Answered step by step

Verified Expert Solution

Question

1 Approved Answer

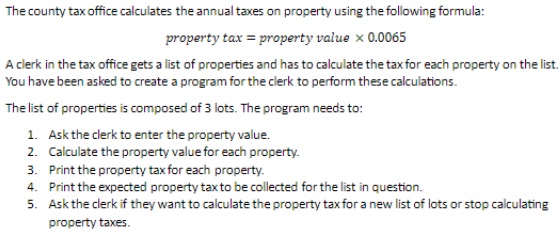

The county tax office calculates the annual taxes on property using the following formula: property tax = property value 0 . 0 0 6 5

The county tax office calculates the annual taxes on property using the following formula:

property tax property value

A clerk in the tax office gets a list of properties and has to calculate the tax for each property on the list.

You have been asked to create a program for the clerk to perform these calculations.

The list of properties is composed of lots. The program needs to:

Ask the clerk to enter the property value.

Calculate the property value for each property.

Print the property tax for each property.

Print the expected property tax to be collected for the list in question.

Ask the clerk if they want to calculate the property tax for a new list of lots or stop calculating

property taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started