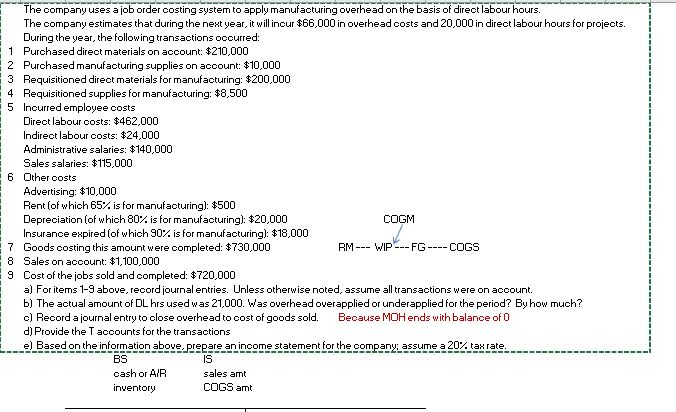

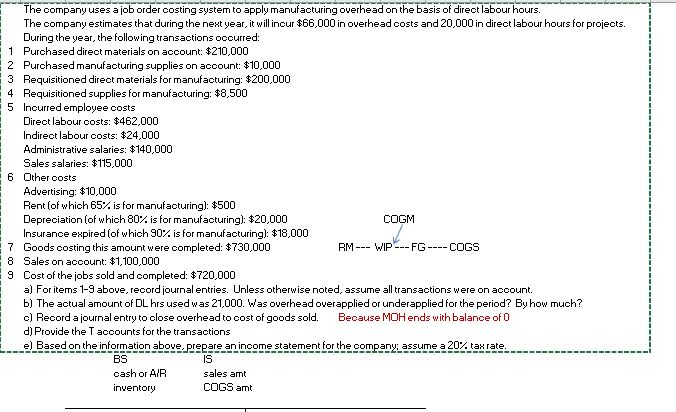

The company uses a job order costing system to apply manufacturing overhead on the basis of direct labour hours. The company estimates that during the next year, it will incur $66,000 in overhead costs and 20,000 in direct labour hours for projects. During the year, the following transactions occurred: 1 Purchased direct materials on account: $210,000 2 Purchased manufacturing supplies on account: $10,000 3 Requisitioned direct materials for manufacturing: $200,000 4 Requisitioned supplies for manufacturing: $8,500 5 Incurred employee costs Direct labour costs: $462,000 Indirect labour costs: $24,000 Administrative salaries: $140,000 Sales salaries: $115,000 6 Other costs Advertising: $10,000 Rent (of which 65% is for manufacturing): $500 Depreciation (of which 80% is for manufacturing): $20,000 COGM Insurance expired (of which 90% is for manufacturing): $18,000 7 Goods costing this amount were completed: $730,000 RM --- WIP ---FG---- COGS 8 Sales on account: $1,100,000 9 Cost of the jobs sold and completed: $720,000 a) For items 1-9 above, record journal entries. Unless otherwise noted, assume all transactions were on account b) The actual amount of DL hrs used was 21,000. Was overhead overapplied or underapplied for the period? By how much? c) Record a journal entry to close overhead to cost of goods sold. Because MOH ends with balance of O d) Provide the Taccounts for the transactions e) Based on the information above, prepare an income statement for the company assume a 20% tax rate. BS IS cash or AIR sales amt inventory COGS amt The company uses a job order costing system to apply manufacturing overhead on the basis of direct labour hours. The company estimates that during the next year, it will incur $66,000 in overhead costs and 20,000 in direct labour hours for projects. During the year, the following transactions occurred: 1 Purchased direct materials on account: $210,000 2 Purchased manufacturing supplies on account: $10,000 3 Requisitioned direct materials for manufacturing: $200,000 4 Requisitioned supplies for manufacturing: $8,500 5 Incurred employee costs Direct labour costs: $462,000 Indirect labour costs: $24,000 Administrative salaries: $140,000 Sales salaries: $115,000 6 Other costs Advertising: $10,000 Rent (of which 65% is for manufacturing): $500 Depreciation (of which 80% is for manufacturing): $20,000 COGM Insurance expired (of which 90% is for manufacturing): $18,000 7 Goods costing this amount were completed: $730,000 RM --- WIP ---FG---- COGS 8 Sales on account: $1,100,000 9 Cost of the jobs sold and completed: $720,000 a) For items 1-9 above, record journal entries. Unless otherwise noted, assume all transactions were on account b) The actual amount of DL hrs used was 21,000. Was overhead overapplied or underapplied for the period? By how much? c) Record a journal entry to close overhead to cost of goods sold. Because MOH ends with balance of O d) Provide the Taccounts for the transactions e) Based on the information above, prepare an income statement for the company assume a 20% tax rate. BS IS cash or AIR sales amt inventory COGS amt