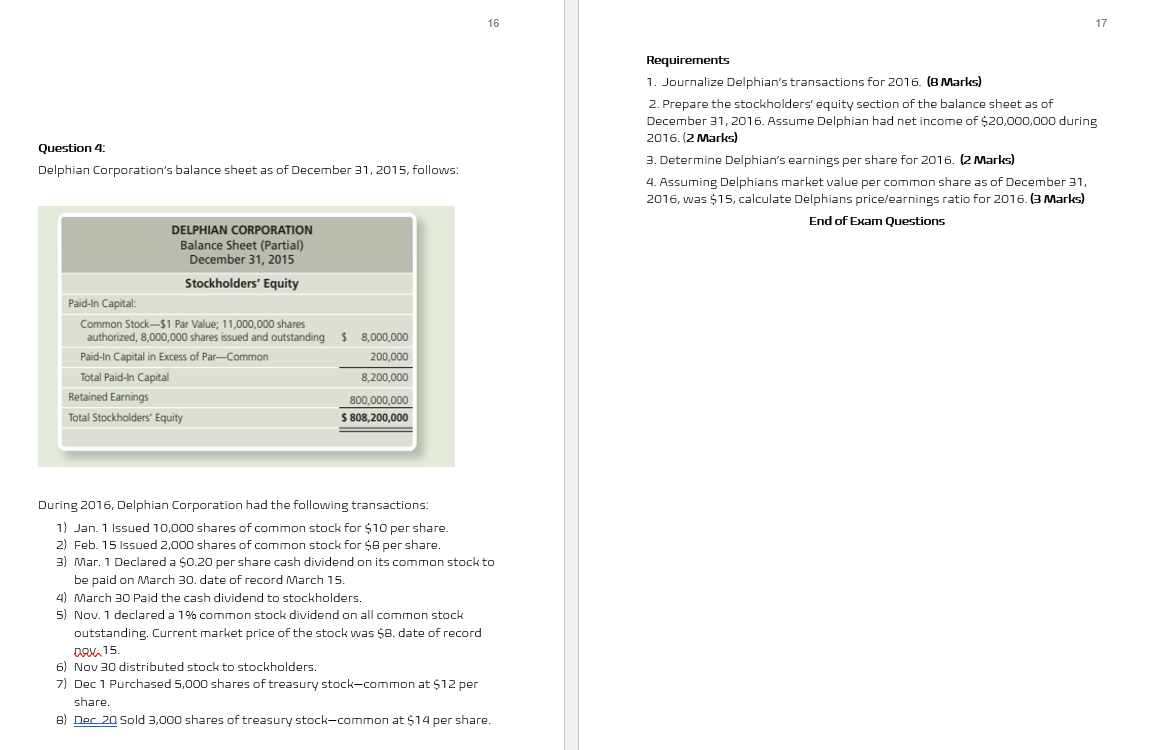

Question 4: Delphian Corporation's balance sheet as of December 31, 2015, follows: DELPHIAN CORPORATION Balance Sheet (Partial) December 31, 2015 Stockholders' Equity Paid-In Capital:

Question 4: Delphian Corporation's balance sheet as of December 31, 2015, follows: DELPHIAN CORPORATION Balance Sheet (Partial) December 31, 2015 Stockholders' Equity Paid-In Capital: Common Stock-$1 Par Value; 11,000,000 shares authorized, 8,000,000 shares issued and outstanding $ 8,000,000 Paid-In Capital in Excess of Par-Common 200,000 Total Paid-In Capital 8,200,000 Retained Earnings Total Stockholders' Equity 800,000,000 $ 808,200,000 16 During 2016, Delphian Corporation had the following transactions: 1) Jan. 1 Issued 10,000 shares of common stock for $10 per share. 2) Feb. 15 Issued 2,000 shares of common stock for $8 per share. 3) Mar. 1 Declared a $0.20 per share cash dividend on its common stock to be paid on March 30. date of record March 15. 4) March 30 Paid the cash dividend to stockholders. 5) Nov. 1 declared a 1% common stock dividend on all common stock outstanding. Current market price of the stock was $8. date of record DRX, 15. 6) Nov 30 distributed stock to stockholders. 7) Dec 1 Purchased 5,000 shares of treasury stock-common at $12 per share. 8) Dec 20 Sold 3,000 shares of treasury stock-common at $14 per share. Requirements 1. Journalize Delphian's transactions for 2016. (8 Marks) 17 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2016. Assume Delphian had net income of $20,000,000 during 2016. (2 Marks) 3. Determine Delphian's earnings per share for 2016. (2 Marks) 4. Assuming Delphians market value per common share as of December 31 2016, was $15, calculate Delphians price/earnings ratio for 2016. (3 Marks) End of Exam Questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 b C d Date Jan01 Feb15 Mar01 Mar30 Nov01 Nov30 Dec01 Dec20 Cash 1000010 Common Stock 100001 Paid i...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started