Answered step by step

Verified Expert Solution

Question

1 Approved Answer

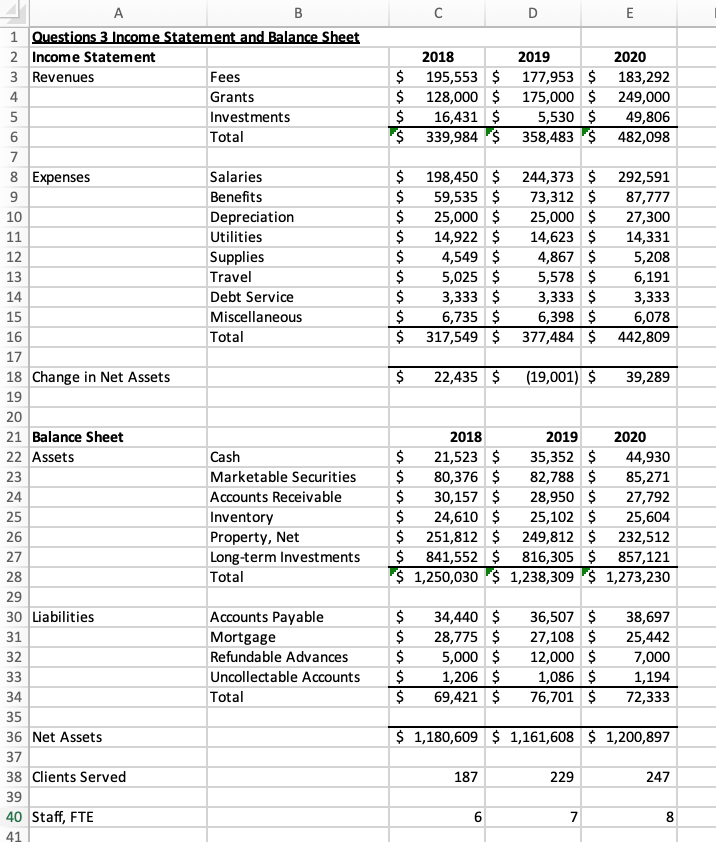

The CFO of your nonprofit left on vacation after preparing an income statement and balance sheet (See spreadsheet for Question 3), but nobody can find

The CFO of your nonprofit left on vacation after preparing an income statement and balance sheet (See spreadsheet for Question 3), but nobody can find the cash flow statement and he cannot be reached. Your boss wants you to create a quick summary statement of cash flows for last year (i.e. Year 2020) to share with the board.

- Derive a cash flow statement that includes operating, investing, and financing cash flows from the other two statements.

- Based on the resulting statement, what concerns do you have about the organizations cash management decisions? What recommendations might you make to improve it?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started