Answered step by step

Verified Expert Solution

Question

1 Approved Answer

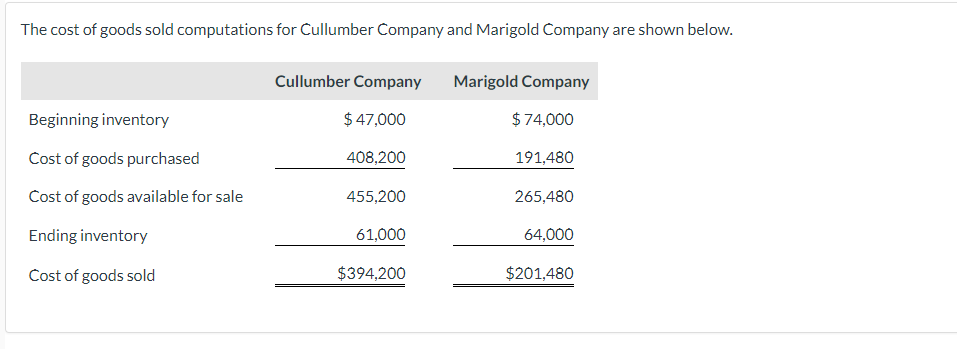

The cost of goods sold computations for Cullumber Company and Marigold Company are shown below. Cullumber Company Marigold Company Beginning inventory $47,000 $74,000 Cost

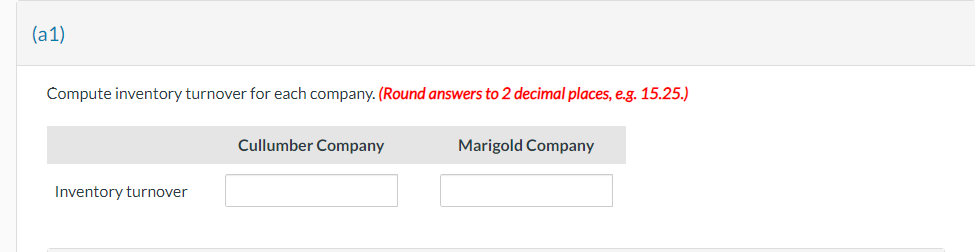

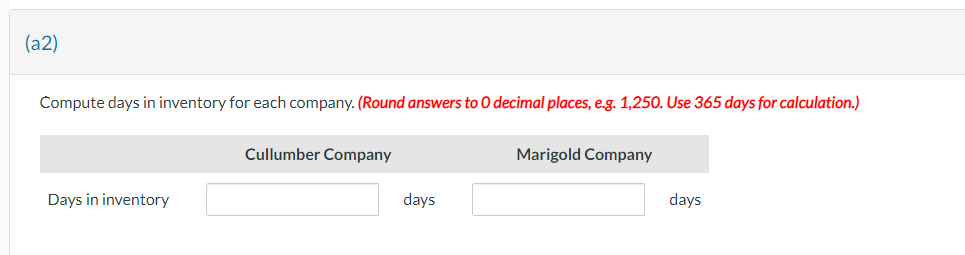

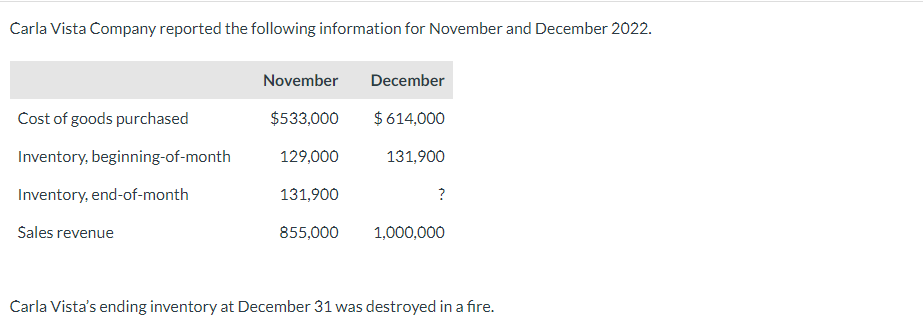

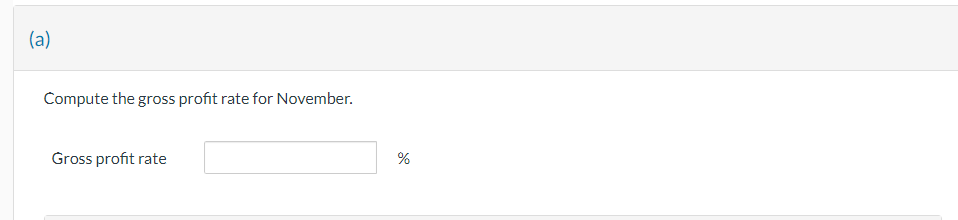

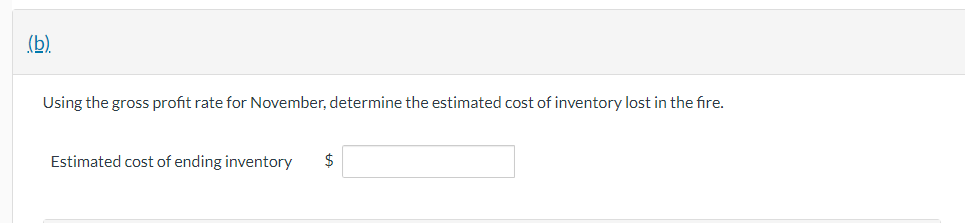

The cost of goods sold computations for Cullumber Company and Marigold Company are shown below. Cullumber Company Marigold Company Beginning inventory $47,000 $74,000 Cost of goods purchased 408,200 191,480 Cost of goods available for sale 455,200 265,480 Ending inventory 61,000 64,000 Cost of goods sold $394,200 $201,480 (a1) Compute inventory turnover for each company. (Round answers to 2 decimal places, e.g. 15.25.) Cullumber Company Inventory turnover Marigold Company (a2) Compute days in inventory for each company. (Round answers to O decimal places, e.g. 1,250. Use 365 days for calculation.) Days in inventory Cullumber Company Marigold Company days days (b) Which company moves its inventory more quickly? Carla Vista Company reported the following information for November and December 2022. November December Cost of goods purchased $533,000 $614,000 Inventory, beginning-of-month 129,000 131,900 Inventory, end-of-month 131,900 ? Sales revenue 855,000 1,000,000 Carla Vista's ending inventory at December 31 was destroyed in a fire. (a) Compute the gross profit rate for November. Gross profit rate % do (b). Using the gross profit rate for November, determine the estimated cost of inventory lost in the fire. Estimated cost of ending inventory $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started