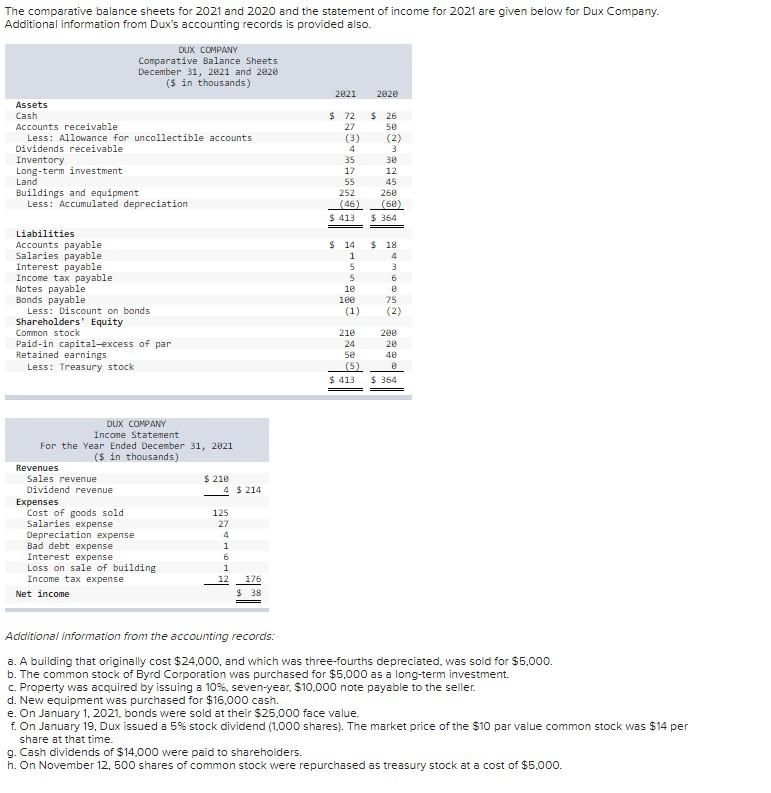

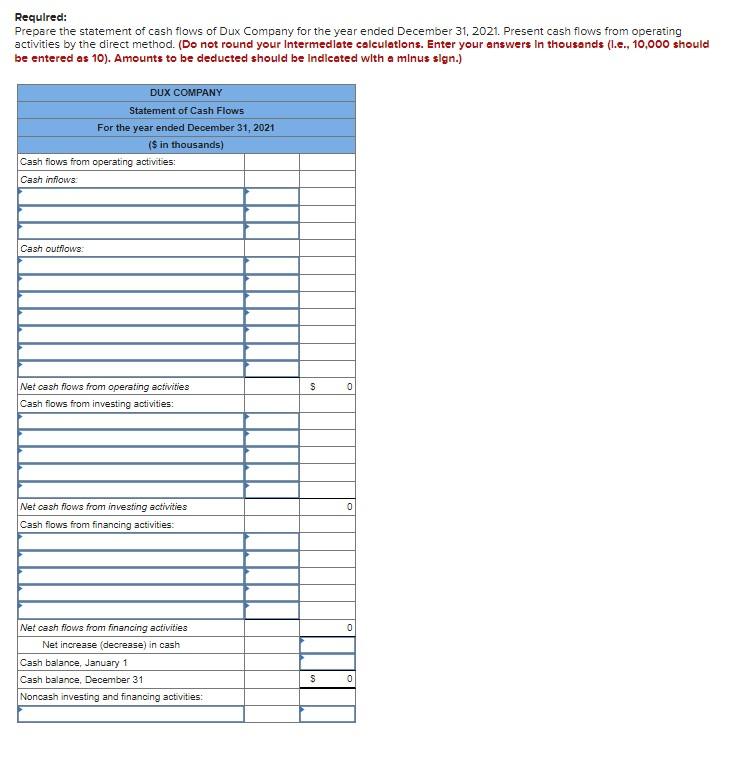

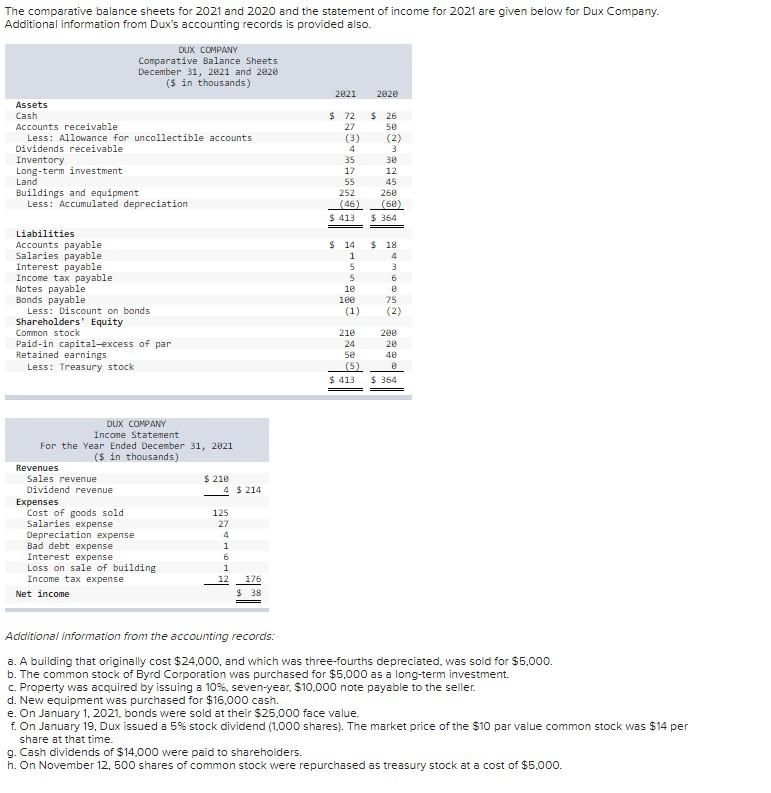

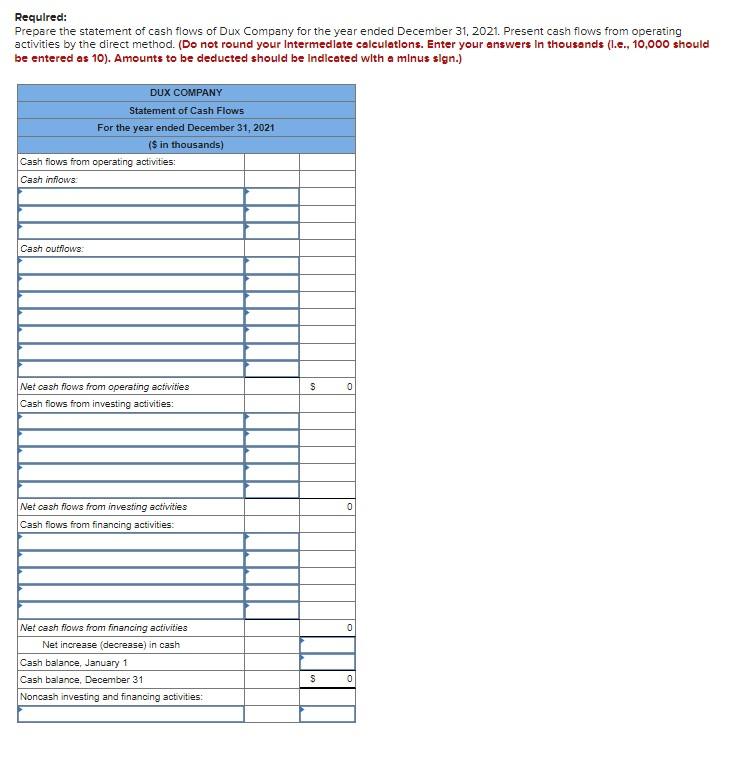

The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux's accounting records is provided also. DUX COMPANY Comparative Balance Sheets December 31, 2021 and 2020 ($ in thousands) 2021 202e Assets Cash $ 72 $ 26 Accounts receivable 27 50 Less: Allowance for uncollectible accounts (3) (2) Dividends receivable 4 3 Inventory 35 30 Long-term investment 17 12 Land 55 45 Buildings and equipment 252 260 Less: Accumulated depreciation (46) (60) $ 413 $ 354 Liabilities Accounts payable $ 14 $ 18 Salaries payable 1 4 Interest payable 5 3 Income tax payable 5 6 Notes payable le e Bonds payable 18e 25 Less: Discount on bonds (1) (2) Shareholders' Equity Common stock 210 200 Paid-in capital-excess of par 24 20 Retained earnings 50 40 Less: Treasury stock (5) $ 413 $ 354 2:1 *****pf gaalal al DUX COMPANY Income Statement For the Year Ended December 31, 2021 ($ in thousands) Revenues Sales revenue $ 210 Dividend revenue 4 $ 214 Expenses Cost of goods sold 125 Salaries expense 27 Depreciation expense 4 Bad debt expense 1 Interest expense 6 Loss on sale of building 1 Income tax expense 12 176 Net income $38 Additional information from the accounting records: a. A building that originally cost $24,000, and which was three-fourths depreciated. was sold for $5.000. b. The common stock of Byrd Corporation was purchased for $5,000 as a long-term investment. c. Property was acquired by issuing a 10%, seven-year. $10.000 note payable to the seller. d. New equipment was purchased for $16,000 cash. e. On January 1, 2021. bonds were sold at their $25.000 face value. f. On January 19, Dux issued a 5% stock dividend (1.000 shares). The market price of the $10 par value common stock was $14 per share at that time. g. Cash dividends of $14.000 were paid to shareholders. h. On November 12, 500 shares of common stock were repurchased as treasury stock at a cost of $5.000. Required: Prepare the statement of cash flows of Dux Company for the year ended December 31, 2021. Present cash flows from operating activities by the direct method. (Do not round your Intermediate calculations. Enter your answers in thousands (1.e., 10,000 should be entered as 10). Amounts to be deducted should be Indicated with a minus sign.) DUX COMPANY Statement of Cash Flows For the year ended December 31, 2021 ($ in thousands) Cash flows from operating activities Cash inflows. Cash outflows: $ 0 Net cash flows from operating activities Cash flows from investing activities: 0 Net cash flows from investing activities Cash flows from financing activities: 0 Net cash flows from financing activities Net increase (decrease) in cash Cash balance, January 1 Cash balance, December 31 Noncash investing and financing activities: s