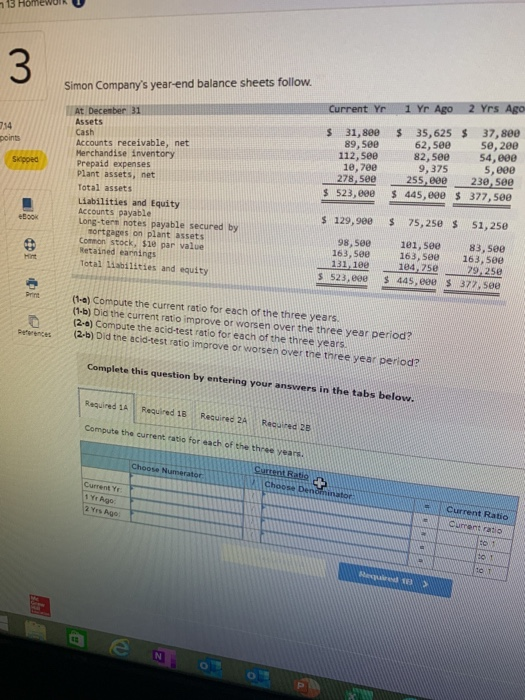

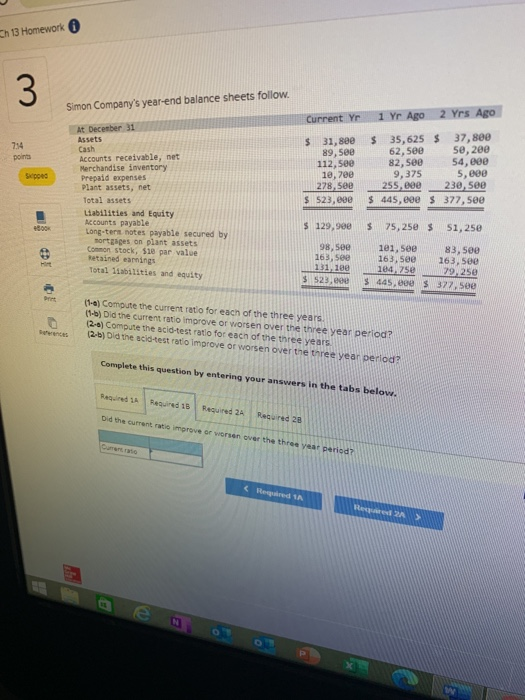

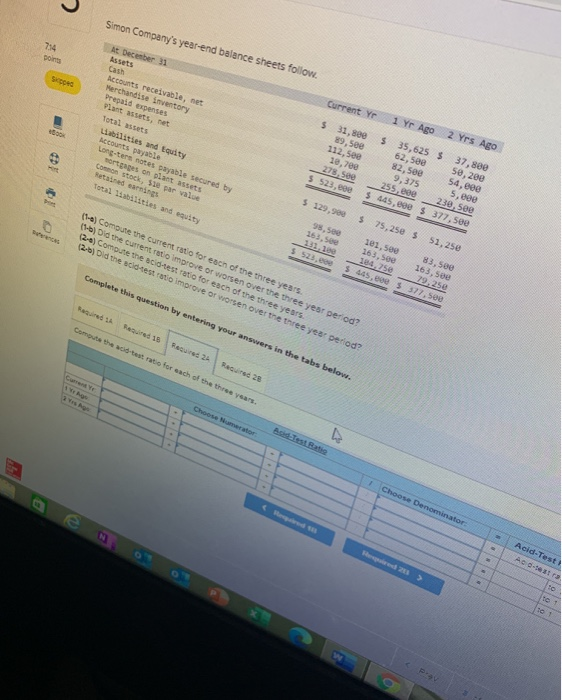

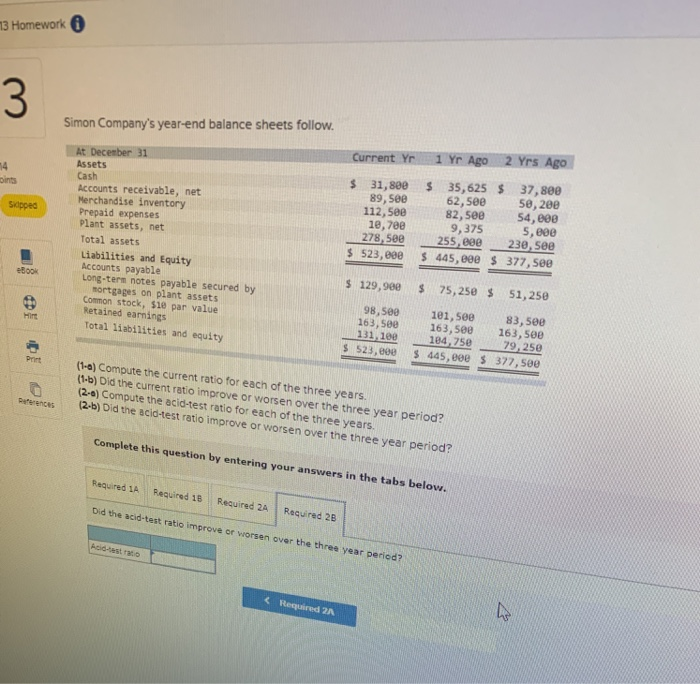

WIR 3 Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago 0.34 points spoed At December 31 Assets Cash Accounts receivable, net Merchandise Inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-ters notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,800 89,500 112,5ee 10,7ee 278,500 $ 523, eee $ 35,625 $ 37,800 62,500 se, 200 82,500 54, eee 9,375 5,000 255,000 230, see $ 445,000 $ 377,500 $ 129,900 $ 75,250 $ 51,250 98,5ee 163,500 131,100 $ 523, eee 101, see 83,500 163, See 163,500 104,750 79,25e $ 445,00 $ 377, See Print (1-0) Compute the current ratio for each of the three years (1-5) Did the current ratio improve or worsen over the three year period? (2-6) Compute the acid-test ratio for each of the three years (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required LA Required 15 Required 2A Recured 2B Compute the current ratio for each of the three years. Choose Numerator Current Ratio Choose Denor Current Ye 14 Ago 2 yrs ago tor Current Ratio Current ratio 10 10 > Ch 13 Homework 3 Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago 754 points At December 31 Assets Cash Accounts receivable, net Merchandise Inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, 510 par value Sped $ 31,800 89,500 112, See 1e, 2ee 278,500 $ 523, eee $ 35,625 $ 37,800 62,500 5e,200 82,500 54,000 9,375 5,800 255, Bee 230, 500 $ 445, eee $ 377,500 $ 129,900 $ 75,250 $ 51,25e tained earnings Total liabilities and equity 98, see 163,500 131, 182 $ 523, 101, 500 83,500 163,500 163,500 100 Zse 79,250 $ 445, eee $ 377,500 Dit (1) Compute the current ratio for each of the three years. (4-6) Did the current ratio improve or worsen over the three year period? (2-4) Compute the acid-test ratio for each of the three years (2-3) Did the scio-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 15 Required 2A Did the current ratio improve or worsen over the three year period? Recured 20 Contato