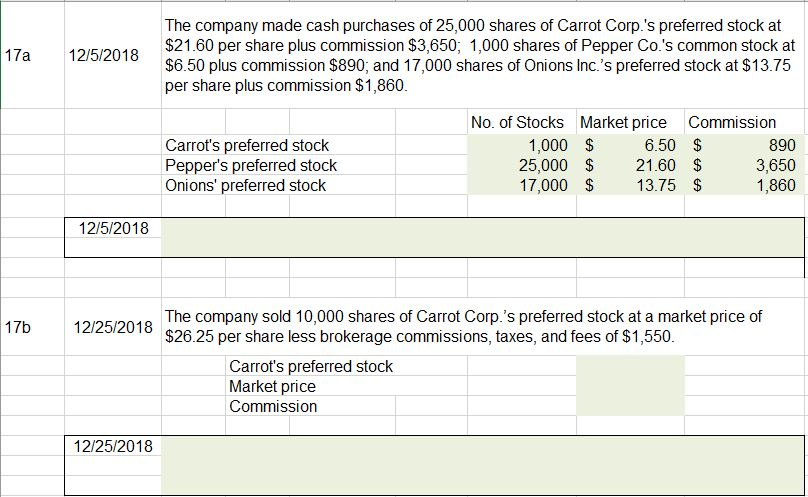

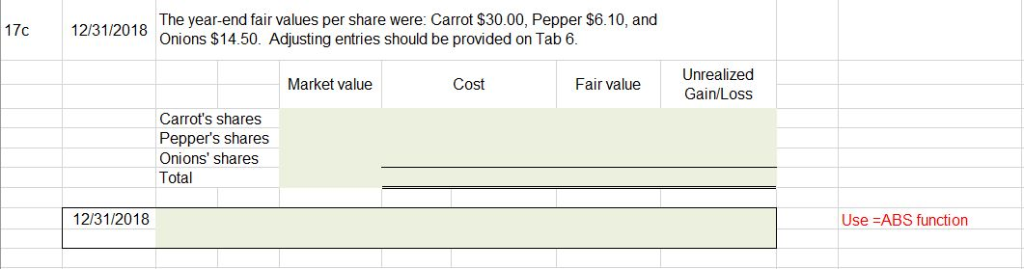

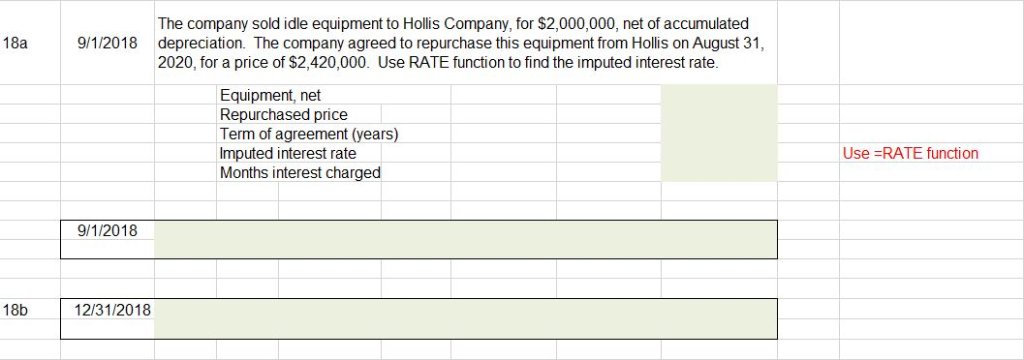

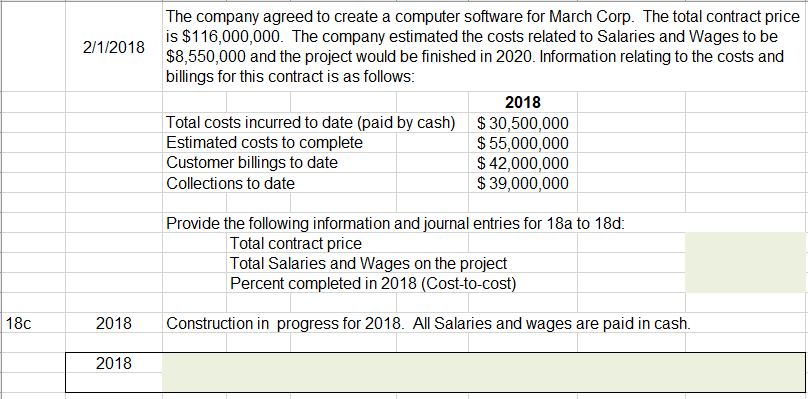

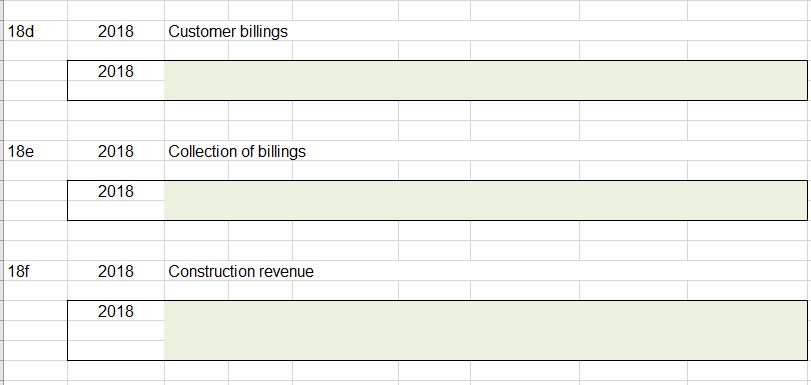

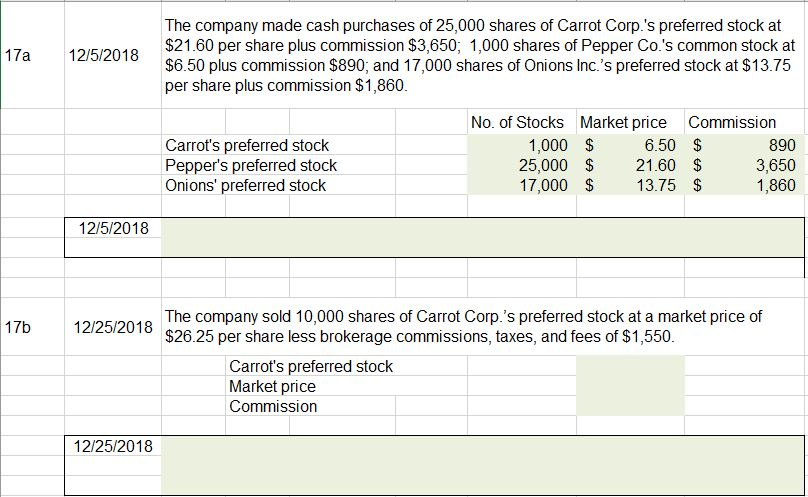

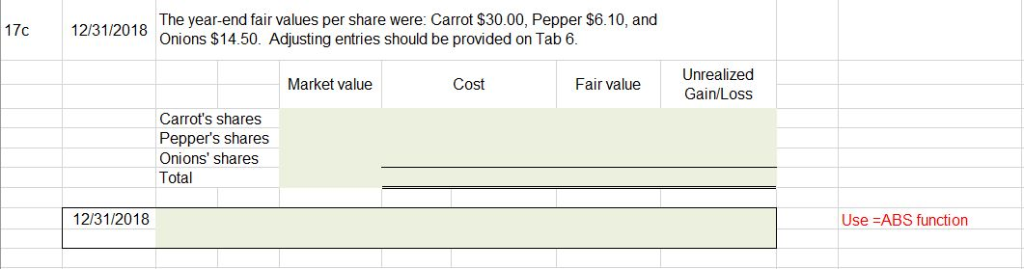

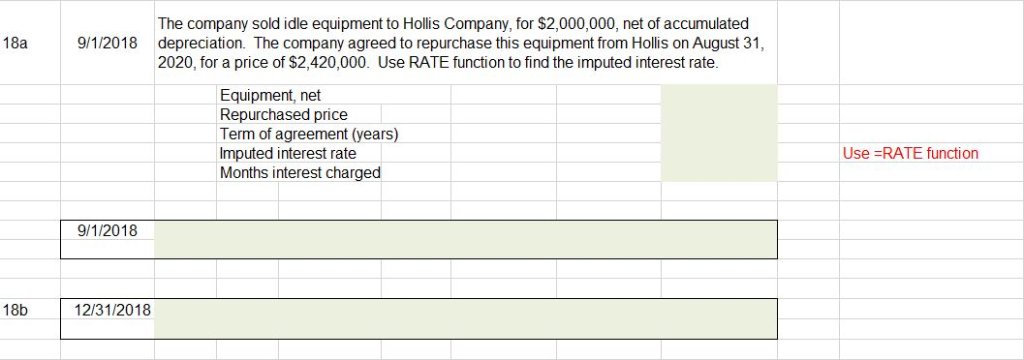

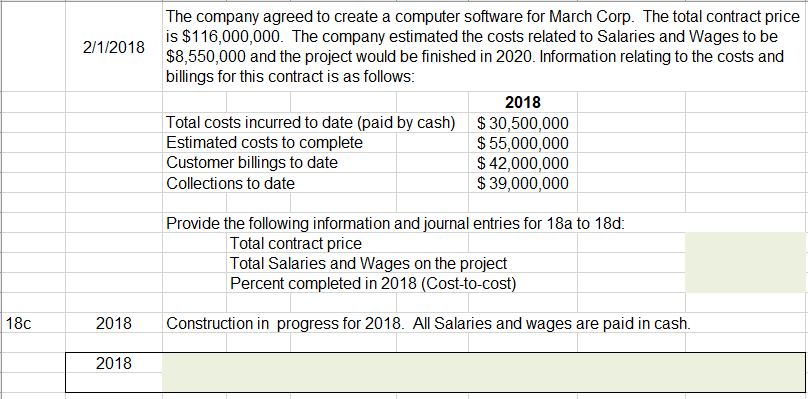

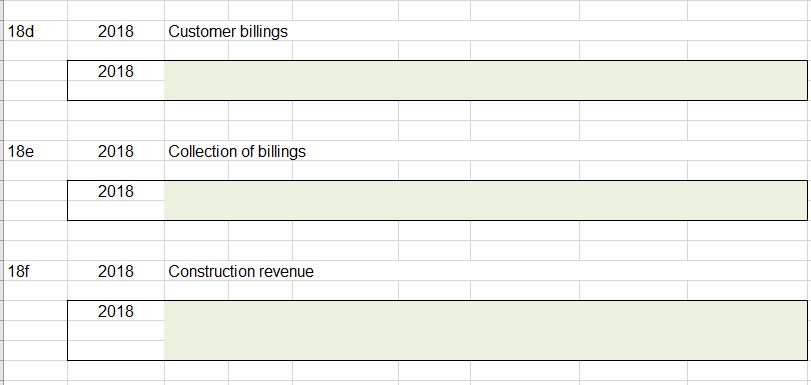

The company made cash purchases of 25,000 shares of Carrot Corp.'s preferred stock at $21.60 per share plus commission $3,650; 1,000 shares of Pepper Co.s common stock at $6.50 plus commission $890, and 17,000 shares of Onions Inc.'s preferred stock at $13.75 per share plus commission $1,860 12/5/2018 17a No. of Stocks Market price Commission 6.50 $ 25,000 $ 21.60 $ 13.75 $ 890 3,650 1,860 Carrot's preferred stock Pepper's preferred stock Onions' preferred stock 1,000 $ 17,000 $ 12/5/2018 The company sold 10,000 shares of Carrot Corp.'s preferred stock at a market price of $26.25 per share less brokerage commissions, taxes, and fees of $1,550 17b 12/25/2018 Carrot's preferred stock Market price Commission 12/25/2018 The year-end fair values per share were: Carrot $30.00, Pepper $6.10, and Onions $14.50. Adjusting entries should be provided on Tab 6. 17c 12/31/2018 Unrealized Gain/Loss Market value Cost Fair value Carrot's shares Peppers shares Onions' shares Tota 12/31/2018 Use =ABS function The company sold idle equipment to Hollis Company, for $2,000,000, net of accumulated depreciation. The company agreed to repurchase this equipment from Hollis on August 31, 2020, for a price of $2,420,000. Use RATE function to find the imputed interest rate 18a 9/1/2018 Equipment, net Repurchased price Term of agreement (years) Imputed interest rate Months interest charged Use RATE function 9/1/2018 18b 12/31/2018 The company agreed to create a computer software for March Corp. The total contract price is $116,000,000. The company estimated the costs related to Salaries and Wages to be $8,550,000 and the project would be finished in 2020. Information relating to the costs and billings for this contract is as follows 2/1/2018 2018 $30,500,000 $55,000,000 $42,000,000 $ 39,000,000 Total costs incurred to date (paid by cash) Estimated costs to complete Customer billings to date Collections to date Provide the following information and journal entries for 18a to 18d Total contract price Total Salaries and Wages on the project Percent completed in 2018 (Cost-to-cost) 18C 2018 Construction in progress for 2018. All Salaries and wages are paid in cash 2018 2018 Customer billings 18d 2018 Collection of billings 2018 18e 2018 2018 Construction revenue 18f 2018 The company made cash purchases of 25,000 shares of Carrot Corp.'s preferred stock at $21.60 per share plus commission $3,650; 1,000 shares of Pepper Co.s common stock at $6.50 plus commission $890, and 17,000 shares of Onions Inc.'s preferred stock at $13.75 per share plus commission $1,860 12/5/2018 17a No. of Stocks Market price Commission 6.50 $ 25,000 $ 21.60 $ 13.75 $ 890 3,650 1,860 Carrot's preferred stock Pepper's preferred stock Onions' preferred stock 1,000 $ 17,000 $ 12/5/2018 The company sold 10,000 shares of Carrot Corp.'s preferred stock at a market price of $26.25 per share less brokerage commissions, taxes, and fees of $1,550 17b 12/25/2018 Carrot's preferred stock Market price Commission 12/25/2018 The year-end fair values per share were: Carrot $30.00, Pepper $6.10, and Onions $14.50. Adjusting entries should be provided on Tab 6. 17c 12/31/2018 Unrealized Gain/Loss Market value Cost Fair value Carrot's shares Peppers shares Onions' shares Tota 12/31/2018 Use =ABS function The company sold idle equipment to Hollis Company, for $2,000,000, net of accumulated depreciation. The company agreed to repurchase this equipment from Hollis on August 31, 2020, for a price of $2,420,000. Use RATE function to find the imputed interest rate 18a 9/1/2018 Equipment, net Repurchased price Term of agreement (years) Imputed interest rate Months interest charged Use RATE function 9/1/2018 18b 12/31/2018 The company agreed to create a computer software for March Corp. The total contract price is $116,000,000. The company estimated the costs related to Salaries and Wages to be $8,550,000 and the project would be finished in 2020. Information relating to the costs and billings for this contract is as follows 2/1/2018 2018 $30,500,000 $55,000,000 $42,000,000 $ 39,000,000 Total costs incurred to date (paid by cash) Estimated costs to complete Customer billings to date Collections to date Provide the following information and journal entries for 18a to 18d Total contract price Total Salaries and Wages on the project Percent completed in 2018 (Cost-to-cost) 18C 2018 Construction in progress for 2018. All Salaries and wages are paid in cash 2018 2018 Customer billings 18d 2018 Collection of billings 2018 18e 2018 2018 Construction revenue 18f 2018