Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the companys dividend history from finance.yahoo.com or the companys own website. 2) the companys market risk exposure measured by Beta (5Y Monthly) from the companys

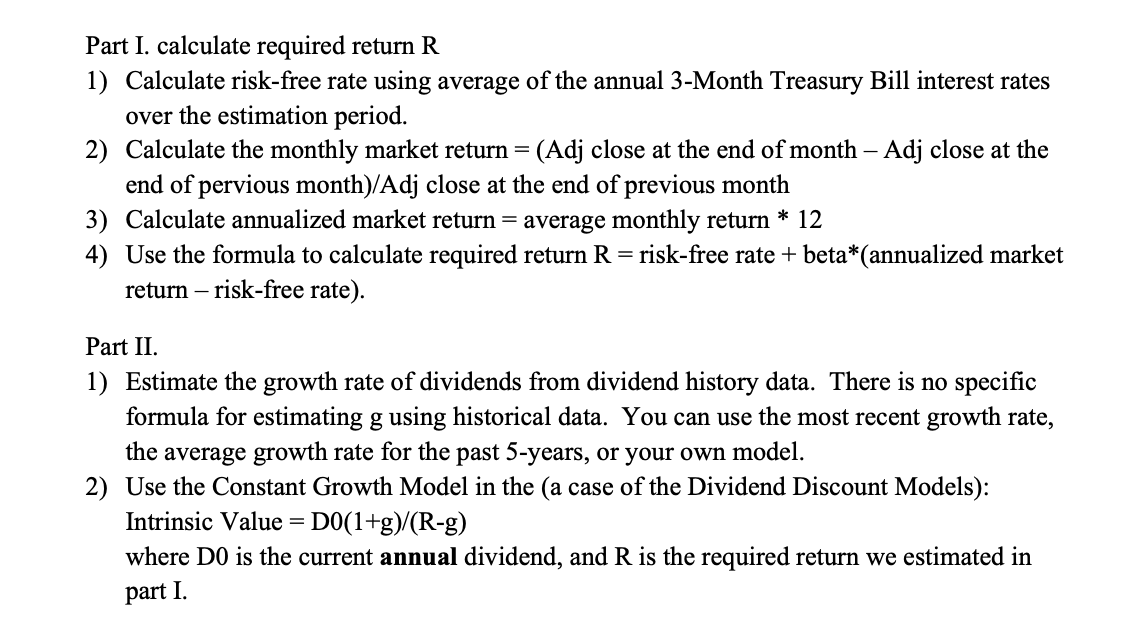

the companys dividend history from finance.yahoo.com or the companys own website. 2) the companys market risk exposure measured by Beta (5Y Monthly) from the companys summary page on finance.yahoo.com 3) choose an estimation period for the required return R, at least going back a 5-year period. 4) risk-free rates (annual rates) for the estimation period 5) monthly market index (use S&P 500) Adj Close prices for the estimation period

the companys dividend history from finance.yahoo.com or the companys own website. 2) the companys market risk exposure measured by Beta (5Y Monthly) from the companys summary page on finance.yahoo.com 3) choose an estimation period for the required return R, at least going back a 5-year period. 4) risk-free rates (annual rates) for the estimation period 5) monthly market index (use S&P 500) Adj Close prices for the estimation period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started