Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The City of Bernard starts the year of 2024 with the following unrestricted amounts in its general fund: cash of $29,000 and investments of

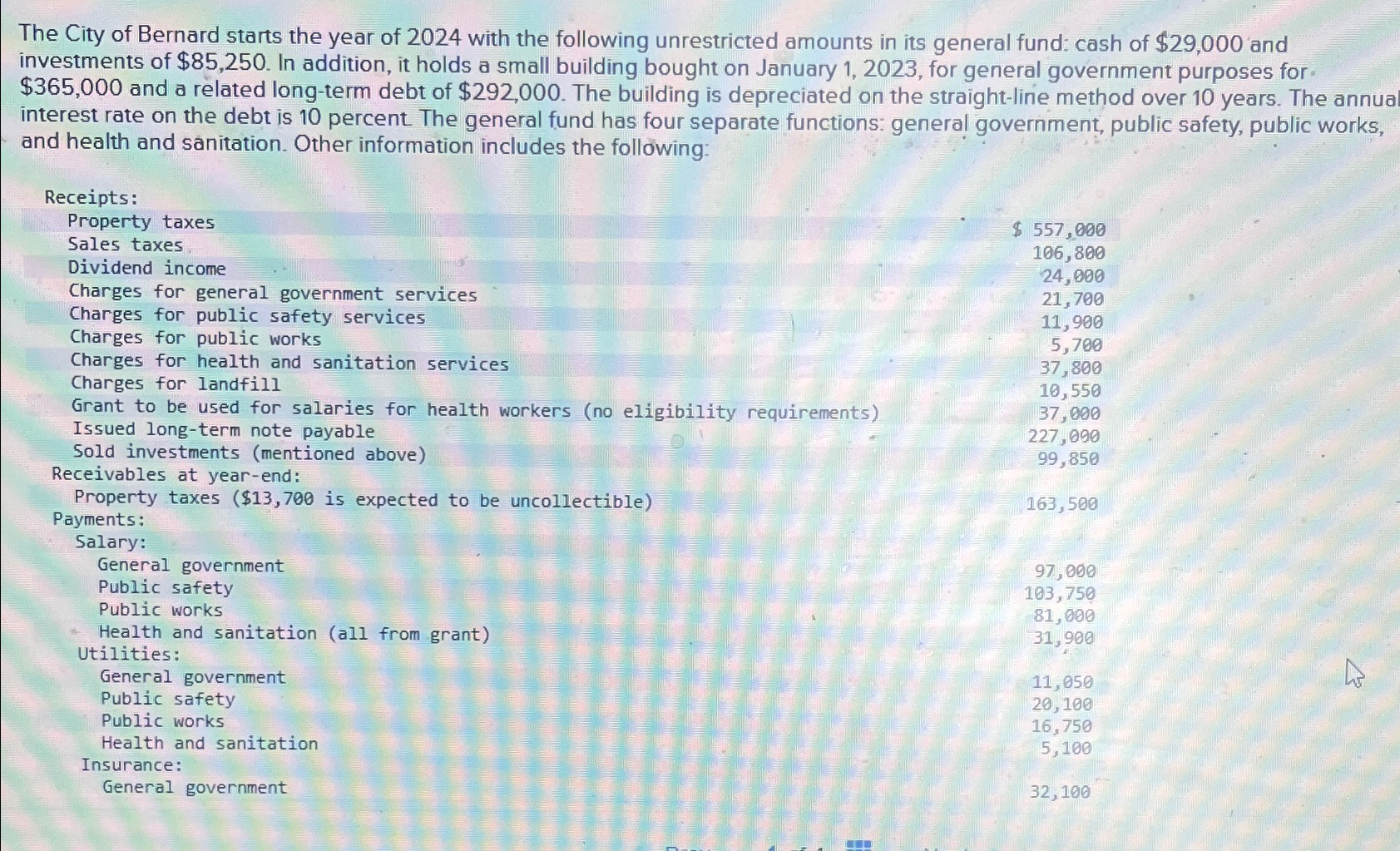

The City of Bernard starts the year of 2024 with the following unrestricted amounts in its general fund: cash of $29,000 and investments of $85,250. In addition, it holds a small building bought on January 1, 2023, for general government purposes for $365,000 and a related long-term debt of $292,000. The building is depreciated on the straight-line method over 10 years. The annual interest rate on the debt is 10 percent. The general fund has four separate functions: general government, public safety, public works, and health and sanitation. Other information includes the following: Receipts: Property taxes Sales taxes Dividend income Charges for general government services Charges for public safety services Charges for public works Charges for health and sanitation services Charges for landfill Grant to be used for salaries for health workers (no eligibility requirements) Issued long-term note payable Sold investments (mentioned above) Receivables at year-end: Property taxes ($13,700 is expected to be uncollectible) Payments: Salary: General government Public safety Public works Health and sanitation (all from grant) Utilities: General government Public safety Public works Health and sanitation Insurance: General government $ 557,000 106,800 24,000 21,700 11,900 5,700 37,800 10,550 37,000 227,090 99,850 163,500 97,000 103,750 81,000 31,900 11,050 20,100 16,750 5,100 32,100 13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started