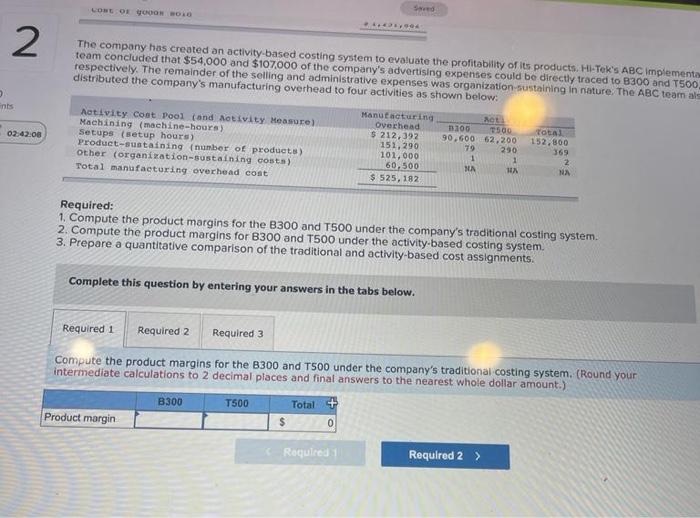

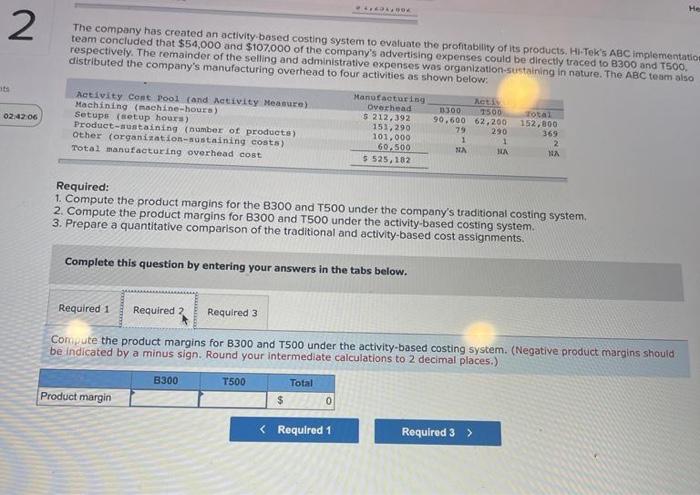

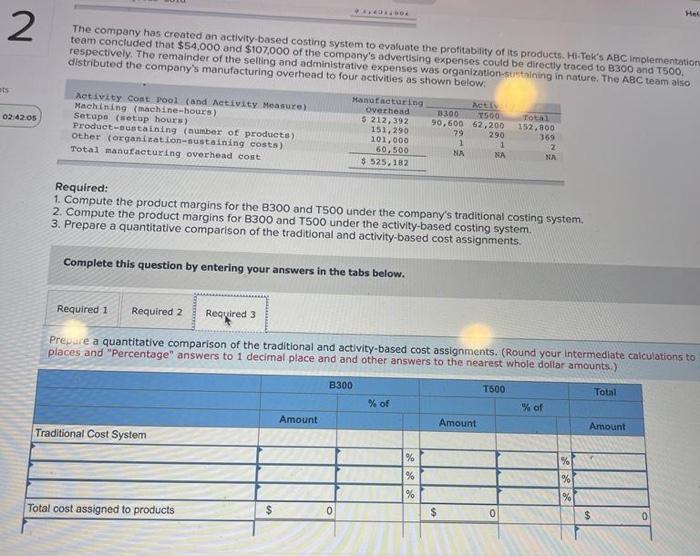

The compary has created an activity-based costing system to evaluate the profitability of its productis Hi-Tek's ABC implement team concluded that $54,000 and $107,000 of the compari's advertising expenses could be directly traced to B300 and T500 distributed the company's manufacturing averhead to drative expenses was organization sustaining in nature, The ABC tearn al Required: 1. Compute the product margins for the B300 and TSO0 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Compute the product margins for the 8300 and T500 under the company's traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) The compary has created an activity-based costing system to evaluate the profitability of its proctucts, Hi-Tek's ABC implementatio team concluded that $54,000 and $107,000 of the compary's advertising expenses could be directly traced to B300 and T500. respectively. The remainder of the selling and administrative expenses was organization-sirtaining in nature. The ABiC tesim also cistributed the company's manufacturing overhead to four activities as shown below: Required: 1. Compute the product margins for the 8300 and TS00 under the company's traditional costing system, 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Compute the product margins for B300 and TS00 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) The company has created an activity-based costing system to evaluate the protitability of its products. Hi-Tek's AbC implementation respectively. The remainder of the selling and administrative expenses was organization-stusthining in nature, The ABC team also Required: 1. Compute the product margins for the B300 and TS00 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Prepure a quantitative comparison of the traditional and activity-based cost assignments. (Round your intermediate calculations to Places and "Percentage" answers to 1 decimal place and and other answers to the nearest whole dolfar amounts.). The compary has created an activity-based costing system to evaluate the profitability of its productis Hi-Tek's ABC implement team concluded that $54,000 and $107,000 of the compari's advertising expenses could be directly traced to B300 and T500 distributed the company's manufacturing averhead to drative expenses was organization sustaining in nature, The ABC tearn al Required: 1. Compute the product margins for the B300 and TSO0 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Compute the product margins for the 8300 and T500 under the company's traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) The compary has created an activity-based costing system to evaluate the profitability of its proctucts, Hi-Tek's ABC implementatio team concluded that $54,000 and $107,000 of the compary's advertising expenses could be directly traced to B300 and T500. respectively. The remainder of the selling and administrative expenses was organization-sirtaining in nature. The ABiC tesim also cistributed the company's manufacturing overhead to four activities as shown below: Required: 1. Compute the product margins for the 8300 and TS00 under the company's traditional costing system, 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Compute the product margins for B300 and TS00 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) The company has created an activity-based costing system to evaluate the protitability of its products. Hi-Tek's AbC implementation respectively. The remainder of the selling and administrative expenses was organization-stusthining in nature, The ABC team also Required: 1. Compute the product margins for the B300 and TS00 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Prepure a quantitative comparison of the traditional and activity-based cost assignments. (Round your intermediate calculations to Places and "Percentage" answers to 1 decimal place and and other answers to the nearest whole dolfar amounts.)