Answered step by step

Verified Expert Solution

Question

1 Approved Answer

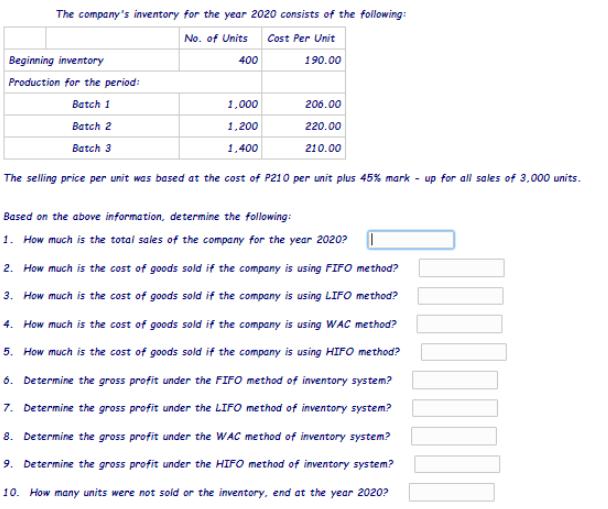

The company's inventory for the year 2020 consists of the following: No. of Units Cost Per Unit 400 190.00 Beginning inventory Production for the

The company's inventory for the year 2020 consists of the following: No. of Units Cost Per Unit 400 190.00 Beginning inventory Production for the period: Batch 1 Batch 2 Batch 3 1,000 206.00 1,200 220.00 1,400 210.00 The selling price per unit was based at the cost of P210 per unit plus 45% mark up for all sales of 3,000 units. Based on the above information, determine the following: 1. How much is the total sales of the company for the year 2020? 2. How much is the cost of goods sold if the company is using FIFO method? 3. How much is the cost of goods sold if the company is using LIFO method? 4. How much is the cost of goods sold if the company is using WAC method? 5. How much is the cost of goods sold if the company is using HIFO method? 6. Determine the gross profit under the FIFO method of inventory system? 7. Determine the gross profit under the LIFO method of inventory system? 8. Determine the gross profit under the WAC method of inventory system? 9. Determine the gross profit under the HIFO method of inventory system? 10. How many units were not sold or the inventory, end at the year 2020?

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Total Sales for the Year 2020 The total sales can be calculated by summing up the units sold multiplied by the selling price per unit Total units sold 3000 Given in the problem Selling price per uni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started