Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The conclusion is the question. Request you to please be as elaborate as possible, this is a Strategic Management university paper. Give a complete SWOT

The conclusion is the question. Request you to please be as elaborate as possible, this is a Strategic Management university paper.

Give a complete SWOT and PESTEL analysis of the Case study (SWOT and PESTEL). What are your recommendations?

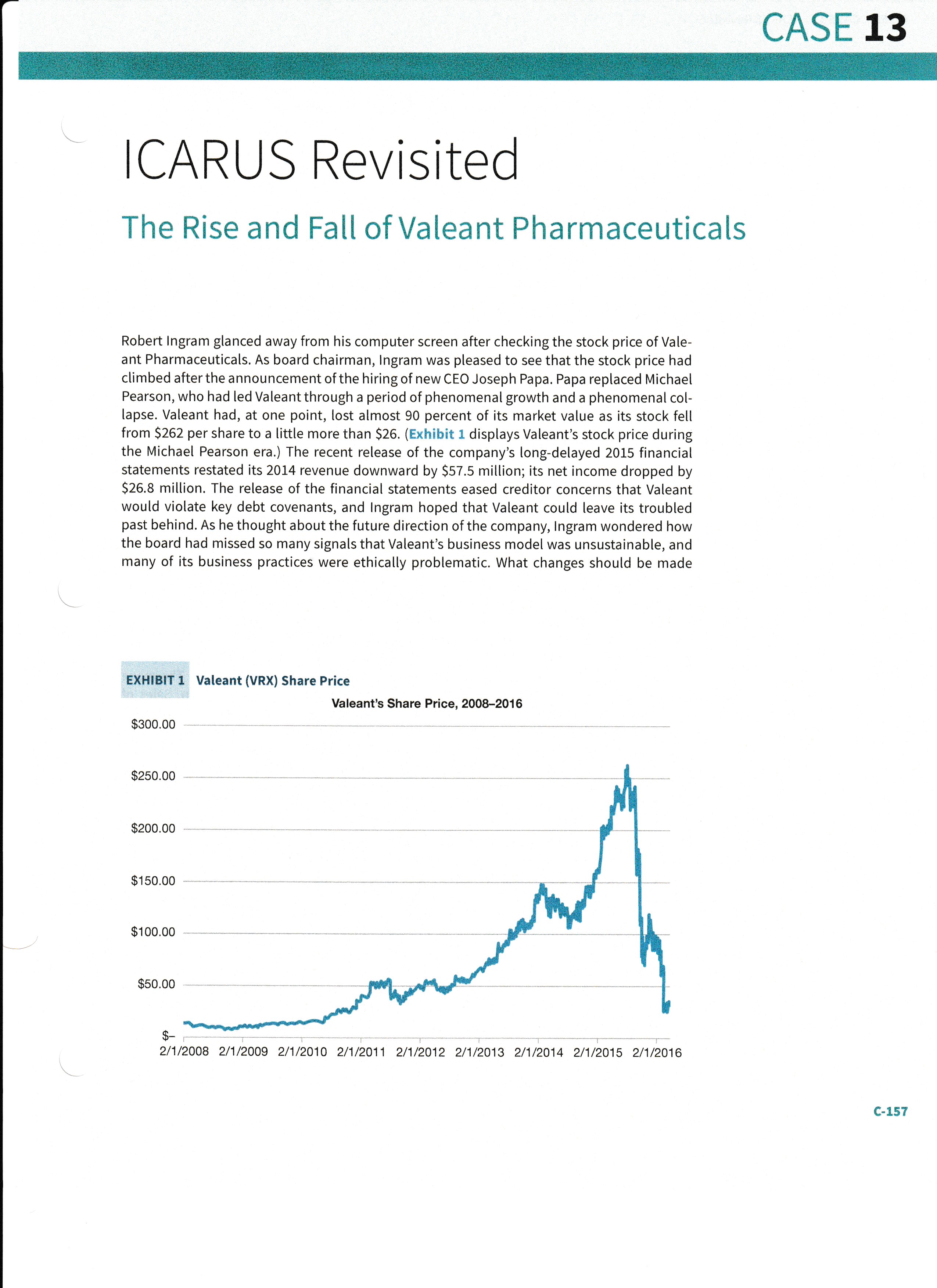

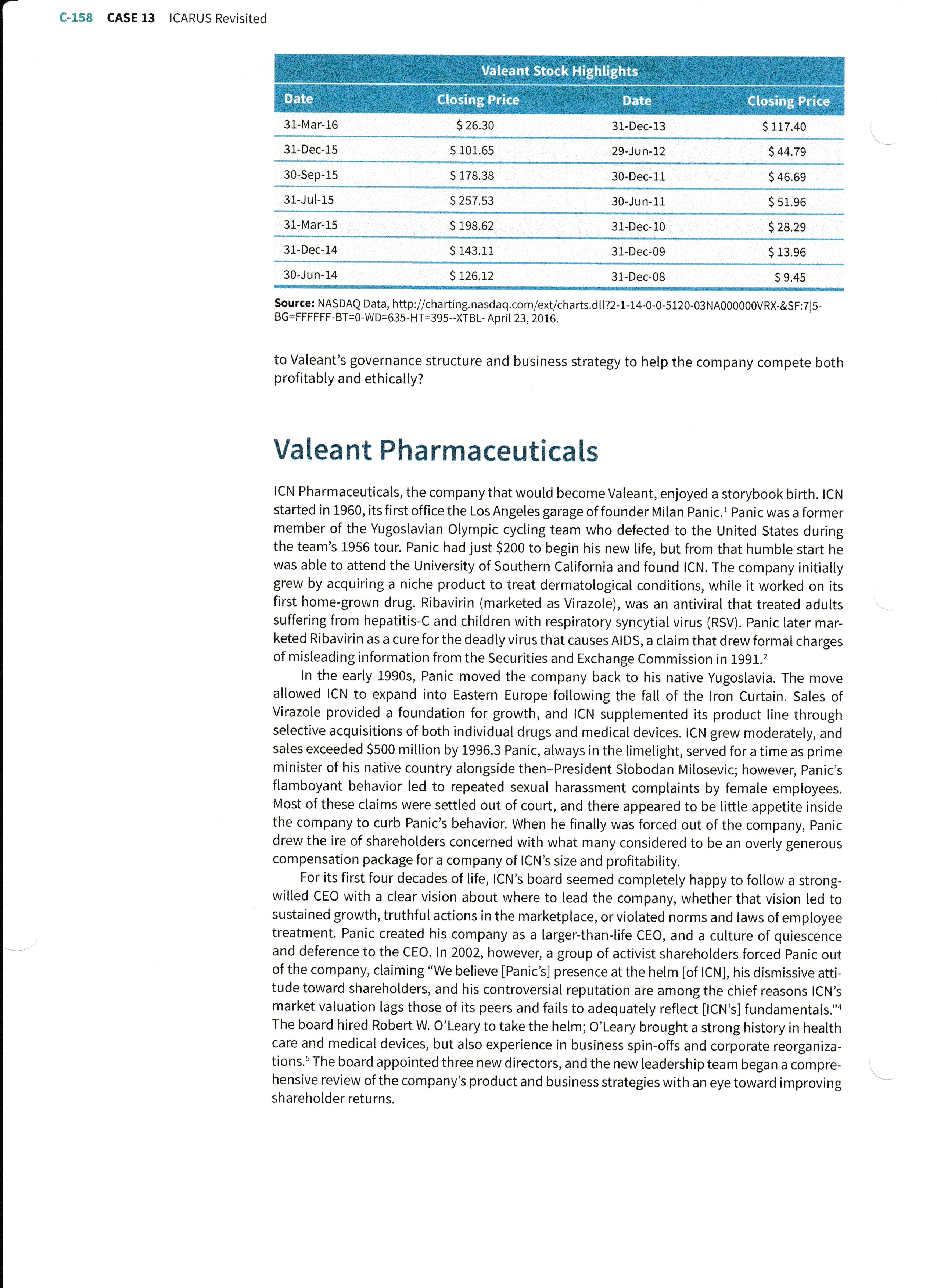

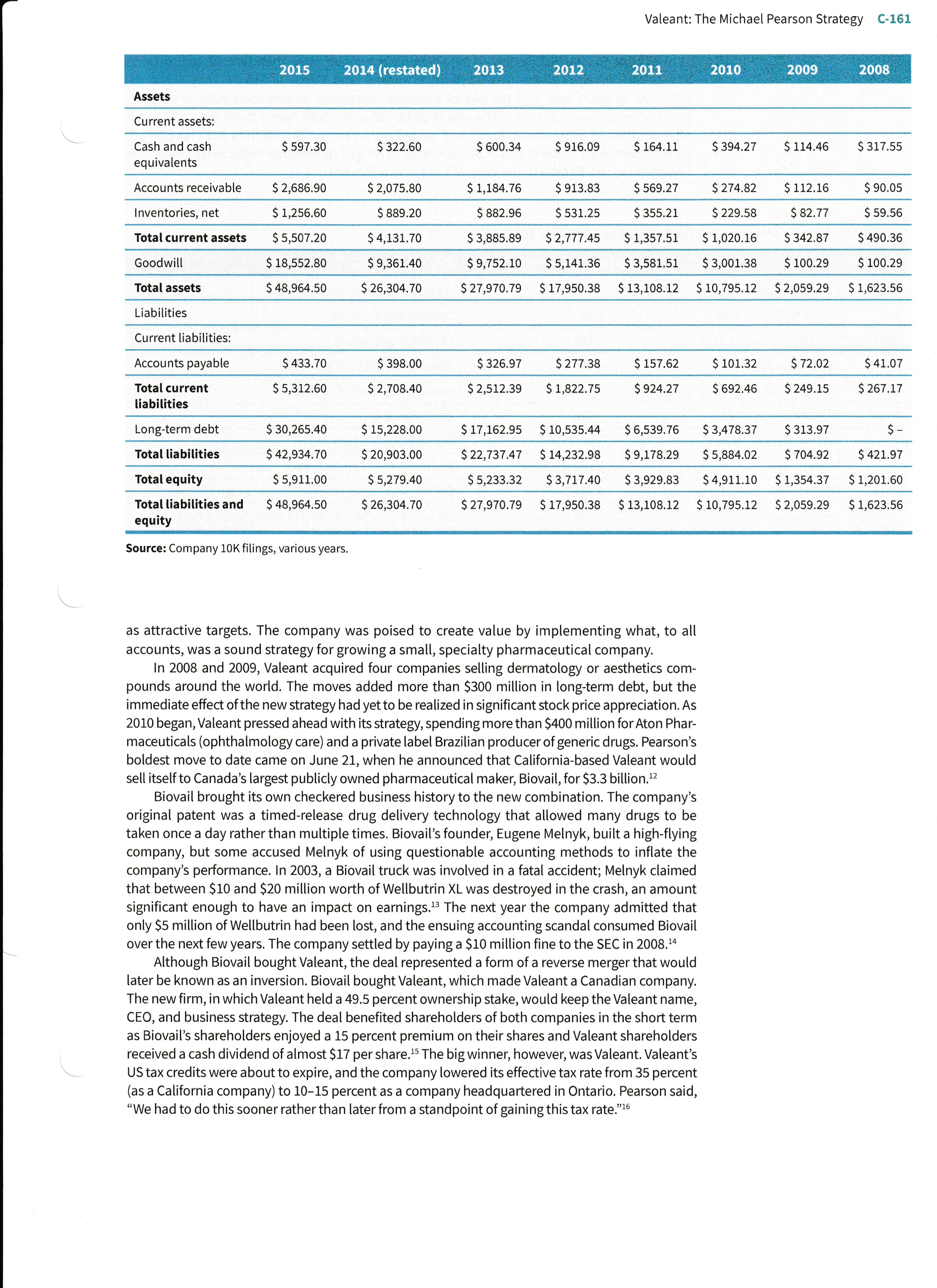

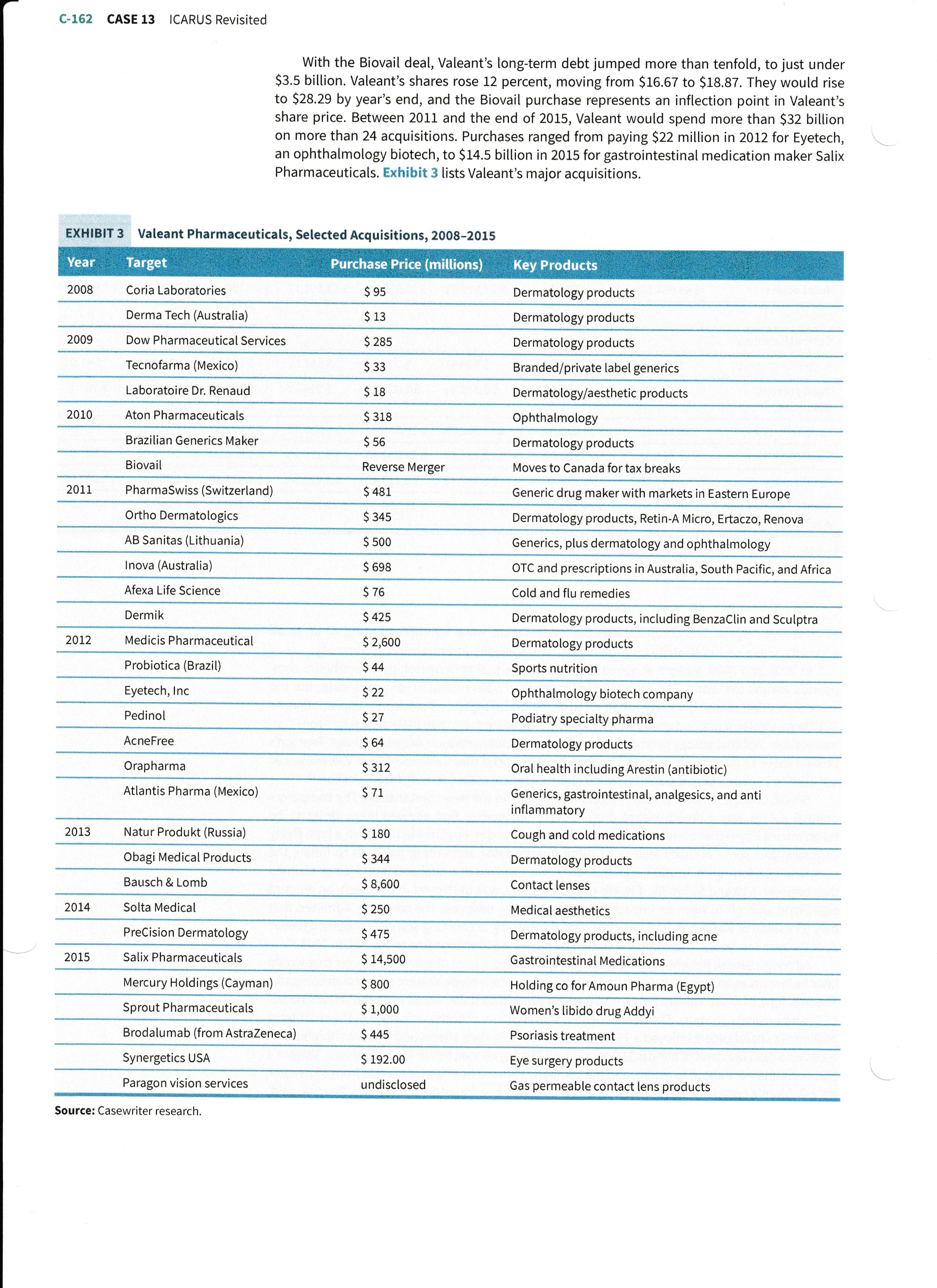

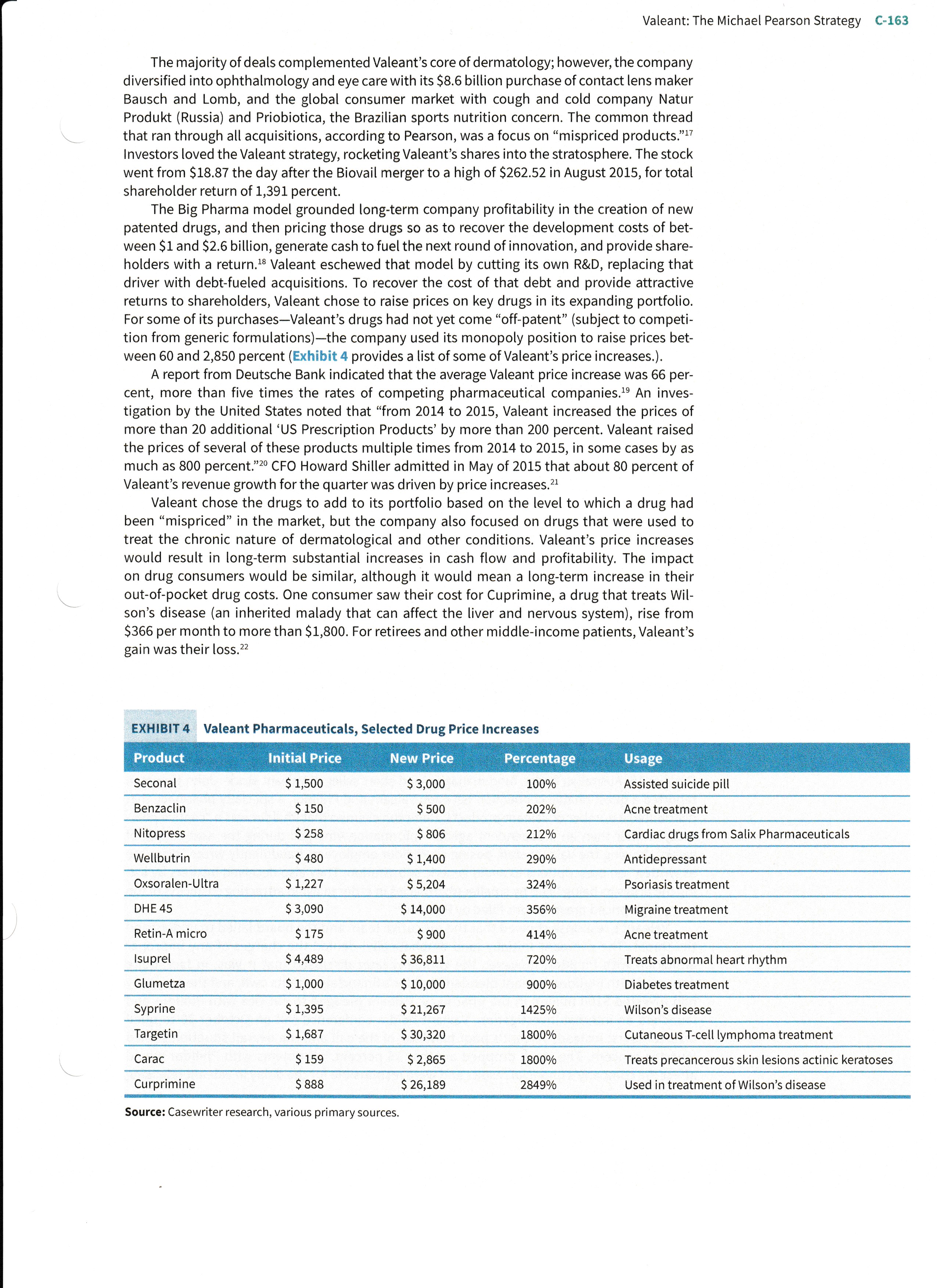

The Rise and Fall of Valeant Pharmaceuticals Robert Ingram glanced away from his computer screen after checking the stock price of Valeant Pharmaceuticals. As board chairman, Ingram was pleased to see that the stock price had climbed after the announcement of the hiring of new CEO Joseph Papa. Papa replaced Michael Pearson, who had led Valeant through a period of phenomenal growth and a phenomenal collapse. Valeant had, at one point, lost almost 90 percent of its market value as its stock fell from $262 per share to a little more than $26. (Exhibit 1 displays Valeant's stock price during the Michael Pearson era.) The recent release of the company's long-delayed 2015 financial statements restated its 2014 revenue downward by $57.5 million; its net income dropped by $26.8 million. The release of the financial statements eased creditor concerns that Valeant would violate key debt covenants, and Ingram hoped that Valeant could leave its troubled past behind. As he thought about the future direction of the company, Ingram wondered how the board had missed so many signals that Valeant's business model was unsustainable, and many of its business practices were ethically problematic. What changes should be made Source: NASDAQ Data, http://charting.nasdaq.com/ext/charts.dIl?2-1-14-0-0-5120-03NA000000VRX-\&SF:7|5BG=FFFFFFBT=0WD=635HT=395XTBL April 23, 2016. to Valeant's governance structure and business strategy to help the company compete both profitably and ethically? Valeant Pharmaceuticals ICN Pharmaceuticals, the company that would become Valeant, enjoyed a storybook birth. ICN started in 1960, its first office the Los Angeles garage of founder Milan Panic. 1 Panic was a former member of the Yugoslavian Olympic cycling team who defected to the United States during the team's 1956 tour. Panic had just \$200 to begin his new life, but from that humble start he was able to attend the University of Southern California and found ICN. The company initially grew by acquiring a niche product to treat dermatological conditions, while it worked on its first home-grown drug. Ribavirin (marketed as Virazole), was an antiviral that treated adults suffering from hepatitis- C and children with respiratory syncytial virus (RSV). Panic later marketed Ribavirin as a cure for the deadly virus that causes AIDS, a claim that drew formal charges of misleading information from the Securities and Exchange Commission in 1991.2 In the early 1990s, Panic moved the company back to his native Yugoslavia. The move allowed ICN to expand into Eastern Europe following the fall of the Iron Curtain. Sales of Virazole provided a foundation for growth, and ICN supplemented its product line through selective acquisitions of both individual drugs and medical devices. ICN grew moderately, and sales exceeded $500 million by 1996.3 Panic, always in the limelight, served for a time as prime minister of his native country alongside then-President Slobodan Milosevic; however, Panic's flamboyant behavior led to repeated sexual harassment complaints by female employees. Most of these claims were settled out of court, and there appeared to be little appetite inside the company to curb Panic's behavior. When he finally was forced out of the company, Panic drew the ire of shareholders concerned with what many considered to be an overly generous compensation package for a company of ICN's size and profitability. For its first four decades of life, ICN's board seemed completely happy to follow a strongwilled CEO with a clear vision about where to lead the company, whether that vision led to sustained growth, truthful actions in the marketplace, or violated norms and laws of employee treatment. Panic created his company as a larger-than-life CEO, and a culture of quiescence and deference to the CEO. In 2002, however, a group of activist shareholders forced Panic out of the company, claiming "We believe [Panic's] presence at the helm [of ICN], his dismissive attitude toward shareholders, and his controversial reputation are among the chief reasons ICN's market valuation lags those of its peers and fails to adequately reflect [ICN's] fundamentals." The board hired Robert W. O'Leary to take the helm; O'Leary brought a strong history in health care and medical devices, but also experience in business spin-offs and corporate reorganizations. 5 The board appointed three new directors, and the new leadership team began a comprehensive review of the company's product and business strategies with an eye toward improving shareholder returns. When ICN changed its name to Valeant Pharmaceuticals in 2003, the company issued a statement: "Our new name represents our focus on value and supports our vision to be a leading, fully integrated specialty pharmaceutical company with a robust research and development capability and a worldwide capacity to commercialize products." 6 Valeant intended to pursue a strategy of developing its own drug pipeline of neurological drugs. The company also produced its own branded generic drugs to supplement its existing product line of skin care medications. The new strategy attempted to make Valeant look and act like other, major pharmaceutical companies that all relied on internal research and development to create a strong pipeline of ethical (prescription) drugs. Once again, the board and company seemed willing to follow a CEO with a clear vision; strangely, the board failed to ask about the viability and long-term sustainability of this strategy before tasking O'Leary to implement it. Valeant's first problem was size. With $823 million in 2003 revenue and $87 million in R\&D spending, Valeant had little hope of developing the depth or breadth of a new drug pipeline that could compete with major pharmaceutical houses. 7 By comparison, Merck's 2003 sales exceeded $22 billion and its R\&D expenditures were more than $3 billion. 8 Valeant pursued a "Big Pharma" strategy, but its lack of size and scale made it difficult (at best) to create an internal pipeline of innovative new drugs. The second problem was Valeant's lack of product and regional focus. With a small R\&D budget to begin with, the company placed its investments in increased product breadth and geographic reach. By 2007, the company sold 2,200 different versions of its 370 core products around the globe, using 85 different third-party suppliers. 9 The company's lack of adequate staff, resources, and skills in global marketing and distribution left it a competitor in too many markets, and leader in too few. As the years passed, it became clear to the board that Valeant's attempts to act like a traditional pharmaceutical company had produced few results, and it had little likelihood of profitable long-term growth. Revenue for 2007 was $842 million, barely ahead of sales five years before. Importantly, the 2007 revenue number represented a 20 percent decline from the previous year, primarily because of a core drug, Wellbutrin, facing intense competition from generic producers. Valeant: The Michael Pearson Strategy In late 2007, the board hired Michael Pearson, a McKinsey consultant with deep experience in the global pharmaceutical industry, to evaluate Valeant's business. Pearson had risen from humble beginnings (his father was a phone installer) to earn his undergraduate degree at Duke and an MBA from the Darden School at the University of Virginia. He joined McKinsey after graduate school and rose to become a partner, board member, and head of McKinsey's pharmaceutical consulting practice. While acting as a consultant to the board, Pearson surveyed Valeant's current condition. He reported: "Your current strategy is not only not working, it doesn't have much of a chance to be successful." 10 Pearson then laid out a bold strategy for the company: Valeant should streamline its operations and compete only in global regions and therapeutic categories where it had a reasonable chance of success. The product portfolio needed to shift away from highly competitive categories such as cardiovascular and infectious disease drugs in which Valeant competed head to head with Big Pharma. The company would always be outgunned in these categories, both in terms of R\&D and marketing and sales budgets. The company should instead focus on niche categories such as dermatology (skin care). Dermatology offered adequate demand and a stable base of customers who often needed lengthy, ongoing treatments to treat chronic conditions. The dermatology market also featured a broad range of specialty, niche ailments that required unique treatments, and a payer base of primarily private individuals rather than government agencies. Pearson also suggested cutting R\&D and focusing on mergers and acquisitions (M\&A) to drive growth. Valeant could acquire smaller companies or individual products that produced enough revenue to create growth but were too small to interest Big Pharma buyers. Pearson, and the Valeant board, believed that there were enough of these undervalued, orphan products to drive substantial future growth. The board liked Pearson's bold vision, and they appreciated his direct management style. "[His]leadership style wasn't a cult of personality or a force of will-though he's extremely willful-but one where the decision making was going to be based on facts, which was a breath of fresh air," said one director. "He felt like a much better fit for what we needed to do." 11 In short, Pearson displayed the clarity and boldness of vision that typified the founder, Milan Panic; however, Pearson did not appear as iconic or eccentric as Panic. Pearson joined Valeant as CEO in February 2008. During that month Valeant's stock price averaged $13.88, ranging from $13.24 to a high of $14.17. Icarus Flies High: Implementing the New Strategy As Pearson and the board began to execute the strategy, they enjoyed three advantages. First, the company had a well-established pipeline that would generate current revenue. Second, the company's balance sheet provided ample room for leverage. In 2008, cash or equivalents represented 60 percent of total assets; importantly, the company had no long-term debt (Exhibit 2 provides selected financial data for Valeant from 2008 to 2015.). Third, it appeared that there were, in fact, a number of just the right types of drugs, and companies, that Pearson identified Valeant: The Michael Pearson Strategy C-161 Source: Company 10K filings, various years. as attractive targets. The company was poised to create value by implementing what, to all accounts, was a sound strategy for growing a small, specialty pharmaceutical company. In 2008 and 2009, Valeant acquired four companies selling dermatology or aesthetics compounds around the world. The moves added more than $300 million in long-term debt, but the immediate effect of the new strategy had yet to be realized in significant stock price appreciation. As 2010 began, Valeant pressed ahead with its strategy, spending more than $400 million for Aton Pharmaceuticals (ophthalmology care) and a private label Brazilian producer of generic drugs. Pearson's boldest move to date came on June 21, when he announced that California-based Valeant would sell itself to Canada's largest publicly owned pharmaceutical maker, Biovail, for $3.3 billion..12 Biovail brought its own checkered business history to the new combination. The company's original patent was a timed-release drug delivery technology that allowed many drugs to be taken once a day rather than multiple times. Biovail's founder, Eugene Melnyk, built a high-flying company, but some accused Melnyk of using questionable accounting methods to inflate the company's performance. In 2003, a Biovail truck was involved in a fatal accident; Melnyk claimed that between $10 and $20 million worth of Wellbutrin XL was destroyed in the crash, an amount significant enough to have an impact on earnings.. 13 The next year the company admitted that only $5 million of Wellbutrin had been lost, and the ensuing accounting scandal consumed Biovail over the next few years. The company settled by paying a $10 million fine to the SEC in 2008.14 Although Biovail bought Valeant, the deal represented a form of a reverse merger that would later be known as an inversion. Biovail bought Valeant, which made Valeant a Canadian company. The new firm, in which Valeant held a 49.5 percent ownership stake, would keep the Valeant name, CEO, and business strategy. The deal benefited shareholders of both companies in the short term as Biovail's shareholders enjoyed a 15 percent premium on their shares and Valeant shareholders received a cash dividend of almost $17 per share..15 The big winner, however, was Valeant. Valeant's US tax credits were about to expire, and the company lowered its effective tax rate from 35 percent (as a California company) to 10-15 percent as a company headquartered in Ontario. Pearson said, "We had to do this sooner rather than later from a standpoint of gaining this tax rate."16 With the Biovail deal, Valeant's long-term debt jumped more than tenfold, to just under $3.5 billion. Valeant's shares rose 12 percent, moving from $16.67 to $18.87. They would rise to $28.29 by year's end, and the Biovail purchase represents an inflection point in Valeant's share price. Between 2011 and the end of 2015, Valeant would spend more than \$32 billion on more than 24 acquisitions. Purchases ranged from paying $22 million in 2012 for Eyetech, an ophthalmology biotech, to $14.5 billion in 2015 for gastrointestinal medication maker Salix Pharmaceuticals. Exhibit 3 lists Valeant's major acquisitions. The majority of deals complemented Valeant's core of dermatology; however, the company diversified into ophthalmology and eye care with its $8.6 billion purchase of contact lens maker Bausch and Lomb, and the global consumer market with cough and cold company Natur Produkt (Russia) and Priobiotica, the Brazilian sports nutrition concern. The common thread that ran through all acquisitions, according to Pearson, was a focus on "mispriced products." " Investors loved the Valeant strategy, rocketing Valeant's shares into the stratosphere. The stock went from $18.87 the day after the Biovail merger to a high of $262.52 in August 2015, for total shareholder return of 1,391 percent. The Big Pharma model grounded long-term company profitability in the creation of new patented drugs, and then pricing those drugs so as to recover the development costs of between $1 and $2.6 billion, generate cash to fuel the next round of innovation, and provide shareholders with a return. 18 Valeant eschewed that model by cutting its own R\&D, replacing that driver with debt-fueled acquisitions. To recover the cost of that debt and provide attractive returns to shareholders, Valeant chose to raise prices on key drugs in its expanding portfolio. For some of its purchases-Valeant's drugs had not yet come "off-patent" (subject to competition from generic formulations)-the company used its monopoly position to raise prices between 60 and 2,850 percent (Exhibit 4 provides a list of some of Valeant's price increases.). A report from Deutsche Bank indicated that the average Valeant price increase was 66 percent, more than five times the rates of competing pharmaceutical companies. 19 An investigation by the United States noted that "from 2014 to 2015, Valeant increased the prices of more than 20 additional 'US Prescription Products' by more than 200 percent. Valeant raised the prices of several of these products multiple times from 2014 to 2015, in some cases by as much as 800 percent., 20 CFO Howard Shiller admitted in May of 2015 that about 80 percent of Valeant's revenue growth for the quarter was driven by price increases. 21 Valeant chose the drugs to add to its portfolio based on the level to which a drug had been "mispriced" in the market, but the company also focused on drugs that were used to treat the chronic nature of dermatological and other conditions. Valeant's price increases would result in long-term substantial increases in cash flow and profitability. The impact on drug consumers would be similar, although it would mean a long-term increase in their out-of-pocket drug costs. One consumer saw their cost for Cuprimine, a drug that treats Wilson's disease (an inherited malady that can affect the liver and nervous system), rise from $366 per month to more than $1,800. For retirees and other middle-income patients, Valeant's gain was their loss. 22 FXHIRIT 4 Valeant pharmareiticale Salerted Drio Drirelneraacac sumice vasevilter iesealci, vailus pililal y suices. Valeant defended its price increases on three grounds. Internally, the company noted that increases (often major) in price did not affect demand. A consultant's report on heart medication Nitropress noted that, "With roughly one year of data showing essentially static volume performance after a substantial price increase (350\%), [the consulting firm] believes pricing flexibility may still exist for the product up to the perceptual price point of $1,000 per vial. ... With current WAC [Wholesale Acquisition Cost] pricing at \$214 per vial, Nitropress is likely to still have flexibility by multiple orders of magnitude.,23 Nitropress had apparently not reached its economic price ceiling, where demand would begin to decrease. Externally, Valeant claimed that its price increases were justified by the money saved from drug therapies versus hospitalization or other intensive treatments. Northern California's KQED reported on Valeant's price increase of Seconal, an assisted suicide drug: "'Valeant sets prices for drugs based on a number of factors,' the company said in a statement, including the cost of developing or acquiring the drug, the availability of generics, and the benefits of the drug compared with costly alternative treatments. 'When possible, we offer patient assistance programs to mitigate the effects of price adjustments and keep out-of-pocket costs affordable for patients.'24 Those patient assistance programs represented the third element of Valeant's justification for its strategy. The company argued that few consumers bore the brunt of their price increases-most of the higher bills would be paid by third-party payers, either private health insurers or government agencies such as Medicare or Medicaid. Valeant's anti-depressant Wellbutrin provides an example. Patients who visited the Wellbutrin website learned that, depending on their insurance plan, they may pay between zero and $50 for "unlimited use." Doctors were told that if they prescribed Wellbutrin XL, and specified "no generic substitution" would find "no hassles and no need for call-backs-guaranteed. Your prescription decision is never questioned by the pharmacy." .25 Wellbutrin had been on the market for three decades and was available in generic form for about $30 per month. Valeant had increased the price 11 times to more than $1,400 a month. The drug's 2015 revenue was projected to top $300 million, double its 2013 level. 26 Icarus Returns to Earth: The Fallout of Valeant's Acquisition Strategy Valeant's drug pricing strategy came under criticism as the US presidential election heated up in the fall of 2015. Democratic candidate Bernie Sanders called for an investigation in August 2015, and Hillary Clinton followed in September. Her tweet pledged action around "outrageous price gouging" by pharmaceuticals put investors in the sell mode. Valeant's shares, trading at more than $250 per share in August, began to fall. On September 28 alone, Valeant's shares dropped 16 percent. 27 Valeant had no response to these attacks. Just over two weeks later, on October 15, Australian hedge fund manager-and short seller of Valeant stock-John Hempton reported a questionable connection between Valeant and Philidor, a specialty pharmacy that distributed a number of Valeant products. Hempton claimed that Philidor was a "captive pharmacy" rather than an independent agent. 28 Information emerged during the next couple of weeks showing the Valeant staff, posing as Philidor employees, fraudulently wrote "dispense as written" on prescriptions to avoid generic substitution. They also deceived insurers by listing the drugs as being filled by smaller pharmacies in order to avoid attracting suspicion of too many high-priced prescriptions filled by Philidor. 29 Valeant's response showed that the executive team and the board failed to understand the threat. The company initially (and emphatically) denied the charges of any improper affiliation with Philidor; however, the company later disclosed that it was, in fact, quite entwined with Philidor. Valeant blended Philidor's financials with its own, and the company had invested \$100 million in the pharmacy. Valeant pledged to cut ties with Philidor and launched an internal investigation. Valeant held a conference call on October 30 to quell investor fears; instead, Valeant's poor handling of the call and the overall situation stoked investor concern. The stock dropped another 16 percent. 30 Problems with Philidor would affect the company's financial results and were responsible for the delay in Valeant releasing Valeant: The its 2015 annual report-a move that threatened to throw the company into default with its creditors. In late December of 2015, Valeant announced that Pearson would take a leave of absence because of a severe case of pneumonia; CFO Howard Shiller would assume Pearson's role and serve as temporary CEO. Robert Ingram would become board chairman and Valeant would finally split the roles of chairman and CEO. Pearson returned to work at the end of February 2016, but Ingram remained board chairman. 31 Throughout the winter of 2016, Valeant continued to exhibit a surprisingly nonchalant public attitude about its drug pricing troubles. In February 2016, Clinton continued her assault: "[Valeant] is one of these companies that is absolutely gouging American consumers and patients," she said. "I'm going after them. We are going to stop this. This is predatory pricing. It is unjustified, it is wrong, and we're going to make sure it is stopped." 32 Between August 2015 and February 2016, Valeant's shares lost more than 60 percent of their value. As Valeant's troubles became front-page news, the US Congress and the US Department of Justice jumped on the bandwagon, the former calling for hearings and the latter opening an investigation into Valeant's pricing behavior. 33 Other Valeant problems came to light. Its 2013 acquisition of Bausch \& Lomb resulted in a commanding market position in the contact lens market. When Valeant purchased Paragon Vision Services in 2015, the company held an estimated 80 percent market share in orthokeratology "buttons," a key input to gas permeable hard contact lenses. The US Federal Trade Commission opened another investigation, and a contact lens manufacturer filed a class action suit to stop Valeant. Jan Svochak, president of the Contact Lens Manufacturers Association described the threat: "The issue is the orthokeratology market . . . We believe they have a monopoly situation in that market," Svochak said. "They significantly raised prices in the orthokeratology market, and they've also taken control of distribution channels." Valeant used the Paragon acquisition to raise prices for the buttons by more than 100 percent. In a final blow to the now-beleaguered company, investors began to raise concerns about CEO Michael Pearson's compensation package. In 2014, activist investor William Ackman noted that Pearson held stock options in Valeant worth more than $1.3 billion, on top of $10.275 million in salary and bonus compensation for the year. Ackman noted that the pay plan would richly reward the Valeant team and Pearson for raising share price over the long term. The company's proxy statement included this description of the pay plan: "Our compensation philosophy is to align management's pay with long-term TSR [Total Shareholder Return] . . We richly reward for outstanding TSR performance, but pay significantly less for below-average TSR performance." Executives would receive their shares only if the stock price hit an annual return of 15 percent; however, if the stock returned 45 percent, shares tripled. They quadrupled if the stock went up 60 percent. Valeant claimed its "executives could be among the best-paid in the industry." Because of Valeant's collapse, neither Pearson nor other Valeant executives would receive stock compensation for the period of 2013-2016, as their options would not vest until 2017. The late-filed 2015 10K report included the board's investigation of the Philidor scandal. The board admitted "the company has determined that the tone at the top of the organization, with its performance-based environment, in which challenging targets were set and achieving those targets was a key performance expectation, was not effective in supporting the control environment... [and] may have been contributing factors resulting in the company's improper revenue recognition." The company also noted the burgeoning number of federal and state investigations underway; the SEC, the United States Senate, and state-level inquiries in Massachusetts, New York, New Jersey, and North Carolina. Doctors, hospitals, and other activist groups began targeting the company. With its future revenue growth increasingly uncertain, investors jumped off the Valeant bandwagon and continued to sell their shares. With the prospect of increased scrutiny from stakeholders in the public and private sectors, Valeant's ability to find, acquire, and re-price "mispriced" drugs appeared in jeopardy. On March 21 , Valeant announced that Pearson would be leaving the company and a search for a new CEO would begin immediately. 34 Valeant's stock finally hit bottom on March 31 , tumbling to $26.30, down almost exactly 90 percent from its peak seven months earlier. Conclusion The shares had come back to Earth, leaving long-term holders of Valeant stock with a company valued at its 2010 price. Consumers who saw their prescription bills were clearly worse off. Who were the real winners in Valeant's rise and fall? These and other questions gave Ingram pause as he considered how to work with the new CEO and directors Valeant named to its board. The investing community was waiting to see how new CEO Joe Papa would alter Valeant's strategy and lead the company toward a new future. As the board chairman, Ingram wanted to see Valeant return to profitability, but he also wanted to ensure that Valeant, and the board, proved more responsive to the charged stakeholder environment in the health care industry. Had Valeant simply transferred wealth from consumers to shareholders through its price increases? How should it set prices in the future to reflect the real value of the drugs but avoid excessive, "gouging" price increases? How should the board govern the company in order to avoid further fraud or accounting scandals? Finally, Ingram wondered about how to address Papa's compensation and other board-level policies: How could they incentivize long-term sustainable growth and build an ethical culture? References "Material in this paragraph from "ICN Pharmaceuticals, Inc. History," Funding Universe, http://www.fundinguniverse.com/company -histories/icn-pharmaceuticals-inc-history/, accessed April 22, 2016. 'Ibid. 3bid. 4Ibid. "ICN Pharmaceuticals Appoints Robert W. O'Leary as Chairman and CEO," PR Newswire, June 20, 2002, http://www.prnewswire.comews -releases/icn-pharmaceuticals-appoints-robert-w-oleary-as-chairman -and-ceo-77943717.html, accessed April 22, 2016. "ICN Pharmaceuticals, Inc. Changes Its Name to Valeant Pharmaceuticals International," Newswire, November 12, 2003, available at http://www.prnewswire.comews-releases/icn-pharmaceuticals-inc -changes-its-name-to-valeant-pharmaceuticals-international-72992612 .html, accessed April 22, 2016. 'Financial data for 2003 from Valeant's 20-F filing with the SEC, http:// hsprod.investis.com/ir/valeant_pharmaceuticals/jsp/sec_index .jsp?ipage =2796961 \&ir_epic_id=valeant_pharmaceuticals, accessed April 23, 2016. 8 Data from Merck's 2003 Annual Report, http://www.merck.com/finance /annualreport/ar2003/pdf/merck2003ar.pdf, accessed April 23, 2016. 'S. Silcoff, "How Valeant Became Canada's Hottest Stock," The Globe and Mail, February 21, 2013, http://www.theglobeandmail.com/report -on-business/rob-magazine/how-valeant-became-canadas-hottest -stock/article8889241/?page=all, accessed April 23, 2016. 10 Ibid. 11 Ibid. 12 P. Jorda and E. Dey, "Drugmaker Biovail to Buy Valeant in $3.3 Billion Deal," Reuters, June 21, 2010, http://www.reuters.com/article /us-biovail-valeant-idUSTRE65K1LA20100621, accessed April 28, 2016. 13 Silcoff. 14"Biovail to Merge with Valeant," New York Times (June 21, 2010), http://dealbook.nytimes.com/2010/06/21/biovail-to-merge-with -valeant/?_r=0, accessed April 28, 2016. 15 Jorda and Dey. 16 Ibid. 17L. Lorenzetti, "Valeant Eases Up on Strategy to Buy Up 'Mispriced Drugs'," Fortune (October 19, 2015), http://fortune.com/2015/10/19 /valeant-backs-down-drug-prices/, accessed April 28, 2016. 18A. E. Caroll, "\$2.6 Billion to Develop a Drug? New Estimate Makes Questionable Assumptions," New York Times (November 18, 2014), http://www.nytimes.com/2014/11/19/upshot/calculating-the-real -costs-of-developing-a-new-drug.html?_r=0, accessed April 29, 2016. 19Ibid. 20"Emails Reveal Turing, Valeant (VRX) Price Increases Were Basis for Revenue Growth," Biospace, February 3, 2016, http://www .biospace.com/News/emails-reveal-turing-valeant-price-increases -were/407561, accessed April 26, 2016. 21 S. Armour and J. Rockoff, "Valeant, Turing Boosted Drug Prices to Fuel Preset Profits," Wall Street Journal (February 2, 2016), http://www.wsj .com/articles/valeant-turing-boosted-drug-prices-to-fuel-preset-profits -1454445342, accessed April 26, 2016. 22 A. Pollack and S. Tavernise, "Valeant's Drug Price Strategy Enriches It, but Infuriates Patients and Lawmakers," New York Times (October 4, 2015), http://www.nytimes.com/2015/10/05/business/valeants-drug -price-strategy-enriches-it-but-infuriates-patients-and-lawmakers .html, accessed April 29, 2016. 23 ibid. 24L. Lopez, "Valeant Bought a Drug that Helps Terminally III People Die and Doubled the Price," Business Insider (March23, 2016), http://www.businessinsider.com/valeant-seconal-price-increase-2016-3, accessed April 26, 2016. 25 Ibid. 26 N. Weinberg and R. Langreth, "How Valeant Tripled Prices, Doubled Sales of Flatlining Drug," Bloomberg (January 8, 2016), http://www .bloomberg.comews/articles/2016-01-08/how-valeant-tripled-prices -doubled-sales-of-flatlining-old-drug, accessed April 26, 2016. 27 S. Gandel, "What Caused Valeant's Epic 90\% Plunge," Fortune (March 20, 2016), http://fortune.com/2016/03/20/valeant-timeline -scandal/, accessed April 26, 2016. 28 S. Gandel, "Valeant: A Timeline of the Big Pharma Scandal," Fortune (October 31, 2015), http://fortune.com/2015/10/31/valeant-scandal/, accessed April 29, 2016. 29J. Hempton, "Philidor 2.0: Valeant and Stephen King Play Chess with a Lot of Pharmacies," November 26, 2016, http://brontecapital .blogspot.com/2015/11/philidor-20-valeant-and-stephen-king.html, accessed April 29, 2016. 30Gandel, Valeant. 31 A. Pollack, "Valeant Pharmaceuticals Chief Returns from Medical Leave," New York Times (February 28, 2016), http://www.nytimes.com /2016/02/29/business/valeant-pharmaceuticals-j-michael-pearson-ceo .html?_r=0, accessed May 6, 2016. 32 D. Crow, "Price of Valeant Drug Singled Out by Clinton Rose 356\% in a Year," Financial Times, http://www.ft.com/cms/s/0/fff89b8e -c922-11e5-be0b-b7ece4e953a0.html\#axzz46y EaggbM, accessed April 26, 2016. 33 A. Pollack, "2 Valeant Dermatology Drugs Lead Steep Price Increases, Study Finds," New York Times (November 25, 2015), http:// www.nytimes.com/2015/11/26/business/2-valeant-dermatology -drugs-lead-steep-price-increases-study-finds.html?_r=0, accessed April 26, 2016. 34N. Vardi, "Mike Pearson Is on His Way Out of Valeant, Former CFO Refuses to Leave Board," Forbes (March 21, 2016), http://www.forbes .com/sitesathanvardi/2016/03/21/mike-pearson-is-on-his-way -out-of-valeant-amid-more-drama-former-cfo-refuses-to-leave -board/\#2c7f12525c1a, accessed May 6, 2016

The Rise and Fall of Valeant Pharmaceuticals Robert Ingram glanced away from his computer screen after checking the stock price of Valeant Pharmaceuticals. As board chairman, Ingram was pleased to see that the stock price had climbed after the announcement of the hiring of new CEO Joseph Papa. Papa replaced Michael Pearson, who had led Valeant through a period of phenomenal growth and a phenomenal collapse. Valeant had, at one point, lost almost 90 percent of its market value as its stock fell from $262 per share to a little more than $26. (Exhibit 1 displays Valeant's stock price during the Michael Pearson era.) The recent release of the company's long-delayed 2015 financial statements restated its 2014 revenue downward by $57.5 million; its net income dropped by $26.8 million. The release of the financial statements eased creditor concerns that Valeant would violate key debt covenants, and Ingram hoped that Valeant could leave its troubled past behind. As he thought about the future direction of the company, Ingram wondered how the board had missed so many signals that Valeant's business model was unsustainable, and many of its business practices were ethically problematic. What changes should be made Source: NASDAQ Data, http://charting.nasdaq.com/ext/charts.dIl?2-1-14-0-0-5120-03NA000000VRX-\&SF:7|5BG=FFFFFFBT=0WD=635HT=395XTBL April 23, 2016. to Valeant's governance structure and business strategy to help the company compete both profitably and ethically? Valeant Pharmaceuticals ICN Pharmaceuticals, the company that would become Valeant, enjoyed a storybook birth. ICN started in 1960, its first office the Los Angeles garage of founder Milan Panic. 1 Panic was a former member of the Yugoslavian Olympic cycling team who defected to the United States during the team's 1956 tour. Panic had just \$200 to begin his new life, but from that humble start he was able to attend the University of Southern California and found ICN. The company initially grew by acquiring a niche product to treat dermatological conditions, while it worked on its first home-grown drug. Ribavirin (marketed as Virazole), was an antiviral that treated adults suffering from hepatitis- C and children with respiratory syncytial virus (RSV). Panic later marketed Ribavirin as a cure for the deadly virus that causes AIDS, a claim that drew formal charges of misleading information from the Securities and Exchange Commission in 1991.2 In the early 1990s, Panic moved the company back to his native Yugoslavia. The move allowed ICN to expand into Eastern Europe following the fall of the Iron Curtain. Sales of Virazole provided a foundation for growth, and ICN supplemented its product line through selective acquisitions of both individual drugs and medical devices. ICN grew moderately, and sales exceeded $500 million by 1996.3 Panic, always in the limelight, served for a time as prime minister of his native country alongside then-President Slobodan Milosevic; however, Panic's flamboyant behavior led to repeated sexual harassment complaints by female employees. Most of these claims were settled out of court, and there appeared to be little appetite inside the company to curb Panic's behavior. When he finally was forced out of the company, Panic drew the ire of shareholders concerned with what many considered to be an overly generous compensation package for a company of ICN's size and profitability. For its first four decades of life, ICN's board seemed completely happy to follow a strongwilled CEO with a clear vision about where to lead the company, whether that vision led to sustained growth, truthful actions in the marketplace, or violated norms and laws of employee treatment. Panic created his company as a larger-than-life CEO, and a culture of quiescence and deference to the CEO. In 2002, however, a group of activist shareholders forced Panic out of the company, claiming "We believe [Panic's] presence at the helm [of ICN], his dismissive attitude toward shareholders, and his controversial reputation are among the chief reasons ICN's market valuation lags those of its peers and fails to adequately reflect [ICN's] fundamentals." The board hired Robert W. O'Leary to take the helm; O'Leary brought a strong history in health care and medical devices, but also experience in business spin-offs and corporate reorganizations. 5 The board appointed three new directors, and the new leadership team began a comprehensive review of the company's product and business strategies with an eye toward improving shareholder returns. When ICN changed its name to Valeant Pharmaceuticals in 2003, the company issued a statement: "Our new name represents our focus on value and supports our vision to be a leading, fully integrated specialty pharmaceutical company with a robust research and development capability and a worldwide capacity to commercialize products." 6 Valeant intended to pursue a strategy of developing its own drug pipeline of neurological drugs. The company also produced its own branded generic drugs to supplement its existing product line of skin care medications. The new strategy attempted to make Valeant look and act like other, major pharmaceutical companies that all relied on internal research and development to create a strong pipeline of ethical (prescription) drugs. Once again, the board and company seemed willing to follow a CEO with a clear vision; strangely, the board failed to ask about the viability and long-term sustainability of this strategy before tasking O'Leary to implement it. Valeant's first problem was size. With $823 million in 2003 revenue and $87 million in R\&D spending, Valeant had little hope of developing the depth or breadth of a new drug pipeline that could compete with major pharmaceutical houses. 7 By comparison, Merck's 2003 sales exceeded $22 billion and its R\&D expenditures were more than $3 billion. 8 Valeant pursued a "Big Pharma" strategy, but its lack of size and scale made it difficult (at best) to create an internal pipeline of innovative new drugs. The second problem was Valeant's lack of product and regional focus. With a small R\&D budget to begin with, the company placed its investments in increased product breadth and geographic reach. By 2007, the company sold 2,200 different versions of its 370 core products around the globe, using 85 different third-party suppliers. 9 The company's lack of adequate staff, resources, and skills in global marketing and distribution left it a competitor in too many markets, and leader in too few. As the years passed, it became clear to the board that Valeant's attempts to act like a traditional pharmaceutical company had produced few results, and it had little likelihood of profitable long-term growth. Revenue for 2007 was $842 million, barely ahead of sales five years before. Importantly, the 2007 revenue number represented a 20 percent decline from the previous year, primarily because of a core drug, Wellbutrin, facing intense competition from generic producers. Valeant: The Michael Pearson Strategy In late 2007, the board hired Michael Pearson, a McKinsey consultant with deep experience in the global pharmaceutical industry, to evaluate Valeant's business. Pearson had risen from humble beginnings (his father was a phone installer) to earn his undergraduate degree at Duke and an MBA from the Darden School at the University of Virginia. He joined McKinsey after graduate school and rose to become a partner, board member, and head of McKinsey's pharmaceutical consulting practice. While acting as a consultant to the board, Pearson surveyed Valeant's current condition. He reported: "Your current strategy is not only not working, it doesn't have much of a chance to be successful." 10 Pearson then laid out a bold strategy for the company: Valeant should streamline its operations and compete only in global regions and therapeutic categories where it had a reasonable chance of success. The product portfolio needed to shift away from highly competitive categories such as cardiovascular and infectious disease drugs in which Valeant competed head to head with Big Pharma. The company would always be outgunned in these categories, both in terms of R\&D and marketing and sales budgets. The company should instead focus on niche categories such as dermatology (skin care). Dermatology offered adequate demand and a stable base of customers who often needed lengthy, ongoing treatments to treat chronic conditions. The dermatology market also featured a broad range of specialty, niche ailments that required unique treatments, and a payer base of primarily private individuals rather than government agencies. Pearson also suggested cutting R\&D and focusing on mergers and acquisitions (M\&A) to drive growth. Valeant could acquire smaller companies or individual products that produced enough revenue to create growth but were too small to interest Big Pharma buyers. Pearson, and the Valeant board, believed that there were enough of these undervalued, orphan products to drive substantial future growth. The board liked Pearson's bold vision, and they appreciated his direct management style. "[His]leadership style wasn't a cult of personality or a force of will-though he's extremely willful-but one where the decision making was going to be based on facts, which was a breath of fresh air," said one director. "He felt like a much better fit for what we needed to do." 11 In short, Pearson displayed the clarity and boldness of vision that typified the founder, Milan Panic; however, Pearson did not appear as iconic or eccentric as Panic. Pearson joined Valeant as CEO in February 2008. During that month Valeant's stock price averaged $13.88, ranging from $13.24 to a high of $14.17. Icarus Flies High: Implementing the New Strategy As Pearson and the board began to execute the strategy, they enjoyed three advantages. First, the company had a well-established pipeline that would generate current revenue. Second, the company's balance sheet provided ample room for leverage. In 2008, cash or equivalents represented 60 percent of total assets; importantly, the company had no long-term debt (Exhibit 2 provides selected financial data for Valeant from 2008 to 2015.). Third, it appeared that there were, in fact, a number of just the right types of drugs, and companies, that Pearson identified Valeant: The Michael Pearson Strategy C-161 Source: Company 10K filings, various years. as attractive targets. The company was poised to create value by implementing what, to all accounts, was a sound strategy for growing a small, specialty pharmaceutical company. In 2008 and 2009, Valeant acquired four companies selling dermatology or aesthetics compounds around the world. The moves added more than $300 million in long-term debt, but the immediate effect of the new strategy had yet to be realized in significant stock price appreciation. As 2010 began, Valeant pressed ahead with its strategy, spending more than $400 million for Aton Pharmaceuticals (ophthalmology care) and a private label Brazilian producer of generic drugs. Pearson's boldest move to date came on June 21, when he announced that California-based Valeant would sell itself to Canada's largest publicly owned pharmaceutical maker, Biovail, for $3.3 billion..12 Biovail brought its own checkered business history to the new combination. The company's original patent was a timed-release drug delivery technology that allowed many drugs to be taken once a day rather than multiple times. Biovail's founder, Eugene Melnyk, built a high-flying company, but some accused Melnyk of using questionable accounting methods to inflate the company's performance. In 2003, a Biovail truck was involved in a fatal accident; Melnyk claimed that between $10 and $20 million worth of Wellbutrin XL was destroyed in the crash, an amount significant enough to have an impact on earnings.. 13 The next year the company admitted that only $5 million of Wellbutrin had been lost, and the ensuing accounting scandal consumed Biovail over the next few years. The company settled by paying a $10 million fine to the SEC in 2008.14 Although Biovail bought Valeant, the deal represented a form of a reverse merger that would later be known as an inversion. Biovail bought Valeant, which made Valeant a Canadian company. The new firm, in which Valeant held a 49.5 percent ownership stake, would keep the Valeant name, CEO, and business strategy. The deal benefited shareholders of both companies in the short term as Biovail's shareholders enjoyed a 15 percent premium on their shares and Valeant shareholders received a cash dividend of almost $17 per share..15 The big winner, however, was Valeant. Valeant's US tax credits were about to expire, and the company lowered its effective tax rate from 35 percent (as a California company) to 10-15 percent as a company headquartered in Ontario. Pearson said, "We had to do this sooner rather than later from a standpoint of gaining this tax rate."16 With the Biovail deal, Valeant's long-term debt jumped more than tenfold, to just under $3.5 billion. Valeant's shares rose 12 percent, moving from $16.67 to $18.87. They would rise to $28.29 by year's end, and the Biovail purchase represents an inflection point in Valeant's share price. Between 2011 and the end of 2015, Valeant would spend more than \$32 billion on more than 24 acquisitions. Purchases ranged from paying $22 million in 2012 for Eyetech, an ophthalmology biotech, to $14.5 billion in 2015 for gastrointestinal medication maker Salix Pharmaceuticals. Exhibit 3 lists Valeant's major acquisitions. The majority of deals complemented Valeant's core of dermatology; however, the company diversified into ophthalmology and eye care with its $8.6 billion purchase of contact lens maker Bausch and Lomb, and the global consumer market with cough and cold company Natur Produkt (Russia) and Priobiotica, the Brazilian sports nutrition concern. The common thread that ran through all acquisitions, according to Pearson, was a focus on "mispriced products." " Investors loved the Valeant strategy, rocketing Valeant's shares into the stratosphere. The stock went from $18.87 the day after the Biovail merger to a high of $262.52 in August 2015, for total shareholder return of 1,391 percent. The Big Pharma model grounded long-term company profitability in the creation of new patented drugs, and then pricing those drugs so as to recover the development costs of between $1 and $2.6 billion, generate cash to fuel the next round of innovation, and provide shareholders with a return. 18 Valeant eschewed that model by cutting its own R\&D, replacing that driver with debt-fueled acquisitions. To recover the cost of that debt and provide attractive returns to shareholders, Valeant chose to raise prices on key drugs in its expanding portfolio. For some of its purchases-Valeant's drugs had not yet come "off-patent" (subject to competition from generic formulations)-the company used its monopoly position to raise prices between 60 and 2,850 percent (Exhibit 4 provides a list of some of Valeant's price increases.). A report from Deutsche Bank indicated that the average Valeant price increase was 66 percent, more than five times the rates of competing pharmaceutical companies. 19 An investigation by the United States noted that "from 2014 to 2015, Valeant increased the prices of more than 20 additional 'US Prescription Products' by more than 200 percent. Valeant raised the prices of several of these products multiple times from 2014 to 2015, in some cases by as much as 800 percent., 20 CFO Howard Shiller admitted in May of 2015 that about 80 percent of Valeant's revenue growth for the quarter was driven by price increases. 21 Valeant chose the drugs to add to its portfolio based on the level to which a drug had been "mispriced" in the market, but the company also focused on drugs that were used to treat the chronic nature of dermatological and other conditions. Valeant's price increases would result in long-term substantial increases in cash flow and profitability. The impact on drug consumers would be similar, although it would mean a long-term increase in their out-of-pocket drug costs. One consumer saw their cost for Cuprimine, a drug that treats Wilson's disease (an inherited malady that can affect the liver and nervous system), rise from $366 per month to more than $1,800. For retirees and other middle-income patients, Valeant's gain was their loss. 22 FXHIRIT 4 Valeant pharmareiticale Salerted Drio Drirelneraacac sumice vasevilter iesealci, vailus pililal y suices. Valeant defended its price increases on three grounds. Internally, the company noted that increases (often major) in price did not affect demand. A consultant's report on heart medication Nitropress noted that, "With roughly one year of data showing essentially static volume performance after a substantial price increase (350\%), [the consulting firm] believes pricing flexibility may still exist for the product up to the perceptual price point of $1,000 per vial. ... With current WAC [Wholesale Acquisition Cost] pricing at \$214 per vial, Nitropress is likely to still have flexibility by multiple orders of magnitude.,23 Nitropress had apparently not reached its economic price ceiling, where demand would begin to decrease. Externally, Valeant claimed that its price increases were justified by the money saved from drug therapies versus hospitalization or other intensive treatments. Northern California's KQED reported on Valeant's price increase of Seconal, an assisted suicide drug: "'Valeant sets prices for drugs based on a number of factors,' the company said in a statement, including the cost of developing or acquiring the drug, the availability of generics, and the benefits of the drug compared with costly alternative treatments. 'When possible, we offer patient assistance programs to mitigate the effects of price adjustments and keep out-of-pocket costs affordable for patients.'24 Those patient assistance programs represented the third element of Valeant's justification for its strategy. The company argued that few consumers bore the brunt of their price increases-most of the higher bills would be paid by third-party payers, either private health insurers or government agencies such as Medicare or Medicaid. Valeant's anti-depressant Wellbutrin provides an example. Patients who visited the Wellbutrin website learned that, depending on their insurance plan, they may pay between zero and $50 for "unlimited use." Doctors were told that if they prescribed Wellbutrin XL, and specified "no generic substitution" would find "no hassles and no need for call-backs-guaranteed. Your prescription decision is never questioned by the pharmacy." .25 Wellbutrin had been on the market for three decades and was available in generic form for about $30 per month. Valeant had increased the price 11 times to more than $1,400 a month. The drug's 2015 revenue was projected to top $300 million, double its 2013 level. 26 Icarus Returns to Earth: The Fallout of Valeant's Acquisition Strategy Valeant's drug pricing strategy came under criticism as the US presidential election heated up in the fall of 2015. Democratic candidate Bernie Sanders called for an investigation in August 2015, and Hillary Clinton followed in September. Her tweet pledged action around "outrageous price gouging" by pharmaceuticals put investors in the sell mode. Valeant's shares, trading at more than $250 per share in August, began to fall. On September 28 alone, Valeant's shares dropped 16 percent. 27 Valeant had no response to these attacks. Just over two weeks later, on October 15, Australian hedge fund manager-and short seller of Valeant stock-John Hempton reported a questionable connection between Valeant and Philidor, a specialty pharmacy that distributed a number of Valeant products. Hempton claimed that Philidor was a "captive pharmacy" rather than an independent agent. 28 Information emerged during the next couple of weeks showing the Valeant staff, posing as Philidor employees, fraudulently wrote "dispense as written" on prescriptions to avoid generic substitution. They also deceived insurers by listing the drugs as being filled by smaller pharmacies in order to avoid attracting suspicion of too many high-priced prescriptions filled by Philidor. 29 Valeant's response showed that the executive team and the board failed to understand the threat. The company initially (and emphatically) denied the charges of any improper affiliation with Philidor; however, the company later disclosed that it was, in fact, quite entwined with Philidor. Valeant blended Philidor's financials with its own, and the company had invested \$100 million in the pharmacy. Valeant pledged to cut ties with Philidor and launched an internal investigation. Valeant held a conference call on October 30 to quell investor fears; instead, Valeant's poor handling of the call and the overall situation stoked investor concern. The stock dropped another 16 percent. 30 Problems with Philidor would affect the company's financial results and were responsible for the delay in Valeant releasing Valeant: The its 2015 annual report-a move that threatened to throw the company into default with its creditors. In late December of 2015, Valeant announced that Pearson would take a leave of absence because of a severe case of pneumonia; CFO Howard Shiller would assume Pearson's role and serve as temporary CEO. Robert Ingram would become board chairman and Valeant would finally split the roles of chairman and CEO. Pearson returned to work at the end of February 2016, but Ingram remained board chairman. 31 Throughout the winter of 2016, Valeant continued to exhibit a surprisingly nonchalant public attitude about its drug pricing troubles. In February 2016, Clinton continued her assault: "[Valeant] is one of these companies that is absolutely gouging American consumers and patients," she said. "I'm going after them. We are going to stop this. This is predatory pricing. It is unjustified, it is wrong, and we're going to make sure it is stopped." 32 Between August 2015 and February 2016, Valeant's shares lost more than 60 percent of their value. As Valeant's troubles became front-page news, the US Congress and the US Department of Justice jumped on the bandwagon, the former calling for hearings and the latter opening an investigation into Valeant's pricing behavior. 33 Other Valeant problems came to light. Its 2013 acquisition of Bausch \& Lomb resulted in a commanding market position in the contact lens market. When Valeant purchased Paragon Vision Services in 2015, the company held an estimated 80 percent market share in orthokeratology "buttons," a key input to gas permeable hard contact lenses. The US Federal Trade Commission opened another investigation, and a contact lens manufacturer filed a class action suit to stop Valeant. Jan Svochak, president of the Contact Lens Manufacturers Association described the threat: "The issue is the orthokeratology market . . . We believe they have a monopoly situation in that market," Svochak said. "They significantly raised prices in the orthokeratology market, and they've also taken control of distribution channels." Valeant used the Paragon acquisition to raise prices for the buttons by more than 100 percent. In a final blow to the now-beleaguered company, investors began to raise concerns about CEO Michael Pearson's compensation package. In 2014, activist investor William Ackman noted that Pearson held stock options in Valeant worth more than $1.3 billion, on top of $10.275 million in salary and bonus compensation for the year. Ackman noted that the pay plan would richly reward the Valeant team and Pearson for raising share price over the long term. The company's proxy statement included this description of the pay plan: "Our compensation philosophy is to align management's pay with long-term TSR [Total Shareholder Return] . . We richly reward for outstanding TSR performance, but pay significantly less for below-average TSR performance." Executives would receive their shares only if the stock price hit an annual return of 15 percent; however, if the stock returned 45 percent, shares tripled. They quadrupled if the stock went up 60 percent. Valeant claimed its "executives could be among the best-paid in the industry." Because of Valeant's collapse, neither Pearson nor other Valeant executives would receive stock compensation for the period of 2013-2016, as their options would not vest until 2017. The late-filed 2015 10K report included the board's investigation of the Philidor scandal. The board admitted "the company has determined that the tone at the top of the organization, with its performance-based environment, in which challenging targets were set and achieving those targets was a key performance expectation, was not effective in supporting the control environment... [and] may have been contributing factors resulting in the company's improper revenue recognition." The company also noted the burgeoning number of federal and state investigations underway; the SEC, the United States Senate, and state-level inquiries in Massachusetts, New York, New Jersey, and North Carolina. Doctors, hospitals, and other activist groups began targeting the company. With its future revenue growth increasingly uncertain, investors jumped off the Valeant bandwagon and continued to sell their shares. With the prospect of increased scrutiny from stakeholders in the public and private sectors, Valeant's ability to find, acquire, and re-price "mispriced" drugs appeared in jeopardy. On March 21 , Valeant announced that Pearson would be leaving the company and a search for a new CEO would begin immediately. 34 Valeant's stock finally hit bottom on March 31 , tumbling to $26.30, down almost exactly 90 percent from its peak seven months earlier. Conclusion The shares had come back to Earth, leaving long-term holders of Valeant stock with a company valued at its 2010 price. Consumers who saw their prescription bills were clearly worse off. Who were the real winners in Valeant's rise and fall? These and other questions gave Ingram pause as he considered how to work with the new CEO and directors Valeant named to its board. The investing community was waiting to see how new CEO Joe Papa would alter Valeant's strategy and lead the company toward a new future. As the board chairman, Ingram wanted to see Valeant return to profitability, but he also wanted to ensure that Valeant, and the board, proved more responsive to the charged stakeholder environment in the health care industry. Had Valeant simply transferred wealth from consumers to shareholders through its price increases? How should it set prices in the future to reflect the real value of the drugs but avoid excessive, "gouging" price increases? How should the board govern the company in order to avoid further fraud or accounting scandals? Finally, Ingram wondered about how to address Papa's compensation and other board-level policies: How could they incentivize long-term sustainable growth and build an ethical culture? References "Material in this paragraph from "ICN Pharmaceuticals, Inc. History," Funding Universe, http://www.fundinguniverse.com/company -histories/icn-pharmaceuticals-inc-history/, accessed April 22, 2016. 'Ibid. 3bid. 4Ibid. "ICN Pharmaceuticals Appoints Robert W. O'Leary as Chairman and CEO," PR Newswire, June 20, 2002, http://www.prnewswire.comews -releases/icn-pharmaceuticals-appoints-robert-w-oleary-as-chairman -and-ceo-77943717.html, accessed April 22, 2016. "ICN Pharmaceuticals, Inc. Changes Its Name to Valeant Pharmaceuticals International," Newswire, November 12, 2003, available at http://www.prnewswire.comews-releases/icn-pharmaceuticals-inc -changes-its-name-to-valeant-pharmaceuticals-international-72992612 .html, accessed April 22, 2016. 'Financial data for 2003 from Valeant's 20-F filing with the SEC, http:// hsprod.investis.com/ir/valeant_pharmaceuticals/jsp/sec_index .jsp?ipage =2796961 \&ir_epic_id=valeant_pharmaceuticals, accessed April 23, 2016. 8 Data from Merck's 2003 Annual Report, http://www.merck.com/finance /annualreport/ar2003/pdf/merck2003ar.pdf, accessed April 23, 2016. 'S. Silcoff, "How Valeant Became Canada's Hottest Stock," The Globe and Mail, February 21, 2013, http://www.theglobeandmail.com/report -on-business/rob-magazine/how-valeant-became-canadas-hottest -stock/article8889241/?page=all, accessed April 23, 2016. 10 Ibid. 11 Ibid. 12 P. Jorda and E. Dey, "Drugmaker Biovail to Buy Valeant in $3.3 Billion Deal," Reuters, June 21, 2010, http://www.reuters.com/article /us-biovail-valeant-idUSTRE65K1LA20100621, accessed April 28, 2016. 13 Silcoff. 14"Biovail to Merge with Valeant," New York Times (June 21, 2010), http://dealbook.nytimes.com/2010/06/21/biovail-to-merge-with -valeant/?_r=0, accessed April 28, 2016. 15 Jorda and Dey. 16 Ibid. 17L. Lorenzetti, "Valeant Eases Up on Strategy to Buy Up 'Mispriced Drugs'," Fortune (October 19, 2015), http://fortune.com/2015/10/19 /valeant-backs-down-drug-prices/, accessed April 28, 2016. 18A. E. Caroll, "\$2.6 Billion to Develop a Drug? New Estimate Makes Questionable Assumptions," New York Times (November 18, 2014), http://www.nytimes.com/2014/11/19/upshot/calculating-the-real -costs-of-developing-a-new-drug.html?_r=0, accessed April 29, 2016. 19Ibid. 20"Emails Reveal Turing, Valeant (VRX) Price Increases Were Basis for Revenue Growth," Biospace, February 3, 2016, http://www .biospace.com/News/emails-reveal-turing-valeant-price-increases -were/407561, accessed April 26, 2016. 21 S. Armour and J. Rockoff, "Valeant, Turing Boosted Drug Prices to Fuel Preset Profits," Wall Street Journal (February 2, 2016), http://www.wsj .com/articles/valeant-turing-boosted-drug-prices-to-fuel-preset-profits -1454445342, accessed April 26, 2016. 22 A. Pollack and S. Tavernise, "Valeant's Drug Price Strategy Enriches It, but Infuriates Patients and Lawmakers," New York Times (October 4, 2015), http://www.nytimes.com/2015/10/05/business/valeants-drug -price-strategy-enriches-it-but-infuriates-patients-and-lawmakers .html, accessed April 29, 2016. 23 ibid. 24L. Lopez, "Valeant Bought a Drug that Helps Terminally III People Die and Doubled the Price," Business Insider (March23, 2016), http://www.businessinsider.com/valeant-seconal-price-increase-2016-3, accessed April 26, 2016. 25 Ibid. 26 N. Weinberg and R. Langreth, "How Valeant Tripled Prices, Doubled Sales of Flatlining Drug," Bloomberg (January 8, 2016), http://www .bloomberg.comews/articles/2016-01-08/how-valeant-tripled-prices -doubled-sales-of-flatlining-old-drug, accessed April 26, 2016. 27 S. Gandel, "What Caused Valeant's Epic 90\% Plunge," Fortune (March 20, 2016), http://fortune.com/2016/03/20/valeant-timeline -scandal/, accessed April 26, 2016. 28 S. Gandel, "Valeant: A Timeline of the Big Pharma Scandal," Fortune (October 31, 2015), http://fortune.com/2015/10/31/valeant-scandal/, accessed April 29, 2016. 29J. Hempton, "Philidor 2.0: Valeant and Stephen King Play Chess with a Lot of Pharmacies," November 26, 2016, http://brontecapital .blogspot.com/2015/11/philidor-20-valeant-and-stephen-king.html, accessed April 29, 2016. 30Gandel, Valeant. 31 A. Pollack, "Valeant Pharmaceuticals Chief Returns from Medical Leave," New York Times (February 28, 2016), http://www.nytimes.com /2016/02/29/business/valeant-pharmaceuticals-j-michael-pearson-ceo .html?_r=0, accessed May 6, 2016. 32 D. Crow, "Price of Valeant Drug Singled Out by Clinton Rose 356\% in a Year," Financial Times, http://www.ft.com/cms/s/0/fff89b8e -c922-11e5-be0b-b7ece4e953a0.html\#axzz46y EaggbM, accessed April 26, 2016. 33 A. Pollack, "2 Valeant Dermatology Drugs Lead Steep Price Increases, Study Finds," New York Times (November 25, 2015), http:// www.nytimes.com/2015/11/26/business/2-valeant-dermatology -drugs-lead-steep-price-increases-study-finds.html?_r=0, accessed April 26, 2016. 34N. Vardi, "Mike Pearson Is on His Way Out of Valeant, Former CFO Refuses to Leave Board," Forbes (March 21, 2016), http://www.forbes .com/sitesathanvardi/2016/03/21/mike-pearson-is-on-his-way -out-of-valeant-amid-more-drama-former-cfo-refuses-to-leave -board/\#2c7f12525c1a, accessed May 6, 2016 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started