Answered step by step

Verified Expert Solution

Question

1 Approved Answer

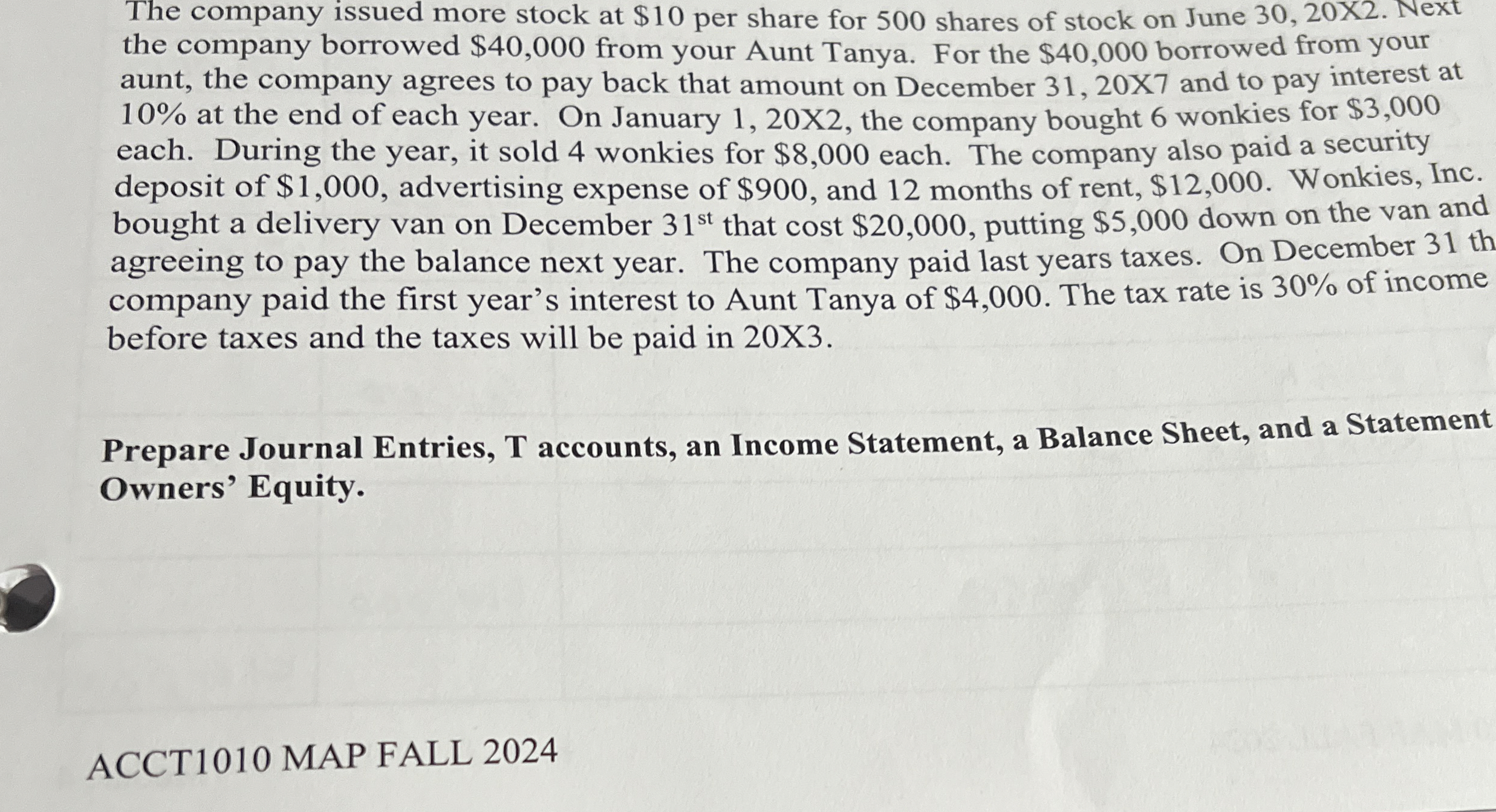

The company issued more stock at $ 1 0 per share for 5 0 0 shares of stock on June 3 0 , 2 0

The company issued more stock at $ per share for shares of stock on June Next

the company borrowed $ from your Aunt Tanya. For the $ borrowed from your

aunt, the company agrees to pay back that amount on December and to pay interest at

at the end of each year. On January the company bought wonkies for $

each. During the year, it sold wonkies for $ each. The company also paid a security

deposit of $ advertising expense of $ and months of rent, $ Wonkies, Inc.

bought a delivery van on December that cost $ putting $ down on the van and

agreeing to pay the balance next year. The company paid last years taxes. On December th

company paid the first year's interest to Aunt Tanya of $ The tax rate is of income

before taxes and the taxes will be paid in X

Prepare Journal Entries, T accounts, an Income Statement, a Balance Sheet, and a Statement

Owners' Equity.

ACCT MAP FALL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started