Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company assigned for the questions is Dish Network. Mostly needing help with part C and how the stock has performed relative to the market

The company assigned for the questions is Dish Network. Mostly needing help with part C and how the stock has performed relative to the market in the last 6 months.

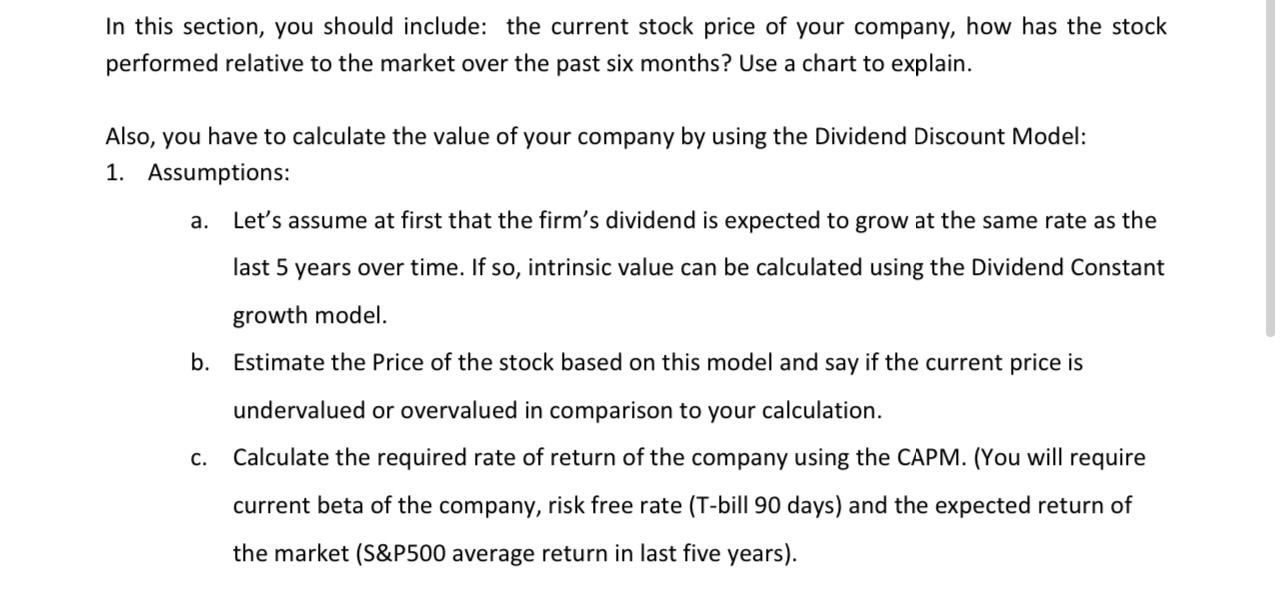

In this section, you should include: the current stock price of your company, how has the stock performed relative to the market over the past six months? Use a chart to explain. Also, you have to calculate the value of your company by using the Dividend Discount Model: 1. Assumptions: a. Let's assume at first that the firm's dividend is expected to grow at the same rate as the last 5 years over time. If so, intrinsic value can be calculated using the Dividend Constant growth model. b. Estimate the price of the stock based on this model and say if the current price is C. undervalued or overvalued in comparison to your calculation. Calculate the required rate of return of the company using the CAPM. (You will require current beta of the company, risk free rate (T-bill 90 days) and the expected return of the market (S&P500 average return in last five years). In this section, you should include: the current stock price of your company, how has the stock performed relative to the market over the past six months? Use a chart to explain. Also, you have to calculate the value of your company by using the Dividend Discount Model: 1. Assumptions: a. Let's assume at first that the firm's dividend is expected to grow at the same rate as the last 5 years over time. If so, intrinsic value can be calculated using the Dividend Constant growth model. b. Estimate the price of the stock based on this model and say if the current price is C. undervalued or overvalued in comparison to your calculation. Calculate the required rate of return of the company using the CAPM. (You will require current beta of the company, risk free rate (T-bill 90 days) and the expected return of the market (S&P500 average return in last five years)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started