Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Company entered into the following two separate transactions in fiscal year 2010, which will impact the Company's results as presented in the statement

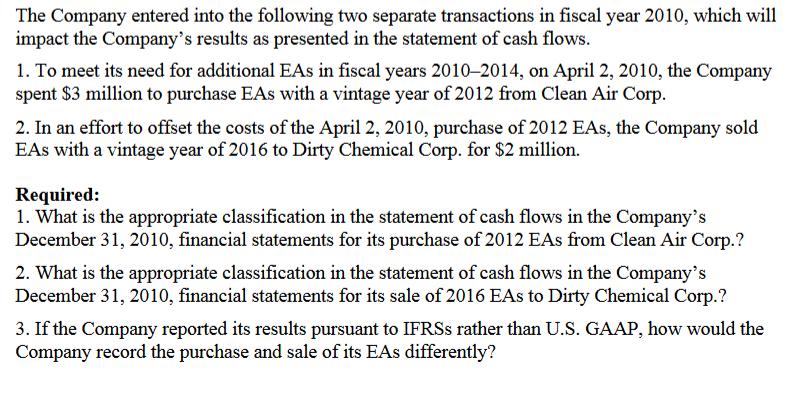

The Company entered into the following two separate transactions in fiscal year 2010, which will impact the Company's results as presented in the statement of cash flows. 1. To meet its need for additional EAs in fiscal years 2010-2014, on April 2, 2010, the Company spent $3 million to purchase EAs with a vintage year of 2012 from Clean Air Corp. 2. In an effort to offset the costs of the April 2, 2010, purchase of 2012 EAs, the Company sold EAs with a vintage year of 2016 to Dirty Chemical Corp. for $2 million. Required: 1. What is the appropriate classification in the statement of cash flows in the Company's December 31, 2010, financial statements for its purchase of 2012 EAs from Clean Air Corp.? 2. What is the appropriate classification in the statement of cash flows in the Company's December 31, 2010, financial statements for its sale of 2016 EAs to Dirty Chemical Corp.? 3. If the Company reported its results pursuant to IFRSs rather than U.S. GAAP, how would the Company record the purchase and sale of its EAs differently?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 PURCHASE OF EAs FROM CLEAN AIR CORP WILL BE CLASSIFIED UNDER INVESTING ACTIVITIES CASH OUT FLOW ie ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started