Answered step by step

Verified Expert Solution

Question

1 Approved Answer

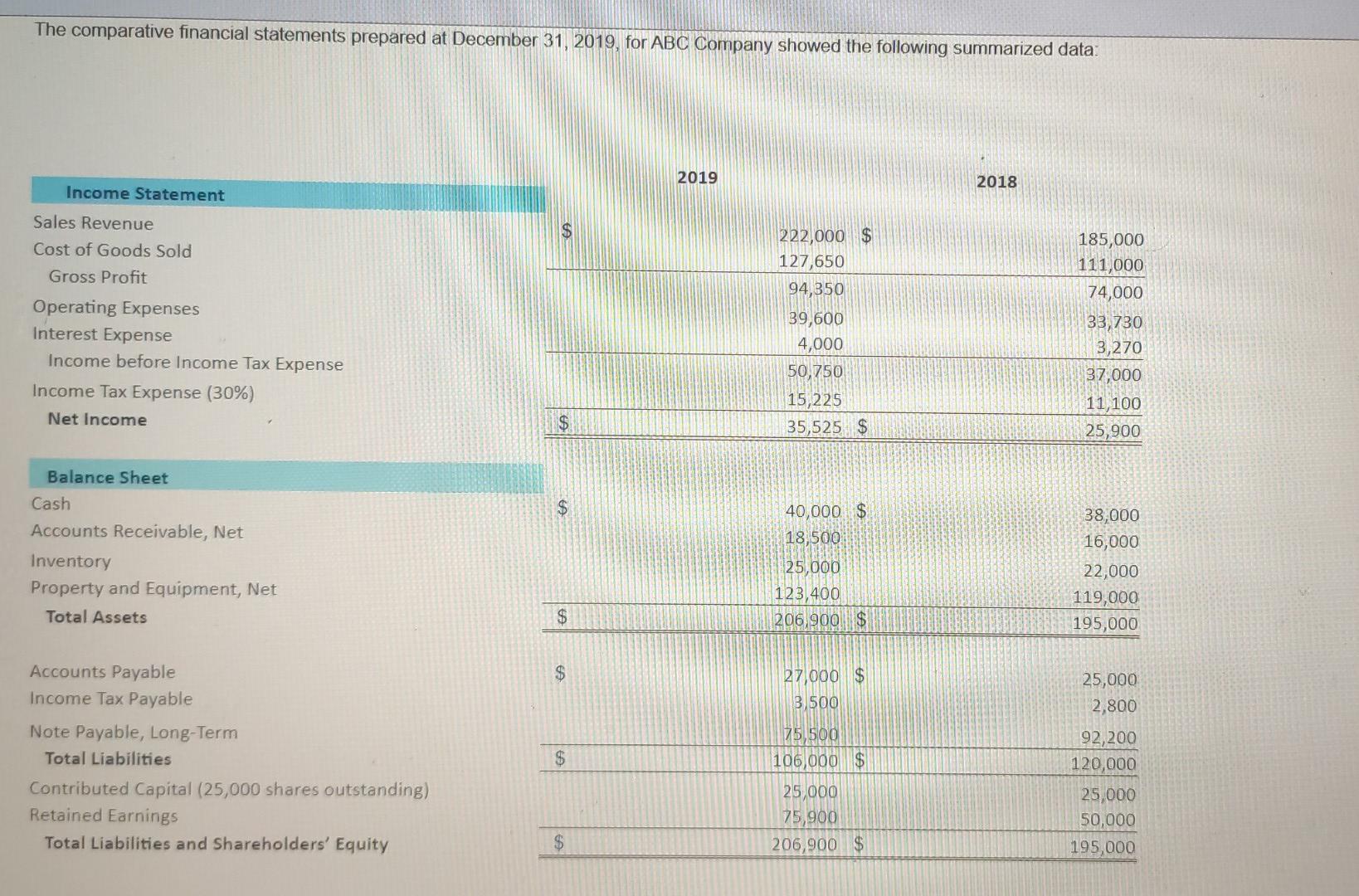

The comparative financial statements prepared at December 31, 2019, for ABC Company showed the following summarized data: 2019 2018 Income Statement $ Sales Revenue Cost

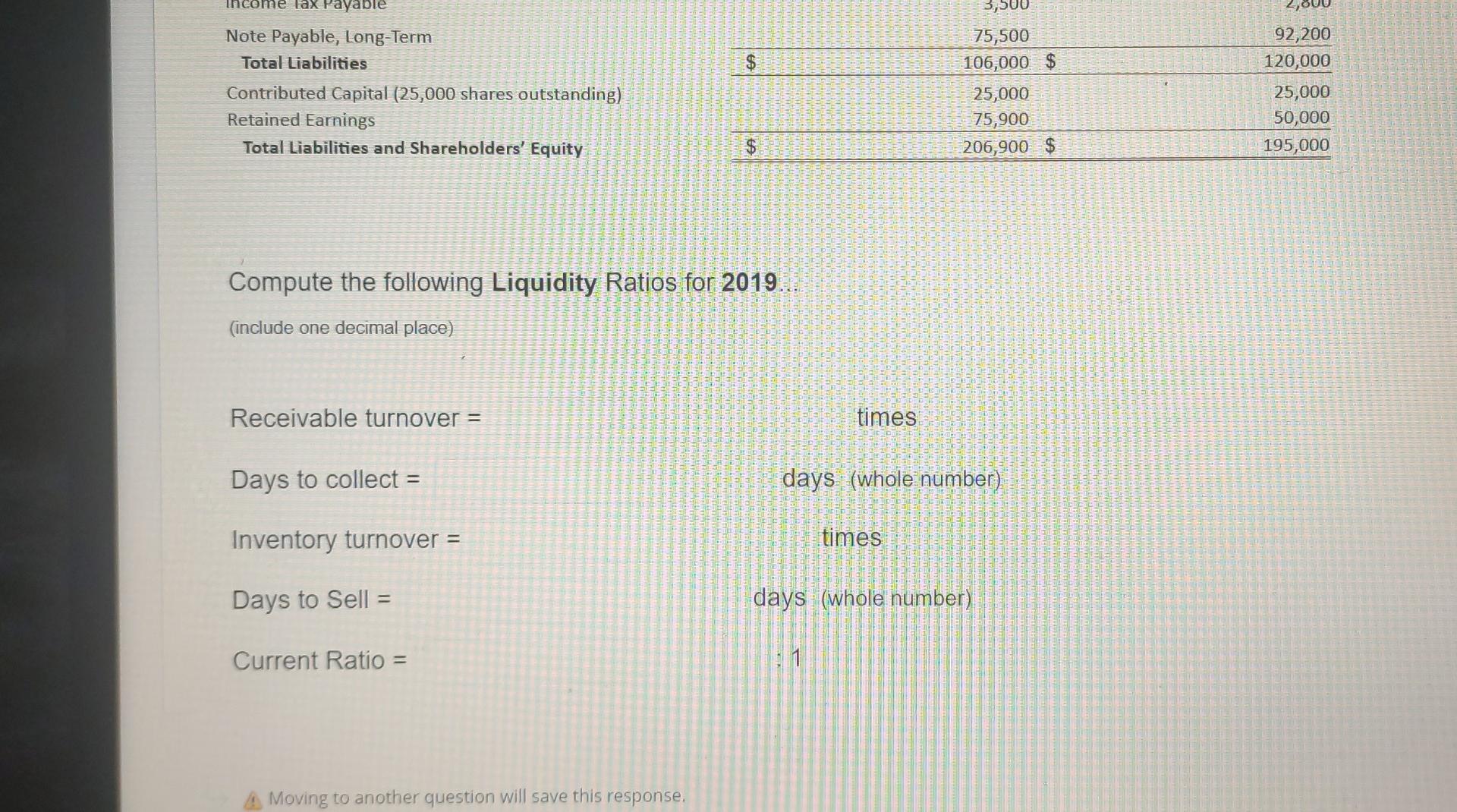

The comparative financial statements prepared at December 31, 2019, for ABC Company showed the following summarized data: 2019 2018 Income Statement $ Sales Revenue Cost of Goods Sold Gross Profit 222,000 $ 127,650 94,350 185,000 111,000 74,000 Operating Expenses Interest Expense Income before Income Tax Expense Income Tax Expense (30%) Net Income 39,600 4,000 50,750 15,225 35,525 $ 33,730 3,270 37,000 11,100 25,900 $ Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net Total Assets 40,000 $ 18,500 25,000 123,400 206,900 $ 38,000 16,000 22,000 119,000 195,000 $ $ 27,000 $ 3,500 Accounts Payable Income Tax Payable Note Payable, Long-Term Total Liabilities Contributed Capital (25,000 shares outstanding) Retained Earnings Total Liabilities and Shareholders' Equity 25,000 2,800 92,200 120,000 75,500 106,000 $ $ 25 000 75,900 206,900 $ 25,000 50,000 195,000 $ lax 2,OU $ ayable Note Payable, Long-Term Total Liabilities Contributed Capital (25,000 shares outstanding) Retained Earnings Total Liabilities and Shareholders' Equity 3,500 75,500 106,000 $ 25,000 75,900 206,900 $ 92,200 120,000 25,000 50,000 195,000 $ Compute the following Liquidity Ratios for 2019. (include one decimal place) Receivable turnover = times Days to collect = days (whole number) Inventory turnover = times Days to Sell = days (whole number) Current Ratio = A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started