Answered step by step

Verified Expert Solution

Question

1 Approved Answer

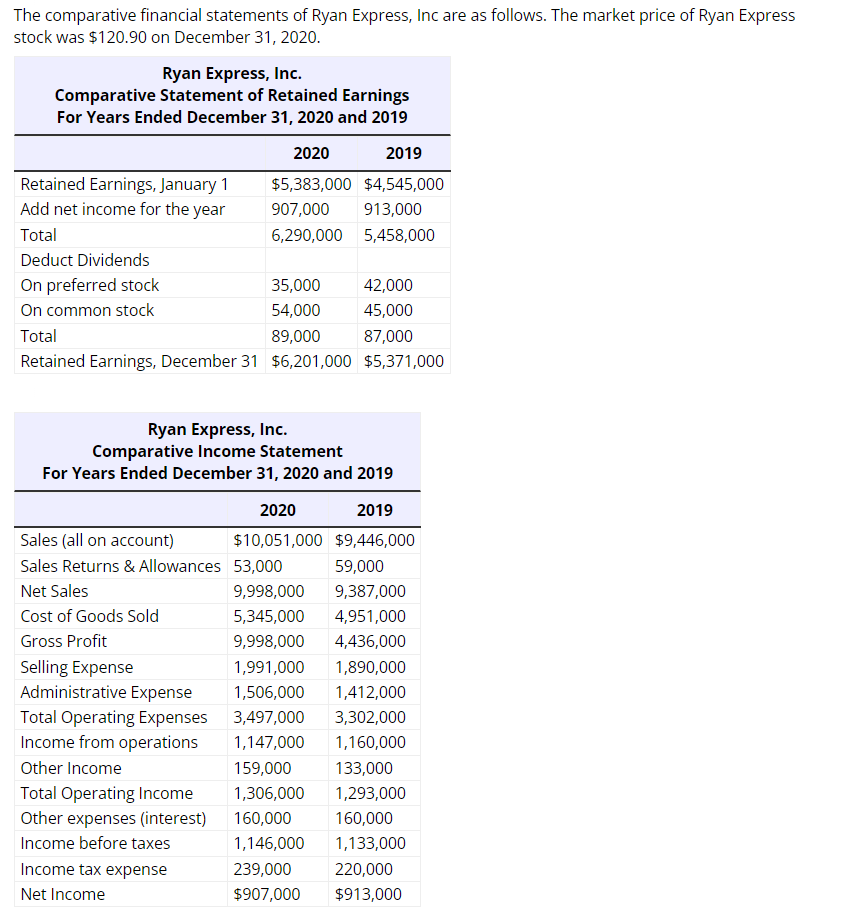

The comparative financial statements of Ryan Express, Inc are as follows. The market price of Ryan Express stock was $120.90 on December 31, 2020. begin{tabular}{|lr}

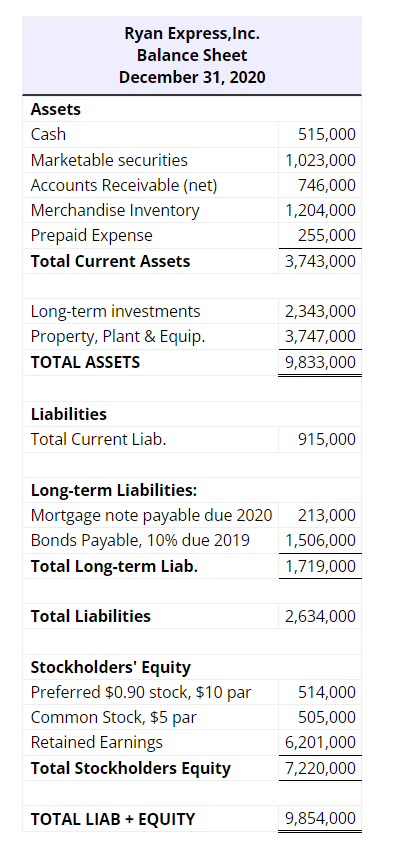

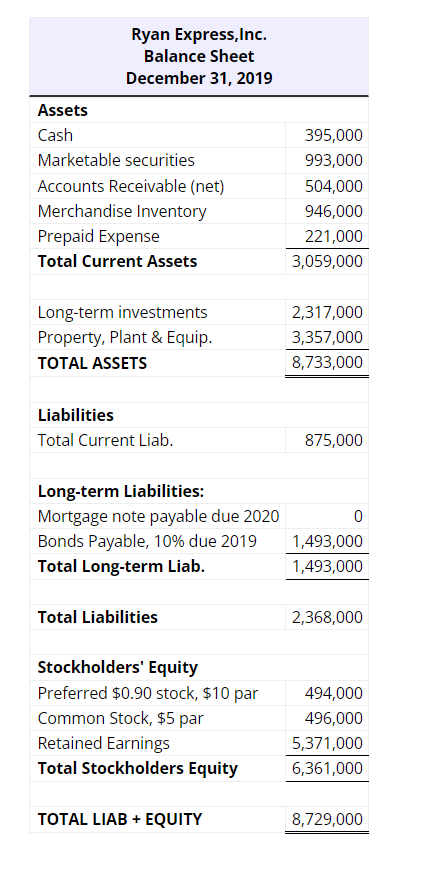

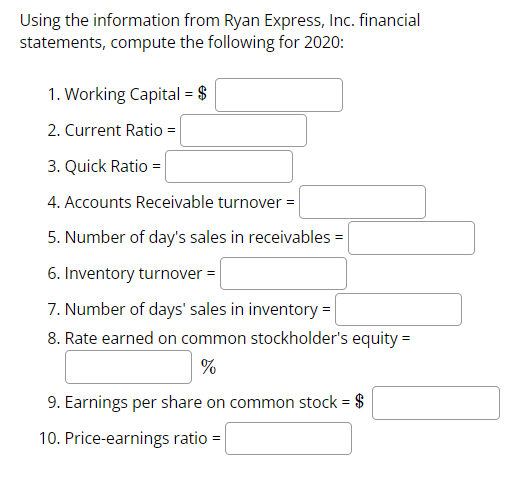

The comparative financial statements of Ryan Express, Inc are as follows. The market price of Ryan Express stock was $120.90 on December 31, 2020. \begin{tabular}{|lr} \hline \multicolumn{2}{|c}{\begin{tabular}{c} Ryan Express, Inc. \\ Balance Sheet \\ December 31, 2020 \end{tabular}} \\ \hline Assets & 515,000 \\ \hline Cash & 1,023,000 \\ \hline Marketable securities & 746,000 \\ \hline Accounts Receivable (net) & 1,204,000 \\ \hline Merchandise Inventory & 255,000 \\ \hline Prepaid Expense & 3,743,000 \\ \hline Total Current Assets & \\ \hline & 2,343,000 \\ \hline Long-term investments & 3,747,000 \\ \hline Property, Plant \& Equip. & 9,833,000 \\ \hline ToTAL ASSETS & 9,854,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{\begin{tabular}{l} Ryan Express, Inc. \\ Balance Sheet \\ December 31, 2019 \end{tabular}} \\ \hline \multicolumn{2}{|l|}{ Assets } \\ \hline Cash & 395,000 \\ \hline Marketable securities & 993,000 \\ \hline Accounts Receivable (net) & 504,000 \\ \hline Merchandise Inventory & 946,000 \\ \hline Prepaid Expense & 221,000 \\ \hline Total Current Assets & 3,059,000 \\ \hline Long-term investments & 2,317,000 \\ \hline Property, Plant \& Equip. & 3,357,000 \\ \hline TOTAL ASSETS & 8,733,000 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline Total Current Liab. & 875,000 \\ \hline \multicolumn{2}{|l|}{ Long-term Liabilities: } \\ \hline Mortgage note payable due 2020 & 0 \\ \hline Bonds Payable, 10\% due 2019 & 1,493,000 \\ \hline Total Long-term Liab. & 1,493,000 \\ \hline Total Liabilities & 2,368,000 \\ \hline \multicolumn{2}{|l|}{ Stockholders' Equity } \\ \hline Preferred $0.90 stock, $10 par & 494,000 \\ \hline Common Stock, \$5 par & 496,000 \\ \hline Retained Earnings & 5,371,000 \\ \hline Total Stockholders Equity & 6,361,000 \\ \hline TOTAL LIAB + EQUITY & 8,729,000 \\ \hline \end{tabular} Using the information from Ryan Express, Inc. financial statements, compute the following for 2020 : 1. Working Capital =$ 2. Current Ratio = 3. Quick Ratio = 4. Accounts Receivable turnover = 5. Number of day's sales in receivables = 6. Inventory turnover = 7. Number of days' sales in inventory = 8. Rate earned on common stockholder's equity = % 9. Earnings per share on common stock =$ 10. Price-earnings ratio =

The comparative financial statements of Ryan Express, Inc are as follows. The market price of Ryan Express stock was $120.90 on December 31, 2020. \begin{tabular}{|lr} \hline \multicolumn{2}{|c}{\begin{tabular}{c} Ryan Express, Inc. \\ Balance Sheet \\ December 31, 2020 \end{tabular}} \\ \hline Assets & 515,000 \\ \hline Cash & 1,023,000 \\ \hline Marketable securities & 746,000 \\ \hline Accounts Receivable (net) & 1,204,000 \\ \hline Merchandise Inventory & 255,000 \\ \hline Prepaid Expense & 3,743,000 \\ \hline Total Current Assets & \\ \hline & 2,343,000 \\ \hline Long-term investments & 3,747,000 \\ \hline Property, Plant \& Equip. & 9,833,000 \\ \hline ToTAL ASSETS & 9,854,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{\begin{tabular}{l} Ryan Express, Inc. \\ Balance Sheet \\ December 31, 2019 \end{tabular}} \\ \hline \multicolumn{2}{|l|}{ Assets } \\ \hline Cash & 395,000 \\ \hline Marketable securities & 993,000 \\ \hline Accounts Receivable (net) & 504,000 \\ \hline Merchandise Inventory & 946,000 \\ \hline Prepaid Expense & 221,000 \\ \hline Total Current Assets & 3,059,000 \\ \hline Long-term investments & 2,317,000 \\ \hline Property, Plant \& Equip. & 3,357,000 \\ \hline TOTAL ASSETS & 8,733,000 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline Total Current Liab. & 875,000 \\ \hline \multicolumn{2}{|l|}{ Long-term Liabilities: } \\ \hline Mortgage note payable due 2020 & 0 \\ \hline Bonds Payable, 10\% due 2019 & 1,493,000 \\ \hline Total Long-term Liab. & 1,493,000 \\ \hline Total Liabilities & 2,368,000 \\ \hline \multicolumn{2}{|l|}{ Stockholders' Equity } \\ \hline Preferred $0.90 stock, $10 par & 494,000 \\ \hline Common Stock, \$5 par & 496,000 \\ \hline Retained Earnings & 5,371,000 \\ \hline Total Stockholders Equity & 6,361,000 \\ \hline TOTAL LIAB + EQUITY & 8,729,000 \\ \hline \end{tabular} Using the information from Ryan Express, Inc. financial statements, compute the following for 2020 : 1. Working Capital =$ 2. Current Ratio = 3. Quick Ratio = 4. Accounts Receivable turnover = 5. Number of day's sales in receivables = 6. Inventory turnover = 7. Number of days' sales in inventory = 8. Rate earned on common stockholder's equity = % 9. Earnings per share on common stock =$ 10. Price-earnings ratio = Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started