Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The comparative balance sheets and income statements for Gypsy Company follow. Additional Data During Year 2, the company sold equipment for $18,849; it had originally

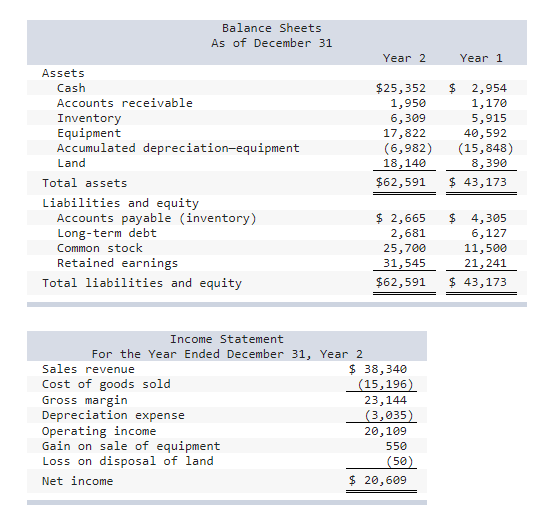

The comparative balance sheets and income statements for Gypsy Company follow.

Additional Data

- During Year 2, the company sold equipment for $18,849; it had originally cost $30,200. Accumulated depreciation on this equipment was $11,901 at the time of the sale. Also, the company purchased equipment for $7,430 cash.

- The company sold land that had cost $4,450. This land was sold for $4,400, resulting in the recognition of a $50 loss. Also, common stock was issued in exchange for title to land that was valued at $14,200 at the time of exchange.

- Paid dividends of $10,305.

Required Prepare a statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)

Balance Sheets As of December 31 Year 2 Year 1 Assets Cash Accounts receivable Inventory Equipment Accumulated depreciation-equipment Land Total assets Liabilities and equity Accounts payable (inventory) Long-term debt Common stock Retained earnings Total liabilities and equity $25,352 1,950 6,309 17,822 (6,982) 18,140 $62,591 $ 2,954 1,170 5,915 40,592 (15,848) 8,390 $ 43,173 $ 2,665 2,681 25,700 31,545 $62,591 $ 4,305 6,127 11,500 21,241 $ 43,173 Income Statement For the Year Ended December 31, Year 2 Sales revenue $ 38, 340 Cost of goods sold (15,196) Gross margin 23, 144 Depreciation expense (3,035) Operating income 20,109 Gain on sale of equipment 550 Loss on disposal of land (50) Net income $ 20,609 Required Prepare a statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) GYPSY COMPANY Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Less: Increases in current assets and Decreases in current liabilities: Plus: Noncash charges Cash flows from investing activities: Cash flows from financing activities: Ending cash balance Schedule of noncash investing and financing activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started