Question

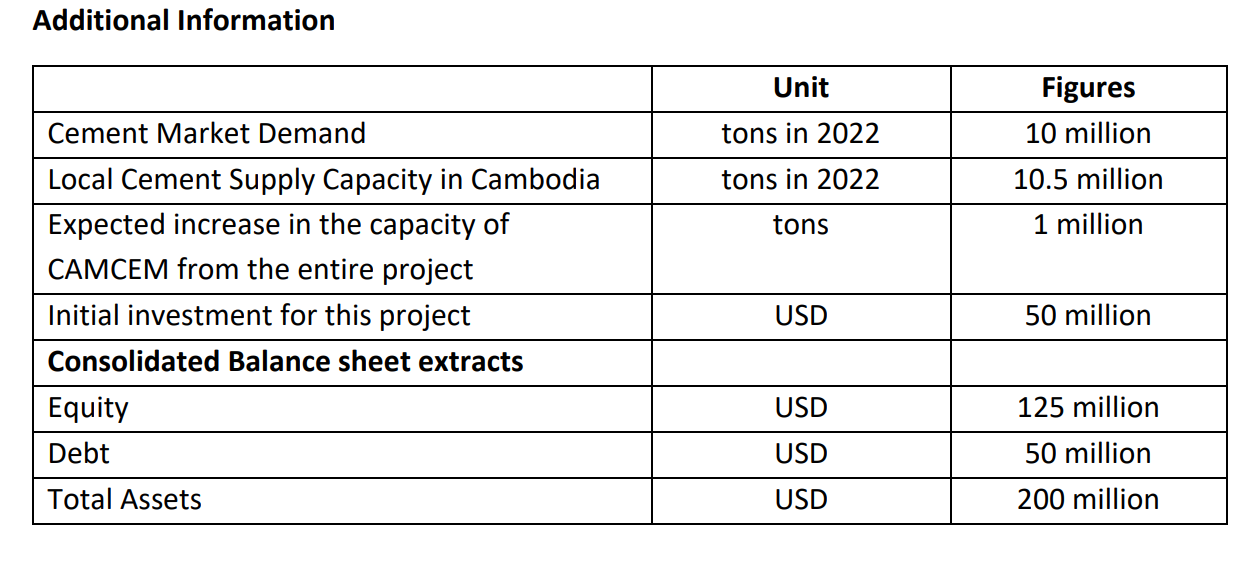

The CFO requires you to analyze several financing options to finance the project. The parent company will not finance this investment with equity. The CAMCEM

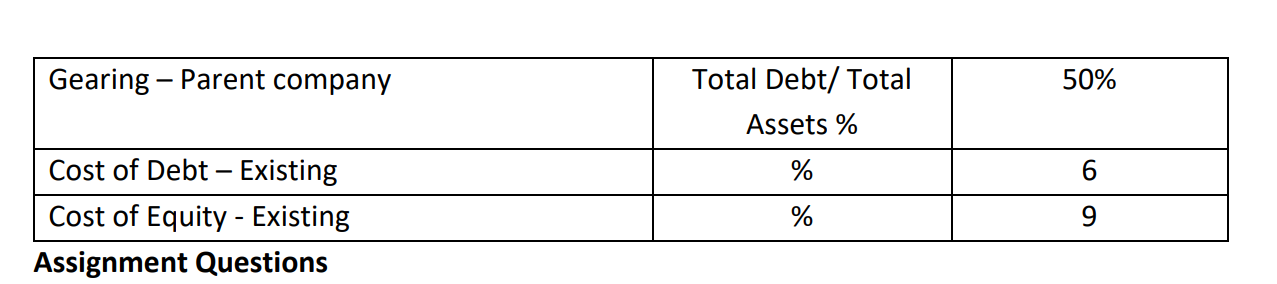

The CFO requires you to analyze several financing options to finance the project. The parent company will not finance this investment with equity. The CAMCEM should fund this new project through their local balance sheet, but it has the option to borrow from any market (not limited to Cambodia). The target gearing ratio of the parent company is 50% (i.e., the Debt/Total Assets ratio should be 50%)

The Cambodian Company will be able to get a tax holiday of 3 years for the new project, and after that, Company must pay a corporate income tax of 20%. The Company will be unable to transfer dividends to the parent company during the tax holiday period. However, whenever there is a remittance in the form of dividends to the parent company, there is a tax of 20%. Assume no Withholding Tax (WHT) on remittances.

The Company will need an initial working capital investment of 3 million USD and plans to borrow the money for this investment. The working capital will be disbursed again at the end of the project.

The Cambodian Company will be able to get a tax holiday of 3 years for the new project, and after that, Company must pay a corporate income tax of 20%. The Company will be unable to transfer dividends to the parent company during the tax holiday period. However, whenever there is a remittance in the form of dividends to the parent company, there is a tax of 20%. Assume no Withholding Tax (WHT) on remittances.

Evaluate different financing options that can be used for raising the required funds for this project. Determine the best financing method and justify your decision with relevant data, research evidence and calculations. You also should calculate the appropriate discount rate for this project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started