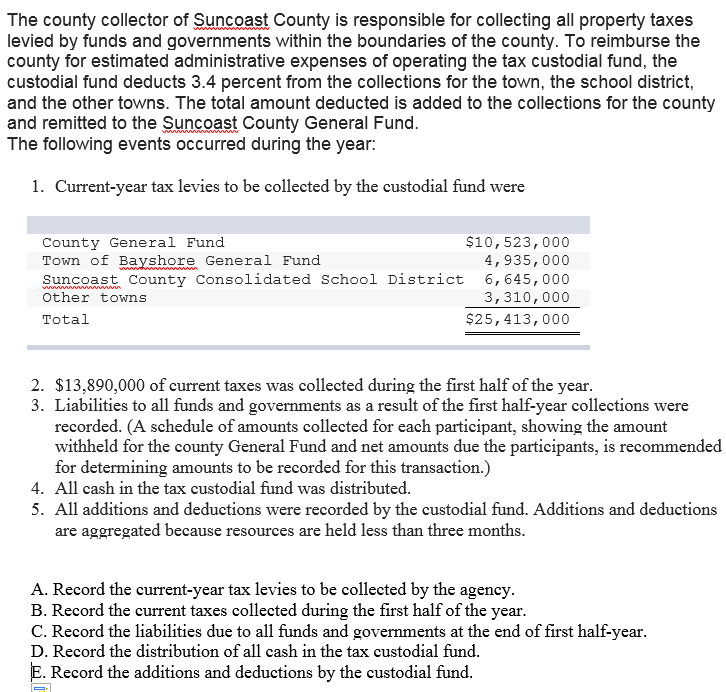

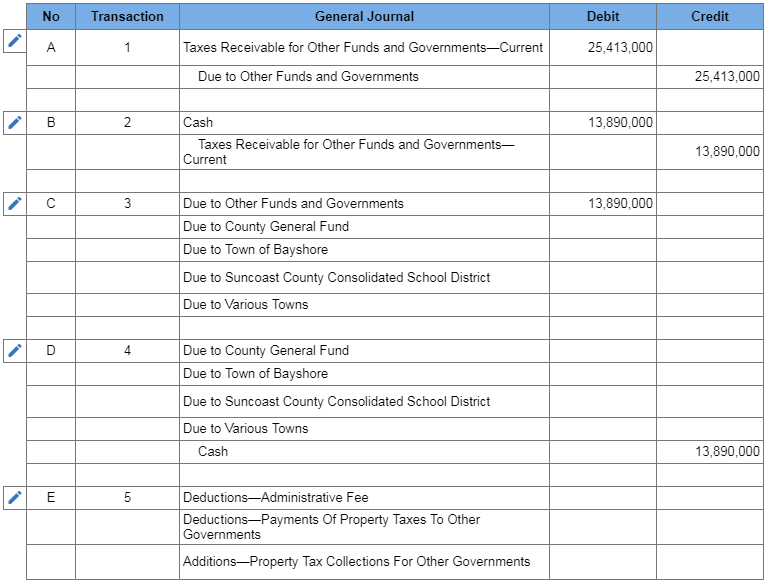

The county collector of Suncoast County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 3.4 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Suncoast County General Fund The following events occurred during the year. 1. Current-year tax levies to be collected by the custodial fund were County General Fund Town of Bayshore General Fund Suncoast County Consolidated School District 6,645, 000 Other towns Total $10,523,000 4,935, 000 3,310,000 $25, 413,000 2. $13,890,000 of current taxes was collected during the first half of the year 3. Liabilities to all funds and governments as a result of the first half-year collections were recorded. (A schedule of amounts collected for each participant, showing the amount withheld for the county General Fund and net amounts due the participants, is recommended for determining amounts to be recorded for this transaction.) 4. All cash in the tax custodial fund was distributed 5. All additions and deductions were recorded by the custodial fund. Additions and deductions are aggregated because resources are held less than three months A. Record the current-year tax levies to be collected by the agency B. Record the current taxes collected during the first half of the year C. Record the liabilities due to all funds and governments at the end of first half-year D. Record the distribution of all cash in the tax custodial fund Record the additions and deductions by the custodial fund. No Transaction General Journal Debit Credit Taxes Receivable for Other Funds and Governments-Current 25,413,000 Due to Other Funds and Governments 25,413,000 Cash 13,890,000 Taxes Receivable for Other Funds and Governments_ Current 13,890,000 Due to Other Funds and Governm Due to County General Fund Due to Town of Bayshore Due to Suncoast County Consolidated School District Due to Various Towns ents 13,890,000 4 Due to County General Fund Due to Town of Bayshore Due to Suncoast County Consolidated School District Due to Various Towns Cash 13,890,000 Deductions-Administrative Fee Deductions-Payments Of Property Taxes To Other Governments Additions-Property Tax Collections For Other Governments The county collector of Suncoast County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 3.4 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Suncoast County General Fund The following events occurred during the year. 1. Current-year tax levies to be collected by the custodial fund were County General Fund Town of Bayshore General Fund Suncoast County Consolidated School District 6,645, 000 Other towns Total $10,523,000 4,935, 000 3,310,000 $25, 413,000 2. $13,890,000 of current taxes was collected during the first half of the year 3. Liabilities to all funds and governments as a result of the first half-year collections were recorded. (A schedule of amounts collected for each participant, showing the amount withheld for the county General Fund and net amounts due the participants, is recommended for determining amounts to be recorded for this transaction.) 4. All cash in the tax custodial fund was distributed 5. All additions and deductions were recorded by the custodial fund. Additions and deductions are aggregated because resources are held less than three months A. Record the current-year tax levies to be collected by the agency B. Record the current taxes collected during the first half of the year C. Record the liabilities due to all funds and governments at the end of first half-year D. Record the distribution of all cash in the tax custodial fund Record the additions and deductions by the custodial fund. No Transaction General Journal Debit Credit Taxes Receivable for Other Funds and Governments-Current 25,413,000 Due to Other Funds and Governments 25,413,000 Cash 13,890,000 Taxes Receivable for Other Funds and Governments_ Current 13,890,000 Due to Other Funds and Governm Due to County General Fund Due to Town of Bayshore Due to Suncoast County Consolidated School District Due to Various Towns ents 13,890,000 4 Due to County General Fund Due to Town of Bayshore Due to Suncoast County Consolidated School District Due to Various Towns Cash 13,890,000 Deductions-Administrative Fee Deductions-Payments Of Property Taxes To Other Governments Additions-Property Tax Collections For Other Governments