Answered step by step

Verified Expert Solution

Question

1 Approved Answer

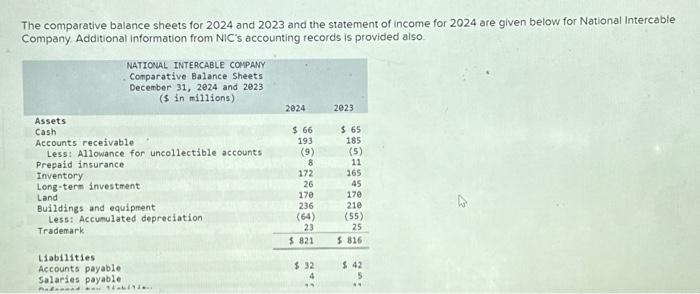

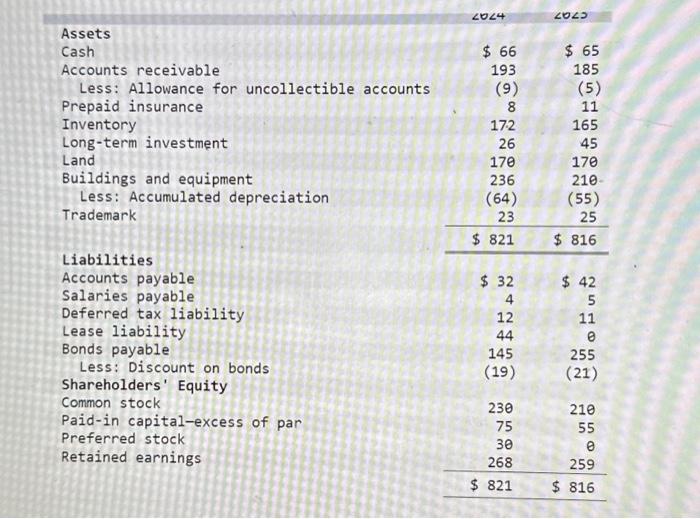

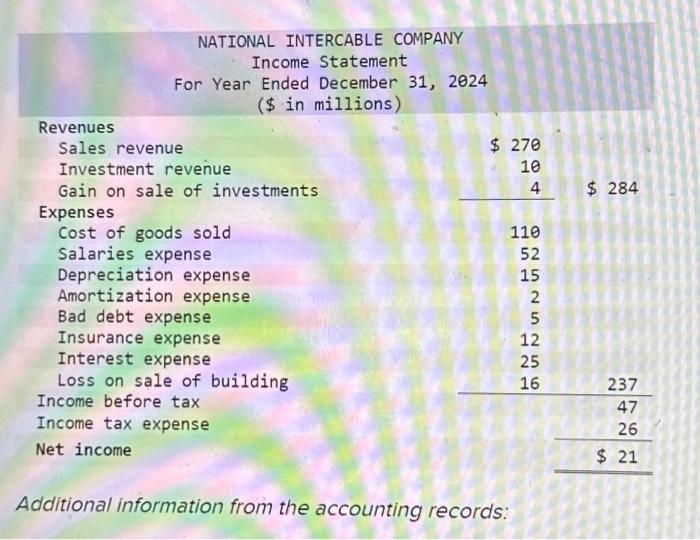

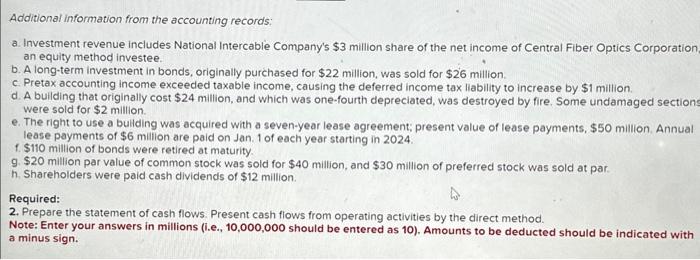

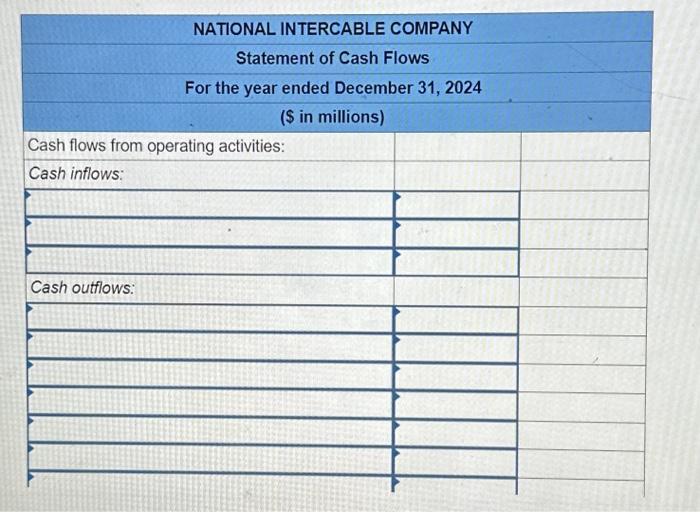

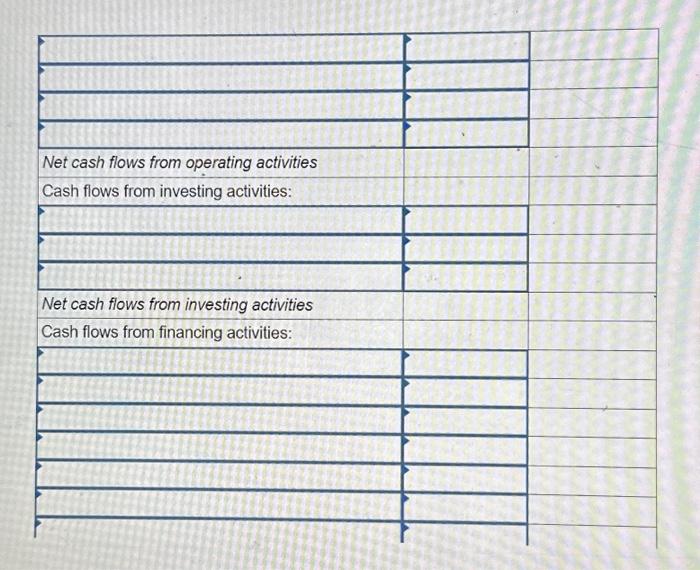

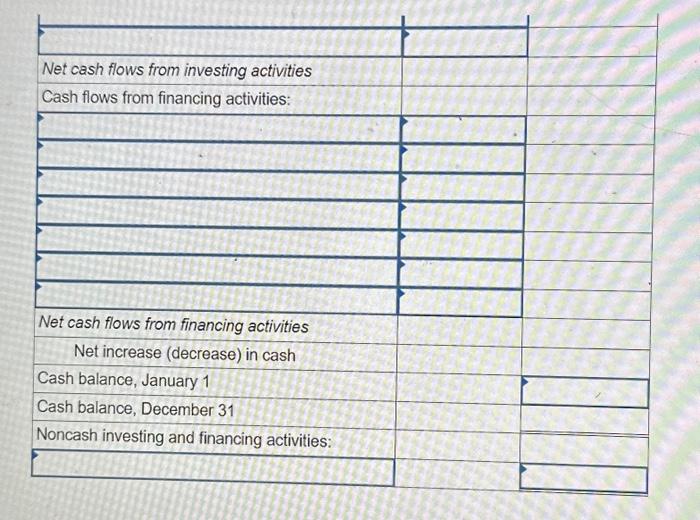

The comparative balance sheets for 2024 and 2023 and the statement of income for 2024 are given below for National intercable Company. Additional information from

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started