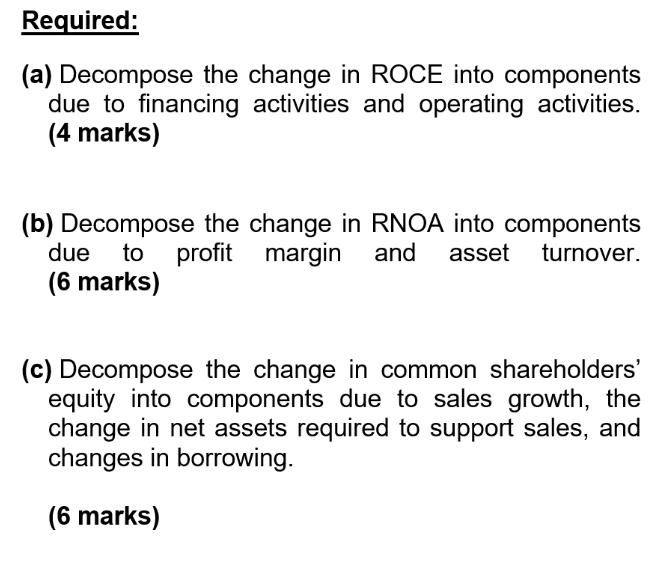

The CEO of Everest Ltd. stated the following in the company's 2021 annual report: "Everest continues to make good use of shareholders' funds through new investments. Shareholders' faith in the company was rewarded by improved performance as indicated by an increase in return on common equity". In response to the managing director's comments, you set about analysing the growth of the company and produce the following table: Return on common equity (ROCE) Return on net operating assets (RNOA) Net borrowing cost (NBC) Sales ($ millions) Operating income after tax ($ millions) Average net operating assets ($ millions) Average net financial obligations ($ millions) Average common shareholders' equity ($ millions) 2021 15.47% 12.86% 3.50% 530 153 1,190 260 930 2020 14.89% 13.87% 3.00% 430 129 930 80 850 Required: (a) Decompose the change in ROCE into components due to financing activities and operating activities. (4 marks) (b) Decompose the change in RNOA into components due to profit margin and asset turnover. (6 marks) (c) Decompose the change in common shareholders' equity into components due to sales growth, the change in net assets required to support sales, and changes in borrowing. (6 marks)

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Decompose the change in ROCE into components due to financing activities and operating activities ROCE2021 Net Operating Profit After Tax Average Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started