Question

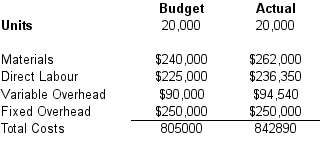

The cost of production budget is shown for a small manufacturing company. Also included are the actual figures for the budgeted period. Variable overhead is

The cost of production budget is shown for a small manufacturing company. Also included are the actual figures for the budgeted period.

Variable overhead is costed at 40% of direct labour.

The budget was developed using an estimated 1.5 kg of material per unit, but 31,875 kg was actually used, at a cost of $262,000 as shown.

Standard labour cost was $15.00 per hour, budgeted time per unit was 0.75 hours, but 14,500 hours were booked against the work.

Note that as budgeted and actual outputs are the same, there is no need for a flexible budget.

1. Calculate variances for all cost categories, labelling them as U or F

2. Using the variance analysis formulae provided, find

3. How much of the materials variance was due to a price variance and how much was due to a usage variance

4. How much of the labour variance was due to a rate (wage) variance and how much was due to an efficiency variance

Notes:

Materials Price variance = (actual price standard price) * actual total usage (kg)

Usage variance = (actual total usage standard usage) * standard price/kg

Labour Rate variance = (actual rate standard rate) * actual total hours

Efficiency variance = (actual total hours standard hours) * standard rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started