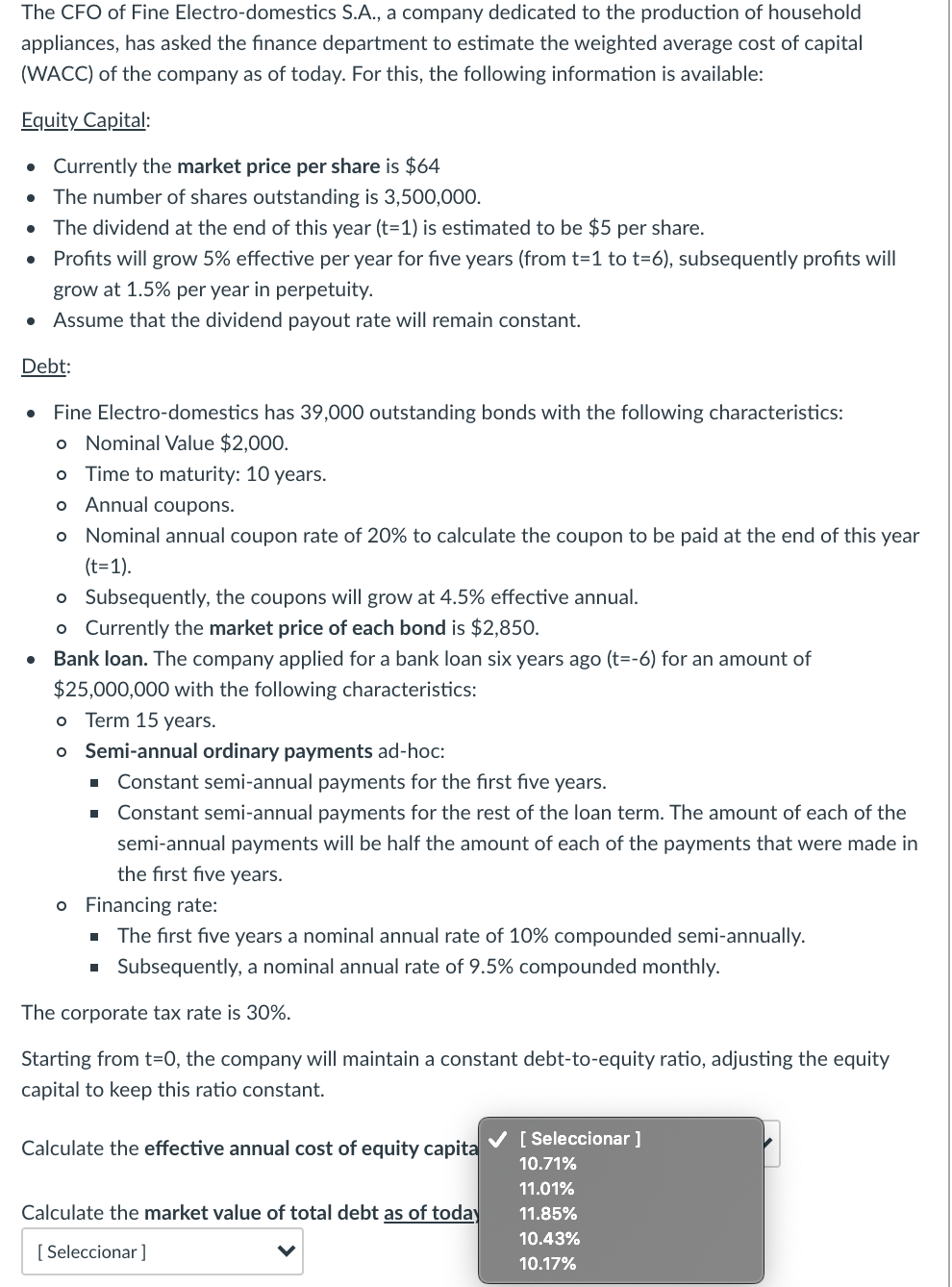

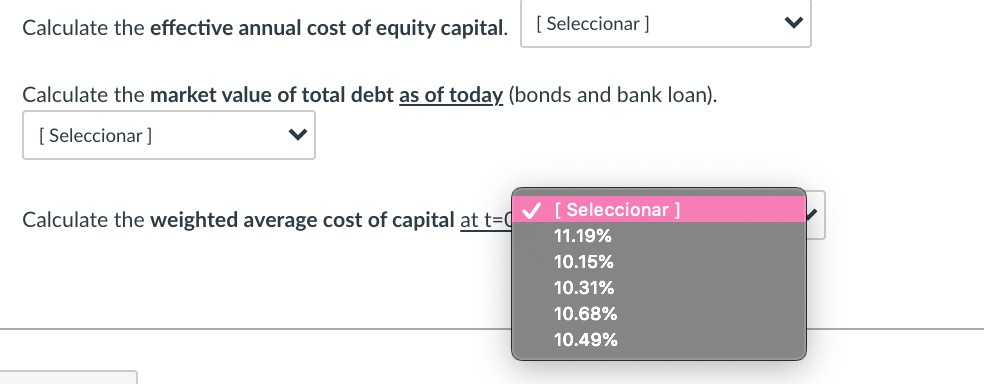

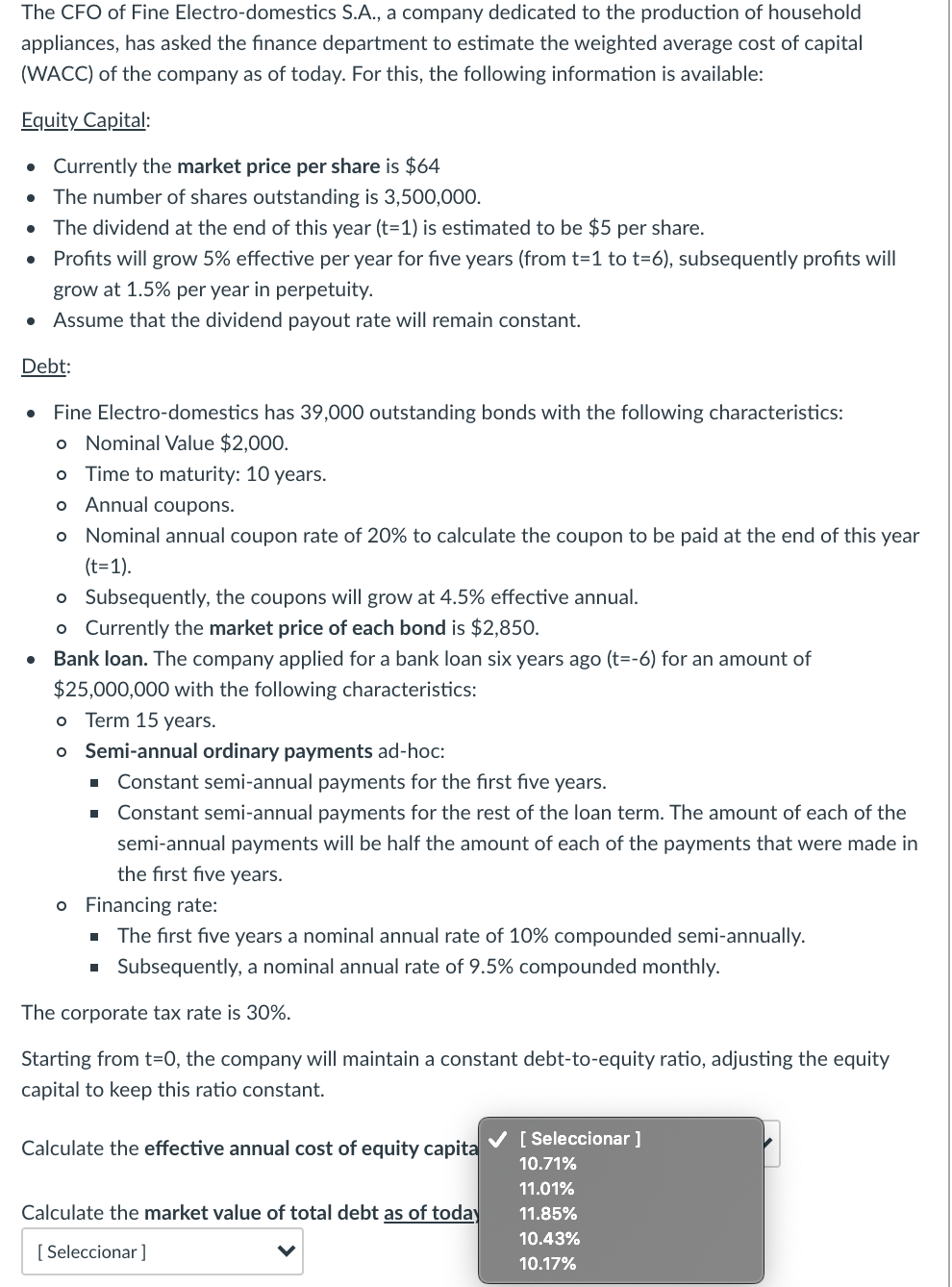

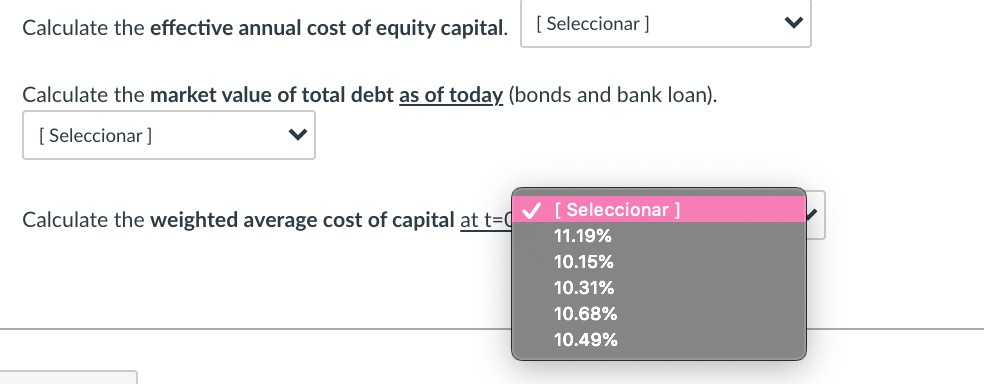

The CFO of Fine Electro-domestics S.A., a company dedicated to the production of household appliances, has asked the finance department to estimate the weighted average cost of capital (WACC) of the company as of today. For this, the following information is available: Equity Capital: Currently the market price per share is $64 The number of shares outstanding is 3,500,000. The dividend at the end of this year (t=1) is estimated to be $5 per share. Profits will grow 5% effective per year for five years (from t=1 to t=6), subsequently profits will grow at 1.5% per year in perpetuity. Assume that the dividend payout rate will remain constant. Debt: . Fine Electro-domestics has 39,000 outstanding bonds with the following characteristics: o Nominal Value $2,000. o Time to maturity: 10 years. o Annual coupons. o Nominal annual coupon rate of 20% to calculate the coupon to be paid at the end of this year (t=1). o Subsequently, the coupons will grow at 4.5% effective annual. o Currently the market price of each bond is $2,850. Bank loan. The company applied for a bank loan six years ago (t=-6) for an amount of $25,000,000 with the following characteristics: o Term 15 years. o Semi-annual ordinary payments ad-hoc: Constant semi-annual payments for the first five years. Constant semi-annual payments for the rest of the loan term. The amount of each of the semi-annual payments will be half the amount of each of the payments that were made in the first five years. o Financing rate: The first five years a nominal annual rate of 10% compounded semi-annually. Subsequently, a nominal annual rate of 9.5% compounded monthly. The corporate tax rate is 30%. Starting from t=0, the company will maintain a constant debt-to-equity ratio, adjusting the equity capital to keep this ratio constant. Calculate the effective annual cost of equity capita [ Seleccionar ] 10.71% 11.01% 11.85% 10.43% 10.17% Calculate the market value of total debt as of today [ Seleccionar ] Calculate the effective annual cost of equity capital. [ Seleccionar ] Calculate the market value of total debt as of today (bonds and bank loan). [ Seleccionar ] [Seleccionar ] Calculate the weighted average cost of capital at t=0 11.19% 10.15% 10.31% 10.68% 10.49% The CFO of Fine Electro-domestics S.A., a company dedicated to the production of household appliances, has asked the finance department to estimate the weighted average cost of capital (WACC) of the company as of today. For this, the following information is available: Equity Capital: Currently the market price per share is $64 The number of shares outstanding is 3,500,000. The dividend at the end of this year (t=1) is estimated to be $5 per share. Profits will grow 5% effective per year for five years (from t=1 to t=6), subsequently profits will grow at 1.5% per year in perpetuity. Assume that the dividend payout rate will remain constant. Debt: . Fine Electro-domestics has 39,000 outstanding bonds with the following characteristics: o Nominal Value $2,000. o Time to maturity: 10 years. o Annual coupons. o Nominal annual coupon rate of 20% to calculate the coupon to be paid at the end of this year (t=1). o Subsequently, the coupons will grow at 4.5% effective annual. o Currently the market price of each bond is $2,850. Bank loan. The company applied for a bank loan six years ago (t=-6) for an amount of $25,000,000 with the following characteristics: o Term 15 years. o Semi-annual ordinary payments ad-hoc: Constant semi-annual payments for the first five years. Constant semi-annual payments for the rest of the loan term. The amount of each of the semi-annual payments will be half the amount of each of the payments that were made in the first five years. o Financing rate: The first five years a nominal annual rate of 10% compounded semi-annually. Subsequently, a nominal annual rate of 9.5% compounded monthly. The corporate tax rate is 30%. Starting from t=0, the company will maintain a constant debt-to-equity ratio, adjusting the equity capital to keep this ratio constant. Calculate the effective annual cost of equity capita [ Seleccionar ] 10.71% 11.01% 11.85% 10.43% 10.17% Calculate the market value of total debt as of today [ Seleccionar ] Calculate the effective annual cost of equity capital. [ Seleccionar ] Calculate the market value of total debt as of today (bonds and bank loan). [ Seleccionar ] [Seleccionar ] Calculate the weighted average cost of capital at t=0 11.19% 10.15% 10.31% 10.68% 10.49%