Answered step by step

Verified Expert Solution

Question

1 Approved Answer

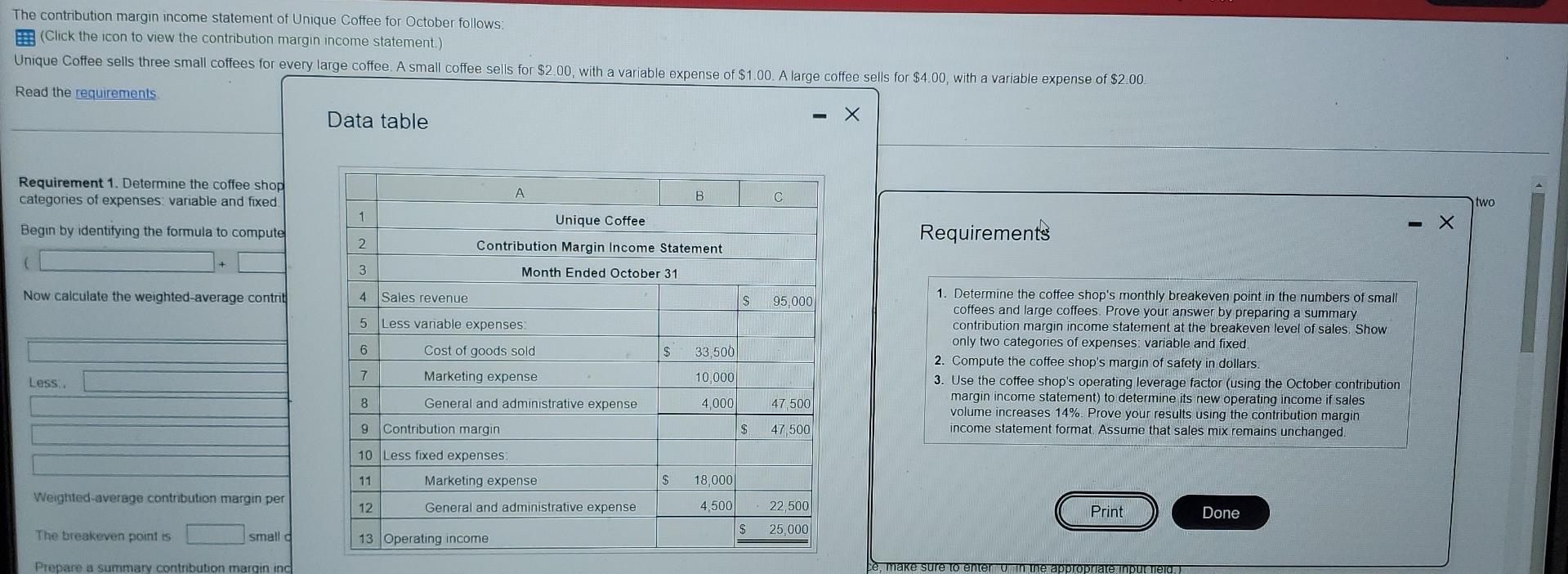

The contribution margin income statement of Unique Coffee for October follows: (Click the icon to view the contribution margin income statement.) Unique Coffee sells three

The contribution margin income statement of Unique Coffee for October follows: (Click the icon to view the contribution margin income statement.) Unique Coffee sells three small coffees for every large coffee. A small coffee sells for $2.00, with a variable expense of $1.00. A large coffee sells for $4.00, with a variable expense of $2.00 Read the requirements Data table Requirement 1. Determine the coffee shop categories of expenses variable and fixed B two 1 Unique Coffee Begin by identifying the formula to compute Requirements 2 Contribution Margin Income Statement + 3 Month Ended October 31 Now calculate the weighted average contrit 4 Sales revenue $ 95.000 5 Less variable expenses 6 Cost of goods sold $ 33,500 1. Determine the coffee shop's monthly breakeven point in the numbers of small coffees and large coffees. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of expenses variable and fixed 2. Compute the coffee shop's margin of safety in dollars. 3. Use the coffee shop's operating leverage factor (using the October contribution margin income statement) to determine its new operating income if sales volume increases 14%. Prove your results using the contribution margin income statement format Assume that sales mix remains unchanged. 7 Less Marketing expense 10,000 8 General and administrative expense 4,000 47 500 9 Contribution margin 47 500 10 Less fixed expenses 11 Marketing expense $ 18,000 Weighted average contribution margin per 12 General and administrative expense 4,500 22,500 25 000 Print Done $ The breakeven point is small a 13 Operating income Prepare a summary contribution margin ind Sureno The contribution margin income statement of Unique Coffee for October follows: (Click the icon to view the contribution margin income statement.) Unique Coffee sells three small coffees for every large coffee. A small coffee sells for $2.00, with a variable expense of $1.00. A large coffee sells for $4.00, with a variable expense of $2.00 Read the requirements Data table Requirement 1. Determine the coffee shop categories of expenses variable and fixed B two 1 Unique Coffee Begin by identifying the formula to compute Requirements 2 Contribution Margin Income Statement + 3 Month Ended October 31 Now calculate the weighted average contrit 4 Sales revenue $ 95.000 5 Less variable expenses 6 Cost of goods sold $ 33,500 1. Determine the coffee shop's monthly breakeven point in the numbers of small coffees and large coffees. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of expenses variable and fixed 2. Compute the coffee shop's margin of safety in dollars. 3. Use the coffee shop's operating leverage factor (using the October contribution margin income statement) to determine its new operating income if sales volume increases 14%. Prove your results using the contribution margin income statement format Assume that sales mix remains unchanged. 7 Less Marketing expense 10,000 8 General and administrative expense 4,000 47 500 9 Contribution margin 47 500 10 Less fixed expenses 11 Marketing expense $ 18,000 Weighted average contribution margin per 12 General and administrative expense 4,500 22,500 25 000 Print Done $ The breakeven point is small a 13 Operating income Prepare a summary contribution margin ind Sureno

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started