Question

The cost of production of the AIO is $450,000 and BMM typically sells the machine for $825,000. LCM would like to lease the AIO for

The cost of production of the AIO is $450,000 and BMM typically sells the machine for $825,000. LCM would like to lease the AIO for 10 years. The AIO has a useful life of 15 years, and BMM estimates the salvage value for the AIO after 10 years will be $250,000. The lease arrangement would not include a guarantee of the residual value by LCM and would require annual payments at the end of each lease year. BMMs implicit interest rate on its leases has recently been 8%. Assuming this lease meets at least one of the criteria to be classified as a finance lease, determine the following amounts related to the lease:

1. Balance in the Net Investment in Leased Assets at the start of the lease

2. Amount of the guaranteed residual

3. Sales recognized at the start of the lease

4. Cost of Goods Sold at the start of the lease

5. Interest Revenue reported in for the year-ended 12/31/2020

6. Amortization expense on the leased asset reported for the year-ended 12/31/2026

7. Annual lease payment

Assuming this lease does not meet any of the criteria for it to classified as a finance lease, determine the following amounts related to the lease:

1. Balance in the Net Investment in Leased Assets at the start of the lease

2. Lease Income reported for year-ended 12/31/2022

3. Amortization expense on the leased asset reported for the year-ended 12/31/2027

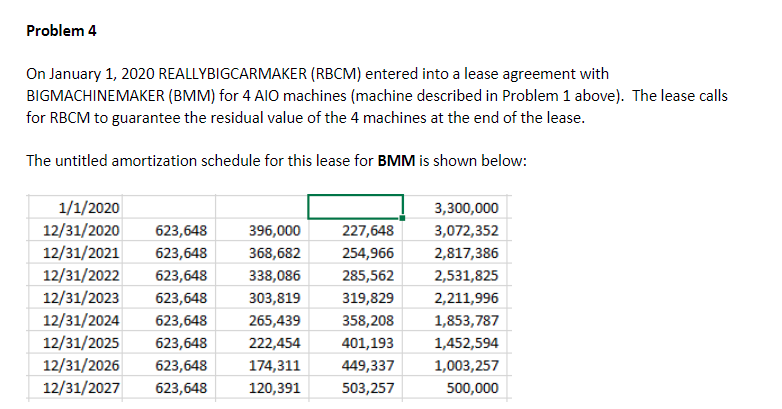

Problem 4 On January 1, 2020 REALLYBIGCARMAKER (RBCM) entered into a lease agreement with BIGMACHINEMAKER (BMM) for 4 AIO machines (machine described in Problem 1 above). The lease calls for RBCM to guarantee the residual value of the 4 machines at the end of the lease. The untitled amortization schedule for this lease for BMM is shown below: 1/1/2020 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 12/31/2026 12/31/2027 623,648 623,648 623,648 623,648 623,648 623,648 623,648 623,648 396,000 368,682 338,086 303,819 265,439 222,454 174,311 120,391 227,648 254,966 285,562 319,829 358,208 401,193 449,337 503,257 3,300,000 3,072,352 2,817,386 2,531,825 2,211,996 1,853,787 1,452,594 1,003,257 500,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started