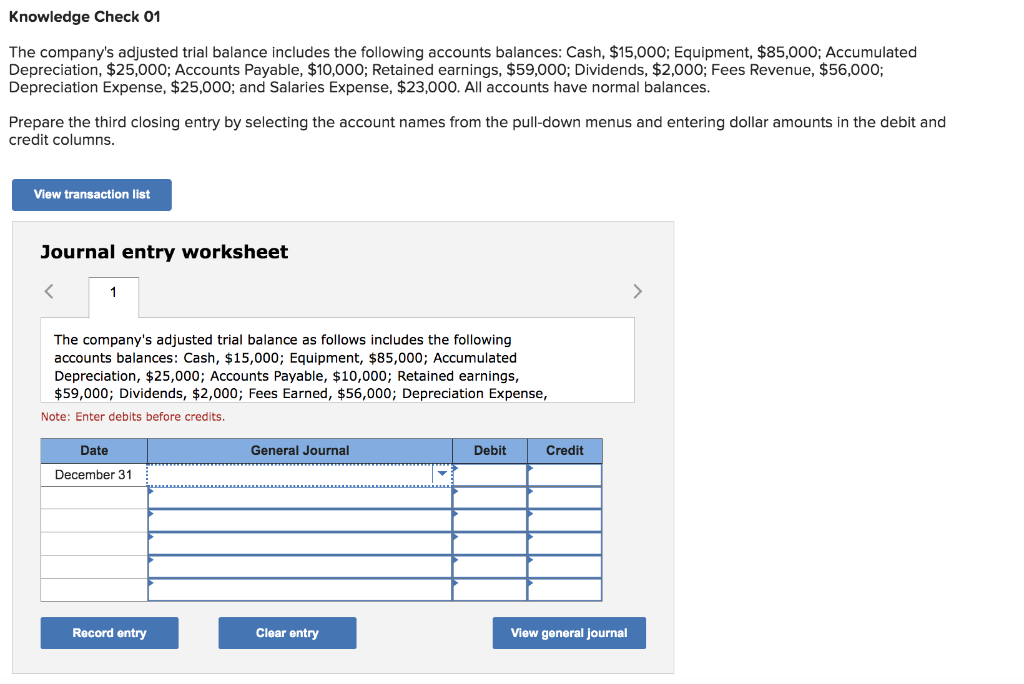

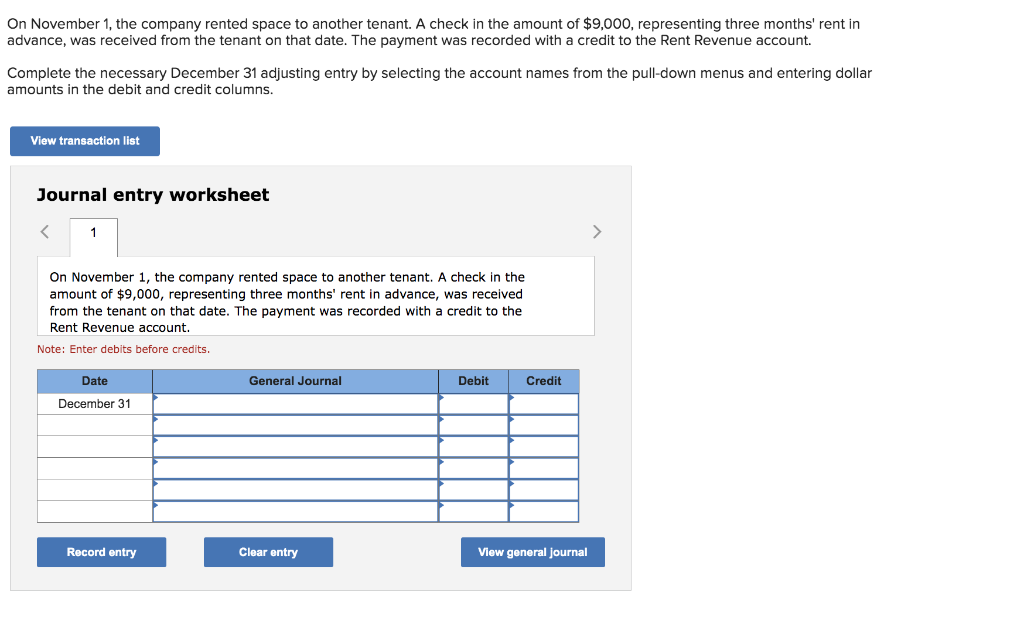

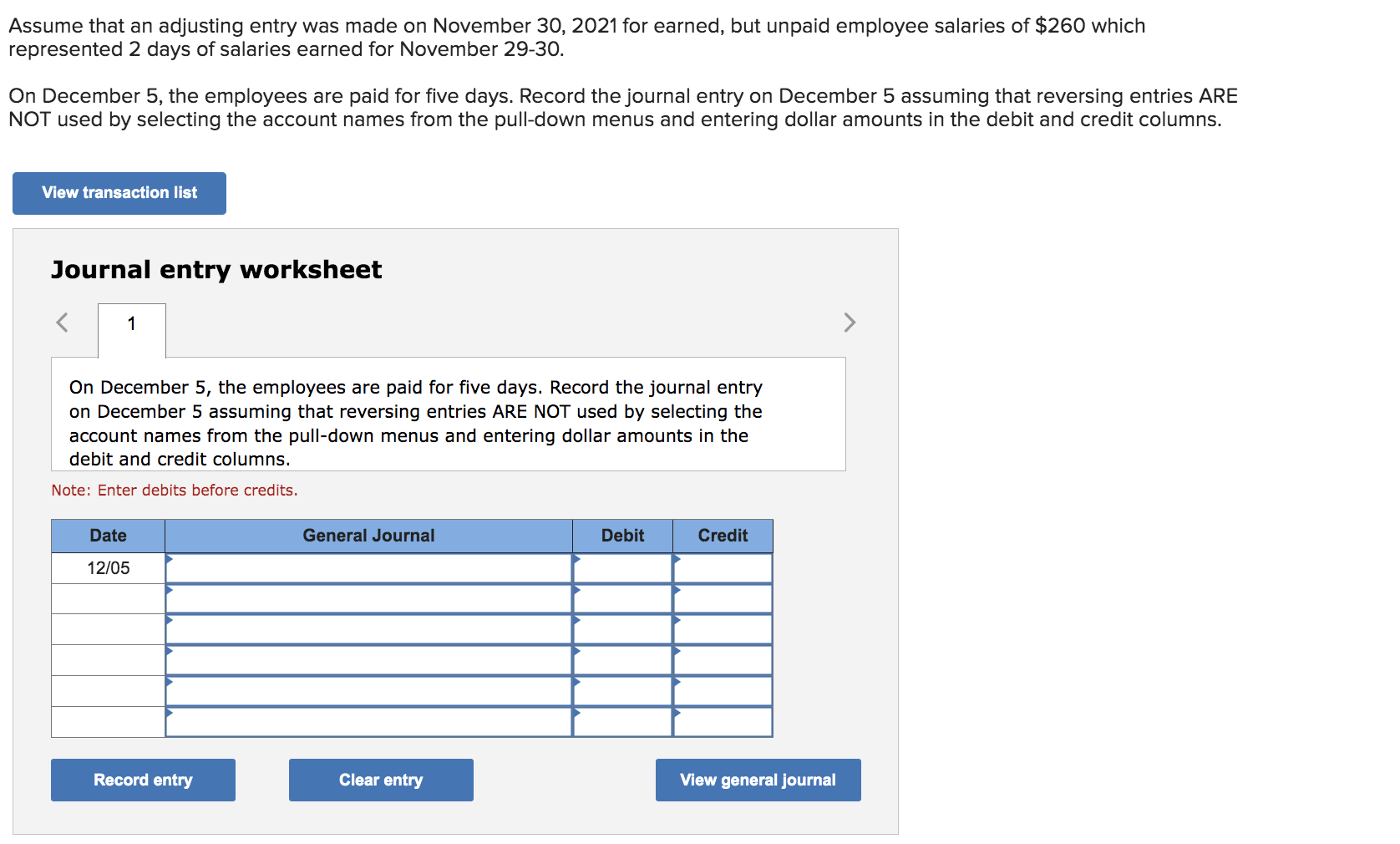

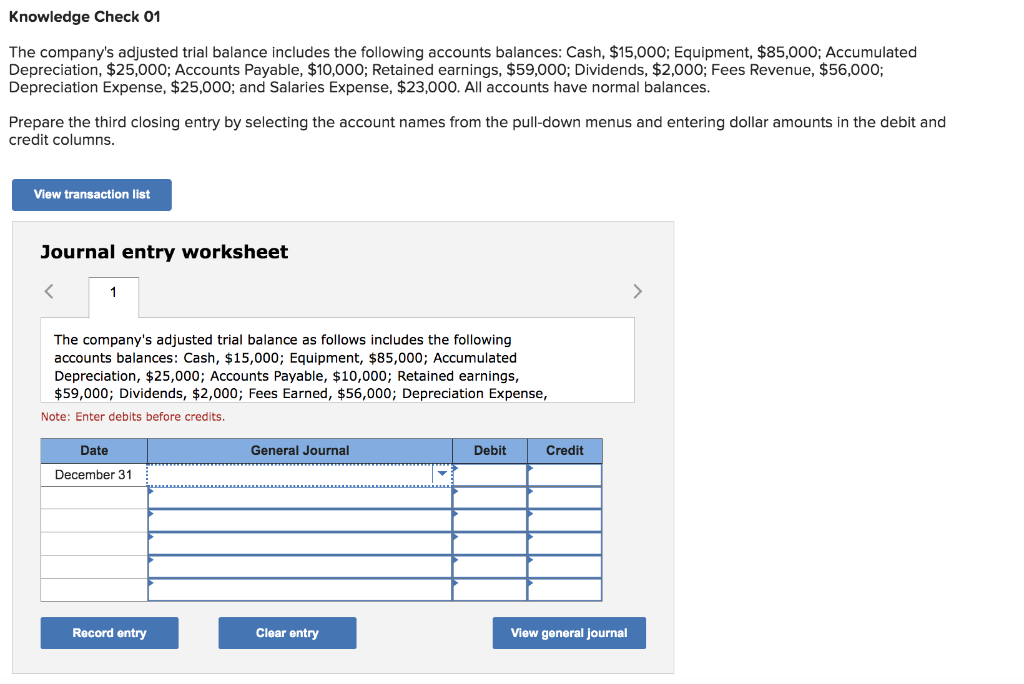

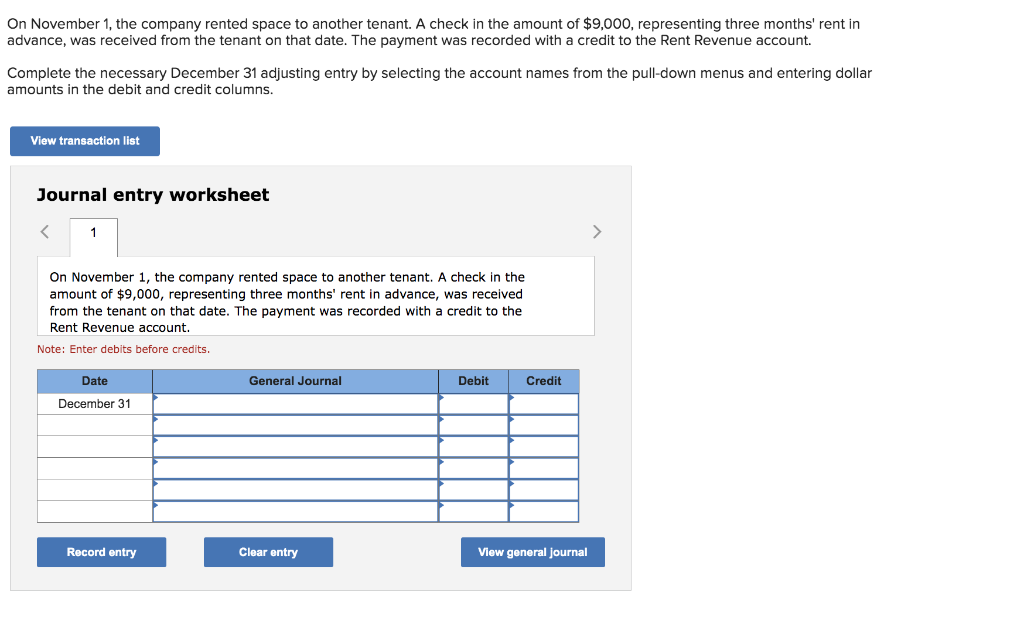

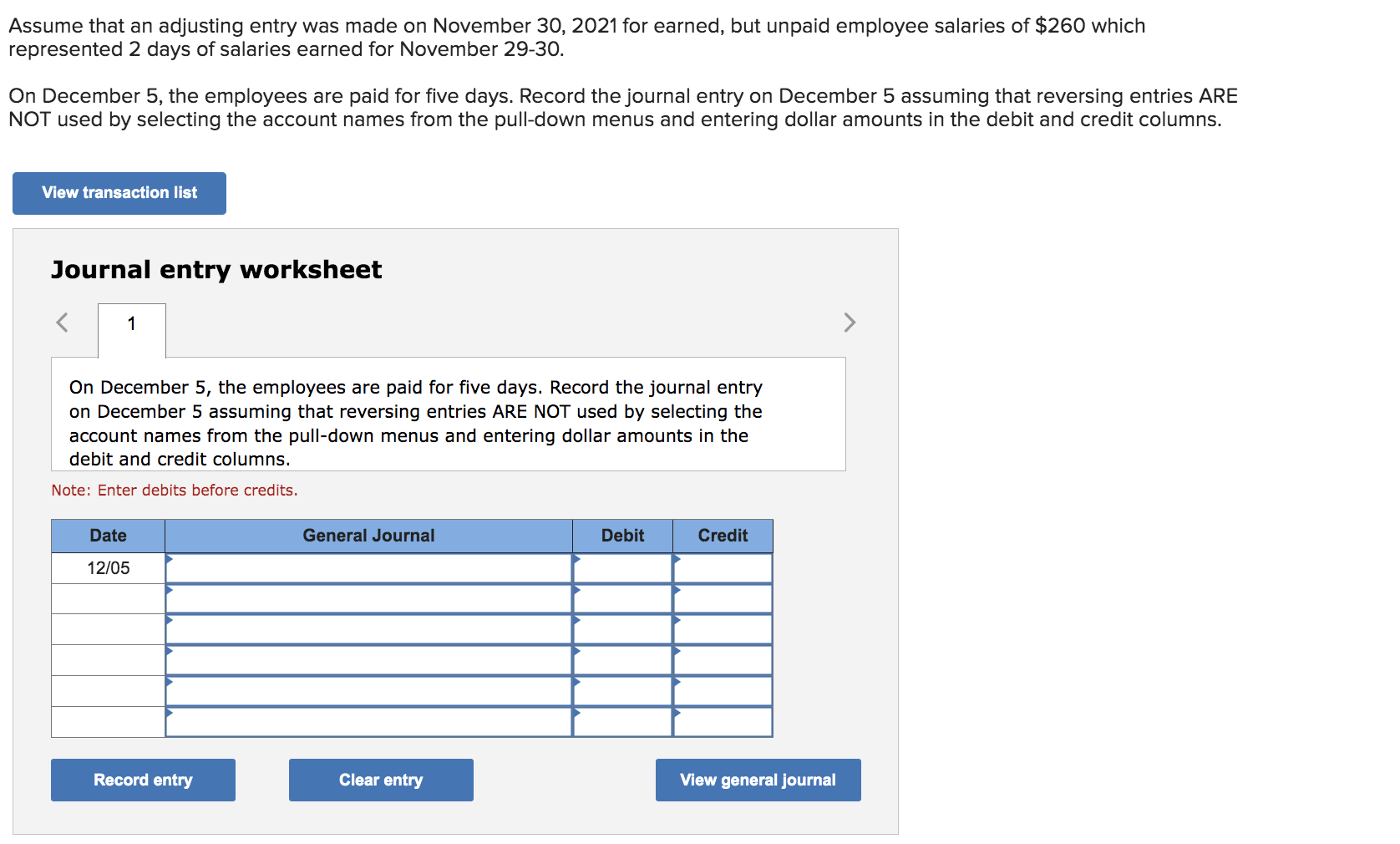

The company's adjusted trial balance includes the following accounts balances: Cash, $15,000; Equipment, $85,000; Accumulated Depreciation, \$25,000; Accounts Payable, $10,000; Retained earnings, $59,000; Dividends, $2,000; Fees Revenue, $56,000; Depreciation Expense, $25,000; and Salaries Expense, $23,000. All accounts have normal balances. Prepare the third closing entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet The company's adjusted trial balance as follows includes the following accounts balances: Cash, $15,000; Equipment, $85,000; Accumulated Depreciation, $25,000; Accounts Payable, $10,000; Retained earnings, $59,000; Dividends, $2,000; Fees Earned, $56,000; Depreciation Expense, On November 1 , the company rented space to another tenant. A check in the amount of $9,000, representing three months' rent in advance, was received from the tenant on that date. The payment was recorded with a credit to the Rent Revenue account. Complete the necessary December 31 adjusting entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet On November 1 , the company rented space to another tenant. A check in the amount of $9,000, representing three months' rent in advance, was received from the tenant on that date. The payment was recorded with a credit to the Rent Revenue account. Note: Enter debits before credits. Assume that an adjusting entry was made on November 30,2021 for earned, but unpaid employee salaries of $260 which epresented 2 days of salaries earned for November 29-30. On December 5 , the employees are paid for five days. Record the journal entry on December 5 assuming that reversing entries AR NOT used by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet On December 5, the employees are paid for five days. Record the journal entry on December 5 assuming that reversing entries ARE NOT used by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Note: Enter debits before credits