Question

(the company) is being assessed by the independent ABC agency for potential acquisition. The company has provided its most recent financial statements (Balance Sheet and

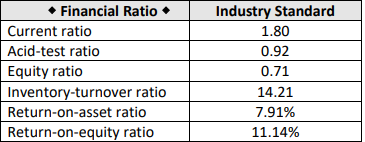

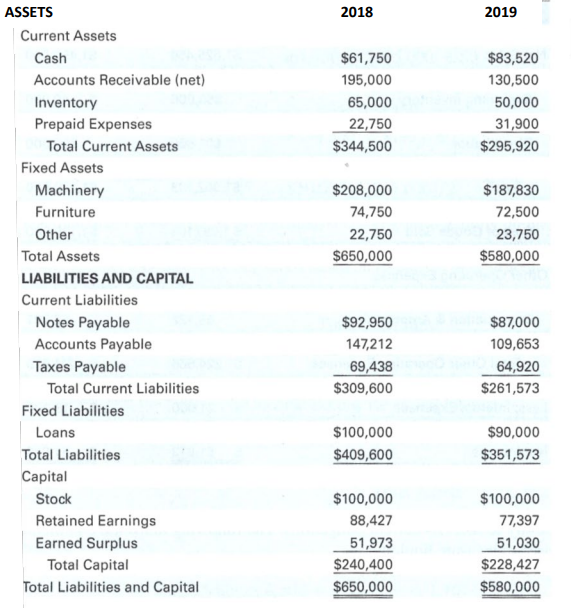

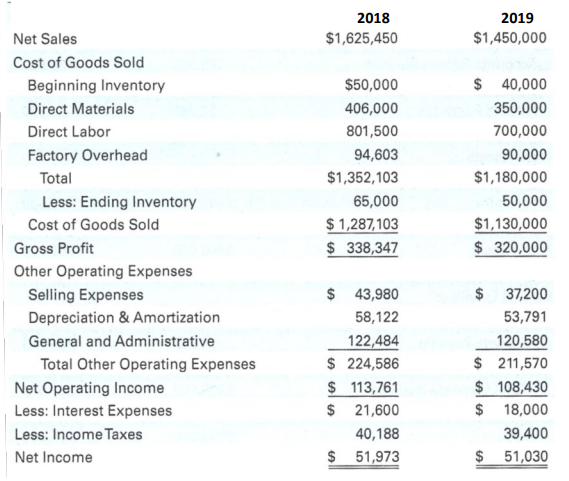

(the company) is being assessed by the independent ABC agency for potential acquisition. The company has provided its most recent financial statements (Balance Sheet and Income Statement) to the ABC agency for assessment. (i) You, an employee of the ABC assessment agency, is requested to calculate: the EBIT*, EBITDA* profitability indicators and the following six financial ratios: Current Ratio, Acid Test Ratio, Equity Ratio, Inventory-Turnover Ratio, Return-On-Assets Ratio, and Return-On-Equity Ratio, for both reported years. (ii) State and justify your recommendation based on the evaluation of the financial statements of the company, the profitability indicators and the ratios that you have determined for both given years, by comparing them against the industry standards provided below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started