Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CFO of Star Asset Management observes the current prices and characteristics of zero-coupon treasury bonds as summarized in the following table. a. Compute

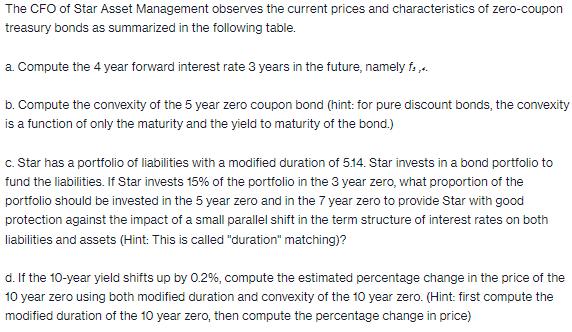

The CFO of Star Asset Management observes the current prices and characteristics of zero-coupon treasury bonds as summarized in the following table. a. Compute the 4 year forward interest rate 3 years in the future, namely f;,.. b. Compute the convexity of the 5 year zero coupon bond (hint: for pure discount bonds, the convexity is a function of only the maturity and the yield to maturity of the bond.) c. Star has a portfolio of liabilities with a modified duration of 5.14. Star invests in a bond portfolio to fund the liabilities. If Star invests 15% of the portfolio in the 3 year zero, what proportion of the portfolio should be invested in the 5 year zero and in the 7 year zero to provide Star with good protection against the impact of a small parallel shift in the term structure of interest rates on both liabilities and assets (Hint: This is called "duration" matching)? d. If the 10-year yield shifts up by 0.2%, compute the estimated percentage change in the price of the 10 year zero using both modified duration and convexity of the 10 year zero. (Hint: first compute the modified duration of the 10 year zero, then compute the percentage change in price)

Step by Step Solution

★★★★★

3.31 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer a To compute the 4 year forward interest rate 3 years in the future we need to use the formula fs 1 yt43 1 where yt is the 3 year yield We can find the 3 year yield from the table provided yt 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started