Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company has decided they need ed to create a full set of budget schedules including financial statements for th e first year of operations

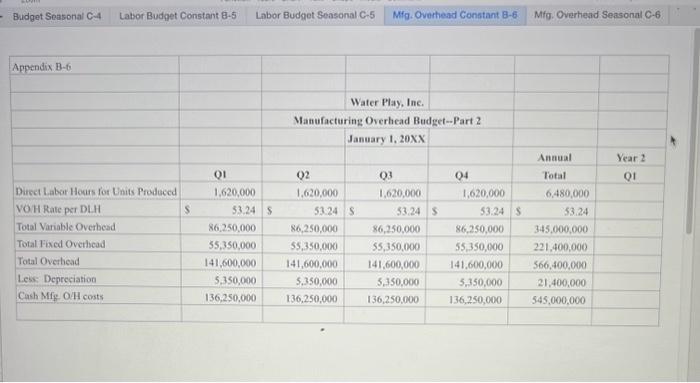

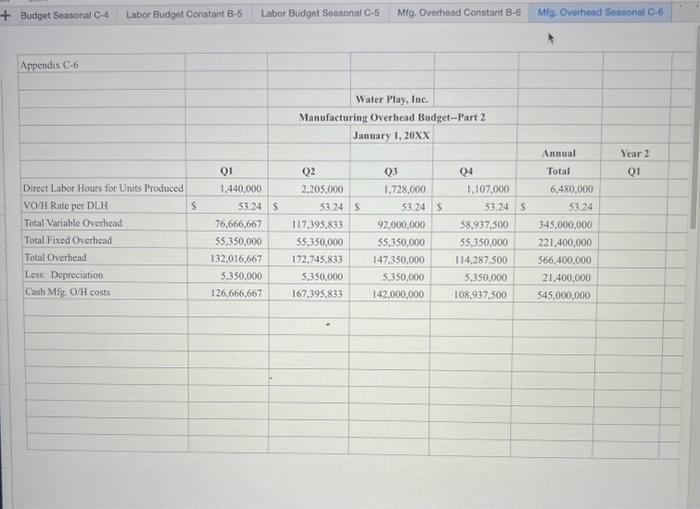

The company has decided they needed to create a full set of budget schedules including financial statementsfor the first year of operations based on an assumption of constant demand of 18,000 quarterly and 72,000 for the first year (appendices B-1 through B-11). A second set of budget schedules and financial statements based on expected unit sales of 15,000 in quarter one, 25,000 in quarter two, 20,000 in quarter three, and finally 12,000 in quarter four for a total of 72,000 for the year based on a seasonal demand pattern (appendices C-1 through C-11). We expect the same quarterly sales patterns in year two meaning 18,000 units per quarter under constant demand and 15,000 units in quarter one under seasonal demand. Compare the constant demand to the seasonal demand budget. Explain the major differences in each of the budget schedules, cash budget and financial statements on both a quarterly and annual basis. Remember the beginning and ending raw material and finished goods inventory units will cause differences in the budgets but also focus on the differences between accrual and cash timing figures.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started