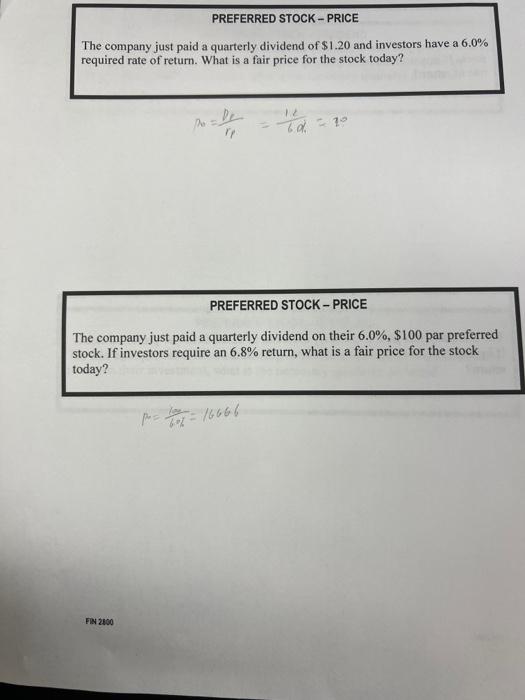

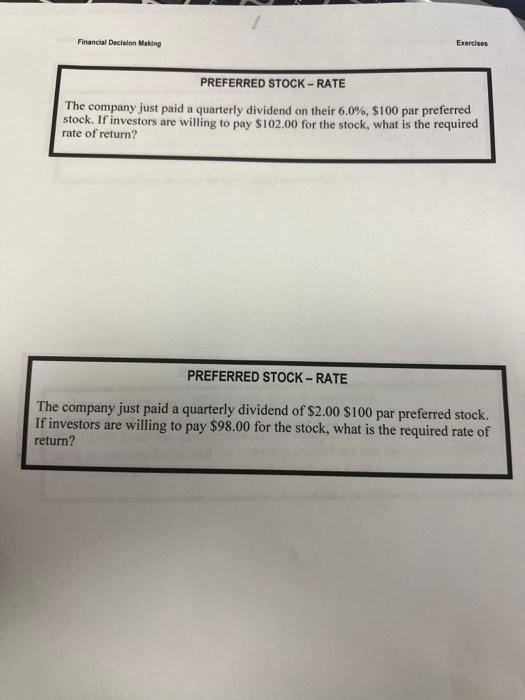

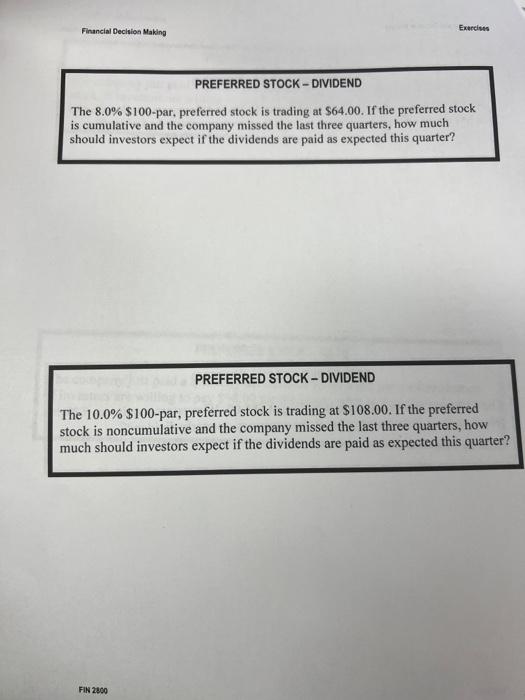

The company just paid a quarterly dividend of $1.20 and investors have a 6.0% required rate of return. What is a fair price for the stock today? D0=rpDe=611L=10 PREFERRED STOCK - PRICE The company just paid a quarterly dividend on their 6.0%,$100 par preferred stock. If investors require an 6.8% return, what is a fair price for the stock today? p=60780=16666 PREFERRED STOCK - RATE The company just paid a quarterly dividend on their 6.0%,$100 par preferred stock. If investors are willing to pay $102.00 for the stock, what is the required rate of return? PREFERRED STOCK - RATE The company just paid a quarterly dividend of $2.00$100 par preferred stock. If investors are willing to pay $98.00 for the stock, what is the required rate of return? PREFERRED STOCK - DIVIDEND The $100-par, preferred stock is trading at $120.00. If investors require an 8.6% return on their investment, what is the necessary quarterly dividend? PREFERRED STOCK - DIVIDEND The $100-par, preferred stock is trading at $88.00. If investors require an 6.8% return on their investment, what is the necessary quarterly dividend? Financial Decision Making Exurcises PREFERRED STOCK - DIVIDEND The 8.0%$100-par, preferred stock is trading at $64.00. If the preferred stock is cumulative and the company missed the last three quarters, how much should investors expect if the dividends are paid as expected this quarter? PREFERRED STOCK - DIVIDEND The 10.0%$100-par, preferred stock is trading at $108.00. If the preferred stock is noncumulative and the company missed the last three quarters, how much should investors expect if the dividends are paid as expected this quarter? The company just paid a quarterly dividend of $1.20 and investors have a 6.0% required rate of return. What is a fair price for the stock today? D0=rpDe=611L=10 PREFERRED STOCK - PRICE The company just paid a quarterly dividend on their 6.0%,$100 par preferred stock. If investors require an 6.8% return, what is a fair price for the stock today? p=60780=16666 PREFERRED STOCK - RATE The company just paid a quarterly dividend on their 6.0%,$100 par preferred stock. If investors are willing to pay $102.00 for the stock, what is the required rate of return? PREFERRED STOCK - RATE The company just paid a quarterly dividend of $2.00$100 par preferred stock. If investors are willing to pay $98.00 for the stock, what is the required rate of return? PREFERRED STOCK - DIVIDEND The $100-par, preferred stock is trading at $120.00. If investors require an 8.6% return on their investment, what is the necessary quarterly dividend? PREFERRED STOCK - DIVIDEND The $100-par, preferred stock is trading at $88.00. If investors require an 6.8% return on their investment, what is the necessary quarterly dividend? Financial Decision Making Exurcises PREFERRED STOCK - DIVIDEND The 8.0%$100-par, preferred stock is trading at $64.00. If the preferred stock is cumulative and the company missed the last three quarters, how much should investors expect if the dividends are paid as expected this quarter? PREFERRED STOCK - DIVIDEND The 10.0%$100-par, preferred stock is trading at $108.00. If the preferred stock is noncumulative and the company missed the last three quarters, how much should investors expect if the dividends are paid as expected this quarter