Question

The CFO for ABC Healthcare Corporation assessed the market value by reviewing its price/earnings ratios. The price/earnings ratio determines the market value of a stock

The CFO for ABC Healthcare Corporation assessed the market value by reviewing its price/earnings ratios. The price/earnings ratio determines the market value of a stock as compared to the company's earnings. The price/earnings ratios are listed in the chart below. To calculate the price/earnings ratio, the CFO took the earnings per share and divided that into the market value. As an example, this means that in 2019 investors were willing to pay $12.10 for $1 of earnings.

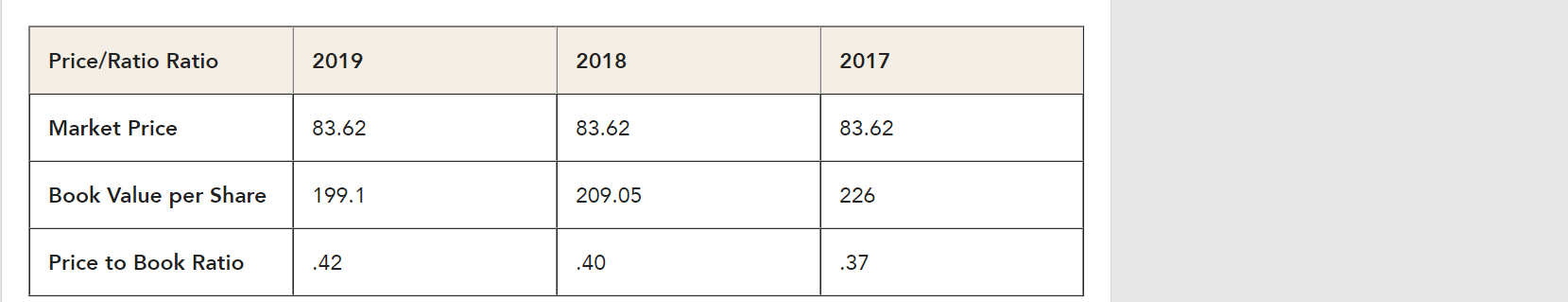

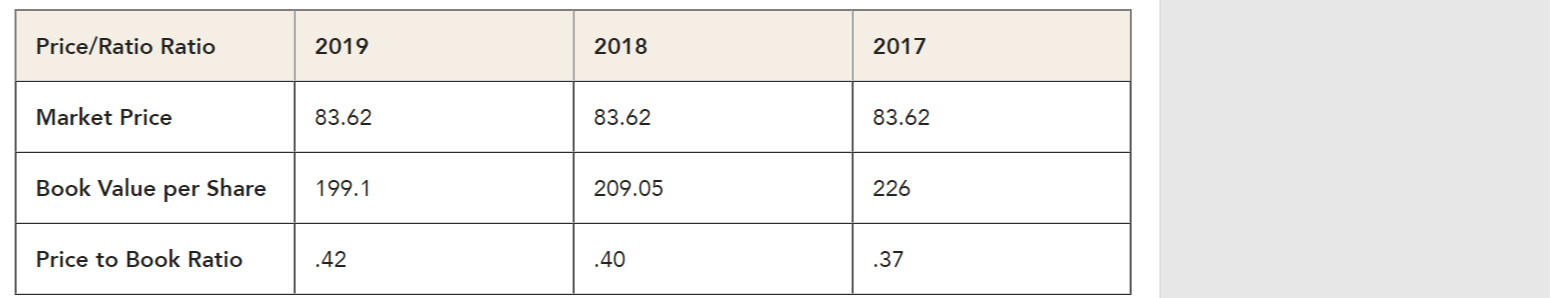

To further assess market value, the CFO looked at book value per share. The book value per share ratio is the per share value of a company in terms of the equity available to stockholders. The book values per share over the past three years are listed in the chart below:

To further assess market value, the CFO looked at book value per share. The book value per share ratio is the per share value of a company in terms of the equity available to stockholders. The book values per share over the past three years are listed in the chart below:

The price-to-book ratio (P/B ratio) compares a firm's market capitalization to its book value. It's calculated by dividing the company's stock price per share by book value per share. Here, for fiscal year 2019, the book value per share ratio was 0.42. This explains that investors were willing to pay $0.42 for $1 of book value equity. Price to book value is an important measure to see how much equity shareholders are paying for the net assets value of the company. P/B ratios under 1 are typically considered solid investments.

The price-to-book ratio (P/B ratio) compares a firm's market capitalization to its book value. It's calculated by dividing the company's stock price per share by book value per share. Here, for fiscal year 2019, the book value per share ratio was 0.42. This explains that investors were willing to pay $0.42 for $1 of book value equity. Price to book value is an important measure to see how much equity shareholders are paying for the net assets value of the company. P/B ratios under 1 are typically considered solid investments.

- Given your review, how can it maximize shareholder value? What are focus areas for enhancing shareholder value for the long term? What short-term steps might be necessary for longer-term gains?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started