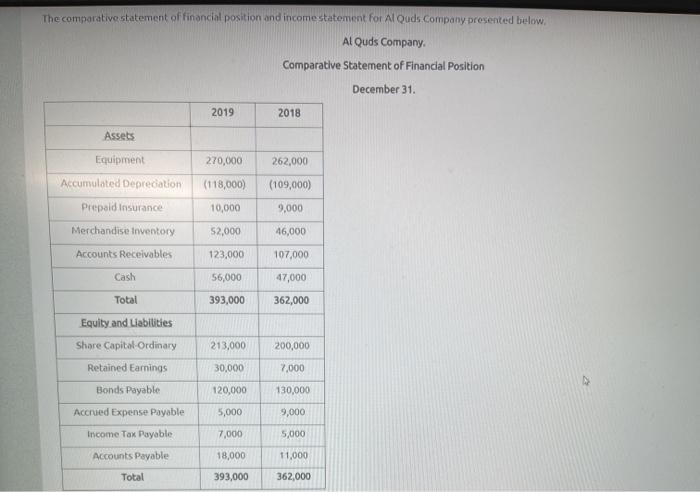

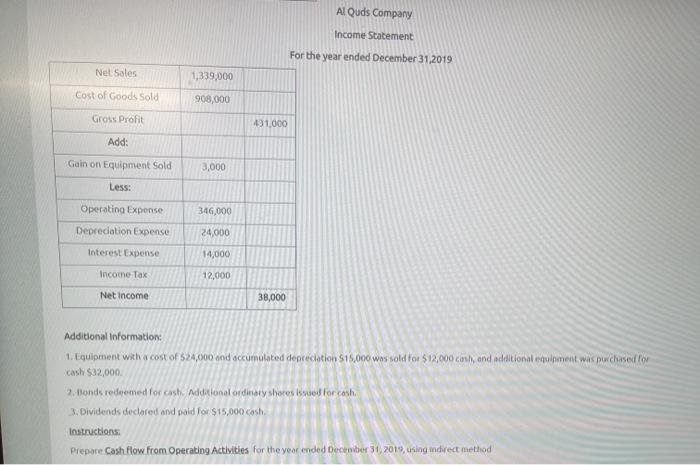

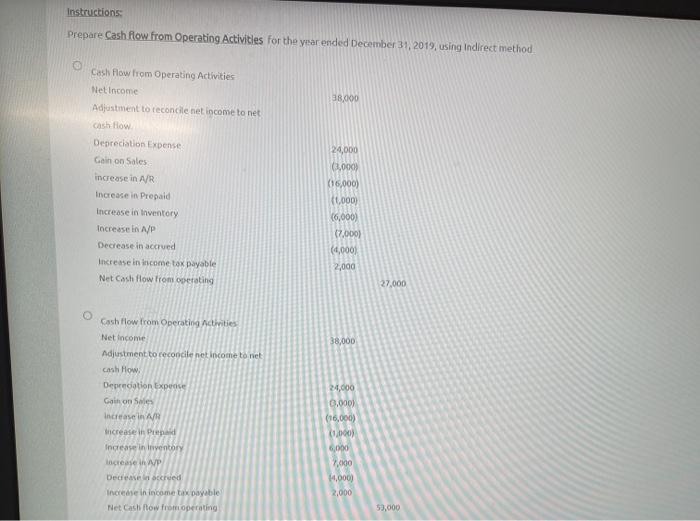

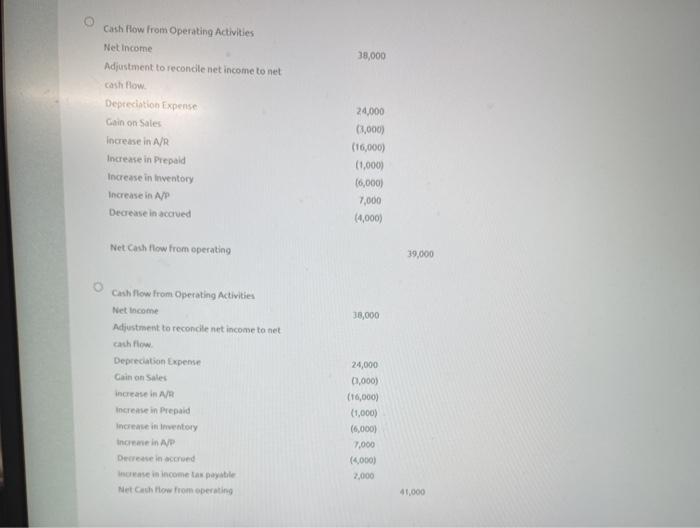

The comparative statement of financial position and income statement for Al Quds company presented below. Al Quds Company Comparative Statement of Financial Position December 31 2019 2018 Assets 262,000 Equipment Accumulated Depreciation Prepold Insurance 270,000 (118,000) 10,000 (109,000) 9,000 Merchandise Inventory $2,000 46,000 Accounts Receivables 123,000 107,000 47,000 Cash 56,000 Total 393,000 362,000 Equity and Liabilities 213,000 200,000 30,000 7,000 120,000 130,000 Share Capital Ordinary Retained Earnings Bonds Payable Accrued Expense Payable Income Tax Payable Accounts Payable 9,000 5,000 7,000 5,000 18,000 11,000 Total 393,000 362,000 Al Quds Company Income Statement For the year ended December 31,2019 Net Sales 1,339,000 Cost of Goods Sold 908,000 Gross Profit 431,000 Add: Gain on Equipment Sold 3,000 Less: Operating Expense 346,000 Depreciation Expense 24,000 Interest Expense 14,000 Income Tax 12,000 Net Income 38,000 Additional Information: 1. Equipment with a cost of 524,000 and accumulated depreciation 515,000 was sold for $12,000 cash, and eceltional equipment was purchased for Cash $32,000 2. Bondsredeemed for cash additional ordinary shores kuued for cash 3. Dividends declared and paid for $15,000 cash, lostructions: Prepare Cash flow from Operating Activities for the year ended December 31, 2019, using indirect method Instructions Prepare Cash flow from Operating Activities for the year ended December 31, 2019, using Indirect method 38.000 Cash flow from Operating Activities Net Income Adjustment to reconcile net income to net Cash How Depreciation Expense Gain on Sales increase in AR Increase in Prepaid Increase in Inventory Increase in N/P Decrease in accrued Increase in income tax payable Net Cash flow from operating 24,000 (3.000) (15,000 10,000) 16,000) (7,000) (5,000 2,000 27,000 38.000 Cash flow from Operating Activities Net Income Adjustment to reconcile net income to net cash flow, Depreciation Expenses Gathon Sale increase in A Increase in Pad Increase in Inventory Increase in WP Decreered Increase in income tax payable Net Cats Row from operating 24,000 2,000 (16,000) (1,000) 6,000 7,000 14,000 2,000 53,000 38,000 Cash flow from Operating Activities Net Income Adjustment to recondle net income to net cash flow Depreciation Expense Gain on Sales Increase in A/B Increase in Prepaid Increase in triventory Increase in A/P Decrease in scarved 24,000 (1,000) (16,000) (1.000) 16,000) 7.000 (4,000) Net Cash How from operating 39,000 38,000 Cash flow from Operating Activities Net Income Adjustment to reconcile net income to net cathlow Depreciation Expense Gain on Sales increase in A/ Increase in Prepaid Increase inventory Inice in AP Decrease in accrued Increase in income tax payable Net Chow from operating 24,000 0,000) (16,000) (1,000) (6,000) 7,000 (5,000) 2,000 41.000