Answered step by step

Verified Expert Solution

Question

1 Approved Answer

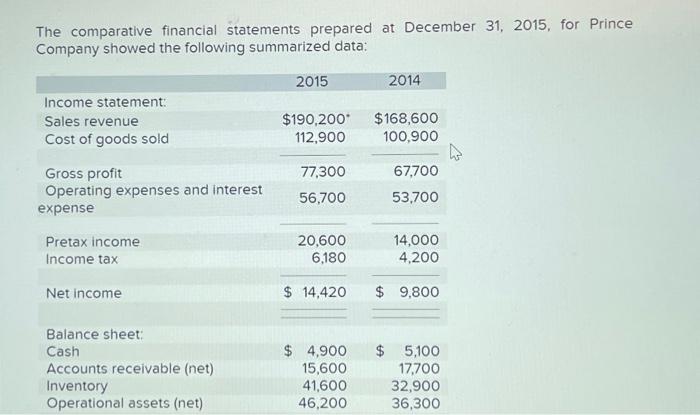

The comparative financial statements prepared at December 31, 2015, for Prince Company showed the following summarized data: 2015 2014 Income statement: Sales revenue $190,200*

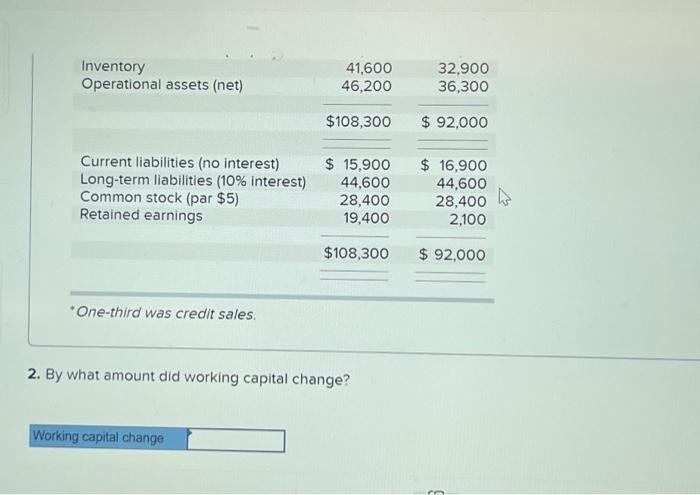

The comparative financial statements prepared at December 31, 2015, for Prince Company showed the following summarized data: 2015 2014 Income statement: Sales revenue $190,200* $168,600 Cost of goods sold 112,900 100,900 Gross profit 77,300 67,700 Operating expenses and interest 56,700 53,700 expense Pretax income 20,600 Income tax 6,180 14,000 4,200 Net income $ 14,420 $ 9,800 Balance sheet: Cash $ 4,900 $ 5,100 Accounts receivable (net) Inventory 15,600 17,700 41,600 32,900 Operational assets (net) 46,200 36,300 Inventory 41,600 32,900 Operational assets (net) 46,200 36,300 $108,300 $ 92,000 Current liabilities (no interest) $ 15,900 $ 16,900 Long-term liabilities (10% interest) 44,600 Common stock (par $5) 28,400 Retained earnings 19,400 44,600 28,400 2,100 *One-third was credit sales. $108,300 $ 92,000 2. By what amount did working capital change? Working capital change

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Total current assets can be computed as Cash Accounts receivable Inventory For 2015 Total curr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started