Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The City of Home, a general purpose government, reported fund balances in the amount of $35,800,000 in the governmental funds balance sheet dated December 31,

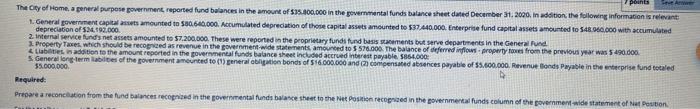

The City of Home, a general purpose government, reported fund balances in the amount of $35,800,000 in the governmental funds balance sheet dated December 31, 2020. In addition, the following Information is relevant: 1. General government capital assets amounted to $80,640.000. Accumulated depreciation of those capital assets amounted to $37,440,000. Enterprise fund capital assets amounted to S48,960,000 with accumulated depreciation of $24,192.000. 2. Internal service fund's net assets amounted to $7,200,000. These were reported in the proprietary funds fund basis statements but serve departments in the General Fund. Property Taxes, which should be recognized as revenue in the government-wide statements, amounted to $ 576.000. The balance of deferred inflows - property taxes from the previous year was $ 490,000. 4. Liabilities, in addition to the amount reported in the governmental funds balance sheet included accrued interest payable. $864.000: 5. General long-term liabilities of the government amounted to (1) general obligation bonds of $16.000.000 and (2) compensated absences payable of $5.600,000. Revenue Bonds Payable in t $5.000,000 enterprise fund totaled Required: Prepare a reconciliation from the fund balances recognized in the governmental funds balance sheet to the Net Position recognized in the governmental funds column of the government-wide statement of Net Position.

points The City of Home, a peneral purpose government reported fund balances in the amount of $35.400.000 in the governmental funds balance sheet dated December 31, 2020. In addition, the following information is relevant 1. General government capital assets amounted to $80.640.000. Accumulated depreciation of these capital assets amounted to $37.440.000 Enterprise fund capital assets amounted to 548.000.000 with accumulated depreciation of SM.199.000 2. Internal service funds net assets amounted to 57.200.000 These were reported in the proprietary fundsfund basis statements et serve departments in the General 2. Property Tases, which should be recognized as revenue in the government wide statements amoured to 5570.000. The balance offered inflows.property toes from the previous year was 5490.000 4 Lab Waddition to the amount reported in the governmental funds balance sheet included accrued interest payable 5866.000 General long-term labies of the government amounted to (1) general obligation bonds of $16.000.000 and 2 compensated absences payable of 55.600.000. Revenue Bonds Payable in the everprise fund totaled 55.000.000, Required Preoare a reconciliation from the fund balances recognized in the governmental funds balance sheet to the et position recognized in the governmental funds column of the government-wide statement of Net Position Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started