Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THE COMPANY: TRANSACTIONS NOT INCLUDED IN THE UNADJUSTED TRLAL BALANCE at Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main

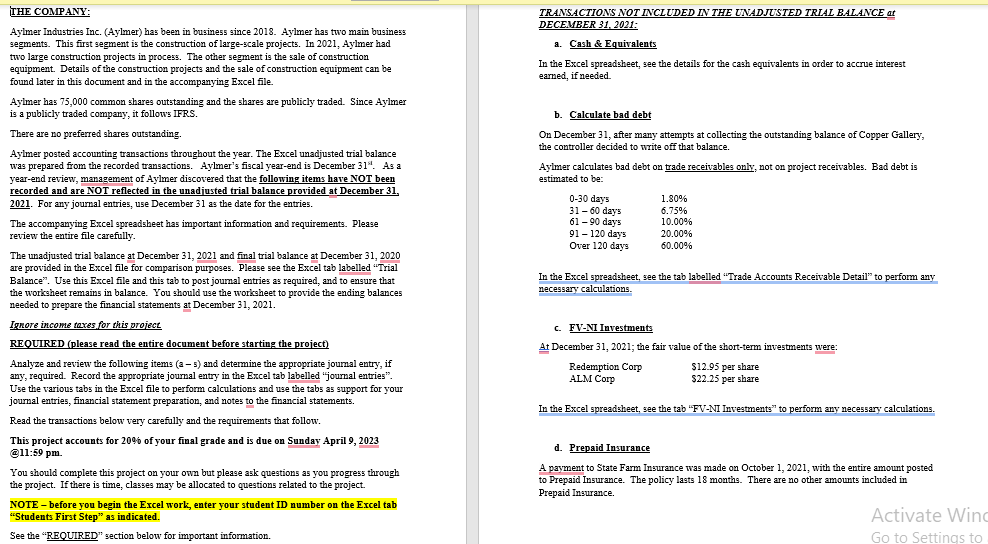

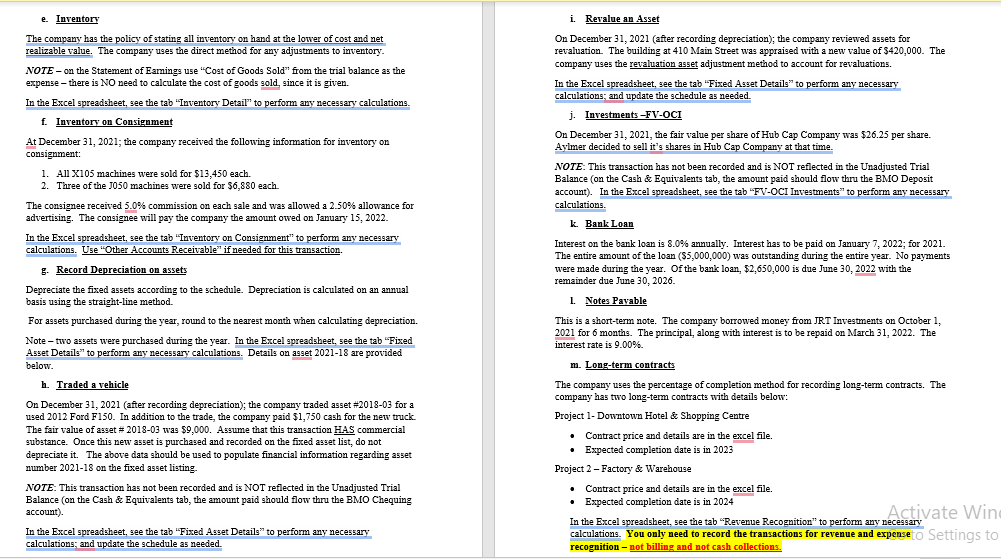

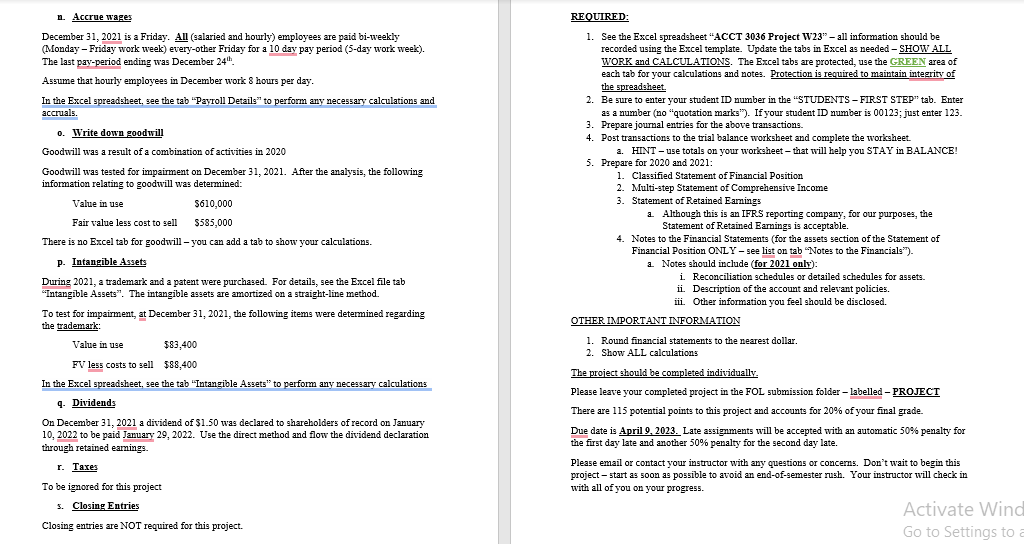

THE COMPANY: TRANSACTIONS NOT INCLUDED IN THE UNADJUSTED TRLAL BALANCE at Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business DECEMBER 31.2021: segments. This first segment is the construction of large-scale projects. In 2021, Aylmer had a. Cash \& Equivalents two large construction projects in process. The other segment is the sale of construction equipment. Details of the construction projects and the sale of construction equipment can be In the Excel spreadsheet, see the details for the cash equivalents in order to accrue interest earned, if needed. found later in this document and in the accompanying Excel file. Aylmer has 75,000 common shares outstanding and the shares are publicly traded. Since Aylmer is a publicly traded company, it follows IFRS. b. Calculate bad debt There are no preferred ghares outstanding. On December 31 , after many attempts at collecting the outstanding balance of Copper Gallery, Aylmer posted accounting transactions throughout the year. The Excel unadjusted trial balance the controller decided to write off that balance. was prepared from the recorded transactions. Aylmer's fiscal year-end is December 3111. As a Aylmer calculates bad debt on trade receivables only, not on project receivables. Bad debt is year-end review, management of Aylmer discovered that the following items have NOT been estimated to be: recorded and are NOT reflected in the unadiusted trial balance provided at December 31 . 2021. For any journal entries, use December 31 as the date for the entries. The accompanying Excel apreadsheet has important information and requirements. Please review the entire file carefully. The unadjusted trial balance at December 31, 2021 and final trial balance at December 31, 2020 are provided in the Excel file for comparison purposes. Please see the Excel tab labelled "Trial Balance". Use this Excel file and this tab to post journal entries as required, and to engure that In the Excel spreadsheet, see the tab labelled "Trade Accounts Receivable Detail" to perform any the worksheet remains in balance. You should uge the worksheet to provide the ending balances necessary calculations. needed to prepare the financial statements at December 31, 2021. Ignore income texes for this project c. FV-NI Investments REOUIRED (please read the entire document before starting the project) At December 31,2021 ; the fair value of the short-term investments were: Analyze and review the following items (a5) and determine the appropriate journal entry, if any, required. Record the appropriate journal entry in the Excel tab labelled "journal entries". Use the various tabs in the Excel file to perform calculations and use the tabs as support for your journal entries, financial statement preparation, and notes to the financial statements. In the Excel spreadsheet, see the tab "FV-NI Investments" to perform any necessary calculations. Read the transactions below very carefully and the requirements that follow. This project accounts for 20% of your final grade and is due on Sunday April 9,2023 (a)11:59 pm. d. Prepaid Insurance You should complete this project on your own but please ask questions as you progress through A payment to State Farm Insurance was made on October 1, 2021, with the entire amount posted the project. If there is time, classes may be allocated to questions related to the project. to Prepaid Insurance. The policy lasts 18 months. There are no other amounts included in Prepaid Insurance. NOTE - before you begin the Excel work, enter your student ID number on the Excel tab "Students First Step" as indicated. e. Inventory i. Revalue an Asset The company has the policy of stating all inventory on hand at the lower of cost and net On December 31, 2021 (after recording depreciation); the company reviewed assets for realizable value. The company uses the direct method for any adjustments to inventory. revaluation. The building at 410Main Street was appraised with a new value of $420,000. The company uges the revaluation asset adjustment method to account for revaluations. NOTE - on the Statement of Eamings use "Cost of Goods Sold" from the trial balance as the expense - there is NO need to calculate the cost of goods gold, gince it is given. In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the schedule as needed. In the Excel spreadsheet, see the tab "Inventory Detail" to perform any necesgary calculations. f. Inventory on Consigument j. Investments-FV-OCI On December 31,2021 , the fair value per share of Hub Cap Company was $26.25 per share. At December 31, 2021; the company received the following information for inventory on Aylmer decided to sell it's shares in Hub Cap Company at that time. consignment: NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial 1. All X105 machines were sold for $13,450 each. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Deposit 2. Three of the J050 machines were sold for $6,880 each. account). In the Excel gpreadsheet, see the tab "FV-OCI Investments" to perform any necessary The consignee received 5.0% commission on each gale and was allowed a 2.50% allowance for calculations. advertising. The consignee will pay the company the amount owed on January 15, 2022. k. BankLoan In the Excel spreadsheet, see the tab "Inventory on Consignment" to perform any necesgary calculations. Use "Other Accounts Receivable" if needed for this transaction. Interest on the bank loan is 8.0% annually. Interest has to be paid on January 7, 2022; for 2021. The entire amount of the loan ($5,000,000) was outstanding during the entire year. No payments g. Record Depreciation on assets were made during the year. Of the bank loan, $2,650,000 is due June 30,2022 with the remainder due June 30,2026 . Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis using the straight-line method. 1. Notes Pavable For assets purchased during the year, round to the nearest month when calculating depreciation. This is a ghort-term note. The company borrowed money from JRT Investments on October 1 , 2021 for 6 months. The principal, along with interest is to be repaid on March 31, 2022. The Note - two assets were purchaged during the year. In the Excel gpreadsheet, see the tab "Fixed interest rate is 9.00%. Asset Details" to perform any necessary calculations. Details on agget 2021-18 are provided m. Long-term contracts h. Traded a vehicle The company uses the percentage of completion method for recording long-term contracts. The company has two long-term contracts with details below: On December 31, 2021 (after recording depreciation); the company traded asset \#2018-03 for a used 2012 Ford F150. In addition to the trade, the company paid $1,750 cash for the new truck. Project 1- Downtown Hotel \& Shopping Centre The fair value of asset =201803 was $9,000. Assume that this transaction H.AS commercial substance. Once this new asset is purchased and recorded on the fixed asset list, do not - Contract price and details are in the excel file. depreciate it. The above data should be used to populate financial information regarding asset - Expected completion date is in 2023 number 2021-18 on the fixed asset listing. Project 2 - Factory \& Warehouge NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial - Contract price and details are in the excel file. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Chequing - Expected completion date is in 2024 account). In the Excel gpreadsheet, see the tab "Revenue Recognition" to perform any neceggary In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the gchedule as needed. calculations. You only need to record the transac recognition - not billing and not cash collections. n. Accrue wages REOUIRED: December 31, 2021 is a Friday. All (galaried and hourly) employees are paid bi-weekly 1. See the Excel spreadgheet "ACCT 3036 Project W23" - all information should be (Monday - Friday work week) every-other Friday for a 10 day pay period (5-day work week). recorded using the Excel template. Update the tabs in Excel as needed - SHOW ALL The last pay-period ending was December 24th.. WORK and CALCULATIONS. The Excel tabs are protected, use the GREEN area of each tab for your calculations and notes. Protection is required to maintain integrity of Assume that hourly employees in December work 8 hours per day. the spreadgheet. In the Excel spreadsheet, see the tab "Payroll Details" to perform any necessary calculations and 2. Be sure to enter your student ID number in the "STUDENTS - FIRST STEP" tab. Enter accruals. as a number (no "quotation marks"). If your student ID number is 00123; just enter 123 . 3. Prepare journal entries for the above transactions. o. Write down goodwill 4. Post transactions to the trial balance worksheet and complete the workcheet. Goodwill was a result of a combination of activities in 2020 a. HINT - use totals on your worksheet - that will help you STAY in BALANCE! 5. Prepare for 2020 and 2021 : Goodwill was tested for impairment on December 31, 2021. After the analysis, the following 1. Classified Statement of Financial Position information relating to goodwill was determined: 2. Multi-9tep Statement of Comprehensive Income Value in use $610,000 3. Statement of Retained Earnings Fair value less cost to sell $585,000 a. Although this is an IFRS reporting company, for our purposes, the Statement of Retained Earnings is acceptable. There is no Excel tab for goodwill - you can add a tab to ghow your calculations. 4. Notes to the Financial Statements (for the assets section of the Statement of Financial Position ONLY - see list on tab "Notes to the Financials"). p. Intangible Assets a. Notes ghould include (for 2021 onlv): During 2021 , a trademark and a patent were purchased. For details, see the Excel file tab i. Reconciliation schedules or detailed schedules for assets. "Intangible Assets". The intangible assets are amortized on a straight-line method. ii. Description of the account and relevant policies. iii. Other information you feel should be disclosed. To test for impairment, at December 31,2021 , the following items were determined regarding the trademark: OTHER IMPORTANT INFORMATION Value in use $83,400 1. Round financial statements to the nearest dollar. 2. Show ALL calculations FV less costs to sell $88,400 The project should be completed individually. In the Excel spreadsheet, see the tab "Intangible Assets" to perform any necessary calculations Please leave your completed project in the FOL submission folder - labelled - PROJECT q. Dividends There are 115 potential points to this project and accounts for 20% of your final grade. On December 31,2021 a dividend of $1.50 was declared to shareholders of record on January 10,2022 to be paid January 29,2022 . Use the direct method and flow the dividend declaration Due date is April 9, 2023. Late assignments will be accepted with an automatic 50% penalty for through retained earnings. the first day late and another 50% penalty for the second day late. r. Taxes Please email or contact your instructor with any questions or concerns. Don't wait to begin this project - start as soon as possible to avoid an end-of-semester rush. Your instructor will check in To be ignored for this project with all of you on your progress. . Closing Entries Closing entries are NOT required for this project. THE COMPANY: TRANSACTIONS NOT INCLUDED IN THE UNADJUSTED TRLAL BALANCE at Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business DECEMBER 31.2021: segments. This first segment is the construction of large-scale projects. In 2021, Aylmer had a. Cash \& Equivalents two large construction projects in process. The other segment is the sale of construction equipment. Details of the construction projects and the sale of construction equipment can be In the Excel spreadsheet, see the details for the cash equivalents in order to accrue interest earned, if needed. found later in this document and in the accompanying Excel file. Aylmer has 75,000 common shares outstanding and the shares are publicly traded. Since Aylmer is a publicly traded company, it follows IFRS. b. Calculate bad debt There are no preferred ghares outstanding. On December 31 , after many attempts at collecting the outstanding balance of Copper Gallery, Aylmer posted accounting transactions throughout the year. The Excel unadjusted trial balance the controller decided to write off that balance. was prepared from the recorded transactions. Aylmer's fiscal year-end is December 3111. As a Aylmer calculates bad debt on trade receivables only, not on project receivables. Bad debt is year-end review, management of Aylmer discovered that the following items have NOT been estimated to be: recorded and are NOT reflected in the unadiusted trial balance provided at December 31 . 2021. For any journal entries, use December 31 as the date for the entries. The accompanying Excel apreadsheet has important information and requirements. Please review the entire file carefully. The unadjusted trial balance at December 31, 2021 and final trial balance at December 31, 2020 are provided in the Excel file for comparison purposes. Please see the Excel tab labelled "Trial Balance". Use this Excel file and this tab to post journal entries as required, and to engure that In the Excel spreadsheet, see the tab labelled "Trade Accounts Receivable Detail" to perform any the worksheet remains in balance. You should uge the worksheet to provide the ending balances necessary calculations. needed to prepare the financial statements at December 31, 2021. Ignore income texes for this project c. FV-NI Investments REOUIRED (please read the entire document before starting the project) At December 31,2021 ; the fair value of the short-term investments were: Analyze and review the following items (a5) and determine the appropriate journal entry, if any, required. Record the appropriate journal entry in the Excel tab labelled "journal entries". Use the various tabs in the Excel file to perform calculations and use the tabs as support for your journal entries, financial statement preparation, and notes to the financial statements. In the Excel spreadsheet, see the tab "FV-NI Investments" to perform any necessary calculations. Read the transactions below very carefully and the requirements that follow. This project accounts for 20% of your final grade and is due on Sunday April 9,2023 (a)11:59 pm. d. Prepaid Insurance You should complete this project on your own but please ask questions as you progress through A payment to State Farm Insurance was made on October 1, 2021, with the entire amount posted the project. If there is time, classes may be allocated to questions related to the project. to Prepaid Insurance. The policy lasts 18 months. There are no other amounts included in Prepaid Insurance. NOTE - before you begin the Excel work, enter your student ID number on the Excel tab "Students First Step" as indicated. e. Inventory i. Revalue an Asset The company has the policy of stating all inventory on hand at the lower of cost and net On December 31, 2021 (after recording depreciation); the company reviewed assets for realizable value. The company uses the direct method for any adjustments to inventory. revaluation. The building at 410Main Street was appraised with a new value of $420,000. The company uges the revaluation asset adjustment method to account for revaluations. NOTE - on the Statement of Eamings use "Cost of Goods Sold" from the trial balance as the expense - there is NO need to calculate the cost of goods gold, gince it is given. In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the schedule as needed. In the Excel spreadsheet, see the tab "Inventory Detail" to perform any necesgary calculations. f. Inventory on Consigument j. Investments-FV-OCI On December 31,2021 , the fair value per share of Hub Cap Company was $26.25 per share. At December 31, 2021; the company received the following information for inventory on Aylmer decided to sell it's shares in Hub Cap Company at that time. consignment: NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial 1. All X105 machines were sold for $13,450 each. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Deposit 2. Three of the J050 machines were sold for $6,880 each. account). In the Excel gpreadsheet, see the tab "FV-OCI Investments" to perform any necessary The consignee received 5.0% commission on each gale and was allowed a 2.50% allowance for calculations. advertising. The consignee will pay the company the amount owed on January 15, 2022. k. BankLoan In the Excel spreadsheet, see the tab "Inventory on Consignment" to perform any necesgary calculations. Use "Other Accounts Receivable" if needed for this transaction. Interest on the bank loan is 8.0% annually. Interest has to be paid on January 7, 2022; for 2021. The entire amount of the loan ($5,000,000) was outstanding during the entire year. No payments g. Record Depreciation on assets were made during the year. Of the bank loan, $2,650,000 is due June 30,2022 with the remainder due June 30,2026 . Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis using the straight-line method. 1. Notes Pavable For assets purchased during the year, round to the nearest month when calculating depreciation. This is a ghort-term note. The company borrowed money from JRT Investments on October 1 , 2021 for 6 months. The principal, along with interest is to be repaid on March 31, 2022. The Note - two assets were purchaged during the year. In the Excel gpreadsheet, see the tab "Fixed interest rate is 9.00%. Asset Details" to perform any necessary calculations. Details on agget 2021-18 are provided m. Long-term contracts h. Traded a vehicle The company uses the percentage of completion method for recording long-term contracts. The company has two long-term contracts with details below: On December 31, 2021 (after recording depreciation); the company traded asset \#2018-03 for a used 2012 Ford F150. In addition to the trade, the company paid $1,750 cash for the new truck. Project 1- Downtown Hotel \& Shopping Centre The fair value of asset =201803 was $9,000. Assume that this transaction H.AS commercial substance. Once this new asset is purchased and recorded on the fixed asset list, do not - Contract price and details are in the excel file. depreciate it. The above data should be used to populate financial information regarding asset - Expected completion date is in 2023 number 2021-18 on the fixed asset listing. Project 2 - Factory \& Warehouge NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial - Contract price and details are in the excel file. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Chequing - Expected completion date is in 2024 account). In the Excel gpreadsheet, see the tab "Revenue Recognition" to perform any neceggary In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the gchedule as needed. calculations. You only need to record the transac recognition - not billing and not cash collections. n. Accrue wages REOUIRED: December 31, 2021 is a Friday. All (galaried and hourly) employees are paid bi-weekly 1. See the Excel spreadgheet "ACCT 3036 Project W23" - all information should be (Monday - Friday work week) every-other Friday for a 10 day pay period (5-day work week). recorded using the Excel template. Update the tabs in Excel as needed - SHOW ALL The last pay-period ending was December 24th.. WORK and CALCULATIONS. The Excel tabs are protected, use the GREEN area of each tab for your calculations and notes. Protection is required to maintain integrity of Assume that hourly employees in December work 8 hours per day. the spreadgheet. In the Excel spreadsheet, see the tab "Payroll Details" to perform any necessary calculations and 2. Be sure to enter your student ID number in the "STUDENTS - FIRST STEP" tab. Enter accruals. as a number (no "quotation marks"). If your student ID number is 00123; just enter 123 . 3. Prepare journal entries for the above transactions. o. Write down goodwill 4. Post transactions to the trial balance worksheet and complete the workcheet. Goodwill was a result of a combination of activities in 2020 a. HINT - use totals on your worksheet - that will help you STAY in BALANCE! 5. Prepare for 2020 and 2021 : Goodwill was tested for impairment on December 31, 2021. After the analysis, the following 1. Classified Statement of Financial Position information relating to goodwill was determined: 2. Multi-9tep Statement of Comprehensive Income Value in use $610,000 3. Statement of Retained Earnings Fair value less cost to sell $585,000 a. Although this is an IFRS reporting company, for our purposes, the Statement of Retained Earnings is acceptable. There is no Excel tab for goodwill - you can add a tab to ghow your calculations. 4. Notes to the Financial Statements (for the assets section of the Statement of Financial Position ONLY - see list on tab "Notes to the Financials"). p. Intangible Assets a. Notes ghould include (for 2021 onlv): During 2021 , a trademark and a patent were purchased. For details, see the Excel file tab i. Reconciliation schedules or detailed schedules for assets. "Intangible Assets". The intangible assets are amortized on a straight-line method. ii. Description of the account and relevant policies. iii. Other information you feel should be disclosed. To test for impairment, at December 31,2021 , the following items were determined regarding the trademark: OTHER IMPORTANT INFORMATION Value in use $83,400 1. Round financial statements to the nearest dollar. 2. Show ALL calculations FV less costs to sell $88,400 The project should be completed individually. In the Excel spreadsheet, see the tab "Intangible Assets" to perform any necessary calculations Please leave your completed project in the FOL submission folder - labelled - PROJECT q. Dividends There are 115 potential points to this project and accounts for 20% of your final grade. On December 31,2021 a dividend of $1.50 was declared to shareholders of record on January 10,2022 to be paid January 29,2022 . Use the direct method and flow the dividend declaration Due date is April 9, 2023. Late assignments will be accepted with an automatic 50% penalty for through retained earnings. the first day late and another 50% penalty for the second day late. r. Taxes Please email or contact your instructor with any questions or concerns. Don't wait to begin this project - start as soon as possible to avoid an end-of-semester rush. Your instructor will check in To be ignored for this project with all of you on your progress. . Closing Entries Closing entries are NOT required for this project

THE COMPANY: TRANSACTIONS NOT INCLUDED IN THE UNADJUSTED TRLAL BALANCE at Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business DECEMBER 31.2021: segments. This first segment is the construction of large-scale projects. In 2021, Aylmer had a. Cash \& Equivalents two large construction projects in process. The other segment is the sale of construction equipment. Details of the construction projects and the sale of construction equipment can be In the Excel spreadsheet, see the details for the cash equivalents in order to accrue interest earned, if needed. found later in this document and in the accompanying Excel file. Aylmer has 75,000 common shares outstanding and the shares are publicly traded. Since Aylmer is a publicly traded company, it follows IFRS. b. Calculate bad debt There are no preferred ghares outstanding. On December 31 , after many attempts at collecting the outstanding balance of Copper Gallery, Aylmer posted accounting transactions throughout the year. The Excel unadjusted trial balance the controller decided to write off that balance. was prepared from the recorded transactions. Aylmer's fiscal year-end is December 3111. As a Aylmer calculates bad debt on trade receivables only, not on project receivables. Bad debt is year-end review, management of Aylmer discovered that the following items have NOT been estimated to be: recorded and are NOT reflected in the unadiusted trial balance provided at December 31 . 2021. For any journal entries, use December 31 as the date for the entries. The accompanying Excel apreadsheet has important information and requirements. Please review the entire file carefully. The unadjusted trial balance at December 31, 2021 and final trial balance at December 31, 2020 are provided in the Excel file for comparison purposes. Please see the Excel tab labelled "Trial Balance". Use this Excel file and this tab to post journal entries as required, and to engure that In the Excel spreadsheet, see the tab labelled "Trade Accounts Receivable Detail" to perform any the worksheet remains in balance. You should uge the worksheet to provide the ending balances necessary calculations. needed to prepare the financial statements at December 31, 2021. Ignore income texes for this project c. FV-NI Investments REOUIRED (please read the entire document before starting the project) At December 31,2021 ; the fair value of the short-term investments were: Analyze and review the following items (a5) and determine the appropriate journal entry, if any, required. Record the appropriate journal entry in the Excel tab labelled "journal entries". Use the various tabs in the Excel file to perform calculations and use the tabs as support for your journal entries, financial statement preparation, and notes to the financial statements. In the Excel spreadsheet, see the tab "FV-NI Investments" to perform any necessary calculations. Read the transactions below very carefully and the requirements that follow. This project accounts for 20% of your final grade and is due on Sunday April 9,2023 (a)11:59 pm. d. Prepaid Insurance You should complete this project on your own but please ask questions as you progress through A payment to State Farm Insurance was made on October 1, 2021, with the entire amount posted the project. If there is time, classes may be allocated to questions related to the project. to Prepaid Insurance. The policy lasts 18 months. There are no other amounts included in Prepaid Insurance. NOTE - before you begin the Excel work, enter your student ID number on the Excel tab "Students First Step" as indicated. e. Inventory i. Revalue an Asset The company has the policy of stating all inventory on hand at the lower of cost and net On December 31, 2021 (after recording depreciation); the company reviewed assets for realizable value. The company uses the direct method for any adjustments to inventory. revaluation. The building at 410Main Street was appraised with a new value of $420,000. The company uges the revaluation asset adjustment method to account for revaluations. NOTE - on the Statement of Eamings use "Cost of Goods Sold" from the trial balance as the expense - there is NO need to calculate the cost of goods gold, gince it is given. In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the schedule as needed. In the Excel spreadsheet, see the tab "Inventory Detail" to perform any necesgary calculations. f. Inventory on Consigument j. Investments-FV-OCI On December 31,2021 , the fair value per share of Hub Cap Company was $26.25 per share. At December 31, 2021; the company received the following information for inventory on Aylmer decided to sell it's shares in Hub Cap Company at that time. consignment: NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial 1. All X105 machines were sold for $13,450 each. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Deposit 2. Three of the J050 machines were sold for $6,880 each. account). In the Excel gpreadsheet, see the tab "FV-OCI Investments" to perform any necessary The consignee received 5.0% commission on each gale and was allowed a 2.50% allowance for calculations. advertising. The consignee will pay the company the amount owed on January 15, 2022. k. BankLoan In the Excel spreadsheet, see the tab "Inventory on Consignment" to perform any necesgary calculations. Use "Other Accounts Receivable" if needed for this transaction. Interest on the bank loan is 8.0% annually. Interest has to be paid on January 7, 2022; for 2021. The entire amount of the loan ($5,000,000) was outstanding during the entire year. No payments g. Record Depreciation on assets were made during the year. Of the bank loan, $2,650,000 is due June 30,2022 with the remainder due June 30,2026 . Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis using the straight-line method. 1. Notes Pavable For assets purchased during the year, round to the nearest month when calculating depreciation. This is a ghort-term note. The company borrowed money from JRT Investments on October 1 , 2021 for 6 months. The principal, along with interest is to be repaid on March 31, 2022. The Note - two assets were purchaged during the year. In the Excel gpreadsheet, see the tab "Fixed interest rate is 9.00%. Asset Details" to perform any necessary calculations. Details on agget 2021-18 are provided m. Long-term contracts h. Traded a vehicle The company uses the percentage of completion method for recording long-term contracts. The company has two long-term contracts with details below: On December 31, 2021 (after recording depreciation); the company traded asset \#2018-03 for a used 2012 Ford F150. In addition to the trade, the company paid $1,750 cash for the new truck. Project 1- Downtown Hotel \& Shopping Centre The fair value of asset =201803 was $9,000. Assume that this transaction H.AS commercial substance. Once this new asset is purchased and recorded on the fixed asset list, do not - Contract price and details are in the excel file. depreciate it. The above data should be used to populate financial information regarding asset - Expected completion date is in 2023 number 2021-18 on the fixed asset listing. Project 2 - Factory \& Warehouge NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial - Contract price and details are in the excel file. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Chequing - Expected completion date is in 2024 account). In the Excel gpreadsheet, see the tab "Revenue Recognition" to perform any neceggary In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the gchedule as needed. calculations. You only need to record the transac recognition - not billing and not cash collections. n. Accrue wages REOUIRED: December 31, 2021 is a Friday. All (galaried and hourly) employees are paid bi-weekly 1. See the Excel spreadgheet "ACCT 3036 Project W23" - all information should be (Monday - Friday work week) every-other Friday for a 10 day pay period (5-day work week). recorded using the Excel template. Update the tabs in Excel as needed - SHOW ALL The last pay-period ending was December 24th.. WORK and CALCULATIONS. The Excel tabs are protected, use the GREEN area of each tab for your calculations and notes. Protection is required to maintain integrity of Assume that hourly employees in December work 8 hours per day. the spreadgheet. In the Excel spreadsheet, see the tab "Payroll Details" to perform any necessary calculations and 2. Be sure to enter your student ID number in the "STUDENTS - FIRST STEP" tab. Enter accruals. as a number (no "quotation marks"). If your student ID number is 00123; just enter 123 . 3. Prepare journal entries for the above transactions. o. Write down goodwill 4. Post transactions to the trial balance worksheet and complete the workcheet. Goodwill was a result of a combination of activities in 2020 a. HINT - use totals on your worksheet - that will help you STAY in BALANCE! 5. Prepare for 2020 and 2021 : Goodwill was tested for impairment on December 31, 2021. After the analysis, the following 1. Classified Statement of Financial Position information relating to goodwill was determined: 2. Multi-9tep Statement of Comprehensive Income Value in use $610,000 3. Statement of Retained Earnings Fair value less cost to sell $585,000 a. Although this is an IFRS reporting company, for our purposes, the Statement of Retained Earnings is acceptable. There is no Excel tab for goodwill - you can add a tab to ghow your calculations. 4. Notes to the Financial Statements (for the assets section of the Statement of Financial Position ONLY - see list on tab "Notes to the Financials"). p. Intangible Assets a. Notes ghould include (for 2021 onlv): During 2021 , a trademark and a patent were purchased. For details, see the Excel file tab i. Reconciliation schedules or detailed schedules for assets. "Intangible Assets". The intangible assets are amortized on a straight-line method. ii. Description of the account and relevant policies. iii. Other information you feel should be disclosed. To test for impairment, at December 31,2021 , the following items were determined regarding the trademark: OTHER IMPORTANT INFORMATION Value in use $83,400 1. Round financial statements to the nearest dollar. 2. Show ALL calculations FV less costs to sell $88,400 The project should be completed individually. In the Excel spreadsheet, see the tab "Intangible Assets" to perform any necessary calculations Please leave your completed project in the FOL submission folder - labelled - PROJECT q. Dividends There are 115 potential points to this project and accounts for 20% of your final grade. On December 31,2021 a dividend of $1.50 was declared to shareholders of record on January 10,2022 to be paid January 29,2022 . Use the direct method and flow the dividend declaration Due date is April 9, 2023. Late assignments will be accepted with an automatic 50% penalty for through retained earnings. the first day late and another 50% penalty for the second day late. r. Taxes Please email or contact your instructor with any questions or concerns. Don't wait to begin this project - start as soon as possible to avoid an end-of-semester rush. Your instructor will check in To be ignored for this project with all of you on your progress. . Closing Entries Closing entries are NOT required for this project. THE COMPANY: TRANSACTIONS NOT INCLUDED IN THE UNADJUSTED TRLAL BALANCE at Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business DECEMBER 31.2021: segments. This first segment is the construction of large-scale projects. In 2021, Aylmer had a. Cash \& Equivalents two large construction projects in process. The other segment is the sale of construction equipment. Details of the construction projects and the sale of construction equipment can be In the Excel spreadsheet, see the details for the cash equivalents in order to accrue interest earned, if needed. found later in this document and in the accompanying Excel file. Aylmer has 75,000 common shares outstanding and the shares are publicly traded. Since Aylmer is a publicly traded company, it follows IFRS. b. Calculate bad debt There are no preferred ghares outstanding. On December 31 , after many attempts at collecting the outstanding balance of Copper Gallery, Aylmer posted accounting transactions throughout the year. The Excel unadjusted trial balance the controller decided to write off that balance. was prepared from the recorded transactions. Aylmer's fiscal year-end is December 3111. As a Aylmer calculates bad debt on trade receivables only, not on project receivables. Bad debt is year-end review, management of Aylmer discovered that the following items have NOT been estimated to be: recorded and are NOT reflected in the unadiusted trial balance provided at December 31 . 2021. For any journal entries, use December 31 as the date for the entries. The accompanying Excel apreadsheet has important information and requirements. Please review the entire file carefully. The unadjusted trial balance at December 31, 2021 and final trial balance at December 31, 2020 are provided in the Excel file for comparison purposes. Please see the Excel tab labelled "Trial Balance". Use this Excel file and this tab to post journal entries as required, and to engure that In the Excel spreadsheet, see the tab labelled "Trade Accounts Receivable Detail" to perform any the worksheet remains in balance. You should uge the worksheet to provide the ending balances necessary calculations. needed to prepare the financial statements at December 31, 2021. Ignore income texes for this project c. FV-NI Investments REOUIRED (please read the entire document before starting the project) At December 31,2021 ; the fair value of the short-term investments were: Analyze and review the following items (a5) and determine the appropriate journal entry, if any, required. Record the appropriate journal entry in the Excel tab labelled "journal entries". Use the various tabs in the Excel file to perform calculations and use the tabs as support for your journal entries, financial statement preparation, and notes to the financial statements. In the Excel spreadsheet, see the tab "FV-NI Investments" to perform any necessary calculations. Read the transactions below very carefully and the requirements that follow. This project accounts for 20% of your final grade and is due on Sunday April 9,2023 (a)11:59 pm. d. Prepaid Insurance You should complete this project on your own but please ask questions as you progress through A payment to State Farm Insurance was made on October 1, 2021, with the entire amount posted the project. If there is time, classes may be allocated to questions related to the project. to Prepaid Insurance. The policy lasts 18 months. There are no other amounts included in Prepaid Insurance. NOTE - before you begin the Excel work, enter your student ID number on the Excel tab "Students First Step" as indicated. e. Inventory i. Revalue an Asset The company has the policy of stating all inventory on hand at the lower of cost and net On December 31, 2021 (after recording depreciation); the company reviewed assets for realizable value. The company uses the direct method for any adjustments to inventory. revaluation. The building at 410Main Street was appraised with a new value of $420,000. The company uges the revaluation asset adjustment method to account for revaluations. NOTE - on the Statement of Eamings use "Cost of Goods Sold" from the trial balance as the expense - there is NO need to calculate the cost of goods gold, gince it is given. In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the schedule as needed. In the Excel spreadsheet, see the tab "Inventory Detail" to perform any necesgary calculations. f. Inventory on Consigument j. Investments-FV-OCI On December 31,2021 , the fair value per share of Hub Cap Company was $26.25 per share. At December 31, 2021; the company received the following information for inventory on Aylmer decided to sell it's shares in Hub Cap Company at that time. consignment: NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial 1. All X105 machines were sold for $13,450 each. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Deposit 2. Three of the J050 machines were sold for $6,880 each. account). In the Excel gpreadsheet, see the tab "FV-OCI Investments" to perform any necessary The consignee received 5.0% commission on each gale and was allowed a 2.50% allowance for calculations. advertising. The consignee will pay the company the amount owed on January 15, 2022. k. BankLoan In the Excel spreadsheet, see the tab "Inventory on Consignment" to perform any necesgary calculations. Use "Other Accounts Receivable" if needed for this transaction. Interest on the bank loan is 8.0% annually. Interest has to be paid on January 7, 2022; for 2021. The entire amount of the loan ($5,000,000) was outstanding during the entire year. No payments g. Record Depreciation on assets were made during the year. Of the bank loan, $2,650,000 is due June 30,2022 with the remainder due June 30,2026 . Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis using the straight-line method. 1. Notes Pavable For assets purchased during the year, round to the nearest month when calculating depreciation. This is a ghort-term note. The company borrowed money from JRT Investments on October 1 , 2021 for 6 months. The principal, along with interest is to be repaid on March 31, 2022. The Note - two assets were purchaged during the year. In the Excel gpreadsheet, see the tab "Fixed interest rate is 9.00%. Asset Details" to perform any necessary calculations. Details on agget 2021-18 are provided m. Long-term contracts h. Traded a vehicle The company uses the percentage of completion method for recording long-term contracts. The company has two long-term contracts with details below: On December 31, 2021 (after recording depreciation); the company traded asset \#2018-03 for a used 2012 Ford F150. In addition to the trade, the company paid $1,750 cash for the new truck. Project 1- Downtown Hotel \& Shopping Centre The fair value of asset =201803 was $9,000. Assume that this transaction H.AS commercial substance. Once this new asset is purchased and recorded on the fixed asset list, do not - Contract price and details are in the excel file. depreciate it. The above data should be used to populate financial information regarding asset - Expected completion date is in 2023 number 2021-18 on the fixed asset listing. Project 2 - Factory \& Warehouge NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial - Contract price and details are in the excel file. Balance (on the Cash \& Equivalents tab, the amount paid should flow thru the BMO Chequing - Expected completion date is in 2024 account). In the Excel gpreadsheet, see the tab "Revenue Recognition" to perform any neceggary In the Excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the gchedule as needed. calculations. You only need to record the transac recognition - not billing and not cash collections. n. Accrue wages REOUIRED: December 31, 2021 is a Friday. All (galaried and hourly) employees are paid bi-weekly 1. See the Excel spreadgheet "ACCT 3036 Project W23" - all information should be (Monday - Friday work week) every-other Friday for a 10 day pay period (5-day work week). recorded using the Excel template. Update the tabs in Excel as needed - SHOW ALL The last pay-period ending was December 24th.. WORK and CALCULATIONS. The Excel tabs are protected, use the GREEN area of each tab for your calculations and notes. Protection is required to maintain integrity of Assume that hourly employees in December work 8 hours per day. the spreadgheet. In the Excel spreadsheet, see the tab "Payroll Details" to perform any necessary calculations and 2. Be sure to enter your student ID number in the "STUDENTS - FIRST STEP" tab. Enter accruals. as a number (no "quotation marks"). If your student ID number is 00123; just enter 123 . 3. Prepare journal entries for the above transactions. o. Write down goodwill 4. Post transactions to the trial balance worksheet and complete the workcheet. Goodwill was a result of a combination of activities in 2020 a. HINT - use totals on your worksheet - that will help you STAY in BALANCE! 5. Prepare for 2020 and 2021 : Goodwill was tested for impairment on December 31, 2021. After the analysis, the following 1. Classified Statement of Financial Position information relating to goodwill was determined: 2. Multi-9tep Statement of Comprehensive Income Value in use $610,000 3. Statement of Retained Earnings Fair value less cost to sell $585,000 a. Although this is an IFRS reporting company, for our purposes, the Statement of Retained Earnings is acceptable. There is no Excel tab for goodwill - you can add a tab to ghow your calculations. 4. Notes to the Financial Statements (for the assets section of the Statement of Financial Position ONLY - see list on tab "Notes to the Financials"). p. Intangible Assets a. Notes ghould include (for 2021 onlv): During 2021 , a trademark and a patent were purchased. For details, see the Excel file tab i. Reconciliation schedules or detailed schedules for assets. "Intangible Assets". The intangible assets are amortized on a straight-line method. ii. Description of the account and relevant policies. iii. Other information you feel should be disclosed. To test for impairment, at December 31,2021 , the following items were determined regarding the trademark: OTHER IMPORTANT INFORMATION Value in use $83,400 1. Round financial statements to the nearest dollar. 2. Show ALL calculations FV less costs to sell $88,400 The project should be completed individually. In the Excel spreadsheet, see the tab "Intangible Assets" to perform any necessary calculations Please leave your completed project in the FOL submission folder - labelled - PROJECT q. Dividends There are 115 potential points to this project and accounts for 20% of your final grade. On December 31,2021 a dividend of $1.50 was declared to shareholders of record on January 10,2022 to be paid January 29,2022 . Use the direct method and flow the dividend declaration Due date is April 9, 2023. Late assignments will be accepted with an automatic 50% penalty for through retained earnings. the first day late and another 50% penalty for the second day late. r. Taxes Please email or contact your instructor with any questions or concerns. Don't wait to begin this project - start as soon as possible to avoid an end-of-semester rush. Your instructor will check in To be ignored for this project with all of you on your progress. . Closing Entries Closing entries are NOT required for this project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started