Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. The common stock of Washington Corporation currently sells for $64.60 per share. Securities analysts feel that most stock market investors expect Washington's future dividends

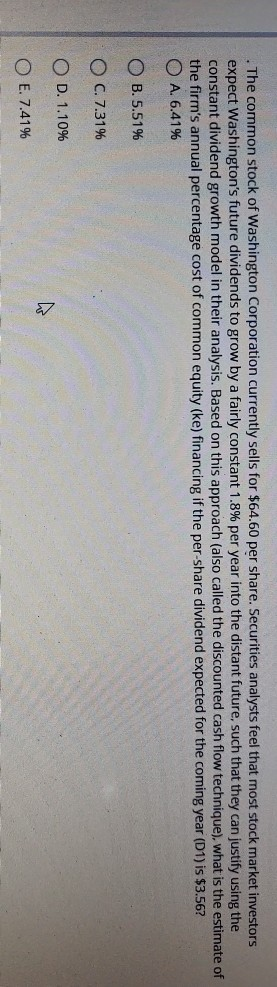

. The common stock of Washington Corporation currently sells for $64.60 per share. Securities analysts feel that most stock market investors expect Washington's future dividends to grow by a fairly constant 1.8% per year into the distant future, such that they can justify using the constant dividend growth model in their analysis. Based on this approach (also called the discounted cash flow technique), what is the estimate of the firm's annual percentage cost of common equity (ke) financing if the per-share dividend expected for the coming year (D1) is $3.56? A. 6.41% OB. 5.51% O C. 7.31% OD. 1.10% O E. 7.41%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started