Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Creative Prospects Plc, a construction company in Mafeteng is planning on purchasing a new assembling plant for M20 000. By making the investment,

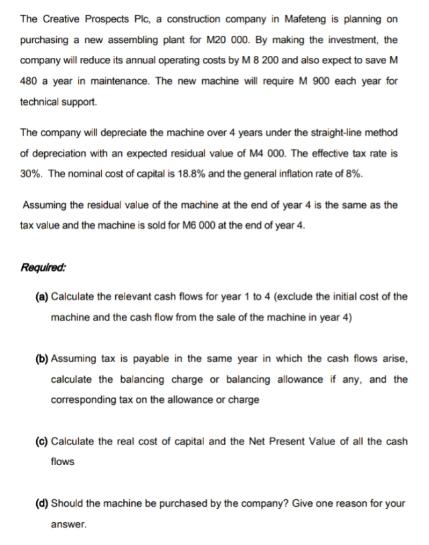

The Creative Prospects Plc, a construction company in Mafeteng is planning on purchasing a new assembling plant for M20 000. By making the investment, the company will reduce its annual operating costs by M 8 200 and also expect to save M 480 a year in maintenance. The new machine will require M 900 each year for technical support. The company will depreciate the machine over 4 years under the straight-line method of depreciation with an expected residual value of M4 000. The effective tax rate is 30%. The nominal cost of capital is 18.8% and the general inflation rate of 8%. Assuming the residual value of the machine at the end of year 4 is the same as the tax value and the machine is sold for M6 000 at the end of year 4. Required: (a) Calculate the relevant cash flows for year 1 to 4 (exclude the initial cost of the machine and the cash flow from the sale of the machine in year 4) (b) Assuming tax is payable in the same year in which the cash flows arise, calculate the balancing charge or balancing allowance if any, and the corresponding tax on the allowance or charge (c) Calculate the real cost of capital and the Net Present Value of all the cash flows (d) Should the machine be purchased by the company? Give one reason for your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the relevant cash flows we need to consider the operating cost savings maintenance savings technical support expenses depreciation tax implications and the sale of the machine Lets break ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started