Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CFO has negotiated a cheaper deal with mCommerceBank, a competitior of eCommerceBanque. The bank has agreed to provide loan of $2102, for 1

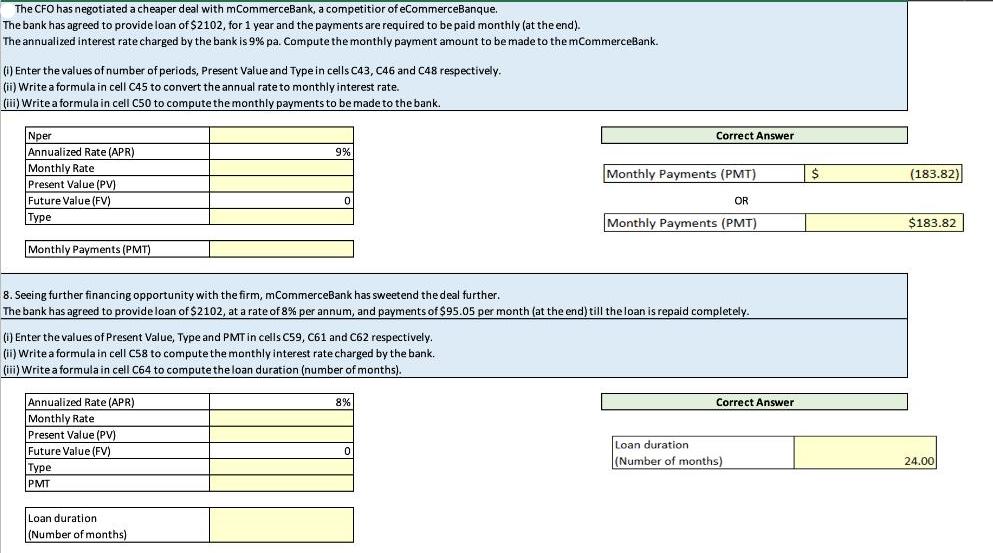

The CFO has negotiated a cheaper deal with mCommerceBank, a competitior of eCommerceBanque. The bank has agreed to provide loan of $2102, for 1 year and the payments are required to be paid monthly (at the end). The annualized interest rate charged by the bank is 9% pa. Compute the monthly payment amount to be made to the mCommerceBank. (i) Enter the values of number of periods, Present Value and Type in cells C43, C46 and C48 respectively. (ii) Write a formula in cell C45 to convert the annual rate to monthly interest rate. (iii) Write a formula in cell C50 to compute the monthly payments to be made to the bank. Nper Annualized Rate (APR) Monthly Rate Present Value (PV) Future Value (FV) Type Monthly Payments (PMT) 9% 0 Correct Answer Monthly Payments (PMT) $ (183.82) OR Monthly Payments (PMT) 8. Seeing further financing opportunity with the firm, mCommerceBank has sweetend the deal further. The bank has agreed to provide loan of $2102, at a rate of 8% per annum, and payments of $95.05 per month (at the end) till the loan is repaid completely. (1) Enter the values of Present Value, Type and PMT in cells C59, C61 and C62 respectively. (ii) Write a formula in cell CS8 to compute the monthly interest rate charged by the bank. (iii) Write a formula in cell C64 to compute the loan duration (number of months). Annualized Rate (APR) Monthly Rate Present Value (PV) Future Value (FV) Type PMT Loan duration (Number of months) 8% 0 Correct Answer Loan duration (Number of months) $183.82 24.00

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this problem 1 Given Loan amount 2102 Interest rate 9 per annu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started